RAPPORTO IN LINGUA INGLESE

Giugno 2015,

I Ed. ,

109 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1696

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S81

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

CSIL Market Research The upholstered furniture market in China, now in its first edition, provides upholstered furniture market size, historical trends of upholstered furniture production and consumption, imports and exports and upholstered furniture market forecasts up to 2019.

The upholstered furniture supply structure is analyzed, with data on companies and employment.

Upholstered furniture production is reported by covering material (fabric, microfibre, leather, artificial leather), product type (groups, recliners, sofa-beds, sectionals, armchairs), style (modern, traditional), destination (home, contract).

Upholstered furniture clusters are also analyzed with data on upholstered furniture production and sales by province.

The report is enriched by an in-depth analysis of the competitive system in terms of company dimension, manufacturing locations and product breakdown.

Figures on sales of the top upholstered furniture manufacturers operating in China are also available (total upholstered furniture production and by covering material; data on top exporting companies of upholstered furniture are also available). The sample has been extended to more than 60 among the leading Chinese manufacturers.

Short profiles of the top upholstered furniture manufacturers are also available with data on product specialization, sales and employees.

Upholstered furniture imports and exports are broken down by country and geographical area of origin/destination.

Data on the distribution system are also provided, with sales broken down by distribution channels and kind of customers. Number of stores served on the Chinese market is also reported. Short profiles of the leading furniture chains and furniture cities are also available.

Over 70 addresses of key operators are included. The study has been carried out involving direct interviews with more than 100 sector firms and distributors operating on the Chinese market.

Demand determinants on population, urbanization, disposable income and construction sector activity are included in the report. Detailed data on the residential market, in terms of investments and houses under construction are reported.

A focus on the luxury segment and the hospitality industry, with data on number of hotels, international tourists arrivals and luxury furniture market are included.

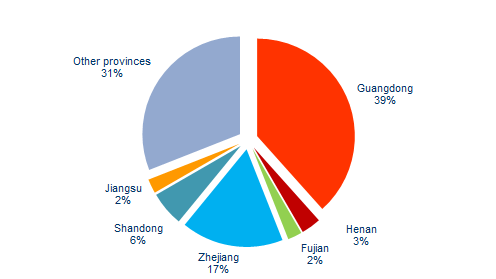

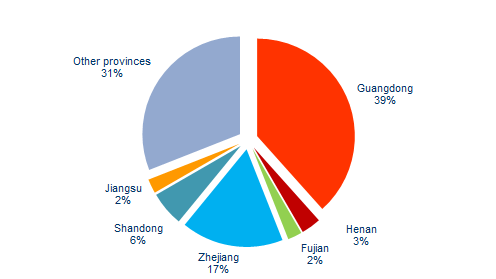

China. Upholstered furniture production. Breakdown by province

China is the first upholstered furniture market worldwide and it ranks first in the world also for its upholstered furniture production and exports. With a 20% average yearly production growth in the 2005-2014 period (+17% yearly in local currency) the country surpassed RMB 219 billion (US$ 35 billion).

China’s middle class is expanding very rapidly and by 2020 it will represent 75% of total population, nearly twice of United States population. This will represent the most attractive consumer market for upholstered furniture companies.

Abstract of Table of Contents

Introduction

Research tool and terminology

Executive Summary

China. Furniture sector highlights.

Overview of the upholstered furniture market

Basic data

- Production, consumption, imports and exports of upholstered furniture in China 2005-2014

- Upholstered furniture consumption trends and forecasts 2015-2019

Activity trend

- Trends in the Chinese upholstered furniture production, consumption, imports and exports (2005-2014)

International trade

Exports

- Upholstered furniture exports by destination country and geographical area, 2009-2014

- Six major countries and fast growing countries of destination for China’s upholstered furniture export

Imports

- Upholstered furniture imports by country and by geographical area, 2009-2014

Supply structure

- Production of upholstered furniture in volume, 2013-2014

Degree of specialization and employment

Production breakdown

- By covering material (percentage values, units and sales in a sample of companies)

- By product type (percentage data based on production in value)

- By style (percentage data based on value data)

- By destination (percentage data based on value data and by destination in a sample of companies)

- By main clusters (percentage values)

The competitive system

Total sales

- Top 30 Chinese upholstered furniture manufacturers (sales and market share on total production)

Sales by material in a sample of companies

- Fabric upholstered furniture

- Microfibre upholstered furniture

- Leather upholstered furniture

- Artificial leather upholstered furniture

Top exporters

Short profile of Chinese companies operating on the Chinese upholstered furniture market

Sales by province

Distribution system

Distribution of upholstered furniture

- Sales by distribution channels

- Breakdown by distribution channel in a sample of companies

Short profile of the leading furniture chains operating in China

Trade fairs

Economy and demand drivers

Economic overview

Demand determinants

- Population and urbanization process

- First, Second and Third Tier towns

- Disposable income

The residential sector: investments and development

The hospitality sector: basic data, major and forecasts

- Basic data

- Forecasts

- Leading Chinese furniture manufacturers operating in the hospitality segment

Wealth distribution: focus on the luxury segment

Annex 1. List of manufacturers

Annex 2. List of retailers

CSIL Market Research The upholstered furniture market in China, now in its first edition, provides upholstered furniture market size, historical trends of upholstered furniture production and consumption, imports and exports and upholstered furniture market forecasts up to 2019.

The upholstered furniture supply structure is analyzed, with data on companies and employment.

Upholstered furniture production is reported by covering material (fabric, microfibre, leather, artificial leather), product type (groups, recliners, sofa-beds, sectionals, armchairs), style (modern, traditional), destination (home, contract).

Upholstered furniture clusters are also analyzed with data on upholstered furniture production and sales by province.

