The lighting fixtures market in India

Il mercato degli apparecchi per illuminazione in India

Illuminazione | Settembre 2020

€1600

RAPPORTO IN LINGUA INGLESE

Settembre 2020,

VIII Ed. ,

176 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1744

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S.33

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

The report provides data and trend (2014-2019) on the production, the international trade and the market size of the lighting fixtures industry in India, broken down by consumer/residential and technical/professional lighting (divided in architectural/commercial, industrial, and outdoor). An overview of the top players in the lamps lighting and lighting controls markets is also provided.

The breakthrough of the LED lighting technology in the Indian lighting fixtures market is analyzed through historical data dated back to 2013 and forecasts up to 2023. The report also considers the main public investment programs launched by the State and National governments for improving the efficiency of lighting consumption in the country, including the Smart City Mission project.

The study also provides a breakdown of the Indian lighting fixtures exports and imports by country and by geographical area of destination/origin for the years 2014-2019. The lighting demand of the Indian market is broken down by segment (consumer/residential lighting, architectural/commercial lighting, industrial lighting and outdoor lighting), by type of products and main applications, and by light source (LED, Conventional). An overview of the geographic distribution of the lighting sales in the country is presented.

The competitive system analyses the main companies present in the Indian lighting fixtures market (as a whole and by segment), with data on sales, market shares and short company profiles.

A breakdown of the distribution channels of lighting fixtures in India is given, together with short profiles of a sample of lighting fixture distributors. Covered channels are: direct sales and contract; lighting fixtures specialists; furniture stores/chains, department stores, DIY; wholesalers; e-commerce sales.

A list of selected architectural companies involved in the Indian lighting business and Lighting designers is given. The main magazines, fairs and organizations related to the lighting industry in India are presented.

Country economic indicators (including GDP, Inflation, private consumption, population indicators, and building construction indicators) are also provided, together with macroeconomic forecasts up to 2023.

Aziende selezionate

Among the analyzed companies: Artlite, Bajaj Electricals, Binay Opto Electronics, Compact Lighting, Cosmo – Firefly, Crompton Greaves, Debbas, Eveready, Fiem Industries, Flos, GM Modular, Goldmedal, Halonix, Havells, Indiabulls, Jaquar Lighting, K-Lite Industries, Kapoor Lamp Shades, Ledure, Ledvance, Luker, Orient Electric, Oreva, Panasonic Life Solutions (Anchor), Pigeon, Sigma Search Lights, Signify (Philips India), Surya Roshni, Spaceage, Syska LED Lights, Tisva, Trilux, Vinay, Wipro Lighting.

Focused cities: Ahmabad, Bangalore, Chennai, Delhi, Hyderabad, Jaipur, Kolkata, Mumbai, Pune, Surat.

Among the mentioned retailers, lighting designers and other stakeholders: Adithya Lamps, Ageco, Brainwave Design, Deekay Electricals, Design Matrix, Elcoma, Flipkart, Light & Beyond, Lighting India, Shimera Project Lighting, Smart Cities India Expo, Snapdeal, The Ministry of Light

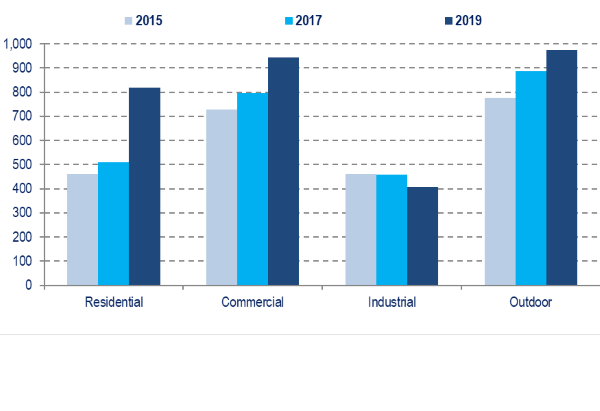

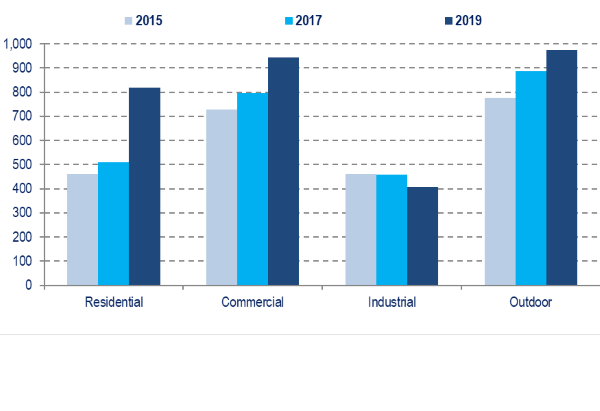

India. Breakdown of lighting fixtures sales by lighting segment, 2015, 2017 and 2019. Million USD

