The European market for emergency lighting

Il mercato europeo dell'illuminazione di emergenza

Illuminazione | Novembre 2017

€1280

RAPPORTO IN LINGUA INGLESE

Novembre 2017,

II Ed. ,

58 pagine

Prezzo (licenza per singolo utente):

EUR 1280 / USD 1395.2

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: EU24

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

This is the second edition of CSIL Report on the European market for emergency lighting.

The information provided in this report is based on desk and field analysis, with information collected on approximately 30 sector companies through 30 direct interviews.

The geographical perimeter of the study covers 30 European Countries including the 28 States of the European Union, plus Norway and Switzerland. The countries were divided into eight clusters according to their geographical proximity and similarity in market characteristics. Nordic countries: Denmark (DK), Finland (FI), Norway (NO), and Sweden (SE); United Kingdom (UK) and Ireland (IE); Netherlands (NL); Germany (DE), Austria (AT) and Switzerland (CH); France (FR) and Belgium (BE); Italy (IT); Spain (ES), Portugal (PT) and Greece (GR); Central-Eastern Europe: Bulgaria (BG), Croatia (HR), Cyprus (CY), Czech Republic (CZ), Estonia (EE), Hungary (HU), Latvia (LV), Lithuania (LT), Malta (MA), Poland (PO), Romania (RO), Slovakia (SK), Slovenia (SI).

Estimated data on European production and consumption of emergency lighting are provided by country and by geographical area.

Activity trend is given as comparison with 2012 (previous edition of this Report).

Financial data are showed in terms of turnover growth rate and EBITDA margin for selected companies.

Estimated sales figures and market share for specific countries are given, as well main technological findings. Short profiles of the major European and international companies are also provided

Aziende selezionate

Arrow Emergency, Adolf Schuch, Awex, Beghelli, Benbon, Bodine, Daisalux, Emergy-Lite, Hochiki, Inotec, Kennede, Legrand, Lumos, Luminox, Norma Grup, Ocean’s King, Philip Payne, Ridi, Schneider, Teknoware, TM Technologie, Trilux, Zumtobel

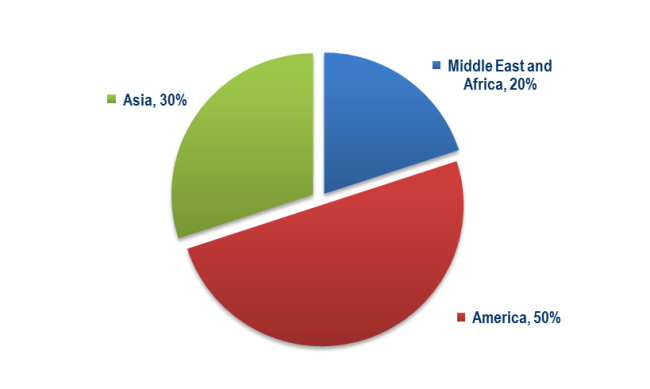

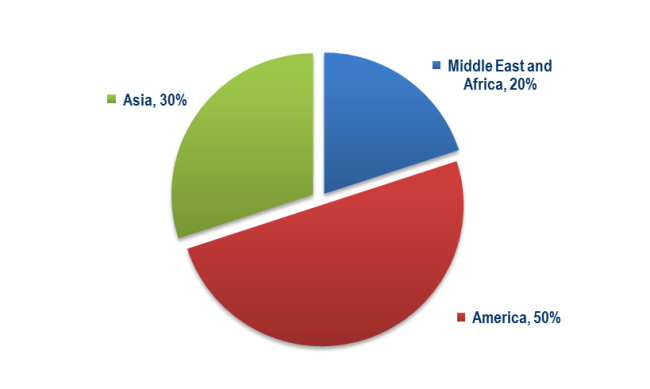

European exports of emergency lighting fixtures by geographical area. Percentage share in value

In recent years, average growth rate per year of the emergency lighting market has been approximately 3.5% in EUR currency. EBITDA margin for the considered products runs around 10% along the considered period. 50 manufacturers hold over 90% of the European market for emergency lighting. The production is made by around 15% of centralized systems, 40% stand-alone systems, 45% signage/ordinary products. The incidence of LED on sales of emergency lighting fixtures was estimated around 20% in 2012. In 2017 it is expected to reach 70%.

1. Basic data and product breakdown

Emergency lighting sector. Estimated data by country and by geographical area

2. Activity trend and financial data

Estimated turnover growth rate 2012-2016 in a sample of emergency lighting companies

EBITDA margin 2012-2016 in a sample of emergency lighting companies

3. Technical background

Overview of the main technological findings

4. Top European players

Estimated sales of Emergency lighting fixtures and market shares for a sample of leading European companies by considered countries and short company profiles:

Nordic countries; United Kingdom and Ireland; Netherlands; Germany, Austria and Switzerland; France and Belgium; Italy; Spain, Portugal and Greece; Central-Eastern Europe

5. Chinese players in Europe

Overview of the major Chinese players active in the European emergency lighting market

This is the second edition of CSIL Report on the European market for emergency lighting.

The information provided in this report is based on desk and field analysis, with information collected on approximately 30 sector companies through 30 direct interviews.

The geographical perimeter of the study covers 30 European Countries including the 28 States of the European Union, plus Norway and Switzerland. The countries were divided into eight clusters according to their geographical proximity and similarity in market characteristics. Nordic countries: Denmark (DK), Finland (FI), Norway (NO), and Sweden (SE); United Kingdom (UK) and Ireland (IE); Netherlands (NL); Germany (DE), Austria (AT) and Switzerland (CH); France (FR) and Belgium (BE); Italy (IT); Spain (ES), Portugal (PT) and Greece (GR); Central-Eastern Europe: Bulgaria (BG), Croatia (HR), Cyprus (CY), Czech Republic (CZ), Estonia (EE), Hungary (HU), Latvia (LV), Lithuania (LT), Malta (MA), Poland (PO), Romania (RO), Slovakia (SK), Slovenia (SI).

