April 2010,

III Ed. ,

71 pages

Price (single user license):

EUR 590 / USD 625.4

For multiple/corporate license prices please contact us

Language: English

Report code: W7.ZA

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

Furniture and solid wood processing is an old and well established manufacturing industry within South Africa and one of the more traditional sectors that account for a significant proportion of employment.

This sector has been experiencing a tough few years, however, the future outlook seems promising, with demand kicking in from the low to middle income households, and with opportunities for niche markets.

In the longer term prospects become even rosier and are linked to the country’s production and export potential. South Africa is a country with abundant raw materials. Also, generally speaking global companies with a presence in South Africa can benefit from the low risk of investing in a stable economy with a stable government, low labour costs and well-established infrastructure, financial and communication systems. Also, as a matter of fact, South Africa often represents a base from which to export products internationally, frequently to other Southern African, Sub-Saharan and Middle Eastern countries.

CSIL Market Research South Africa Furniture Outlook is part of the Country Furniture Outlook Series, covering at present 60 countries.

What can be expected to happen in the market in coming years?

An executive summary (see The Key Facts of the Furniture Sector) provides the furniture industry overview, based on CSIL processing of statistics and company data from official sources, both national and international, as well as industry information and field information collected through interviews with companies and industry experts. CSIL then provides an independent assessment of the industry performance and prospects for the coming years.

What is the market size and its growth rate?

Furniture industry performance is illustrated through updated furniture statistics and through tables, graphs and illustrated maps. Information covers all the main variables necessary to analyze the industry, from the supply side (see Productive Factors – sawnwood, wood-based panels, forest resources, woodworking machinery- and Furniture Production – by segment: upholstered furniture, kitchen furniture, office furniture; by geographical regions in the country) to the market side (see Demand Determinants – population, per capita GDP, households, residential dwellings and buildings, new office buildings and international tourism), Furniture Consumption – by segment: upholstered furniture, kitchen furniture, office furniture).

Which is the structure of import / export?

This study also considers the international trading activity (see Furniture Imports and Furniture Exports) including additional information on countries of destination/origin of furniture and placing all the statistics in a broader context by giving world comparisons of the imports/consumption and exports/production ratios.

Is there potential for my business to go into this country?

Future industry prospects and CSIL’s assessment of market potential are also provided (see Furniture Market Potential – in terms of size of the market, performance, furniture consumer spending, market openness, import penetration) and a cross-country comparison (see Annex: Country Rankings) further enriches the analysis.

Who are the main players, where are they, what do they do?

Information on actors operating in the country are provided both for manufacturers and retailers (see Major Furniture Companies ) for a total of 32 short profiles, and for other industry operators (see Sector fairs, Press and Institutional Bodies).

Selected companies

Steinhoff International, JD Group, Ellerine Holdings, CN Business Furniture, Bravo Group, Easylife Kitchens

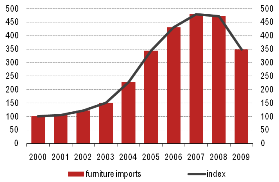

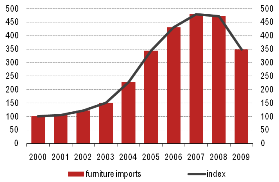

Furniture imports, 2000-2009

Abstract of Table of Contents

South Africa. The Key Facts of the Furniture Industry

South Africa. Furniture Market Potential

Furniture market profile (size of the market, performance, furniture consumer spending, market openness, import penetration)

Furniture market forecasts (furniture consumption, real growth rates 2010-2012)

South Africa. Business Climate

Business climate rankings

- Among the other indicators: starting a business, enforcing contracts, paying taxes, registering property

Selected business climate indicators

- Among the other indicators: time required to build a warehouse, logistic performance index

South Africa. Demand Determinants

Population, breakdown by age group

Households and urban population, population by region

Population and per capita GDP by region

New residential dwellings

Residential and Non Residential Buildings by type of building and international tourism

