The lighting fixtures market in Japan

Il mercato degli apparecchi per illuminazione in Giappone

Illuminazione | Settembre 2021

€1600

RAPPORTO IN LINGUA INGLESE

Settembre 2021,

V Ed. ,

124 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1728

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S72JP-2021

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

The report ‘The lighting fixtures market in Japan’ is at its fifth edition. It provides historical statistical data 2015-2020 of Production, International trade and Market size of the lighting fixtures industry in Japan. Total and LED-based consumption of lighting fixtures forecasts up to 2023 are also provided.

Lighting fixtures demand for the Japanese market is broken down by segment (consumer/residential lighting, architectural/commercial lighting, industrial lighting and outdoor lighting) and by light source (Conventional and LED). A focus on LED lighting is provided as well as a snapshot of the advent of Connected Smart Lighting and Human Centric Lighting.

A breakdown of Japanese lighting fixtures exports and imports is provided by country and by geographical area of destination/origin.

The competitive system analyses the main companies present in the Japanese lighting fixtures market (by segment, by product and application), with data on sales and market shares and short company profiles.

A breakdown of the distribution channels of lighting fixtures in Japan is given, together with short profiles and sales of a sample of lighting fixture distributors. Covered channels are: direct sales and contract; lighting fixtures specialists; furniture stores/chains, department stores, DIY; Wholesalers; E-commerce sales; appliances/electronic stores. A list of selected architectural companies in Japan involved in the lighting business and Lighting designers is given. A relevant financial analysis is included for around 30 Japanese manufacturers of lighting fixtures and related activities.

Population trends, macroeconomic indicators (including GDP, Inflation, population indicators, building construction indicators), and construction data are also provided.

Addresses of the mentioned lighting companies in Japan are also enclosed.

Aziende selezionate

Artemide, Arup Japan, ALG – Architectural Lighting Group, Cree, Daiko, Dongmyung, Feelux, FSL, Kumho, DPA Lighting, Endo, Erco, Flos, Hansol, Hitachi, IDC Otsuka, Iwasaki, KKDC, Koizumi, Kum Kyeong, Louis Poulsen, LPA, Lumens, Maltani, Mitsubishi, Nec, Opple, Odelic, Panasonic, Signify, Samsung LED, Toshiba, Wooree

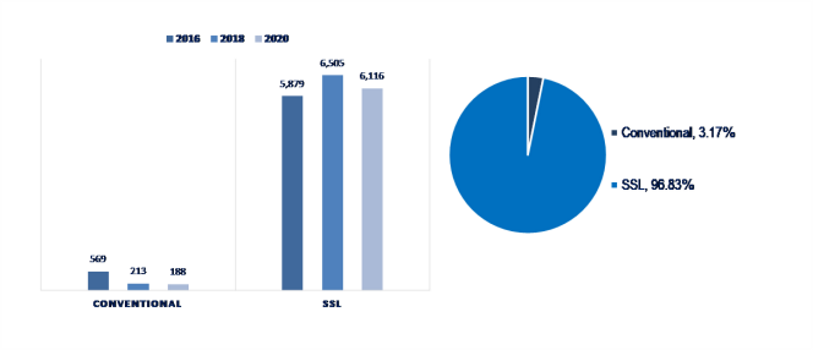

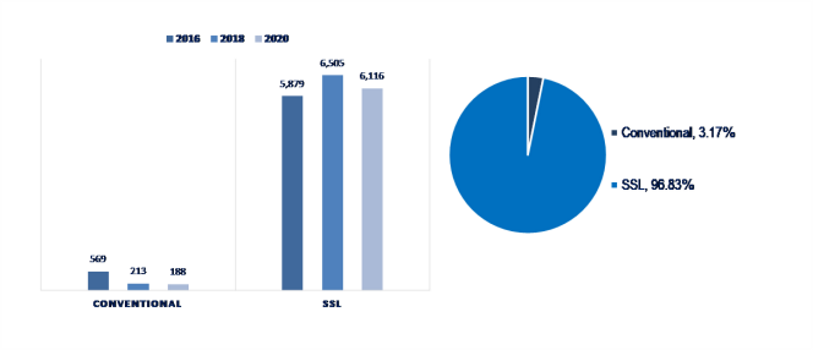

Japan. Lighting fixtures. Sales breakdown by light source, 2016-2018-2020. Million USD, % share

The lighting fixtures market in Japan dropped by 7.5% (-9.4% in YEN) in 2020 to a market value of US$ 6.3 billion (YEN 673 billion). The recovery in 2021 (+2.8% in USD y-o-y in 2021), driven by the global economy and government spending, is expected to be moderate as the reintroduction of sanitary measures in early 2021 has dented near-term economic prospects.

In 2020, in Japan less than 10% of the local consumption was satisfied by imports (US$ 659 million); China remains the top importing country (76% of the total import value). Exports only amounted to US$ 60 million (only 1% of the production).

The LED-base lighting fixtures segment has almost reached 98% of the market. As it has almost saturated the market, the industry has identified Connected Smart Lighting (CSL) and Human Centric Lighting (HCL) as the next propelling force that will guide the market in the next future.

