May 2023,

XXXIII Ed. ,

305 pages

Price (single user license):

EUR 4200 / USD 4494

For multiple/corporate license prices please contact us

Language: English

Report code: EU04

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

This is the 33rd edition of “The European market for kitchen furniture” Report, issued by CSIL.

The Report is structured as follows:

Chapter 1. Basic data presents an overview of the European kitchen furniture sector based on CSIL’s processing of statistics and company data from official sources, both national and international, as well as sector information and field information collected through direct interviews with companies and sector experts. Through tables and graphs, data on kitchen furniture production, consumption and international trade are analysed, at European level as a whole and for each country considered, both in value and in volume, for the total sector and by price range.

Chapter 2. Activity trend and forecasts offers kitchen furniture statistics and the main macroeconomic indicators necessary to analyse the performance of the sector for the last 6 years (2017-2022), together with forecasts for the next four years, at European level as a whole and for each country considered.

Chapter 3. International trade provides detailed tables on the kitchen furniture exports and imports in the 30 European Countries considered, for the last 6 years, broken down by country and by geographical area of destination/origin.

Chapter 4. Financial Analysis builds, on a sample of 200 European kitchen furniture manufacturers, a study of their main profitability ratios (ROA, ROE and EBITDA) and measures their employee ratios.

Chapter 5. Supply structure offers an analysis of the types of products manufactured by the European kitchen furniture manufacturers, in addition to tables and information on the key players operating in each segment. Production is broken down by cabinet door material, by cabinet door style, by cabinet door colour, by lacquered cabinet door type and by worktop material.

Chapter 6. Distribution channels gives an overview of the main distribution channels active on the European kitchen furniture market, at European level as a whole and for country clusters considered.

Chapter 7. The competitive system: sales by price range and by country offers an insight into the leading local and foreign players present in each price range segment and in each European country considered. Through detailed tables are shown sales data and market shares of the top kitchen furniture companies; short profiles of the main players in the kitchen furniture industry are also available. In the end of this chapter, there is also a focus on European kitchen furniture exports and market shares outside EU30, by area of destination (Middle East and Africa, Asia and Pacific, North and Central-South America).

Annex. Directory of companies mentioned provides contact information for the main companies mentioned in this Report.

30 European countries are considered: Austria, Belgium-Luxembourg, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom (Europe 17, formerly “Europe Part I”), Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Romania, Slovakia, