March 2023,

IX Ed. ,

208 pages

Price (single user license):

EUR 3500 / USD 3745

For multiple/corporate license prices please contact us

Language: English

Report code: EU12

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

CSIL’s Research Report The contract furniture and furnishings market in Europe offers a comprehensive picture of the European contract furniture business providing market size, production, market development and forecasts, demand drivers and projects, sales and market shares of the leading players, sales by destination segment –with a special focus on furniture for the Education segment– and by product category.

CONTRACT FURNITURE AND FURNISHING SECTOR OVERVIEW IN EUROPE: MARKET EVOLUTION AND PERFORMANCE BY COUNTRY

The European Contract furniture and furnishings production in 2022 and market size for the time series 2016-2022 are broken down by area and by country.

In this edition, the geographical perimeter has been expanded to 30 European countries, in detail: Northern Europe (Denmark, Finland, Norway, Sweden); Central Europe (Austria, Germany, Switzerland); Western Europe (Belgium-Lux, France, Ireland, the Netherlands, the United Kingdom); Southern Europe (Greece, Italy, Portugal, Spain), Central-Eastern Europe (Poland, Lithuania, Czech Republic, Romania, Other Central-Eastern European countries).

The European contract furniture and furnishing market forecasts are provided for the years 2023 and 2024.

Based on a recent survey conducted by CSIL on a sample of over 200 contract furniture and furnishing manufacturers in Europe, this report also shows the segments that are expected to increase faster and companies’ market approach in terms of “turn-key” Vs “soft contract”, own product Vs traded products, and distribution channels.

The Contract furniture production and consumption in Europe are broken down by destination segment:

- Retail

- Hospitality

- Office spaces

- Restaurants and bars

- Real estates

- Education (focus of this year’s edition)

- Entertainment

- Marine

- Healthcare

- Airports

Contract furniture production in Europe is also provided by product category:

- Bathroom furniture and fittings

- Bedroom furniture and mattresses

- Kitchen furniture

- Lighting fixtures

- Office furniture

- Outdoor furniture

- Tables and chairs

- Upholstered furniture

FEATURES OF THE CONTRACT FURNITURE BUSINESS: DESTINATION SEGMENTS AND PRODUCT CATEGORIES

An overview of the main demand drivers and projects in the Retail, Hospitality, Office space, Real estate, Educational and entertainment, Marine, and Healthcare segments is also provided.

THE COMPETITIVE LANDSCAPE FEATURES: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES

For the Top 100 companies operating in the European contract furniture sector, this report includes sales of contract furniture, incidence of the contract business on total company sales, and the company’s share of total European production, with short profiles of selected firms.

Contract furniture sales are provided for a sample of companies even by destination segment and by product category.

This study overall considers around 380 firms active in the contract furniture sector.

NEW: FOCUS ON EDUCATION FURNITURE: This year’s edition provides a detailed analysis of the Education segment including market values, the potential demand for education furniture, distribution channels, and purchasing process, product trends, average customer budgets, certifications, and projects.

FINANCIAL ANALYSIS: a set of financial indicators (Operating Revenue –Turnover-, Added Value, P/L for Period -Net Income-, Shareholders Funds, Cash Flow, ROI, ROE, EBITDA margin, EBIT margin, Solvency Ratio, Current Ratio, Number of Employees, Turnover per Employee, Added value per Employee) are reported for 70 companies operating in the contract furniture business.

ANNEX: Contact details for about 50 architect and design studios, List of relevant trade exhibitions for Hospitality, Building, Architectural and Design, Interiors, List of the first 300 hotel companies at global level, Contact details for around 380 contract furniture and furnishing manufacturers mentioned in the research.

Selected companies

Among the considered companies mentioned: Ahrend Group, Geberit, HMY Group Hermes Metal & Yudigar, Input Interiör, ISG, Itab Shop Concept, Kinnarps, Lifestyle Design, MillerKnoll, Nobia Group, Nowy Styl, Overbury, Pedrali, Stamhuis Groep, Steelcase, Tegometall International Sales, Umdasch ShopFitting Group, Villeroy & Boch, Vitra, VS Möbel.

