September 2022,

III Ed. ,

115 pages

Price (single user license):

EUR 2600 / USD 2808

For multiple/corporate license prices please contact us

Language: English

Report code: M01

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

Remote working is becoming a consolidated method, which is radically changing the connection between home and work environments and taking to the design of ever more hybrid spaces. The pandemic led to increased flexibility for both employers and employees, allowing people to work from different places, with the working week split between home and the office.

The new edition of the CSIL report “Home office furniture market in Europe” analyses the evolution of the working from home furniture segment, present scenario and growth prospects, and it is structured in two parts:

PART 1. HOME OFFICE FURNITURE IN EUROPE: BASIC DATA, BUSINESS PERFORMANCE AND COMPETITION

This part deals with the market size at end-user prices and forecasts of the home office furniture sector in Europe, demand drivers, estimated sales by country, leading manufacturers and distributors.

The Home office furniture consumption in Europe is provided by geographical area (Northern Europe, Western Europe, Central Europe DACH, Southern Europe, Central-Eastern Europe) divided according to their geographical proximity and similarity in market characteristics, and by European markets.

Distribution of home office furniture in Europe: shares and evolution of the distribution channels (Office Furniture Dealers, Home Furniture Dealers, Large Scale Retail, E-commerce, DIY, Other), estimated sales of home office furniture for 70 selected leading distributors in Europe and short profiles of the main players.

Breakdown of the Home office furniture market in Europe by product segment (Seats, Desks, Cabinets/Other furnishings)

Competition: market features, concentration and leading manufacturers of home office furniture with total revenues and estimated sales in home office for a sample of 75 leading furniture and office furniture manufacturers in Europe and short profiles of selected companies and insights on how marketing policy and logistic system have been re-addressed in order to achieve the home-office furniture business.

PART 2. WORKING FROM HOME. THE END-USER EXPERIENCE

In the period May-July 2022, CSIL conducted a survey on a sample of end-users, of different ages and occupations, collecting the opinions of over 400 respondents from all over Europe. A previous survey to a similar target and geography has been made in mid-2020. Results of both surveys are shown to show changes that have occurred in the meantime.

The survey goes in-depth into the following aspects:

– Hybrid working: Usual working location and teleworking;

– Modifications of the domestic space and rooms used while working from home;

– Furniture used in the home workstations;

– Level of satisfaction with the home office environment (internet connection, sound/noise, privacy, lighting, desking seating);

– Purchasing process (home office products purchased, budget spent, channels and retail brands).

KEY QUESTIONS ANSWERED IN THIS STUDY:

- What is the home office furniture market size in Europe?

- What is the incidence of this segment in the European countries?

- What are the products involved and their features?

- What companies produce and sell for this segment?

CONSIDERED PRODUCTS: Seating (Swivel chairs with or without castors used for home offices, other kind of ergonomic chairs), Standard desks (Desks of different dimensions like the ones used in offices, free-standing or wall-mounted desks or part of a cabinet/bookcases system), HAT (Height Adjustable Tables or ‘sit-stand’ desks), Small home office desks (Desks of small dimension with integrated storage or not), Cabinets and Storage (Bookcases, pedestals, single cabinets, cabinet systems).

GEOGRAPHICAL AREA COVERED:

– Northern Europe (Denmark, Finland, Norway and Sweden)

– Western Europe (Belgium-Lux, France, Ireland, Netherlands and the United Kingdom)

– Central Europe DACH (Germany, Austria and Switzerland)

– Southern Europe (Greece, Italy, Portugal and Spain)

– Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovakia, Slovenia)

Selected companies

Actona, Bisley, BoConcept, BRW, Composad, Furniture Village, Furniture@work, Gautier, Gaverzicht-Be Okay, Giroflex, Hofmeister, Kinnarps, Lago, Livique, Meble Vox. Viasit. Knoll + Muuto, Moebel Hoeffner, Molteni&C, Nowy Styl, Palmberg, Roche Bobois, Sokoa, Topstar, Unifor, Wayfair, XXXLutz

