The lighting fixtures market in Latin America

Il mercato degli apparecchi per illuminazione in America Latina

Illuminazione | Settembre 2022

€1600

RAPPORTO IN LINGUA INGLESE

Settembre 2022,

V Ed. ,

150 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1728

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S.58

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

This is the fifth edition of ‘The lighting fixtures market in Latin America’ Report, issued by CSIL.

Five considered countries (in alphabetical order): Argentina, Brazil, Chile, Colombia, Mexico.

The report is structured as follows.

The first chapter offers an overview of the lighting fixtures industry in Latin America (5 countries) as a whole, with basic data and trend on production, consumption and international trade, estimates of lighting fixtures sales by segment (consumer/professional, indoor/outdoor), specific products and applications (downlights, projectors, high bays, etc.; hospitality, retail, healthcare, street lighting, etc.), light sources (LED share), distribution channels, ranking the top players.

After a first glance of the Latin America lighting fixtures market as a whole, for each country considered:

- Paragraph I Basic data and market structure offers an overview of the lighting fixtures industry with data on production, consumption and international trade, whenever possible with in-deep information on the main market segments (consumer/professional, indoor/outdoor, LED/Conventional, specific applications and products)

- Paragraph II Activity trend and market drivers offers lighting fixtures time series and forecast data on production, consumption and international trade; market drivers include macroeconomic indicators, social trends, building activity

- Paragraph III International trade provides detailed tables on lighting fixtures exports and imports by country and by geographical area of destination/origin.

- Paragraph IV Competitive System and distribution channels analyses the competitive system offering an insight into the leading local and foreign players present in each segment; an overview of the main distribution channels and a selection of architectural offices and lighting designers is also included.

Aziende selezionate

Among the analyzed companies: 180 Grados Iluminacion, Accord, Acuity Brands, Atomlux, Beghelli, Bella Iluminacao, Blumenau, BronzeArte, Candil Iluminacion, Celsa, Clever, Construlita, Current, Eglo, Electrafk, Elmsa, Estevez, Fasa, Experience Brands, Forlighting, FSL Lighting, Home Depot, Hunter Industries, Iltec, Ilunato, Feilo, HGE, Inahsa, Interlight, Intral, Leds C4, Ledvance, Lumenac, Lumicenter, Lumifluor, Lumini, Luminotecnia, Luxmart, Marshall, NVC, Olivo, Ourolux, Pix, Repume, Rolec, Roy Alpha, Save Energy, Schreder, Startec, Signify (Philips Lighting), Taschibra, Tecnowatt, Tospo, Trazzo, Yankon, Wac Lighting.

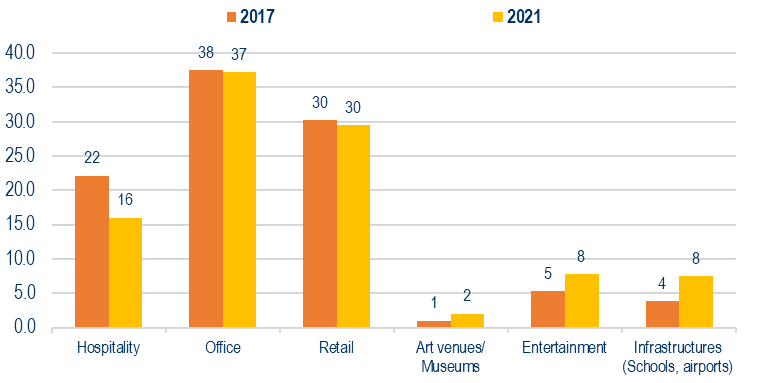

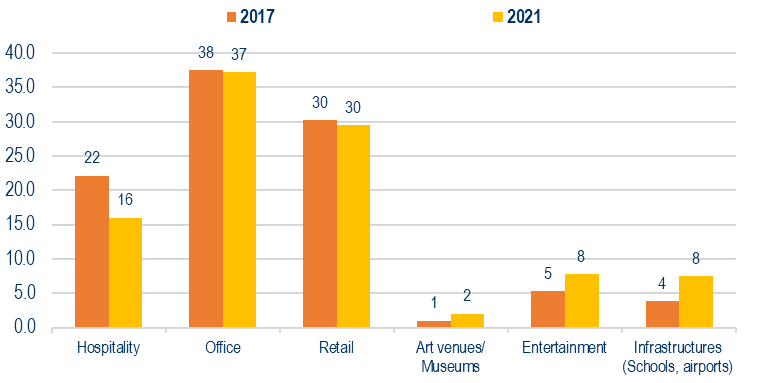

Latin America. Estimated breakdown of commercial/architectural indoor lighting fixtures sales by application, 2017 and 2021.Percentage share

This Report analyses the lighting fixtures and LED market in 5 Latin America countries (in alphabetical order: Argentina, Brazil, Chile, Colombia, Mexico), a market with an estimated consumption (at production or import prices, excluding retail mark-up) that, in 2021, amounts to USD 4,360 million.