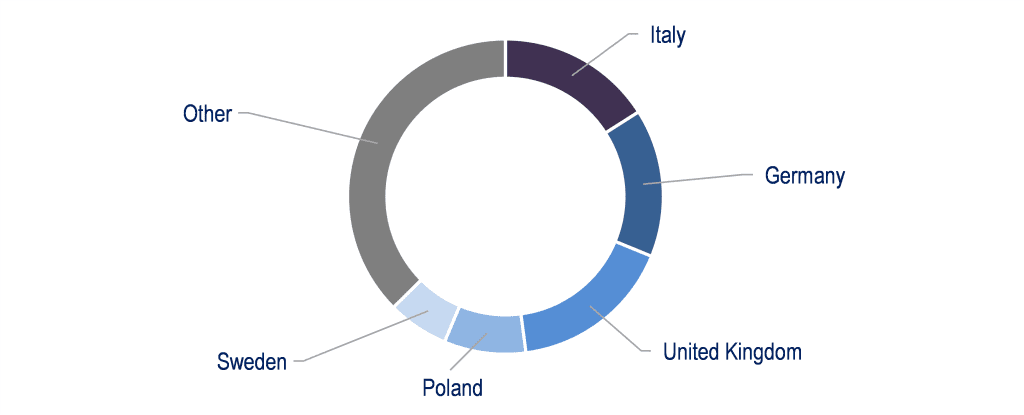

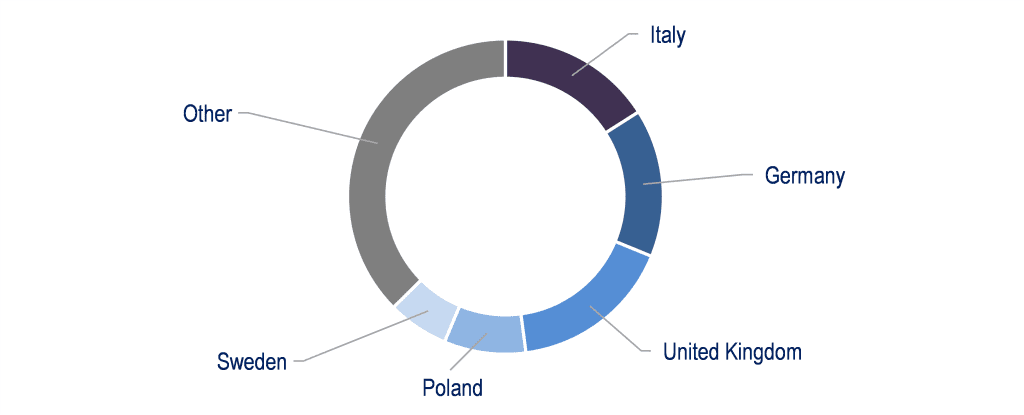

Europe. Contract furniture. Production by country, % shares

The contract furniture production in Europe currently amounts to around EUR 14 billion. The largest part of this output is destined for projects within Europe, while less than 20% is addressed outside, to North America, Middle East, and Asia-Pacific.

Italy, Germany, the UK, Poland, and Sweden are the major manufacturing countries, representing together over 60% of the total European contract furniture production.

Contract furniture segments are evolving at a different speed further to a deep transformation of public and commercial furniture demand drivers. While Healthcare, Marine, Real Estate, Education, Luxury Shops, and Restaurant segments are showing a fast post-pandemic recovery, the Retail sector has been hardly challenged with a significant downgrade of the mass market retail, even if sustained by the grocery segment. Office and Hospitality businesses have not yet reached the pre-pandemic level, but are expected to grow in the next years.

Abstract of Table of Contents

METHODOLOGY. Introduction, Research Tools, Considered segments, and Sample

1. EXECUTIVE SUMMARY: The contract furniture and furnishings market in Europe

2. THE CONTRACT FURNITURE MARKET SCENARIO IN EUROPE

2.1 Contract furniture market evolution: European production and consumption of contract furniture

– Production and consumption of contract furniture by country, by segment, and Production of contract furniture by product

2.2 Contract furniture and furnishing consumption. Market forecasts for 2023 and 2024

2.3 Market approach: Turn-key vs soft contract in Europe, Own product vs traded products, Distribution channels

2.4 Leading groups in Europe and their market shares: Market concentration and shares on total production

3. CONTRACT FURNITURE MARKET PERFORMANCE BY AREA AND BY COUNTRY

3.1 Consumption of contract furniture and furnishing in Northern Europe and by country (Denmark, Finland, Norway, and Sweden) with macroeconomic indicators

3.2 Consumption of contract furniture and furnishing in Central Europe (Austria, Germany, Switzerland) with macroeconomic indicators

3.3 Consumption of contract furniture and furnishing in Western Europe (Belgium-Lux, France, Ireland, Netherlands, United Kingdom) with macroeconomic indicators

3.4 Consumption of contract furniture and furnishing in Southern Europe (Greece, Italy, Portugal, Spain) with macroeconomic indicators

3.5 Consumption of contract furniture and furnishing in Central-Eastern Europe (Poland, Lithuania, Czech Republic, Romania) with macroeconomic indicators

4. FOCUS: EDUCATION FURNITURE

4.1 Market values: Contract furniture and furnishings market for education

4.2 The potential demand for education furniture: educational buildings, target population, and public programs

4.3 Distribution channels and purchasing process

4.4 Product trends: education furniture market by product segment and by premium/non-premium segments

4.5 Average customer budgets

4.6 Certifications

4.7 Projects

5. THE CONTRACT FURNITURE MARKET BY SEGMENT. Demand drivers, market values, and projects in the:

– Retail, Hospitality, Office spaces, Restaurants and bars, Real estate, Entertainment, Marine, Healthcare, and Airports segments