According to CSIL estimates, the Indian Lighting Industry witnessed a growth in the total consumption of lighting fixtures from USD 2,886 million in 2018 to USD 3,146 million in 2019 (from 19.7 to 22.1 million Crores). To be added, a market for lamps of around USD 840 million.

After the Outdoor lighting boom during 2018, 2019 has seen a relevant growth especially for residential lighting and lighting for infrastructures (especially schools and airports).

Overall, lighting sales decrease through 2020 could limit in around -5% to rebound in 2021 and still grow moderately during 2022 and 2023. According to CSIL forecasts, already in 2021, the market size will be at least the same than in 2019.

Almost one third of this market value comes from imports (now close to one billion USD) while exports run under 400 million USD since years.

The Indian LED Lighting Market is projected to grow at a CAGR of 7.1% during 2019-23.

In India, the top 60 companies account for around 85% of the country production. While, in term of consumption, the top 60 leading players (both Indian and international) hold a market share of almost 70% of sales in India.

BASIC DATA AND ACTIVITY TREND 2014-2019

Indian lighting fixtures production, consumption and international trade, 2014-2019. USD Million, EUR Million and INR Crores

Lighting fixtures export/production and import/consumption ratio, 2009-2019

2020-2023 FORECASTS

Indian performance of the lighting fixtures consumption by segment. 2019 estimates and 2020 forecasts

Lighting fixtures sales on the Indian market, 2009-2019 estimated data and 2020-2023 forecasts

LED-based and Conventional source-based lighting fixtures sales in India, 2013-2019 estimated data and 2020-2023 forecasts

Smart Cities Mission 2019-2020

INTERNATIONAL TRADE

Indian exports and Imports of lighting fixtures by country and by geographical area of destination/origin, 2014-2019

Exports and Imports of lighting fixtures by product and by segment

Exports and Imports of lamps

MARKET STRUCTURE

India. Incidence of consumer and professional lighting fixtures on total lighting fixtures consumption. 2009-2019

Indian lighting fixtures production, consumption and international trade by segment. USD Million, EUR Million, INR Crores

Breakdown of lighting fixtures sales in India by lighting segment, 2015, 2017 and 2019

Breakdown of residential, commercial, industrial, outdoor lighting fixtures sales by style, products type, main applications. Market estimates and data for a sample of companies

DISTRIBUTION SYSTEM

India. Breakdown of domestic lighting fixtures sales by geographical area

Breakdown of lighting fixtures sales in India by distribution channel, 2015-2017 and 2019

Selected profiles of lighting wholesalers, retailers, lighting specialists, builders, furniture stores and chains, e-commerce portals

Selection of contacts for the contract market: architectural companies, lighting designers, consultancy

Lighting fixtures reference prices in India for a sample of products and by price range, 2020

Lighting demand in a selected sample of Indian cities: 2013 and 2018 estimates, 2023 forecast

COMPETITION

Top players: lighting fixtures turnover and market share for a sample of 60 leading Indian manufacturers

Top players in the Residential/Consumer, Architectural/Commercial, Industrial and Outdoor lighting markets. Sales data, market share, company profiles

Main players in the lamps and lighting controls markets in India

MACROECONOMIC AND GROWTH DRIVERS

Geography, population and urbanisation process; Main country economic indicators; Indian consumer markets and Building activity

Appendix: Directory of the leading mentioned companies

The report provides data and trend (2014-2019) on the production, the international trade and the market size of the lighting fixtures industry in India, broken down by consumer/residential and technical/professional lighting (divided in architectural/commercial, industrial, and outdoor). An overview of the top players in the lamps lighting and lighting controls markets is also provided.

