June 2020,

VIII Ed. ,

105 pages

Price (single user license):

EUR 3000 / USD 3240

For multiple/corporate license prices please contact us

Language: Italian

Report code: IT.3

Publisher: CSIL

Status: available for online purchase and immediate download. English available upon request

Download

Table of contents

CSIL Report The Kitchen furniture distribution in Italy, now at its eight edition (previous: 2008, 2012, 2015, 2018), aims to:

- Analyse the qualitative features of the ‘best’ kitchen furniture stores (that sell more than 20 kitchens per year)

- Analyse the service in the outlets and the trade satisfaction for the top 16 kitchen furniture companies operating in the Italian market

- Offer a series of benchmarks for the companies in the sector, regarding service, an independent certification of the results achieved, a training tool for the sales force.

The study focused on the main kitchen furniture brands in our country, with qualitative assessment and trade satisfaction analysis in terms of services, products, prices, promotion (grouped in 17 items) and identification of strengths and weaknesses for each of the 16 brands analysed: Aran, Arredo3, Arrital, Arrex, Doimo, Ernestomeda, Lube/Creo, MobilTuri, Modulnova, Nobilia, Poliform, Scavolini, Snaidero, Stosa, Valcucine, Veneta. To these were also added the categories Other High Range Brands and Other Brands which group around fifty other kitchen furniture brands mentioned by the sample interviewed.

Data were collected through 270 interviews carried out mainly by e-mail, with frequent telephone re-calls, with the help of a semi-structured questionnaire with questions about: structural data characterizing the outlet (outlet size, number of kitchen sold, average price), relationship with suppliers (main brands covered, opinions about these brands for selected items, as an example: frequency/facility of contacts with the supplier, loyalty to distribution channels, punctuality in delivering?), type of customers and promotions, the presence of retailers on Facebook, Instagram, Youtube, the type of top used, software, appliances, adherence to new forms of advertising.

The geographical composition of the sample corresponds roughly to the actual national number, with a slight over-representation of Northern Italy (about 60%). Slightly higher in the South, the presence of small retail outlets. A certain correlation is also recorded for the average price of the kitchen and geographical location: higher range in the North, medium-economic in the South.

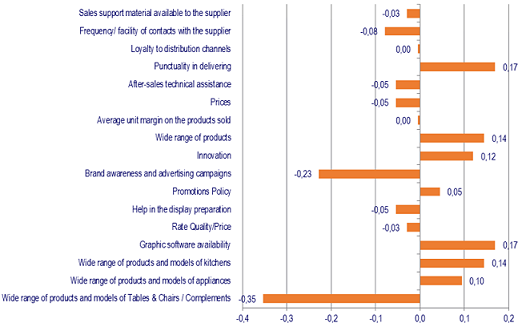

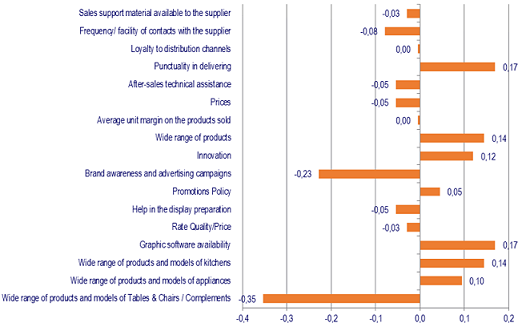

The sample of retailers interviewed was asked to express an evaluation from 1 to 5 (where 5 is the maximum and 1 the minimum) on the preferred brand of kitchens (most treated) for each of the considered characteristics (aspects related to the product, service, price and promotion), for which the average ratings were then calculated.

The 17 evaluation criteria considered were the following: materials to support retailer sales, frequency/ easiness of contact with the supplier, fidelity, delivery times, after-sales technical assistance, prices and margins, range of products and models (kitchen furniture, appliances, Tables, Chairs and Complements), innovation rate, brand awareness and advertising campaigns, promotion skills, support in the planning and the installations of the fittings, quality-price ratio, software availability.

The brands that reported the highest number of judgments were then selected and the averages were calculated both between the judgments expressed for the individual characteristic observed, in order to compare the different brands on that particular characteristic, and between the judgments expressed for the individual manufacturer, so as to highlight the strengths and weaknesses of the individual brand.

