RAPPORTO IN LINGUA INGLESE

Aprile 2013,

II Ed. ,

57 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1696

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S.65

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

CSIL Market Research The office furniture market in Brazil provides office furniture market size, trends in office furniture production and consumption, office furniture imports and exports. 2010-2011 official data and 2012 estimates, based on market growth till September 2012.

Office furniture production is reported by segment (office seating, operative desks, executive furniture, office storage, wall to wall units). Office furniture imports and exports are broken down by country and geographical area of origin/destination.

The research is enriched by an in-depth analysis of the competitive system in terms of company dimension, manufacturing locations and product breakdown. Figures on sales and estimates on market shares of the top 50 office furniture manufacturers operating in Brazil are also available (total office furniture production and segments: seating, operative desks, executive furniture, storage, wall to wall units).

About 50 short company profiles for major office furniture manufacturers are also included.

An analysis of the market potential focuses on construction sector and office spaces evolution, Brazilian richest cities, luxury retail location and trends in the hospitality sector.

About 124 addresses of key players (both manufacturers and architectural companies) are included.

The study has been carried out involving direct interviews with over 60 sector firms and distributors operating on the Brazilian market. Most of the interviews have been carried out in Sao Paulo, Bento Gonçalves, Rio de Janeiro.

Aziende selezionate

Aurus Industrial (Giroflex), Bortolini, Flexform, Cavaletti

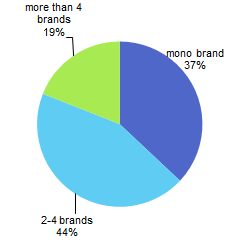

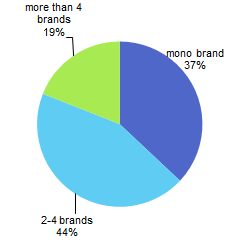

Brazil. Number of office furniture brands distributed in a sample of specialist dealers.. Percentage shares 2012

The office furniture production in Brazil reached US$ 2,132 million in 2012 at factory prices (4,023 million Reais).

Export values represent just 1% of office furniture production. On the other hand imports are steadily increasing (+13% on the basis of half year 2012). Import represents just 3% of domestic consumption due to the high level of import duties on finished products.

Top 40 office furniture manufacturers hold 39% of the Brazilian market and 42% in 2012. A growing market share is registered for (in alphabetical order) Alberflex, ArtLine, Bortolini, Cavaletti, Giroflex, Marelli, Todeschini, Voko.

Brazilian consumption of office furniture, looked at Local Currency Unit (Real), increased by 15% in 2011 and 10% in 2012.

Meaning +5% in real terms (excluding the inflation effect).

Office furniture manufacturers operate in the domestic market through licensed/franchised partners (less than 40 showrooms in average) of through independent dealers (more than 300 independent stores in average).

Abstract of Table of Contents

Research field and methodology

1. Market overview

1.1 The office furniture sector: basic data

- Production, consumption, exports and imports over the period 2007-2012. Values and percentage change

1.2 International trade

- Exports and Imports of office furniture by country and by geographical area of origin/destination, 2006-2012

- Exports and Imports of office furniture (excluding seating) by country and by geographical area of origin/destination, 2006-2012

- Exports and Imports of office furniture seating by country and by geographical area of origin/destination, 2006-2012

1.3 Driving forces for understanding the evolution of the market

1.4 Market shares

- Brazil. Office furniture. Major companies’ shares of total country consumption, 2010-2012 (estimate).

Percentages

2. The competitive system

2.1 Product segments and market shares

- Brazil. Office furniture. Breakdown of consumption by product segments, 2010-2012. Percentage shares

Seating, Desking, Executive furniture, Storage and archiving systems - Sales and market shares in a sample of companies, 2010-2012

3. Distribution

3.1 Trend

- Brazil. Office furniture. Distribution channels, 2010-2012. Values in million US$ and percentages

- Brazil. Number of brands distributed in a sample* of specialist dealers, 2012 Percentage shares

- Brazil. Brands distributed/licensed in a sample of manufacturers.

3.2 Competitive system by distribution channel: Direct sales, Architects and specialist dealers/showrooms

- Sales in a sample of leading companies, 2012. Million US$ and percentages

3.3 Prices

- Average list prices by product segment (seating, desk, drawers, cabinets, bookcases) and by distribution channel (architects, large surfaces, specialists), 2012. Reais

4 Office furniture demand

4.1 Demand determinats

Annex 1: Imports and Exports procedures

Annex 2: Hospitality sector

- Brazil. Breakdown of hotel supply by category, 2010. Percentage values

- Brazil. Hotel chains operating in the market.

- Brazil. Main architectural companies working in the hospitality market.

Annex 3: An office related segment: commercial lighting fixtures in Brazil

- Brazil. Lighting Fixtures. Sales among the major players. US$ million and percentage values

Appendix 1: List main architectural companies

Appendix 2: Addresses of office furniture manufacturers:

CSIL Market Research The office furniture market in Brazil provides office furniture market size, trends in office furniture production and consumption, office furniture imports and exports. 2010-2011 official data and 2012 estimates, based on market growth till September 2012.

Office furniture production is reported by segment (office seating, operative desks, executive furniture, office storage, wall to wall units). Office furniture imports and exports are broken down by country and geographical area of origin/destination.

The research is enriched by an in-depth analysis of the competitive system in terms of company dimension, manufacturing locations and product breakdown. Figures on sales and estimates on market shares of the top 50 office furniture manufacturers operating in Brazil are also available (total office furniture production and segments: seating, operative desks, executive furniture, storage, wall to wall units).

About 50 short company profiles for major office furniture manufacturers are also included.

