RAPPORTO IN LINGUA INGLESE

Maggio 2020,

II Ed. ,

337 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1696

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S60

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

The goal of the Report Smart & Fast Cities is to provide:

- High-end design companies and contract players with a tool to identify potential locations where to set their mono-brand stores, keeping into account potential synergies (for instance the presence of complementary brands) as well as an indicator of the cost of the area;

- The industry, in general, with an analysis on the medium-term trends affecting the main cities worldwide;

In general, the Report is intended to all the companies operating in all the durable consumer goods segments. More specifically, an in-depth analysis is addressed to two of the CSIL’s core-business segments: kitchen furniture and lighting fixtures.

The Report provides profiles of 151 cities worldwide with a selection of economic and demographic indicators (2013 and 2018), estimates of the potential market of two selected durable consumer goods sectors (2013 and 2018), lighting and kitchen furniture, in each city and the forecasts for the market development to the year 2023 (*). The study also offers an indicator that, through six dimensions (demographic dynamics, economic wealth, consumption, quality of life, infrastructure, governance), ranks the cities according to their business attractiveness. In their last part, the profiles deliver an analysis of the geographical presence of a selected sample of 65 brands, each of which operates as a trend-setter in its own category, in 143 out of the 151 cities considered. Each identified location is characterized by its type (store, multibrand store, shopping centre) and the cost of the area in which they are located. The aim is, thus, to provide a comprehensive view of the cities that a selection of international retailers entered.

For each city profile, the following data, indicators and forecasts are provided:

- Population and its rank within the sample, 2013, 2018 and 2023

- Households and its rank within the sample, 2013, 2018 and 2023

- Gross domestic product per capita and its rank within the sample, 2013, 2018 and 2023

- Household’s consumption per capita and its rank within the sample, 2013, 2018 and 2023

- Gross domestic product and its rank within the sample, 2013, 2018 and 2023

- Household’s consumption and its rank within the sample, 2013, 2018 and 2023

- Breakdown of households by the level of income, 2013, 2018 and 2023

- Lighting demand and its growth rate, 2013, 2018 and 2023

- Kitchen furniture demand and its growth rate, 2013, 2018 and 2023

- Business attractiveness index and its components

- Spatial analysis of the distribution of 65 brands within the city map

Selected cities group by geographic areas:

Asia and Pacific: Kabul, AF; Melbourne, AU; Sydney, AU; Chittagong, BD; Dhaka, BD; Beijing, CN; Changchun, CN; Chengdu, CN; Chongqing, CN; Dalian, CN; Dongguan, CN; Foshan, CN; Guangzhou, CN; Hangzhou, CN; Harbin, CN; Hong Kong, CN; Jinan, CN; Nanjing, CN; Qingdao, CN; Shanghai, CN; Shenyang, CN; Shenzhen, CN; Suzhou, CN; Tianjin, CN; Wuhan, CN; Xiamen, CN; Xi’an, CN; Ahmadabad, IN; Bangalore, IN; Chennai, IN; Hyderabad, IN; Jaipur, IN; Kolkata, IN; Mumbai, IN; Pune, IN; Surat, IN; Delhi, IN; Jakarta, ID; Nagoya, JP; Fukuoka, JP; Osaka, JP; Tokyo, JP; Busan, KR; Seoul, KR; Kuala Lumpur-Klang Valley, MY; Rangoon, MM; Auckland, NZ; Faisalabad, PK; Karachi, PK; Lahore, PK; Manila, PH; Singapore, SG; Taipei-Keelung, TW; Bangkok, TH; Hanoi, VT; Ho Chi Minh City, VT

Eastern Europe outside the EU and Russia: Moscow, RU; Saint Petersburg, RU; Ankara, TR; Istanbul, TR; Kiev, UA

Western Europe (or Europe): Vienna, AT; Brussels, BE; Prague, CZ; Copenhagen, DK; Helsinki, FI; Lyon, FR; Paris, FR; Cologne, DE; Munich, DE; Berlin, DE; Frankfurt, DE; Hamburg, DE; Athens, GR; Budapest, HU; Dublin, IE; Milan, IT; Rome, IT; Turin, IT; Amsterdam, NL; Oslo, NO; Krakow, PO; Warsaw, PO; Lisbon, PT; Bucharest, RO; Barcelona, ES; Madrid, ES; Stockholm, SE; Zurich, CH; Birmingham, UK; Manchester, UK; London, UK