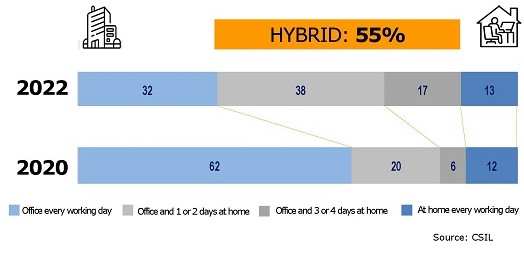

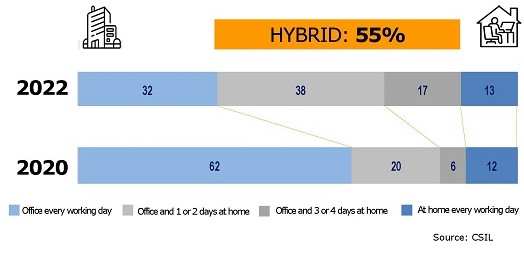

Where do you work, normally? Breakdown of respondents

The home office furniture market in Europe currently amounts to EUR 2.2 billion at end-user prices. It is a booming segment whose growth results from the increasing demand by people working from home, regularly or occasionally, especially since 2020. Germany is the largest home office furniture market in Europe, followed by the United Kingdom and France.

With the disposition to invest more in home office furniture and equipment, the number of actors participating in the home office supply business multiplies into different categories: traditional manufacturers of office furniture, home furniture, upholstered furniture, office chairs, and RTA furniture producers.

Abstract of Table of Contents

METHODOLOGY AND EXECUTIVE SUMMARY

1. BASIC DATA

1.1 Market evolution and figures by country

- Home Office Furniture in Europe. Market size at end-user prices

- Consumption of Home Office Furniture, Office furniture and Home Furniture

- Home Office Furniture market by geographical region

- Home office furniture consumption by country

1.2 Consumption of Home Office Furniture, forecasts

2. HOME OFFICE FURNITURE: BUSINESS PERFORMANCE BY GEOGRAPHICAL REGION AND COUNTRY

2.1 Northern Europe (Denmark, Finland, Norway, Sweden)

- Home office furniture consumption in Northern Europe

- Remote working and macroeconomic indicators

2.2 Western Europe (Belgium, France, Netherland, United Kingdom)

- Home office furniture consumption in Western Europe

- Remote working and macroeconomic indicators

2.3 DACH (Austria, Germany, Switzerland)

- Home office furniture consumption in DACH region

- Remote working and macroeconomic indicators

2.4 Southern Europe (Greece, Italy, Portugal, Spain)

- Home office furniture consumption in Southern Europe

- Remote working and macroeconomic indicators

2.5 Central Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovakia, Slovenia)

- Home office furniture consumption in Central Eastern Europe

- Remote working and macroeconomic indicators

3. DEMAND DRIVERS

3.1 European office take-up and flexible office spaces

3.2 Home-based workers

4. DISTRIBUTION AND PRODUCTS

4.1 Home office furniture retail system

- Office furniture and Home Office furniture comparison

- Percentage shares and distribution by geographical area and countries

4.2 Products

- Home office furniture by product segment (Seats, Desks, Cabinets/Other furnishings)

5. COMPETITIVE SYSTEM: HOME OFFICE FURNITURE PLAYERS IN EUROPE

5.1 Market features and concentration

5.2 Leading distributors of home office furniture in Europe

- Sales in a sample of leading distributors of home office furniture

5.3 The leading manufacturers of home office furniture in Europe

- Sales in a sample of leading manufacturers of home office furniture

6. WORKING FROM HOME: RESULTS OF THE CSIL SURVEY

6.1 The sample

6.2 Hybrid working: Working location, Home and Office spaces

6.3 Working from home: Rooms, Changes to accommodate WFH practices and Home environment

6.4 Furniture: Seating, Desking, Work tools and Storage products

6.5 Level of satisfaction with the home office environment

6.6 The purchasing process: Home office purchased, budget, channels and intention to buy

APPENDIX: LIST OF MENTIONED COMPANIES with activity, product specialization and general contact details

Remote working is becoming a consolidated method, which is radically changing the connection between home and work environments and taking to the design of ever more hybrid spaces. The pandemic led to increased flexibility for both employers and employees, allowing people to work from different places, with the working week split between home and the office.