The breakthrough of the LED lighting technology in the Indian lighting fixtures market is analyzed through historical data dated back to 2013 and forecasts up to 2023. The report also considers the main public investment programs launched by the State and National governments for improving the efficiency of lighting consumption in the country, including the Smart City Mission project.

The study also provides a breakdown of the Indian lighting fixtures exports and imports by country and by geographical area of destination/origin for the years 2014-2019. The lighting demand of the Indian market is broken down by segment (consumer/residential lighting, architectural/commercial lighting, industrial lighting and outdoor lighting), by type of products and main applications, and by light source (LED, Conventional). An overview of the geographic distribution of the lighting sales in the country is presented.

The competitive system analyses the main companies present in the Indian lighting fixtures market (as a whole and by segment), with data on sales, market shares and short company profiles.

A breakdown of the distribution channels of lighting fixtures in India is given, together with short profiles of a sample of lighting fixture distributors. Covered channels are: direct sales and contract; lighting fixtures specialists; furniture stores/chains, department stores, DIY; wholesalers; e-commerce sales.

A list of selected architectural companies involved in the Indian lighting business and Lighting designers is given. The main magazines, fairs and organizations related to the lighting industry in India are presented.

Country economic indicators (including GDP, Inflation, private consumption, population indicators, and building construction indicators) are also provided, together with macroeconomic forecasts up to 2023.

India. Breakdown of lighting fixtures sales by lighting segment, 2015, 2017 and 2019. Million USD

According to CSIL estimates, the Indian Lighting Industry witnessed a growth in the total consumption of lighting fixtures from USD 2,886 million in 2018 to USD 3,146 million in 2019 (from 19.7 to 22.1 million Crores). To be added, a market for lamps of around USD 840 million.

After the Outdoor lighting boom during 2018, 2019 has seen a relevant growth especially for residential lighting and lighting for infrastructures (especially schools and airports).

Overall, lighting sales decrease through 2020 could limit in around -5% to rebound in 2021 and still grow moderately during 2022 and 2023. According to CSIL forecasts, already in 2021, the market size will be at least the same than in 2019.

Almost one third of this market value comes from imports (now close to one billion USD) while exports run under 400 million USD since years.

The Indian LED Lighting Market is projected to grow at a CAGR of 7.1% during 2019-23.

In India, the top 60 companies account for around 85% of the country production. While, in term of consumption, the top 60 leading players (both Indian and international) hold a market share of almost 70% of sales in India.

BASIC DATA AND ACTIVITY TREND 2014-2019

Indian lighting fixtures production, consumption and international trade, 2014-2019. USD Million, EUR Million and INR Crores

Lighting fixtures export/production and import/consumption ratio, 2009-2019

2020-2023 FORECASTS

Indian performance of the lighting fixtures consumption by segment. 2019 estimates and 2020 forecasts

Lighting fixtures sales on the Indian market, 2009-2019 estimated data and 2020-2023 forecasts

LED-based and Conventional source-based lighting fixtures sales in India, 2013-2019 estimated data and 2020-2023 forecasts

Smart Cities Mission 2019-2020

INTERNATIONAL TRADE

Indian exports and Imports of lighting fixtures by country and by geographical area of destination/origin, 2014-2019

Exports and Imports of lighting fixtures by product and by segment

Exports and Imports of lamps

MARKET STRUCTURE

India. Incidence of consumer and professional lighting fixtures on total lighting fixtures consumption. 2009-2019

Indian lighting fixtures production, consumption and international trade by segment. USD Million, EUR Million, INR Crores

Breakdown of lighting fixtures sales in India by lighting segment, 2015, 2017 and 2019

Breakdown of residential, commercial, industrial, outdoor lighting fixtures sales by style, products type, main applications. Market estimates and data for a sample of companies

DISTRIBUTION SYSTEM

India. Breakdown of domestic lighting fixtures sales by geographical area

Breakdown of lighting fixtures sales in India by distribution channel, 2015-2017 and 2019

Selected profiles of lighting wholesalers, retailers, lighting specialists, builders, furniture stores and chains, e-commerce portals

Selection of contacts for the contract market: architectural companies, lighting designers, consultancy

Lighting fixtures reference prices in India for a sample of products and by price range, 2020