Middle East and Africa: Kinshasa, CD; Alexandria, EG; Cairo, EG; Tehran, IR; Tel Aviv-Jaffa, IL; Kuwait City, KW; Casablanca, MO; Lagos, NG; Doha, QA; Jedda, SA; Riyadh, SA; Cape Town, ZA; Johannesburg, ZA; Khartoum, SD; Abu Dhabi, AE; Dubai, AE

North America: Montreal, CA; Toronto, CA; Vancouver, CA; Guadalajara, MX; Monterrey, MX; Mexico City, MX; Puebla, MX; Atlanta, US; Baltimore, US; Cleveland, US; Dallas-Fort Worth, US; Denver, US; Detroit, US; Houston, US; Los Angeles, US; Miami, US; Phoenix, US; Pittsburgh, US; San Diego, US; San Francisco, US; Seattle, US; Boston, US; Chicago, US; Minneapolis-Saint Paul, US; New York, US; Philadelphia, US; Portland, US; Saint Louis, US; Washington, US

South America: Buenos Aires, AR; Belo Horizonte, BR; Brasilia, BR; Fortaleza, BR; Porto Alegre, BR; Recife, BR; Rio de Janeiro, BR; Salvador, BR; Sao Paulo, BR; Santiago de Chile, CL; Medellin, CO; Bogota, CO; Lima, PE; Caracas, VE

(*) Our economic and demographic indicator database is dated January 2020, therefore macroeconomic and sectorial estimations and forecasts were made before that date. The world has changed dramatically in the three months as the world has been put in a Great Lockdown. According to the IMF, “the magnitude and speed of collapse in activity that has followed is unlike anything experienced in our lifetimes”. Up to the publication date of this report updates on forecasts up to 2023 haven’t be released.

Aziende selezionate

Arper, Ashley Furniture, B&B Italia, Molteni, Natuzzi, Poliform, Gensler, Grohe, Kohler, Villeroy & Boch, Boffi, Bulthaup, Nobilia, Scavolini, Siematic, Valcucine, Veneta Cucine, Herman Miller, Steelcase, Artemide, Flos, Foscarini, Iguzzini, Kare Design, Leroy Merlin, Sonepar, Wesco, B+H Architects, Foster + Partners, LPA Lighting Partners Associates, Speirs+Major

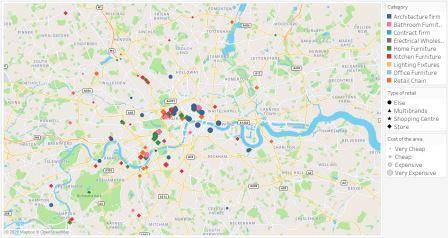

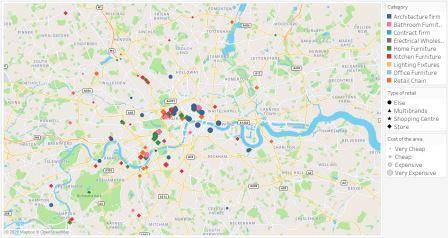

London. Retail and business distribution

Overall, in 2018 the 151 cities selected in CSIL sample cumulatively show: population of 1,115 million inhabitants; GDP of US$ 31,085 billion; number of household of 342 million; household consumption of US$ 19,164 billion.

Therefore, they accounted for 16% of the global population and almost 37% of the world’s GDP. Compared to their respective countries, on average they account for 23% of the GDP and 10% of the population. In terms of population, Tokyo, Jakarta, and Delhi are the largest cities; Zurich, Abu Dhabi, and Oslo the smallest ones. On the other hand, Oslo is the number in terms of GDP per capita, Zurich ranks 6th in terms of household consumption per capita.

Economically. New York, Tokyo, and Los Angeles are the largest city in terms of total GDP (both in 2018 and 2013). However, in 2018 Tokyo has the largest city-level lighting market, followed by New York, Los Angeles, and Seoul. By 2023, Seoul is expected to overcome Los Angeles and reach the third position. Looking at the kitchen market, Seoul already ranks 3th in 2018, after Tokyo and New York. This ranking is expected to hold also in 2023.