Selected companies

Aran, Arredo3, Arrital, Arrex, Doimo, Ernestomeda, Lube/Creo, MobilTuri, Modulnova, Nobilia, Poliform, Scavolini, Snaidero, Stosa, Valcucine, Veneta/Forma 2

Average deviation of the single item from the average of all items (equal to 4.02). XXXXX brand

The average store sells 50 kitchens per year and is increasingly present on Instagram. Transport, assembly, installation and disposal costs affect more than 10% of the value of the kitchen sold. The average of the trade satisfaction ratings for Veneta, Scavolini and Lube is growing strongly, leading in terms of brand awareness / advertising campaigns. Valcucine is the reference company for innovation; Veneta is among the companies to which it is easier to relate; Stosa appears among the leaders for promotional policy and Arrex for the breadth of the product range offered. Arredo3 and MobilTuri increase the degree of penetration. Nobilia is among the ‘companies to watch’.

Abstract of Table of Contents

Methodology and basic data

Aim of the research and methodology

The sample interviewed: Breakdown by geographic area, outlet size dedicated to kitchens, number and value of kitchen sold in the last year, number of brands treated

Strengths and weaknesses of the brands analyzed: 2015-2018-2020 summary data

General features of the outlet

Kitchen furniture brands analyzed

Total outlet size and display area dedicated to the kitchens

Number of kitchens sold and average price of a kitchen

Transport, assembly, installation and disposal

Kitchen sold with tables and chairs, worktop and built-in appliances provided by the kitchen producer

Success rate of sales negotiations

Planning Software

Worktop

How is the incidence of the top on the price of the kitchen

Display area dedicated to the kitchen top

Built-in appliances

How is the incidence of the built-in appliances on the price of the kitchen

Display area dedicated to appliances

Suppliers’ turnover rate

Percentage of outlets that changed kitchen suppliers in the last two years and related reasons

Customers and promotions

Do you have a website? Are you on Facebook? On Youtube or other social network?

Promotions used

Opinions on the features of the kitchen furniture brands

Service

- Sales support material available to the supplier

- Frequency/ facility of contacts with the supplier

- Loyalty to distribution channels

- Punctuality in delivering

- After-sales technical assistance and willingness to satisfy customer’s needs

- Graphic software availability

Prices and margins

- Prices; Average unit margin on the products sold

Products

- Wide range of products and models of of kitchens, appliances, Tables & Chairs / Complements

- Innovation

Promotion

- Brand awareness and advertising campaigns

- Promotions

- Help in the display preparation

Strengths and weaknesses of the single brand

Aran

Arredo3

Arrex

Arrital

Doimo

Ernestomeda

Lube e Creo

MobilTuri

Modulnova

Nobilia

Poliform

Scavolini

Snaidero

Stosa

Valcucine

Veneta e Forma 2000

Other High Range brands

Other brands

CSIL Report The Kitchen furniture distribution in Italy, now at its eight edition (previous: 2008, 2012, 2015, 2018), aims to:

- Analyse the qualitative features of the ‘best’ kitchen furniture stores (that sell more than 20 kitchens per year)

- Analyse the service in the outlets and the trade satisfaction for the top 16 kitchen furniture companies operating in the Italian market

- Offer a series of benchmarks for the companies in the sector, regarding service, an independent certification of the results achieved, a training tool for the sales force.

The study focused on the main kitchen furniture brands in our country, with qualitative assessment and trade satisfaction analysis in terms of services, products, prices, promotion (grouped in 17 items) and identification of strengths and weaknesses for each of the 16 brands analysed: Aran, Arredo3, Arrital, Arrex, Doimo, Ernestomeda, Lube/Creo, MobilTuri, Modulnova, Nobilia, Poliform, Scavolini, Snaidero, Stosa, Valcucine, Veneta. To these were also added the categories Other High Range Brands and Other Brands which group around fifty other kitchen furniture brands mentioned by the sample interviewed.

Data were collected through 270 interviews carried out mainly by e-mail, with frequent telephone re-calls, with the help of a semi-structured questionnaire with questions about: structural data characterizing the outlet (outlet size, number of kitchen sold, average price), relationship with suppliers (main brands covered, opinions about these brands for selected items, as an example: frequency/facility of contacts with the supplier, loyalty to distribution channels, punctuality in delivering?), type of customers and promotions, the presence of retailers on Facebook, Instagram, Youtube, the type of top used, software, appliances, adherence to new forms of advertising.

The geographical composition of the sample corresponds roughly to the actual national number, with a slight over-representation of Northern Italy (about 60%). Slightly higher in the South, the presence of small retail outlets. A certain correlation is also recorded for the average price of the kitchen and geographical location: higher range in the North, medium-economic in the South.

The sample of retailers interviewed was asked to express an evaluation from 1 to 5 (where 5 is the maximum and 1 the minimum) on the preferred brand of kitchens (most treated) for each of the considered characteristics (aspects related to the product, service, price and promotion), for which the average ratings were then calculated.