The new edition of the CSIL report “Home office furniture market in Europe” analyses the evolution of the working from home furniture segment, present scenario and growth prospects, and it is structured in two parts:

PART 1. HOME OFFICE FURNITURE IN EUROPE: BASIC DATA, BUSINESS PERFORMANCE AND COMPETITION

This part deals with the market size at end-user prices and forecasts of the home office furniture sector in Europe, demand drivers, estimated sales by country, leading manufacturers and distributors.

The Home office furniture consumption in Europe is provided by geographical area (Northern Europe, Western Europe, Central Europe DACH, Southern Europe, Central-Eastern Europe) divided according to their geographical proximity and similarity in market characteristics, and by European markets.

Distribution of home office furniture in Europe: shares and evolution of the distribution channels (Office Furniture Dealers, Home Furniture Dealers, Large Scale Retail, E-commerce, DIY, Other), estimated sales of home office furniture for 70 selected leading distributors in Europe and short profiles of the main players.

Breakdown of the Home office furniture market in Europe by product segment (Seats, Desks, Cabinets/Other furnishings)

Competition: market features, concentration and leading manufacturers of home office furniture with total revenues and estimated sales in home office for a sample of 75 leading furniture and office furniture manufacturers in Europe and short profiles of selected companies and insights on how marketing policy and logistic system have been re-addressed in order to achieve the home-office furniture business.

PART 2. WORKING FROM HOME. THE END-USER EXPERIENCE

In the period May-July 2022, CSIL conducted a survey on a sample of end-users, of different ages and occupations, collecting the opinions of over 400 respondents from all over Europe. A previous survey to a similar target and geography has been made in mid-2020. Results of both surveys are shown to show changes that have occurred in the meantime.

The survey goes in-depth into the following aspects:

– Hybrid working: Usual working location and teleworking;

– Modifications of the domestic space and rooms used while working from home;

– Furniture used in the home workstations;

– Level of satisfaction with the home office environment (internet connection, sound/noise, privacy, lighting, desking seating);

– Purchasing process (home office products purchased, budget spent, channels and retail brands).

KEY QUESTIONS ANSWERED IN THIS STUDY:

- What is the home office furniture market size in Europe?

- What is the incidence of this segment in the European countries?

- What are the products involved and their features?

- What companies produce and sell for this segment?

CONSIDERED PRODUCTS: Seating (Swivel chairs with or without castors used for home offices, other kind of ergonomic chairs), Standard desks (Desks of different dimensions like the ones used in offices, free-standing or wall-mounted desks or part of a cabinet/bookcases system), HAT (Height Adjustable Tables or ‘sit-stand’ desks), Small home office desks (Desks of small dimension with integrated storage or not), Cabinets and Storage (Bookcases, pedestals, single cabinets, cabinet systems).

GEOGRAPHICAL AREA COVERED:

– Northern Europe (Denmark, Finland, Norway and Sweden)

– Western Europe (Belgium-Lux, France, Ireland, Netherlands and the United Kingdom)

– Central Europe DACH (Germany, Austria and Switzerland)

– Southern Europe (Greece, Italy, Portugal and Spain)

– Central-Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovakia, Slovenia)

Where do you work, normally? Breakdown of respondents

The home office furniture market in Europe currently amounts to EUR 2.2 billion at end-user prices. It is a booming segment whose growth results from the increasing demand by people working from home, regularly or occasionally, especially since 2020. Germany is the largest home office furniture market in Europe, followed by the United Kingdom and France.

With the disposition to invest more in home office furniture and equipment, the number of actors participating in the home office supply business multiplies into different categories: traditional manufacturers of office furniture, home furniture, upholstered furniture, office chairs, and RTA furniture producers.