2021 registers in the whole area an increasing of imports equal to a booming 40%. Lighting for schools, emergency lighting, street lighting are the most increasing segments. To be noticed, a market of about 150 million USD for consumer design lighting, and approximately the same as design-oriented fixtures for commercial spaces.

Distribution shows a polarization among contract/direct sales from one side (from 16% to 20% of the total market) and the mass market (DIY and e-commerce together growing from 9% to 19%) on the other side.

Market of LED based lighting fixtures in Latin America is estimated around USD 1,470 million for the year 2017 and USD 2,900 million in 2021. In comparison with the previous year, growth rate has been around 28% in 2021. The share of LED on the lamps market is around 63%, and an estimated 68% on lighting fixtures market (less for residential, more for professional and outdoor).

The market is still fragmented: top 50 players hold only a 50% of share in most of the considered countries.

OVERVIEW – The lighting fixtures market in Latin America: scenario

Data on lighting fixtures production, consumption, international trade by country and by segment, activity trend 2016-2022, trend analysis 2015-2021 and forecasts 2022-2025 on LED market, distribution system and major players.

Estimated breakdown of commercial/architectural indoor, industrial and outdoor lighting fixtures sales by application: 2017 versus 2021 and data for a sample of companies.

COUNTRY ANALYSIS – Argentina, Brazil, Chile, Colombia, Mexico

For each country considered:

– Basic data and market structure: data on lighting fixtures production, international trade and consumption, breakdown of the main market segments (consumer/professional, indoor/outdoor, LED/Conventional, specific applications and products).

– Activity trend and market drivers: lighting fixtures time series (2016-2022) on production, consumption and international trade, data and forecasts for selected economic and population indicators.

– International trade: export and import flows of lighting fixtures and lamps by country and by geographical area of destination/origin.

– Competitive system and distribution channels: estimated lighting fixtures sales data and market shares among the major local and international players present in each market segment, as well as short company profiles; an overview of the distribution system and a selection of architectural offices and lighting designers, lighting fairs, associations and magazines.

This is the fifth edition of ‘The lighting fixtures market in Latin America’ Report, issued by CSIL.

Five considered countries (in alphabetical order): Argentina, Brazil, Chile, Colombia, Mexico.

The report is structured as follows.

The first chapter offers an overview of the lighting fixtures industry in Latin America (5 countries) as a whole, with basic data and trend on production, consumption and international trade, estimates of lighting fixtures sales by segment (consumer/professional, indoor/outdoor), specific products and applications (downlights, projectors, high bays, etc.; hospitality, retail, healthcare, street lighting, etc.), light sources (LED share), distribution channels, ranking the top players.

After a first glance of the Latin America lighting fixtures market as a whole, for each country considered:

- Paragraph I Basic data and market structure offers an overview of the lighting fixtures industry with data on production, consumption and international trade, whenever possible with in-deep information on the main market segments (consumer/professional, indoor/outdoor, LED/Conventional, specific applications and products)

- Paragraph II Activity trend and market drivers offers lighting fixtures time series and forecast data on production, consumption and international trade; market drivers include macroeconomic indicators, social trends, building activity

- Paragraph III International trade provides detailed tables on lighting fixtures exports and imports by country and by geographical area of destination/origin.

- Paragraph IV Competitive System and distribution channels analyses the competitive system offering an insight into the leading local and foreign players present in each segment; an overview of the main distribution channels and a selection of architectural offices and lighting designers is also included.

Latin America. Estimated breakdown of commercial/architectural indoor lighting fixtures sales by application, 2017 and 2021.Percentage share

This Report analyses the lighting fixtures and LED market in 5 Latin America countries (in alphabetical order: Argentina, Brazil, Chile, Colombia, Mexico), a market with an estimated consumption (at production or import prices, excluding retail mark-up) that, in 2021, amounts to USD 4,360 million.

2021 registers in the whole area an increasing of imports equal to a booming 40%. Lighting for schools, emergency lighting, street lighting are the most increasing segments. To be noticed, a market of about 150 million USD for consumer design lighting, and approximately the same as design-oriented fixtures for commercial spaces.

Distribution shows a polarization among contract/direct sales from one side (from 16% to 20% of the total market) and the mass market (DIY and e-commerce together growing from 9% to 19%) on the other side.

Market of LED based lighting fixtures in Latin America is estimated around USD 1,470 million for the year 2017 and USD 2,900 million in 2021. In comparison with the previous year, growth rate has been around 28% in 2021. The share of LED on the lamps market is around 63%, and an estimated 68% on lighting fixtures market (less for residential, more for professional and outdoor).

The market is still fragmented: top 50 players hold only a 50% of share in most of the considered countries.