The 17 evaluation criteria considered were the following: materials to support retailer sales, frequency/ easiness of contact with the supplier, fidelity, delivery times, after-sales technical assistance, prices and margins, range of products and models (kitchen furniture, appliances, Tables, Chairs and Complements), innovation rate, brand awareness and advertising campaigns, promotion skills, support in the planning and the installations of the fittings, quality-price ratio, software availability.

The brands that reported the highest number of judgments were then selected and the averages were calculated both between the judgments expressed for the individual characteristic observed, in order to compare the different brands on that particular characteristic, and between the judgments expressed for the individual manufacturer, so as to highlight the strengths and weaknesses of the individual brand.

Average deviation of the single item from the average of all items (equal to 4.02). XXXXX brand

The average store sells 50 kitchens per year and is increasingly present on Instagram. Transport, assembly, installation and disposal costs affect more than 10% of the value of the kitchen sold. The average of the trade satisfaction ratings for Veneta, Scavolini and Lube is growing strongly, leading in terms of brand awareness / advertising campaigns. Valcucine is the reference company for innovation; Veneta is among the companies to which it is easier to relate; Stosa appears among the leaders for promotional policy and Arrex for the breadth of the product range offered. Arredo3 and MobilTuri increase the degree of penetration. Nobilia is among the ‘companies to watch’.

Abstract of Table of Contents

Methodology and basic data

Aim of the research and methodology

The sample interviewed: Breakdown by geographic area, outlet size dedicated to kitchens, number and value of kitchen sold in the last year, number of brands treated

Strengths and weaknesses of the brands analyzed: 2015-2018-2020 summary data

General features of the outlet

Kitchen furniture brands analyzed

Total outlet size and display area dedicated to the kitchens

Number of kitchens sold and average price of a kitchen

Transport, assembly, installation and disposal

Kitchen sold with tables and chairs, worktop and built-in appliances provided by the kitchen producer

Success rate of sales negotiations

Planning Software

Worktop

How is the incidence of the top on the price of the kitchen

Display area dedicated to the kitchen top

Built-in appliances

How is the incidence of the built-in appliances on the price of the kitchen

Display area dedicated to appliances

Suppliers’ turnover rate

Percentage of outlets that changed kitchen suppliers in the last two years and related reasons

Customers and promotions

Do you have a website? Are you on Facebook? On Youtube or other social network?

Promotions used

Opinions on the features of the kitchen furniture brands

Service

- Sales support material available to the supplier

- Frequency/ facility of contacts with the supplier

- Loyalty to distribution channels

- Punctuality in delivering

- After-sales technical assistance and willingness to satisfy customer’s needs

- Graphic software availability

Prices and margins

- Prices; Average unit margin on the products sold

Products

- Wide range of products and models of of kitchens, appliances, Tables & Chairs / Complements

- Innovation

Promotion

- Brand awareness and advertising campaigns

- Promotions

- Help in the display preparation

Strengths and weaknesses of the single brand

Aran

Arredo3

Arrex

Arrital

Doimo

Ernestomeda

Lube e Creo

MobilTuri

Modulnova

Nobilia

Poliform

Scavolini

Snaidero

Stosa

Valcucine

Veneta e Forma 2000

Other High Range brands

Other brands

SEE ALSO

Furniture retailing in Europe

February 2024, XVII Ed. , 296 pages

Comparative analysis of the home furniture retailing industry in 15 European countries, with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers in Europe

Top 100 mattress specialist retailers in Europe

November 2023, I Ed. , 14 pages

A bird’s eye view of players in the European mattress market with a ranking of the 100 leading mattress specialist retailers in Europe.

E-commerce in the mattress industry

September 2023, V Ed. , 102 pages

Detailed analysis of the global e-commerce mattress markets with a focus on North America, Europe, and the Asia Pacific. Features of the online mattress business, the current incidence of online mattress sales by geographical areas and in key countries, the major markets, e-commerce mattress sales of the leading retailers by area, and company profiles of top players operating in the online mattress sector.

La distribuzione del mobile in Italia. Analisi per provincia (Italian)

July 2023, XX Ed. , 174 pages

This report provides a detailed picture of the Italian furniture market and retailing, for the whole national market and by province, providing the size and development of the home furniture market and its segments, market shares and development of distribution channels, estimated home furniture sales for key retailers, in-depth analysis of both large retail chains and independent retailers, companies’ strategies and trends

E-commerce for the furniture industry

November 2022, IX Ed. , 118 pages

This report analyses e-commerce in the furniture market, with a focus on key geographical areas (Europe, North America, and Asia Pacific) and key countries, providing current market size, e-commerce business models, the performance of the leading players, and the results of a CSIL survey to furniture manufacturers that highlights their approach to the web channel, their strategies, future expectations, and the most-demanded furniture products online.