Lighting demand in a selected sample of Indian cities: 2013 and 2018 estimates, 2023 forecast

COMPETITION

Top players: lighting fixtures turnover and market share for a sample of 60 leading Indian manufacturers

Top players in the Residential/Consumer, Architectural/Commercial, Industrial and Outdoor lighting markets. Sales data, market share, company profiles

Main players in the lamps and lighting controls markets in India

MACROECONOMIC AND GROWTH DRIVERS

Geography, population and urbanisation process; Main country economic indicators; Indian consumer markets and Building activity

Appendix: Directory of the leading mentioned companies

RAPPORTI CORRELATI

The worldwide market for connected lighting (english)

Febbraio 2024,

I Ed. ,

88 pagine

Il mercato mondiale dell'illuminazione connessa

Questo rapporto analizza il mercato globale dell’illuminazione concentrandosi sulle tendenze dei LED e dell’illuminazione connessa. Fornisce previsioni di mercato sottolineando l’impatto della transizione green e della trasformazione digitale. Lo studio include anche una sezione sulla concorrenza del settore, stimando le vendite e le quote di mercato dei principali produttori.

Lighting: World Market Outlook (English)

Novembre 2023,

XXVI Ed. ,

123 pagine

Il mercato mondiale dell'illuminazione

La ventiseiesima edizione della ricerca CSIL “Lighting: World market outlook” analizza, attraverso tabelle e grafici, i dati relativi alla produzione, al consumo e al commercio internazionale di apparecchi di illuminazione a livello mondiale nel suo complesso con un focus su 70 Paesi, per gli anni 2013-2022 e i preliminari del 2023. Sono inoltre fornite previsioni di mercato per i prossimi tre anni (2024-2026).

The lighting fixtures market in China (English)

Settembre 2023,

XVI Ed. ,

205 pagine

Il mercato degli apparecchi per illuminazione in Cina

La 16a edizione di The Lighting Fixtures market in China offre un’analisi accurata e approfondita del settore degli apparecchi di illuminazione in Cina, fornendo dati e tendenze per il periodo 2017-2022 e previsioni fino al 2025. Da un lato, il rapporto analizza le principali tendenze che hanno interessato il mercato negli ultimi cinque anni, considerando la produzione, il consumo, le importazioni e le esportazioni di apparecchi di illuminazione nel Paese. Dall’altro, offre un’analisi della struttura dell’offerta e del sistema competitivo, una panoramica sul trend dell’ illuminazione connessa/smart, il sistema di distribuzione e i principali attori che operano nel mercato.

The lighting fixtures market in the United States (English)

Giugno 2023,

XVII Ed. ,

256 pagine

Il mercato degli apparecchi per illuminazione negli Stati Uniti

Il mercato statunitense dell’illuminazione nel 2022 registra una crescita del 6,5% in termini nominali per quanto riguarda gli apparecchi di illuminazione (consumer, professionale, per esterni), fino a 23,2 miliardi di dollari. Il mercato delle lampade registra un calo (circa -2,9%). Il segmento residenziale è cresciuto ben oltre la media del mercato (+5,9% in media negli ultimi cinque anni). Nel 2022, il peso degli uffici e dell’intrattenimento sul mercato complessivo dell’illuminazione commerciale è diminuito, mentre sono cresciuti i locali pubblici e l’ospitalità. Nel 2022, il valore delle costruzioni completate è cresciuto di oltre il 10%, raggiungendo quasi 1,8 miliardi di dollari.

The European market for lighting fixtures (English)

Maggio 2023,

XXXII Ed. ,

392 pagine

Il mercato europeo degli apparecchi per illuminazione

Nel 2022, il consumo di apparecchi di illuminazione nei Paesi dell’UE30 ha registrato un aumento dell’8,3%, raggiungendo un valore di 19,9 miliardi di euro. Risultati migliori per l’illuminazione commerciale (rispetto a quella residenziale, industriale e per esterni), per i grandi operatori (con un Ebitda del 12%), per il design, per l’illuminazione di aree, per l’ospitalità, per il contract (rispetto alla vendita al dettaglio), per l’illuminazione lineare e per l’emergenza. Più brevetti IP e acquisizioni. I primi 10 operatori detengono una quota di mercato del 30%.