BASIC DATA AND ACTIVITY TREND

Japan. Total lighting market consumption by segment (lighting fixtures, lamp, controls), 2019-2021

Japan. Lighting fixtures production, export, import and consumption, 2015-2020: Total, Residential and Technical Lighting, 2015-2020

INTERNATIONAL TRADE

Japan. Lighting fixtures exports and imports by country of destination/origin and by geographical area, 2015-2020

MARKET STRUCTURE

Japan. Lighting fixtures. Sales breakdown by market segment: consumer/residential, architectural/commercial, industrial and outdoor lighting.

Japan. Lighting fixtures. Sales breakdown by style, product type and application.

Japan. LED based lighting fixtures sales, 2015-2020 estimated data and 2021-2023 forecasts.

Japan. LED based lighting fixtures sales and market shares of 50 among the leading companies

Japan. Lighting fixtures. Sales breakdown by light source

Japan. A focus on Connected Smart Lighting and Human Centric Lighting

Japan. EBIT Margin, ROI and other financial structure indicators for a sample of companies

DISTRIBUTION

Japan. Lighting fixtures. Sales breakdown by Region, 2020

Japan. Lighting fixtures. Sales breakdown by distribution channel and short company profiles (Direct Sales and Contract, Lighting Specialists, Department Stores, Furniture Retailers and Furniture Chains, DIY and Home Centres, Lifestyle Concept Stores, Wholesalers and Home Builders, Consumer Electronic Stores, E-Commerce)

Japan. Reference prices

Japan. Architectural and Design companies involved in the lighting business

COMPETITIVE SYSTEM

Japan. Lighting fixtures sales and market shares of 50 among the leading companies

Japan. Residential, commercial, industrial, outdoor lighting fixtures sales and market shares for a sample of leading companies.

Japan. Lighting fixtures sales and market shares of the leading companies broken down by style, kind of product and application.

MACROECONOMIC INDICATORS

Japan. Population indicators, Country Indicators, GDP and inflation (historical data and forecasts up to 2024)

Japan. Construction market data

APPENDIX: list of the mentioned lighting companies operating in Japan

The report ‘The lighting fixtures market in Japan’ is at its fifth edition. It provides historical statistical data 2015-2020 of Production, International trade and Market size of the lighting fixtures industry in Japan. Total and LED-based consumption of lighting fixtures forecasts up to 2023 are also provided.

Lighting fixtures demand for the Japanese market is broken down by segment (consumer/residential lighting, architectural/commercial lighting, industrial lighting and outdoor lighting) and by light source (Conventional and LED). A focus on LED lighting is provided as well as a snapshot of the advent of Connected Smart Lighting and Human Centric Lighting.

A breakdown of Japanese lighting fixtures exports and imports is provided by country and by geographical area of destination/origin.

The competitive system analyses the main companies present in the Japanese lighting fixtures market (by segment, by product and application), with data on sales and market shares and short company profiles.

A breakdown of the distribution channels of lighting fixtures in Japan is given, together with short profiles and sales of a sample of lighting fixture distributors. Covered channels are: direct sales and contract; lighting fixtures specialists; furniture stores/chains, department stores, DIY; Wholesalers; E-commerce sales; appliances/electronic stores. A list of selected architectural companies in Japan involved in the lighting business and Lighting designers is given. A relevant financial analysis is included for around 30 Japanese manufacturers of lighting fixtures and related activities.

Population trends, macroeconomic indicators (including GDP, Inflation, population indicators, building construction indicators), and construction data are also provided.

Addresses of the mentioned lighting companies in Japan are also enclosed.

Japan. Lighting fixtures. Sales breakdown by light source, 2016-2018-2020. Million USD, % share

The lighting fixtures market in Japan dropped by 7.5% (-9.4% in YEN) in 2020 to a market value of US$ 6.3 billion (YEN 673 billion). The recovery in 2021 (+2.8% in USD y-o-y in 2021), driven by the global economy and government spending, is expected to be moderate as the reintroduction of sanitary measures in early 2021 has dented near-term economic prospects.

In 2020, in Japan less than 10% of the local consumption was satisfied by imports (US$ 659 million); China remains the top importing country (76% of the total import value). Exports only amounted to US$ 60 million (only 1% of the production).

The LED-base lighting fixtures segment has almost reached 98% of the market. As it has almost saturated the market, the industry has identified Connected Smart Lighting (CSL) and Human Centric Lighting (HCL) as the next propelling force that will guide the market in the next future.

BASIC DATA AND ACTIVITY TREND

Japan. Total lighting market consumption by segment (lighting fixtures, lamp, controls), 2019-2021

Japan. Lighting fixtures production, export, import and consumption, 2015-2020: Total, Residential and Technical Lighting, 2015-2020

INTERNATIONAL TRADE

Japan. Lighting fixtures exports and imports by country of destination/origin and by geographical area, 2015-2020

MARKET STRUCTURE

Japan. Lighting fixtures. Sales breakdown by market segment: consumer/residential, architectural/commercial, industrial and outdoor lighting.

Japan. Lighting fixtures. Sales breakdown by style, product type and application.