6. COMPETITION: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES BY SEGMENT

6.1 Contract furniture sales in Europe and leading companies’ sales

– Contract furniture sales and leading companies’ sales in Retail, Hospitality, Office, Restaurants and bars, Real estate, Education, entertainment, art & museum, Healthcare, Marine, and Airports segments

7. COMPETITION: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES BY PRODUCT

– Contract furniture sales of Bathroom furniture and equipment, Bedroom furniture and mattress, Kitchen furniture, Lighting fixtures, Office furniture, Outdoor furniture, Tables and chairs, and Upholstered furniture

8. FINANCIAL ANALYSIS

– Financial figures of 70 companies active in the contract furniture business

9. APPENDIX

– List of Architects and Designers, Hotel Companies, Trade exhibitions and Manufacturers

CSIL’s Research Report The contract furniture and furnishings market in Europe offers a comprehensive picture of the European contract furniture business providing market size, production, market development and forecasts, demand drivers and projects, sales and market shares of the leading players, sales by destination segment –with a special focus on furniture for the Education segment– and by product category.

CONTRACT FURNITURE AND FURNISHING SECTOR OVERVIEW IN EUROPE: MARKET EVOLUTION AND PERFORMANCE BY COUNTRY

The European Contract furniture and furnishings production in 2022 and market size for the time series 2016-2022 are broken down by area and by country.

In this edition, the geographical perimeter has been expanded to 30 European countries, in detail: Northern Europe (Denmark, Finland, Norway, Sweden); Central Europe (Austria, Germany, Switzerland); Western Europe (Belgium-Lux, France, Ireland, the Netherlands, the United Kingdom); Southern Europe (Greece, Italy, Portugal, Spain), Central-Eastern Europe (Poland, Lithuania, Czech Republic, Romania, Other Central-Eastern European countries).

The European contract furniture and furnishing market forecasts are provided for the years 2023 and 2024.

Based on a recent survey conducted by CSIL on a sample of over 200 contract furniture and furnishing manufacturers in Europe, this report also shows the segments that are expected to increase faster and companies’ market approach in terms of “turn-key” Vs “soft contract”, own product Vs traded products, and distribution channels.

The Contract furniture production and consumption in Europe are broken down by destination segment:

- Retail

- Hospitality

- Office spaces

- Restaurants and bars

- Real estates

- Education (focus of this year’s edition)

- Entertainment

- Marine

- Healthcare

- Airports

Contract furniture production in Europe is also provided by product category:

- Bathroom furniture and fittings

- Bedroom furniture and mattresses

- Kitchen furniture

- Lighting fixtures

- Office furniture

- Outdoor furniture

- Tables and chairs

- Upholstered furniture

FEATURES OF THE CONTRACT FURNITURE BUSINESS: DESTINATION SEGMENTS AND PRODUCT CATEGORIES

An overview of the main demand drivers and projects in the Retail, Hospitality, Office space, Real estate, Educational and entertainment, Marine, and Healthcare segments is also provided.

THE COMPETITIVE LANDSCAPE FEATURES: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES

For the Top 100 companies operating in the European contract furniture sector, this report includes sales of contract furniture, incidence of the contract business on total company sales, and the company’s share of total European production, with short profiles of selected firms.

Contract furniture sales are provided for a sample of companies even by destination segment and by product category.

This study overall considers around 380 firms active in the contract furniture sector.

NEW: FOCUS ON EDUCATION FURNITURE: This year’s edition provides a detailed analysis of the Education segment including market values, the potential demand for education furniture, distribution channels, and purchasing process, product trends, average customer budgets, certifications, and projects.

FINANCIAL ANALYSIS: a set of financial indicators (Operating Revenue –Turnover-, Added Value, P/L for Period -Net Income-, Shareholders Funds, Cash Flow, ROI, ROE, EBITDA margin, EBIT margin, Solvency Ratio, Current Ratio, Number of Employees, Turnover per Employee, Added value per Employee) are reported for 70 companies operating in the contract furniture business.

ANNEX: Contact details for about 50 architect and design studios, List of relevant trade exhibitions for Hospitality, Building, Architectural and Design, Interiors, List of the first 300 hotel companies at global level, Contact details for around 380 contract furniture and furnishing manufacturers mentioned in the research.

Europe. Contract furniture. Production by country, % shares

The contract furniture production in Europe currently amounts to around EUR 14 billion. The largest part of this output is destined for projects within Europe, while less than 20% is addressed outside, to North America, Middle East, and Asia-Pacific.