As regards business attractiveness, the top destinations are Tokyo, Atlanta, and Stockholm. All of them stand out in terms of quality of life and good governance. The worse scores are recorded for Caracas, Teheran, and Recife.

Using big data, CSIL identifies the commercial areas of 150 cities through the geolocation of over 65 brands, each of which operates as a trend-setter in its own category. Each identified location is characterized by its type (store, multi-brand store, shopping centre) and the cost of the area in which it is positioned. CSIL managed to identify 4,809 locations across 143 cities. The cities that host a higher number of companies from our sample are: Moscow, London, Milano, Istanbul, and New York. On the other hand, the most expensive locations are in the USA, in order: Atlanta, Washington, D.C., Boston, Miami, and Chicago; the cheapest ones are sited in Asia: Haerbin (CN), Changchun (CN), Lahore (PK), Hyderabad (IN), and Xi’an, Shaanxi (CN).

Abstract of Table of Contents

INTRODUCTION

CITY PROFILES

Population and its rank within the sample, 2013, 2018 and 2023

Households and its rank within the sample, 2013, 2018 and 2023

Gross domestic product per capita and its rank within the sample, 2013, 2018 and 2023

Household?s consumption per capita and its rank within the sample, 2013, 2018 and 2023

Gross domestic product and its rank within the sample, 2013, 2018 and 2023

Household?s consumption and its rank within the sample, 2013, 2018 and 2023

Breakdown of households by the level of income, 2013, 2018 and 2023

Lighting demand and its growth rate, 2013, 2018 and 2023

Kitchen furniture demand and its growth rate, 2013, 2018 and 2023

Business attractiveness index and its components

Spatial analysis of the distribution of 65 brands within the city map

The goal of the Report Smart & Fast Cities is to provide:

- High-end design companies and contract players with a tool to identify potential locations where to set their mono-brand stores, keeping into account potential synergies (for instance the presence of complementary brands) as well as an indicator of the cost of the area;

- The industry, in general, with an analysis on the medium-term trends affecting the main cities worldwide;

In general, the Report is intended to all the companies operating in all the durable consumer goods segments. More specifically, an in-depth analysis is addressed to two of the CSIL’s core-business segments: kitchen furniture and lighting fixtures.

The Report provides profiles of 151 cities worldwide with a selection of economic and demographic indicators (2013 and 2018), estimates of the potential market of two selected durable consumer goods sectors (2013 and 2018), lighting and kitchen furniture, in each city and the forecasts for the market development to the year 2023 (*). The study also offers an indicator that, through six dimensions (demographic dynamics, economic wealth, consumption, quality of life, infrastructure, governance), ranks the cities according to their business attractiveness. In their last part, the profiles deliver an analysis of the geographical presence of a selected sample of 65 brands, each of which operates as a trend-setter in its own category, in 143 out of the 151 cities considered. Each identified location is characterized by its type (store, multibrand store, shopping centre) and the cost of the area in which they are located. The aim is, thus, to provide a comprehensive view of the cities that a selection of international retailers entered.

For each city profile, the following data, indicators and forecasts are provided:

- Population and its rank within the sample, 2013, 2018 and 2023

- Households and its rank within the sample, 2013, 2018 and 2023

- Gross domestic product per capita and its rank within the sample, 2013, 2018 and 2023

- Household’s consumption per capita and its rank within the sample, 2013, 2018 and 2023

- Gross domestic product and its rank within the sample, 2013, 2018 and 2023

- Household’s consumption and its rank within the sample, 2013, 2018 and 2023

- Breakdown of households by the level of income, 2013, 2018 and 2023

- Lighting demand and its growth rate, 2013, 2018 and 2023

- Kitchen furniture demand and its growth rate, 2013, 2018 and 2023

- Business attractiveness index and its components

- Spatial analysis of the distribution of 65 brands within the city map

Selected cities group by geographic areas:

Asia and Pacific: Kabul, AF; Melbourne, AU; Sydney, AU; Chittagong, BD; Dhaka, BD; Beijing, CN; Changchun, CN; Chengdu, CN; Chongqing, CN; Dalian, CN; Dongguan, CN; Foshan, CN; Guangzhou, CN; Hangzhou, CN; Harbin, CN; Hong Kong, CN; Jinan, CN; Nanjing, CN; Qingdao, CN; Shanghai, CN; Shenyang, CN; Shenzhen, CN; Suzhou, CN; Tianjin, CN; Wuhan, CN; Xiamen, CN; Xi’an, CN; Ahmadabad, IN; Bangalore, IN; Chennai, IN; Hyderabad, IN; Jaipur, IN; Kolkata, IN; Mumbai, IN; Pune, IN; Surat, IN; Delhi, IN; Jakarta, ID; Nagoya, JP; Fukuoka, JP; Osaka, JP; Tokyo, JP; Busan, KR; Seoul, KR; Kuala Lumpur-Klang Valley, MY; Rangoon, MM; Auckland, NZ; Faisalabad, PK; Karachi, PK; Lahore, PK; Manila, PH; Singapore, SG; Taipei-Keelung, TW; Bangkok, TH; Hanoi, VT; Ho Chi Minh City, VT

Eastern Europe outside the EU and Russia: Moscow, RU; Saint Petersburg, RU; Ankara, TR; Istanbul, TR; Kiev, UA

Western Europe (or Europe): Vienna, AT; Brussels, BE; Prague, CZ; Copenhagen, DK; Helsinki, FI; Lyon, FR; Paris, FR; Cologne, DE; Munich, DE; Berlin, DE; Frankfurt, DE; Hamburg, DE; Athens, GR; Budapest, HU; Dublin, IE; Milan, IT; Rome, IT; Turin, IT; Amsterdam, NL; Oslo, NO; Krakow, PO; Warsaw, PO; Lisbon, PT; Bucharest, RO; Barcelona, ES; Madrid, ES; Stockholm, SE; Zurich, CH; Birmingham, UK; Manchester, UK; London, UK

Middle East and Africa: Kinshasa, CD; Alexandria, EG; Cairo, EG; Tehran, IR; Tel Aviv-Jaffa, IL; Kuwait City, KW; Casablanca, MO; Lagos, NG; Doha, QA; Jedda, SA; Riyadh, SA; Cape Town, ZA; Johannesburg, ZA; Khartoum, SD; Abu Dhabi, AE; Dubai, AE

North America: Montreal, CA; Toronto, CA; Vancouver, CA; Guadalajara, MX; Monterrey, MX; Mexico City, MX; Puebla, MX; Atlanta, US; Baltimore, US; Cleveland, US; Dallas-Fort Worth, US; Denver, US; Detroit, US; Houston, US; Los Angeles, US; Miami, US; Phoenix, US; Pittsburgh, US; San Diego, US; San Francisco, US; Seattle, US; Boston, US; Chicago, US; Minneapolis-Saint Paul, US; New York, US; Philadelphia, US; Portland, US; Saint Louis, US; Washington, US

South America: Buenos Aires, AR; Belo Horizonte, BR; Brasilia, BR; Fortaleza, BR; Porto Alegre, BR; Recife, BR; Rio de Janeiro, BR; Salvador, BR; Sao Paulo, BR; Santiago de Chile, CL; Medellin, CO; Bogota, CO; Lima, PE; Caracas, VE

(*) Our economic and demographic indicator database is dated January 2020, therefore macroeconomic and sectorial estimations and forecasts were made before that date. The world has changed dramatically in the three months as the world has been put in a Great Lockdown. According to the IMF, “the magnitude and speed of collapse in activity that has followed is unlike anything experienced in our lifetimes”. Up to the publication date of this report updates on forecasts up to 2023 haven’t be released.

London. Retail and business distribution

Overall, in 2018 the 151 cities selected in CSIL sample cumulatively show: population of 1,115 million inhabitants; GDP of US$ 31,085 billion; number of household of 342 million; household consumption of US$ 19,164 billion.

Therefore, they accounted for 16% of the global population and almost 37% of the world’s GDP. Compared to their respective countries, on average they account for 23% of the GDP and 10% of the population. In terms of population, Tokyo, Jakarta, and Delhi are the largest cities; Zurich, Abu Dhabi, and Oslo the smallest ones. On the other hand, Oslo is the number in terms of GDP per capita, Zurich ranks 6th in terms of household consumption per capita.