The report is enriched by an in-depth analysis of the competitive system in terms of company dimension, manufacturing locations and product breakdown.

Figures on sales of the top upholstered furniture manufacturers operating in China are also available (total upholstered furniture production and by covering material; data on top exporting companies of upholstered furniture are also available). The sample has been extended to more than 60 among the leading Chinese manufacturers.

Short profiles of the top upholstered furniture manufacturers are also available with data on product specialization, sales and employees.

Upholstered furniture imports and exports are broken down by country and geographical area of origin/destination.

Data on the distribution system are also provided, with sales broken down by distribution channels and kind of customers. Number of stores served on the Chinese market is also reported. Short profiles of the leading furniture chains and furniture cities are also available.

Over 70 addresses of key operators are included. The study has been carried out involving direct interviews with more than 100 sector firms and distributors operating on the Chinese market.

Demand determinants on population, urbanization, disposable income and construction sector activity are included in the report. Detailed data on the residential market, in terms of investments and houses under construction are reported.

A focus on the luxury segment and the hospitality industry, with data on number of hotels, international tourists arrivals and luxury furniture market are included.

China. Upholstered furniture production. Breakdown by province

China is the first upholstered furniture market worldwide and it ranks first in the world also for its upholstered furniture production and exports. With a 20% average yearly production growth in the 2005-2014 period (+17% yearly in local currency) the country surpassed RMB 219 billion (US$ 35 billion).

China’s middle class is expanding very rapidly and by 2020 it will represent 75% of total population, nearly twice of United States population. This will represent the most attractive consumer market for upholstered furniture companies.

Abstract of Table of Contents

Introduction

Research tool and terminology

Executive Summary

China. Furniture sector highlights.

Overview of the upholstered furniture market

Basic data

- Production, consumption, imports and exports of upholstered furniture in China 2005-2014

- Upholstered furniture consumption trends and forecasts 2015-2019

Activity trend

- Trends in the Chinese upholstered furniture production, consumption, imports and exports (2005-2014)

International trade

Exports

- Upholstered furniture exports by destination country and geographical area, 2009-2014

- Six major countries and fast growing countries of destination for China’s upholstered furniture export

Imports

- Upholstered furniture imports by country and by geographical area, 2009-2014

Supply structure

- Production of upholstered furniture in volume, 2013-2014

Degree of specialization and employment

Production breakdown

- By covering material (percentage values, units and sales in a sample of companies)

- By product type (percentage data based on production in value)

- By style (percentage data based on value data)

- By destination (percentage data based on value data and by destination in a sample of companies)

- By main clusters (percentage values)

The competitive system

Total sales

- Top 30 Chinese upholstered furniture manufacturers (sales and market share on total production)

Sales by material in a sample of companies

- Fabric upholstered furniture

- Microfibre upholstered furniture

- Leather upholstered furniture

- Artificial leather upholstered furniture

Top exporters

Short profile of Chinese companies operating on the Chinese upholstered furniture market

Sales by province

Distribution system

Distribution of upholstered furniture

- Sales by distribution channels

- Breakdown by distribution channel in a sample of companies

Short profile of the leading furniture chains operating in China

Trade fairs

Economy and demand drivers

Economic overview

Demand determinants

- Population and urbanization process

- First, Second and Third Tier towns

- Disposable income

The residential sector: investments and development

The hospitality sector: basic data, major and forecasts

- Basic data

- Forecasts

- Leading Chinese furniture manufacturers operating in the hospitality segment

Wealth distribution: focus on the luxury segment

Annex 1. List of manufacturers

Annex 2. List of retailers

RAPPORTI CORRELATI

Top 100 upholstered furniture manufacturers in China (English)

Ottobre 2023,

I Ed. ,

15 pagine

Top 100 produttori di mobili imbottiti in Cina

Analisi del sistema competitivo cinese del mobile imbottito attraverso i dati e il ranking dei 100 principali produttori.

The upholstered furniture market in the United States (English)

Ottobre 2023,

IX Ed. ,

106 pagine

Il mercato dei mobili imbottiti negli Stati Uniti

Rapporto CSIL che analizza il mercato dei mobili imbottiti negli Stati Uniti, con dati di base come produzione e consumo di mobili imbottiti in valore, commercio e principali partner commerciali. Questo studio include anche i profili dei produttori di mobili imbottiti negli Stati Uniti e l’analisi dei canali distributivi.

Top 100 motion upholstered furniture manufacturers in the World (English)

Settembre 2023,

I Ed. ,

15 pagine

Top 100 produttori di mobili imbottiti recliner nel mondo

Quali sono i principali produttori di mobili imbottiti recliner al mondo? Questo studio fornisce una panoramica del sistema competitivo dell’industria mondiale dei mobili imbottiti recliner attraverso l’analisi dei 100 principali produttori, analizzando le loro performance.

Top 100 upholstered furniture manufacturers in the World (English)

Settembre 2023,

II Ed. ,

15 pagine

Top 100 produttori di mobili imbottiti nel mondo

Quali sono i principali produttori di mobili imbottiti al mondo? Questo studio fornisce una panoramica del sistema competitivo dell’industria mondiale dei mobili imbottiti attraverso l’analisi dei 100 principali produttori, analizzando le loro prestazioni e la concentrazione dell’intero settore.

The world upholstered furniture industry (English)

Giugno 2023,

XXI Ed. ,

498 pagine

L'industria mondiale dei mobili imbottiti

Questo studio offre una analisi dettagliata dell’industria mondiale del mobile imbottito: dimensioni del mercato, serie storiche di dati di base (produzione, consumo, commercio internazionale 2013-2022), previsioni di consumo per il 2023-2024, profili dettagliati dei principali produttori e un focus sui principali 20 paesi del settore con analisi del panorama competitivo.