Trends and Perspectives of the Office Furniture Industry in Europe

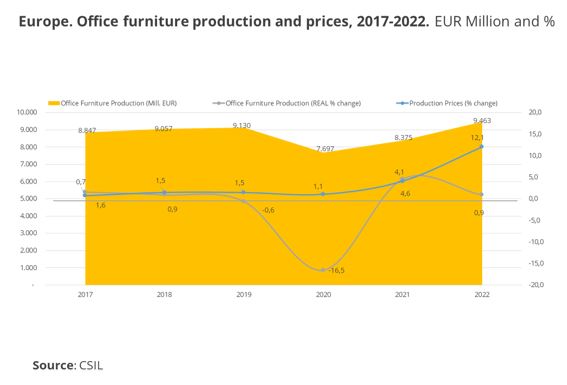

According to CSIL’s preliminary figures, European production of office furniture, measured in current values, increased by +13% in 2022, reaching a value of EUR 9.5 billion.

However, it is worth noting that the real-term result is far less exciting (+0.9%) due to the significant impact of rising inflation on revenue trends.

Raw material costs heavily influenced the list prices as office manufacturers were forced to raise their list prices multiple times in 2022, resulting in an average total variation of over +12% (over +14% in some countries).

After a strong performance in the first half of the year, demand cooled down in September due to the concerning economic landscape.

Eurostat’s international trade figures for the entire year of 2022 indicated a slowdown in imports (-4%), while exports continued to grow (+11%).

The year 2023 is expected to be challenging as commercial real estate investments are tapering off. Observers suggest that rising interest rates, economic uncertainty, and the strength of the U.S. dollar are weighing on performance. Nevertheless, office occupancy is recovering in line with the hybrid working model, which is having a positive impact on the quality of offices. Investors are prioritizing premium spaces.

Price evolution is expected to moderate in 2023; however, the aforementioned conditions will lead to a slowdown in European office furniture production.

CSIL’s The European market for office furniture Report 2023 will be issued by half of June. Contents description (link goes to the current 2022 release) at https://www.worldfurnitureonline.com/report/the-european-market-for-office-furniture/