South Africa. Furniture Consumption

Per capita furniture spending in South Africa compared to the average level for the High Income countries. Ratio (%)

Furniture consumption. Comparison with the aggregate for Middle and Low Income countries

South Africa. Furniture Imports and Exports

Furniture import and exports, imports/consumption and exports/production ratio

Furniture imports and exports. Comparison with the aggregate for Middle and Low Income countries

Main countries of origin-destination of furniture imports- exports

Furniture imports-exports by geographical area of origin-destination

Furniture imports and exports by segment

- Upholstered furniture, non-upholstered seats, bedroom furniture, kitchen furniture, office furniture, furniture n.e.c.

South Africa. Sector Fairs, Press and Institutional Bodies

South Africa. Productive Factors

Consumption of sawnwood and wood-based panels

Forest resources and distribution of land

Imports of wood-based panels and woodworking machinery

South Africa. Furniture Production

Location of top furniture companies

Furniture production growth performance. World comparison

Furniture production. Comparison with the aggregate for Middle and Low Income countries

South Africa. Top Furniture Companies

32 short company profiles

South Africa. Annexes

South Africa. Country Rankings

- Among the other indicators: country attractiveness, per capita furniture spending, furniture growth rates, furniture market openness

South Africa. Socio-Economic Data

- Macroeconomic Trends, exchange rates, value added breakdown, labour market indicators, investment and human capital

South Africa. Furniture Data

- Production, exports, imports and consumption: Absolute values and year on year variations

- Furniture Market Forecasts: Year on year variations

Furniture and solid wood processing is an old and well established manufacturing industry within South Africa and one of the more traditional sectors that account for a significant proportion of employment.

This sector has been experiencing a tough few years, however, the future outlook seems promising, with demand kicking in from the low to middle income households, and with opportunities for niche markets.

In the longer term prospects become even rosier and are linked to the country’s production and export potential. South Africa is a country with abundant raw materials. Also, generally speaking global companies with a presence in South Africa can benefit from the low risk of investing in a stable economy with a stable government, low labour costs and well-established infrastructure, financial and communication systems. Also, as a matter of fact, South Africa often represents a base from which to export products internationally, frequently to other Southern African, Sub-Saharan and Middle Eastern countries.

CSIL Market Research South Africa Furniture Outlook is part of the Country Furniture Outlook Series, covering at present 60 countries.

What can be expected to happen in the market in coming years?

An executive summary (see The Key Facts of the Furniture Sector) provides the furniture industry overview, based on CSIL processing of statistics and company data from official sources, both national and international, as well as industry information and field information collected through interviews with companies and industry experts. CSIL then provides an independent assessment of the industry performance and prospects for the coming years.

What is the market size and its growth rate?

Furniture industry performance is illustrated through updated furniture statistics and through tables, graphs and illustrated maps. Information covers all the main variables necessary to analyze the industry, from the supply side (see Productive Factors – sawnwood, wood-based panels, forest resources, woodworking machinery- and Furniture Production – by segment: upholstered furniture, kitchen furniture, office furniture; by geographical regions in the country) to the market side (see Demand Determinants – population, per capita GDP, households, residential dwellings and buildings, new office buildings and international tourism), Furniture Consumption – by segment: upholstered furniture, kitchen furniture, office furniture).

Which is the structure of import / export?

This study also considers the international trading activity (see Furniture Imports and Furniture Exports) including additional information on countries of destination/origin of furniture and placing all the statistics in a broader context by giving world comparisons of the imports/consumption and exports/production ratios.

Is there potential for my business to go into this country?

Future industry prospects and CSIL’s assessment of market potential are also provided (see Furniture Market Potential – in terms of size of the market, performance, furniture consumer spending, market openness, import penetration) and a cross-country comparison (see Annex: Country Rankings) further enriches the analysis.

Who are the main players, where are they, what do they do?