Abstract of Table of Contents

METHODOLOGY AND EXECUTIVE SUMMARY

1. BASIC DATA

1.1 Market evolution and figures by country

- Home Office Furniture in Europe. Market size at end-user prices

- Consumption of Home Office Furniture, Office furniture and Home Furniture

- Home Office Furniture market by geographical region

- Home office furniture consumption by country

1.2 Consumption of Home Office Furniture, forecasts

2. HOME OFFICE FURNITURE: BUSINESS PERFORMANCE BY GEOGRAPHICAL REGION AND COUNTRY

2.1 Northern Europe (Denmark, Finland, Norway, Sweden)

- Home office furniture consumption in Northern Europe

- Remote working and macroeconomic indicators

2.2 Western Europe (Belgium, France, Netherland, United Kingdom)

- Home office furniture consumption in Western Europe

- Remote working and macroeconomic indicators

2.3 DACH (Austria, Germany, Switzerland)

- Home office furniture consumption in DACH region

- Remote working and macroeconomic indicators

2.4 Southern Europe (Greece, Italy, Portugal, Spain)

- Home office furniture consumption in Southern Europe

- Remote working and macroeconomic indicators

2.5 Central Eastern Europe (Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Malta, Poland, Romania, Slovakia, Slovenia)

- Home office furniture consumption in Central Eastern Europe

- Remote working and macroeconomic indicators

3. DEMAND DRIVERS

3.1 European office take-up and flexible office spaces

3.2 Home-based workers

4. DISTRIBUTION AND PRODUCTS

4.1 Home office furniture retail system

- Office furniture and Home Office furniture comparison

- Percentage shares and distribution by geographical area and countries

4.2 Products

- Home office furniture by product segment (Seats, Desks, Cabinets/Other furnishings)

5. COMPETITIVE SYSTEM: HOME OFFICE FURNITURE PLAYERS IN EUROPE

5.1 Market features and concentration

5.2 Leading distributors of home office furniture in Europe

- Sales in a sample of leading distributors of home office furniture

5.3 The leading manufacturers of home office furniture in Europe

- Sales in a sample of leading manufacturers of home office furniture

6. WORKING FROM HOME: RESULTS OF THE CSIL SURVEY

6.1 The sample

6.2 Hybrid working: Working location, Home and Office spaces

6.3 Working from home: Rooms, Changes to accommodate WFH practices and Home environment

6.4 Furniture: Seating, Desking, Work tools and Storage products

6.5 Level of satisfaction with the home office environment

6.6 The purchasing process: Home office purchased, budget, channels and intention to buy

APPENDIX: LIST OF MENTIONED COMPANIES with activity, product specialization and general contact details

SEE ALSO

The world office furniture industry

December 2023, XII Ed. , 442 pages

A comprehensive picture of the global office furniture sector with production, consumption imports, and export data for the time series 2014-2023, international trade, market forecasts for the years 2024 and 2025, profiles of the leading office furniture manufacturers, and summary tables for 60 countries. Focus on the Top 20 office furniture countries.

The world market for Height Adjustable Tables

November 2023, I Ed. , 80 pages

A comprehensive analysis of the Height Adjustable Tables (HAT) market, delving into key players (manufacturers and suppliers), trends, and market forecasts by major world areas and relevant regions, focusing on product destinations.

The world market for office seating

November 2023, II Ed. , 162 pages

A comprehensive report analysing key statistics of the global office seating industry, including production, consumption, and international trade for the 2018-2023 time series, office seating market forecasts for 2024 and 2025, the leading companies, a range of products and their features, with a focus on three world regions (North America, Europe, and Asia-Pacific) and key countries.

The office furniture market in North America. The United States, Canada, and Mexico

July 2023, VII Ed. , 129 pages

Analysis of the office furniture industry in North America with a focus on the USA, Canada and Mexico. Value of office furniture market, market forecasts, figures by country, market share of leading companies, distribution channels

The European market for office furniture

June 2023, XXXV Ed. , 281 pages

An extensive analysis of the office furniture sector in Europe, with historical data on key indicators, and demand prospects, delving into the performance of the leading manufacturers, the product categories, and the distribution.