Economically. New York, Tokyo, and Los Angeles are the largest city in terms of total GDP (both in 2018 and 2013). However, in 2018 Tokyo has the largest city-level lighting market, followed by New York, Los Angeles, and Seoul. By 2023, Seoul is expected to overcome Los Angeles and reach the third position. Looking at the kitchen market, Seoul already ranks 3th in 2018, after Tokyo and New York. This ranking is expected to hold also in 2023.

As regards business attractiveness, the top destinations are Tokyo, Atlanta, and Stockholm. All of them stand out in terms of quality of life and good governance. The worse scores are recorded for Caracas, Teheran, and Recife.

Using big data, CSIL identifies the commercial areas of 150 cities through the geolocation of over 65 brands, each of which operates as a trend-setter in its own category. Each identified location is characterized by its type (store, multi-brand store, shopping centre) and the cost of the area in which it is positioned. CSIL managed to identify 4,809 locations across 143 cities. The cities that host a higher number of companies from our sample are: Moscow, London, Milano, Istanbul, and New York. On the other hand, the most expensive locations are in the USA, in order: Atlanta, Washington, D.C., Boston, Miami, and Chicago; the cheapest ones are sited in Asia: Haerbin (CN), Changchun (CN), Lahore (PK), Hyderabad (IN), and Xi’an, Shaanxi (CN).

Abstract of Table of Contents

INTRODUCTION

CITY PROFILES

Population and its rank within the sample, 2013, 2018 and 2023

Households and its rank within the sample, 2013, 2018 and 2023

Gross domestic product per capita and its rank within the sample, 2013, 2018 and 2023

Household?s consumption per capita and its rank within the sample, 2013, 2018 and 2023

Gross domestic product and its rank within the sample, 2013, 2018 and 2023

Household?s consumption and its rank within the sample, 2013, 2018 and 2023

Breakdown of households by the level of income, 2013, 2018 and 2023

Lighting demand and its growth rate, 2013, 2018 and 2023

Kitchen furniture demand and its growth rate, 2013, 2018 and 2023

Business attractiveness index and its components

Spatial analysis of the distribution of 65 brands within the city map

RAPPORTI CORRELATI

The Furniture Industry in India (English)

Aprile 2024,

IX Ed. ,

81 pagine

L'industria del mobile in India

Analisi dettagliata del settore del mobile in India, che approfondisce il sistema produttivo del paese, la domanda e il commercio di mobili (serie storiche 2013-2023), lo sviluppo del mercato del mobile (previsioni al 2025) con commenti CSIL sul potenziale di mercato e sul panorama competitivo che comprende i principali produttori indiani di mobili, performance e profili aziendali.

Poland Furniture Outlook (English)

Gennaio 2024,

XXII Ed. ,

25 pagine

L'industria del mobile in Polonia

Questa ricerca di mercato analizza l’industria del mobile in Polonia: dimensioni e previsioni del mercato del mobile, tendenze di produzione, consumo, importazioni ed esportazioni di mobili, elenco delle principali aziende del settore. Determinanti della domanda, potenziale di mercato e prospettive future del mercato polacco del mobile.

France Furniture Outlook (English)

Gennaio 2024,

XXVIII Ed. ,

20 pagine

L'industria del mobile in Francia

Questa ricerca di mercato analizza il mercato dell’arredamento in Francia, fornendo valori e tendenze di produzione e consumo di mobili, importazioni ed esportazioni di mobili. Le principali aziende di mobili. Determinanti della domanda, mercato potenziale e previsioni future per il mercato del mobile.

Germany Furniture Outlook (English)

Gennaio 2024,

XXVIII Ed. ,

23 pagine

L'industria del mobile in Germania

Questa ricerca di mercato analizza il mercato del mobile in Germania, fornendo valori e tendenze di produzione e consumo di mobili, importazioni ed esportazioni di mobili. Le principali aziende di mobili in Germania. Determinanti della domanda, mercato potenziale e previsioni future per il mercato del mobile.

United Kingdom Furniture Outlook (English)

Gennaio 2024,

XXVIII Ed. ,

23 pagine

L'industria del mobile nel Regno Unito

Analisi del mercato del mobile nel Regno Unito, dimensione e tendenze di produzione e consumo di mobili, importazioni ed esportazioni di mobili. Principali aziende dell’industria del mobile nel Regno Unito. Determinanti della domanda, potenziale di mercato e prospettive future per il mercato del mobile.