Italy, Germany, the UK, Poland, and Sweden are the major manufacturing countries, representing together over 60% of the total European contract furniture production.

Contract furniture segments are evolving at a different speed further to a deep transformation of public and commercial furniture demand drivers. While Healthcare, Marine, Real Estate, Education, Luxury Shops, and Restaurant segments are showing a fast post-pandemic recovery, the Retail sector has been hardly challenged with a significant downgrade of the mass market retail, even if sustained by the grocery segment. Office and Hospitality businesses have not yet reached the pre-pandemic level, but are expected to grow in the next years.

Abstract of Table of Contents

METHODOLOGY. Introduction, Research Tools, Considered segments, and Sample

1. EXECUTIVE SUMMARY: The contract furniture and furnishings market in Europe

2. THE CONTRACT FURNITURE MARKET SCENARIO IN EUROPE

2.1 Contract furniture market evolution: European production and consumption of contract furniture

– Production and consumption of contract furniture by country, by segment, and Production of contract furniture by product

2.2 Contract furniture and furnishing consumption. Market forecasts for 2023 and 2024

2.3 Market approach: Turn-key vs soft contract in Europe, Own product vs traded products, Distribution channels

2.4 Leading groups in Europe and their market shares: Market concentration and shares on total production

3. CONTRACT FURNITURE MARKET PERFORMANCE BY AREA AND BY COUNTRY

3.1 Consumption of contract furniture and furnishing in Northern Europe and by country (Denmark, Finland, Norway, and Sweden) with macroeconomic indicators

3.2 Consumption of contract furniture and furnishing in Central Europe (Austria, Germany, Switzerland) with macroeconomic indicators

3.3 Consumption of contract furniture and furnishing in Western Europe (Belgium-Lux, France, Ireland, Netherlands, United Kingdom) with macroeconomic indicators

3.4 Consumption of contract furniture and furnishing in Southern Europe (Greece, Italy, Portugal, Spain) with macroeconomic indicators

3.5 Consumption of contract furniture and furnishing in Central-Eastern Europe (Poland, Lithuania, Czech Republic, Romania) with macroeconomic indicators

4. FOCUS: EDUCATION FURNITURE

4.1 Market values: Contract furniture and furnishings market for education

4.2 The potential demand for education furniture: educational buildings, target population, and public programs

4.3 Distribution channels and purchasing process

4.4 Product trends: education furniture market by product segment and by premium/non-premium segments

4.5 Average customer budgets

4.6 Certifications

4.7 Projects

5. THE CONTRACT FURNITURE MARKET BY SEGMENT. Demand drivers, market values, and projects in the:

– Retail, Hospitality, Office spaces, Restaurants and bars, Real estate, Entertainment, Marine, Healthcare, and Airports segments

6. COMPETITION: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES BY SEGMENT

6.1 Contract furniture sales in Europe and leading companies’ sales

– Contract furniture sales and leading companies’ sales in Retail, Hospitality, Office, Restaurants and bars, Real estate, Education, entertainment, art & museum, Healthcare, Marine, and Airports segments

7. COMPETITION: SALES OF THE LEADING CONTRACT FURNITURE COMPANIES BY PRODUCT

– Contract furniture sales of Bathroom furniture and equipment, Bedroom furniture and mattress, Kitchen furniture, Lighting fixtures, Office furniture, Outdoor furniture, Tables and chairs, and Upholstered furniture

8. FINANCIAL ANALYSIS

– Financial figures of 70 companies active in the contract furniture business

9. APPENDIX

– List of Architects and Designers, Hotel Companies, Trade exhibitions and Manufacturers

SEE ALSO

The world high-end furniture market

June 2022, IV Ed. , 194 pages

A comprehensive picture of the world market for high-end furniture, providing market size, forecasts, distribution channels and retailers, market features, barriers, purchasing trends and short profiles of the leading world high-end furniture brands.

Windows and doors: world market outlook

October 2013, I Ed. , 133 pages

This new market research contains current and historical data (production, consumption, imports, exports) and analysis of Window and Door industry for a total of 70 countries

World hospitality market

July 2013, II Ed. , 200 pages

This research provides an overview of the world hospitality furniture market, namely the world contract furniture market for hotels and resorts with a focus on the four and five star segments.

The Italian market for windows and glass surfaces

March 2013, II Ed. , 74 pages

This study provides data on the production and consumption of windows, French windows and glass covered surfaces on the Italian market. It is the result of roughly 100 direct interviews with representative firms

The Chinese contract market

January 2013, I Ed. , 85 pages

The Report is the result of 200 interviews with key players (Contract Furniture Manufacturers, Design Studios and Builders, Hotel Chains and other relevant Clients) and two years of CSIL research in China, on contract-related topics. Figures and analysis are described from two different point of views: end user sectors and main products.