Information on actors operating in the country are provided both for manufacturers and retailers (see Major Furniture Companies ) for a total of 32 short profiles, and for other industry operators (see Sector fairs, Press and Institutional Bodies).

Furniture imports, 2000-2009

Abstract of Table of Contents

South Africa. The Key Facts of the Furniture Industry

South Africa. Furniture Market Potential

Furniture market profile (size of the market, performance, furniture consumer spending, market openness, import penetration)

Furniture market forecasts (furniture consumption, real growth rates 2010-2012)

South Africa. Business Climate

Business climate rankings

- Among the other indicators: starting a business, enforcing contracts, paying taxes, registering property

Selected business climate indicators

- Among the other indicators: time required to build a warehouse, logistic performance index

South Africa. Demand Determinants

Population, breakdown by age group

Households and urban population, population by region

Population and per capita GDP by region

New residential dwellings

Residential and Non Residential Buildings by type of building and international tourism

South Africa. Furniture Consumption

Per capita furniture spending in South Africa compared to the average level for the High Income countries. Ratio (%)

Furniture consumption. Comparison with the aggregate for Middle and Low Income countries

South Africa. Furniture Imports and Exports

Furniture import and exports, imports/consumption and exports/production ratio

Furniture imports and exports. Comparison with the aggregate for Middle and Low Income countries

Main countries of origin-destination of furniture imports- exports

Furniture imports-exports by geographical area of origin-destination

Furniture imports and exports by segment

- Upholstered furniture, non-upholstered seats, bedroom furniture, kitchen furniture, office furniture, furniture n.e.c.

South Africa. Sector Fairs, Press and Institutional Bodies

South Africa. Productive Factors

Consumption of sawnwood and wood-based panels

Forest resources and distribution of land

Imports of wood-based panels and woodworking machinery

South Africa. Furniture Production

Location of top furniture companies

Furniture production growth performance. World comparison

Furniture production. Comparison with the aggregate for Middle and Low Income countries

South Africa. Top Furniture Companies

32 short company profiles

South Africa. Annexes

South Africa. Country Rankings

- Among the other indicators: country attractiveness, per capita furniture spending, furniture growth rates, furniture market openness

South Africa. Socio-Economic Data

- Macroeconomic Trends, exchange rates, value added breakdown, labour market indicators, investment and human capital

South Africa. Furniture Data

- Production, exports, imports and consumption: Absolute values and year on year variations

- Furniture Market Forecasts: Year on year variations

SEE ALSO

The furniture industry in India

April 2024, IX Ed. , 81 pages

Comprehensive analysis of the furniture sector in India, delving into the country’s productive system, the furniture demand and trade (time series 2013-2023), the furniture market development (forecasts up to 2025) with CSIL’s assessment of market potential and competitive landscape covering the leading Indian manufacturers of furniture, their performance and profiles.

Italy Furniture Outlook

January 2024, XXVIII Ed. , 38 pages

This market research analyses the furniture industry in Italy: furniture market size and forecasts, trends in furniture production, consumption, imports and exports, list of top furniture companies. Demand determinants, market potential and future prospect for the Italian furniture market.

United Kingdom Furniture Outlook

January 2024, XXVIII Ed. , 23 pages

Analysis of the furniture market in the United Kingdom, with value and trends of furniture production and consumption, furniture imports, and exports. Top furniture companies in the UK. Demand determinants, market potential and future prospect for the Furniture market.

Germany Furniture Outlook

January 2024, XXVIII Ed. , 23 pages

This market research analyses the furniture market in Germany providing value and trends of furniture production and consumption, furniture imports and exports. Top furniture companies in Germany with short profiles. Demand determinants, market potential and future prospect for the Furniture market.

Poland Furniture Outlook

January 2024, XXII Ed. , 25 pages

Market research analyses the furniture industry in Poland: furniture market size and forecasts, trends in furniture production, consumption, imports and exports, list of top furniture companies. Demand determinants, market potential and future prospect for the Polish furniture market.