OVERVIEW – The lighting fixtures market in Latin America: scenario

Data on lighting fixtures production, consumption, international trade by country and by segment, activity trend 2016-2022, trend analysis 2015-2021 and forecasts 2022-2025 on LED market, distribution system and major players.

Estimated breakdown of commercial/architectural indoor, industrial and outdoor lighting fixtures sales by application: 2017 versus 2021 and data for a sample of companies.

COUNTRY ANALYSIS – Argentina, Brazil, Chile, Colombia, Mexico

For each country considered:

– Basic data and market structure: data on lighting fixtures production, international trade and consumption, breakdown of the main market segments (consumer/professional, indoor/outdoor, LED/Conventional, specific applications and products).

– Activity trend and market drivers: lighting fixtures time series (2016-2022) on production, consumption and international trade, data and forecasts for selected economic and population indicators.

– International trade: export and import flows of lighting fixtures and lamps by country and by geographical area of destination/origin.

– Competitive system and distribution channels: estimated lighting fixtures sales data and market shares among the major local and international players present in each market segment, as well as short company profiles; an overview of the distribution system and a selection of architectural offices and lighting designers, lighting fairs, associations and magazines.

RAPPORTI CORRELATI

The worldwide market for connected lighting (english)

Febbraio 2024,

I Ed. ,

88 pagine

Il mercato mondiale dell'illuminazione connessa

Questo rapporto analizza il mercato globale dell’illuminazione concentrandosi sulle tendenze dei LED e dell’illuminazione connessa. Fornisce previsioni di mercato sottolineando l’impatto della transizione green e della trasformazione digitale. Lo studio include anche una sezione sulla concorrenza del settore, stimando le vendite e le quote di mercato dei principali produttori.

Lighting: World Market Outlook (English)

Novembre 2023,

XXVI Ed. ,

123 pagine

Il mercato mondiale dell'illuminazione

La ventiseiesima edizione della ricerca CSIL “Lighting: World market outlook” analizza, attraverso tabelle e grafici, i dati relativi alla produzione, al consumo e al commercio internazionale di apparecchi di illuminazione a livello mondiale nel suo complesso con un focus su 70 Paesi, per gli anni 2013-2022 e i preliminari del 2023. Sono inoltre fornite previsioni di mercato per i prossimi tre anni (2024-2026).

The lighting fixtures market in China (English)

Settembre 2023,

XVI Ed. ,

205 pagine

Il mercato degli apparecchi per illuminazione in Cina

La 16a edizione di The Lighting Fixtures market in China offre un’analisi accurata e approfondita del settore degli apparecchi di illuminazione in Cina, fornendo dati e tendenze per il periodo 2017-2022 e previsioni fino al 2025. Da un lato, il rapporto analizza le principali tendenze che hanno interessato il mercato negli ultimi cinque anni, considerando la produzione, il consumo, le importazioni e le esportazioni di apparecchi di illuminazione nel Paese. Dall’altro, offre un’analisi della struttura dell’offerta e del sistema competitivo, una panoramica sul trend dell’ illuminazione connessa/smart, il sistema di distribuzione e i principali attori che operano nel mercato.

The lighting fixtures market in the United States (English)

Giugno 2023,

XVII Ed. ,

256 pagine

Il mercato degli apparecchi per illuminazione negli Stati Uniti

Il mercato statunitense dell’illuminazione nel 2022 registra una crescita del 6,5% in termini nominali per quanto riguarda gli apparecchi di illuminazione (consumer, professionale, per esterni), fino a 23,2 miliardi di dollari. Il mercato delle lampade registra un calo (circa -2,9%). Il segmento residenziale è cresciuto ben oltre la media del mercato (+5,9% in media negli ultimi cinque anni). Nel 2022, il peso degli uffici e dell’intrattenimento sul mercato complessivo dell’illuminazione commerciale è diminuito, mentre sono cresciuti i locali pubblici e l’ospitalità. Nel 2022, il valore delle costruzioni completate è cresciuto di oltre il 10%, raggiungendo quasi 1,8 miliardi di dollari.

The European market for lighting fixtures (English)

Maggio 2023,

XXXII Ed. ,

392 pagine

Il mercato europeo degli apparecchi per illuminazione

Nel 2022, il consumo di apparecchi di illuminazione nei Paesi dell’UE30 ha registrato un aumento dell’8,3%, raggiungendo un valore di 19,9 miliardi di euro. Risultati migliori per l’illuminazione commerciale (rispetto a quella residenziale, industriale e per esterni), per i grandi operatori (con un Ebitda del 12%), per il design, per l’illuminazione di aree, per l’ospitalità, per il contract (rispetto alla vendita al dettaglio), per l’illuminazione lineare e per l’emergenza. Più brevetti IP e acquisizioni. I primi 10 operatori detengono una quota di mercato del 30%.