An analysis of the market potential focuses on construction sector and office spaces evolution, Brazilian richest cities, luxury retail location and trends in the hospitality sector.

About 124 addresses of key players (both manufacturers and architectural companies) are included.

The study has been carried out involving direct interviews with over 60 sector firms and distributors operating on the Brazilian market. Most of the interviews have been carried out in Sao Paulo, Bento Gonçalves, Rio de Janeiro.

Brazil. Number of office furniture brands distributed in a sample of specialist dealers.. Percentage shares 2012

The office furniture production in Brazil reached US$ 2,132 million in 2012 at factory prices (4,023 million Reais).

Export values represent just 1% of office furniture production. On the other hand imports are steadily increasing (+13% on the basis of half year 2012). Import represents just 3% of domestic consumption due to the high level of import duties on finished products.

Top 40 office furniture manufacturers hold 39% of the Brazilian market and 42% in 2012. A growing market share is registered for (in alphabetical order) Alberflex, ArtLine, Bortolini, Cavaletti, Giroflex, Marelli, Todeschini, Voko.

Brazilian consumption of office furniture, looked at Local Currency Unit (Real), increased by 15% in 2011 and 10% in 2012.

Meaning +5% in real terms (excluding the inflation effect).

Office furniture manufacturers operate in the domestic market through licensed/franchised partners (less than 40 showrooms in average) of through independent dealers (more than 300 independent stores in average).

Abstract of Table of Contents

Research field and methodology

1. Market overview

1.1 The office furniture sector: basic data

- Production, consumption, exports and imports over the period 2007-2012. Values and percentage change

1.2 International trade

- Exports and Imports of office furniture by country and by geographical area of origin/destination, 2006-2012

- Exports and Imports of office furniture (excluding seating) by country and by geographical area of origin/destination, 2006-2012

- Exports and Imports of office furniture seating by country and by geographical area of origin/destination, 2006-2012

1.3 Driving forces for understanding the evolution of the market

1.4 Market shares

- Brazil. Office furniture. Major companies’ shares of total country consumption, 2010-2012 (estimate).

Percentages

2. The competitive system

2.1 Product segments and market shares

- Brazil. Office furniture. Breakdown of consumption by product segments, 2010-2012. Percentage shares

Seating, Desking, Executive furniture, Storage and archiving systems - Sales and market shares in a sample of companies, 2010-2012

3. Distribution

3.1 Trend

- Brazil. Office furniture. Distribution channels, 2010-2012. Values in million US$ and percentages

- Brazil. Number of brands distributed in a sample* of specialist dealers, 2012 Percentage shares

- Brazil. Brands distributed/licensed in a sample of manufacturers.

3.2 Competitive system by distribution channel: Direct sales, Architects and specialist dealers/showrooms

- Sales in a sample of leading companies, 2012. Million US$ and percentages

3.3 Prices

- Average list prices by product segment (seating, desk, drawers, cabinets, bookcases) and by distribution channel (architects, large surfaces, specialists), 2012. Reais

4 Office furniture demand

4.1 Demand determinats

Annex 1: Imports and Exports procedures

Annex 2: Hospitality sector

- Brazil. Breakdown of hotel supply by category, 2010. Percentage values

- Brazil. Hotel chains operating in the market.

- Brazil. Main architectural companies working in the hospitality market.

Annex 3: An office related segment: commercial lighting fixtures in Brazil

- Brazil. Lighting Fixtures. Sales among the major players. US$ million and percentage values

Appendix 1: List main architectural companies

Appendix 2: Addresses of office furniture manufacturers:

RAPPORTI CORRELATI

The world office furniture industry (English)

Dicembre 2023,

XII Ed. ,

442 pagine

L'industria mondiale dei mobili per ufficio

Panoramica del settore mondiale dell’arredo ufficio con dati di produzione, consumo, importazioni ed esportazioni 2014-2023, commercio internazionale, previsioni di mercato 2024 e 2025, profili dei principali produttori e le tabelle di sintesi per 60 Paesi. Focus sui 20 principali paesi produttori di mobili per ufficio.

The World Market for Height Adjustable Tables (English)

Novembre 2023,

I Ed. ,

80 pagine

Il mercato mondiale delle scrivanie regolabili in altezza

Rapporto dettagliato sul settore mondiale delle scrivanie regolabili in altezza (HAT), che analizza le tendenze e le previsioni di mercato per le principali aree geografiche e regioni nel mondo, i maggiori player (produttori e fornitori), la destinazione di prodotto.

The world market for office seating (English)

Novembre 2023,

II Ed. ,

162 pagine

Il mercato mondiale delle sedute per ufficio

Rapporto dettagliato che analizza il settore mondiale delle sedute per ufficio, con dati di produzione, consumo e commercio internazionale per la serie storica 2018-2023, previsioni del mercato 2024 e 2025, il sistema competitivo, le diverse tipologie di prodotto e le loro caratteristiche, con un focus su tre aree (Nord America, Europa e Asia-Pacifico) e paesi chiave.

The office furniture market in North America: the United States, Canada and Mexico (English)

Luglio 2023,

VII Ed. ,

129 pagine

Il mercato dei mobili per ufficio in Nord America: Stati Uniti, Canada e Messico

Analisi dell’industria dei mobili per ufficio in Nord America, con focus su Stati Uniti, Canada e Messico. Valore del mercato e previsioni, dati per paese, quote di mercato delle aziende leader, canali distributivi.

The European market for office furniture (English)

Giugno 2023,

XXXV Ed. ,

281 pagine

Il mercato europeo dei mobili per ufficio

Analisi dettagliata del settore dei mobili per ufficio in Europa: dati storici, principali indicatori e dati di base, prospettive della domanda, sistema competitivo e performance dei principali produttori, categorie di prodotto e distribuzione.