Japan. LED based lighting fixtures sales, 2015-2020 estimated data and 2021-2023 forecasts.

Japan. LED based lighting fixtures sales and market shares of 50 among the leading companies

Japan. Lighting fixtures. Sales breakdown by light source

Japan. A focus on Connected Smart Lighting and Human Centric Lighting

Japan. EBIT Margin, ROI and other financial structure indicators for a sample of companies

DISTRIBUTION

Japan. Lighting fixtures. Sales breakdown by Region, 2020

Japan. Lighting fixtures. Sales breakdown by distribution channel and short company profiles (Direct Sales and Contract, Lighting Specialists, Department Stores, Furniture Retailers and Furniture Chains, DIY and Home Centres, Lifestyle Concept Stores, Wholesalers and Home Builders, Consumer Electronic Stores, E-Commerce)

Japan. Reference prices

Japan. Architectural and Design companies involved in the lighting business

COMPETITIVE SYSTEM

Japan. Lighting fixtures sales and market shares of 50 among the leading companies

Japan. Residential, commercial, industrial, outdoor lighting fixtures sales and market shares for a sample of leading companies.

Japan. Lighting fixtures sales and market shares of the leading companies broken down by style, kind of product and application.

MACROECONOMIC INDICATORS

Japan. Population indicators, Country Indicators, GDP and inflation (historical data and forecasts up to 2024)

Japan. Construction market data

APPENDIX: list of the mentioned lighting companies operating in Japan

RAPPORTI CORRELATI

The worldwide market for connected lighting (english)

Febbraio 2024,

I Ed. ,

88 pagine

Il mercato mondiale dell'illuminazione connessa

Questo rapporto analizza il mercato globale dell’illuminazione concentrandosi sulle tendenze dei LED e dell’illuminazione connessa. Fornisce previsioni di mercato sottolineando l’impatto della transizione green e della trasformazione digitale. Lo studio include anche una sezione sulla concorrenza del settore, stimando le vendite e le quote di mercato dei principali produttori.

Lighting: World Market Outlook (English)

Novembre 2023,

XXVI Ed. ,

123 pagine

Il mercato mondiale dell'illuminazione

La ventiseiesima edizione della ricerca CSIL “Lighting: World market outlook” analizza, attraverso tabelle e grafici, i dati relativi alla produzione, al consumo e al commercio internazionale di apparecchi di illuminazione a livello mondiale nel suo complesso con un focus su 70 Paesi, per gli anni 2013-2022 e i preliminari del 2023. Sono inoltre fornite previsioni di mercato per i prossimi tre anni (2024-2026).

The lighting fixtures market in China (English)

Settembre 2023,

XVI Ed. ,

205 pagine

Il mercato degli apparecchi per illuminazione in Cina

La 16a edizione di The Lighting Fixtures market in China offre un’analisi accurata e approfondita del settore degli apparecchi di illuminazione in Cina, fornendo dati e tendenze per il periodo 2017-2022 e previsioni fino al 2025. Da un lato, il rapporto analizza le principali tendenze che hanno interessato il mercato negli ultimi cinque anni, considerando la produzione, il consumo, le importazioni e le esportazioni di apparecchi di illuminazione nel Paese. Dall’altro, offre un’analisi della struttura dell’offerta e del sistema competitivo, una panoramica sul trend dell’ illuminazione connessa/smart, il sistema di distribuzione e i principali attori che operano nel mercato.

The lighting fixtures market in the United States (English)

Giugno 2023,

XVII Ed. ,

256 pagine

Il mercato degli apparecchi per illuminazione negli Stati Uniti

Il mercato statunitense dell’illuminazione nel 2022 registra una crescita del 6,5% in termini nominali per quanto riguarda gli apparecchi di illuminazione (consumer, professionale, per esterni), fino a 23,2 miliardi di dollari. Il mercato delle lampade registra un calo (circa -2,9%). Il segmento residenziale è cresciuto ben oltre la media del mercato (+5,9% in media negli ultimi cinque anni). Nel 2022, il peso degli uffici e dell’intrattenimento sul mercato complessivo dell’illuminazione commerciale è diminuito, mentre sono cresciuti i locali pubblici e l’ospitalità. Nel 2022, il valore delle costruzioni completate è cresciuto di oltre il 10%, raggiungendo quasi 1,8 miliardi di dollari.

The European market for lighting fixtures (English)

Maggio 2023,

XXXII Ed. ,

392 pagine

Il mercato europeo degli apparecchi per illuminazione

Nel 2022, il consumo di apparecchi di illuminazione nei Paesi dell’UE30 ha registrato un aumento dell’8,3%, raggiungendo un valore di 19,9 miliardi di euro. Risultati migliori per l’illuminazione commerciale (rispetto a quella residenziale, industriale e per esterni), per i grandi operatori (con un Ebitda del 12%), per il design, per l’illuminazione di aree, per l’ospitalità, per il contract (rispetto alla vendita al dettaglio), per l’illuminazione lineare e per l’emergenza. Più brevetti IP e acquisizioni. I primi 10 operatori detengono una quota di mercato del 30%.