Estimated data on European production and consumption of emergency lighting are provided by country and by geographical area.

Activity trend is given as comparison with 2012 (previous edition of this Report).

Financial data are showed in terms of turnover growth rate and EBITDA margin for selected companies.

Estimated sales figures and market share for specific countries are given, as well main technological findings. Short profiles of the major European and international companies are also provided

European exports of emergency lighting fixtures by geographical area. Percentage share in value

In recent years, average growth rate per year of the emergency lighting market has been approximately 3.5% in EUR currency. EBITDA margin for the considered products runs around 10% along the considered period. 50 manufacturers hold over 90% of the European market for emergency lighting. The production is made by around 15% of centralized systems, 40% stand-alone systems, 45% signage/ordinary products. The incidence of LED on sales of emergency lighting fixtures was estimated around 20% in 2012. In 2017 it is expected to reach 70%.

1. Basic data and product breakdown

Emergency lighting sector. Estimated data by country and by geographical area

2. Activity trend and financial data

Estimated turnover growth rate 2012-2016 in a sample of emergency lighting companies

EBITDA margin 2012-2016 in a sample of emergency lighting companies

3. Technical background

Overview of the main technological findings

4. Top European players

Estimated sales of Emergency lighting fixtures and market shares for a sample of leading European companies by considered countries and short company profiles:

Nordic countries; United Kingdom and Ireland; Netherlands; Germany, Austria and Switzerland; France and Belgium; Italy; Spain, Portugal and Greece; Central-Eastern Europe

5. Chinese players in Europe

Overview of the major Chinese players active in the European emergency lighting market

RAPPORTI CORRELATI

The worldwide market for connected lighting (english)

Febbraio 2024,

I Ed. ,

88 pagine

Il mercato mondiale dell'illuminazione connessa

Questo rapporto analizza il mercato globale dell’illuminazione concentrandosi sulle tendenze dei LED e dell’illuminazione connessa. Fornisce previsioni di mercato sottolineando l’impatto della transizione green e della trasformazione digitale. Lo studio include anche una sezione sulla concorrenza del settore, stimando le vendite e le quote di mercato dei principali produttori.

Lighting: World Market Outlook (English)

Novembre 2023,

XXVI Ed. ,

123 pagine

Il mercato mondiale dell'illuminazione

La ventiseiesima edizione della ricerca CSIL “Lighting: World market outlook” analizza, attraverso tabelle e grafici, i dati relativi alla produzione, al consumo e al commercio internazionale di apparecchi di illuminazione a livello mondiale nel suo complesso con un focus su 70 Paesi, per gli anni 2013-2022 e i preliminari del 2023. Sono inoltre fornite previsioni di mercato per i prossimi tre anni (2024-2026).

The lighting fixtures market in China (English)

Settembre 2023,

XVI Ed. ,

205 pagine

Il mercato degli apparecchi per illuminazione in Cina

La 16a edizione di The Lighting Fixtures market in China offre un’analisi accurata e approfondita del settore degli apparecchi di illuminazione in Cina, fornendo dati e tendenze per il periodo 2017-2022 e previsioni fino al 2025. Da un lato, il rapporto analizza le principali tendenze che hanno interessato il mercato negli ultimi cinque anni, considerando la produzione, il consumo, le importazioni e le esportazioni di apparecchi di illuminazione nel Paese. Dall’altro, offre un’analisi della struttura dell’offerta e del sistema competitivo, una panoramica sul trend dell’ illuminazione connessa/smart, il sistema di distribuzione e i principali attori che operano nel mercato.

The lighting fixtures market in the United States (English)

Giugno 2023,

XVII Ed. ,

256 pagine

Il mercato degli apparecchi per illuminazione negli Stati Uniti

Il mercato statunitense dell’illuminazione nel 2022 registra una crescita del 6,5% in termini nominali per quanto riguarda gli apparecchi di illuminazione (consumer, professionale, per esterni), fino a 23,2 miliardi di dollari. Il mercato delle lampade registra un calo (circa -2,9%). Il segmento residenziale è cresciuto ben oltre la media del mercato (+5,9% in media negli ultimi cinque anni). Nel 2022, il peso degli uffici e dell’intrattenimento sul mercato complessivo dell’illuminazione commerciale è diminuito, mentre sono cresciuti i locali pubblici e l’ospitalità. Nel 2022, il valore delle costruzioni completate è cresciuto di oltre il 10%, raggiungendo quasi 1,8 miliardi di dollari.

The European market for lighting fixtures (English)

Maggio 2023,

XXXII Ed. ,

392 pagine

Il mercato europeo degli apparecchi per illuminazione

Nel 2022, il consumo di apparecchi di illuminazione nei Paesi dell’UE30 ha registrato un aumento dell’8,3%, raggiungendo un valore di 19,9 miliardi di euro. Risultati migliori per l’illuminazione commerciale (rispetto a quella residenziale, industriale e per esterni), per i grandi operatori (con un Ebitda del 12%), per il design, per l’illuminazione di aree, per l’ospitalità, per il contract (rispetto alla vendita al dettaglio), per l’illuminazione lineare e per l’emergenza. Più brevetti IP e acquisizioni. I primi 10 operatori detengono una quota di mercato del 30%.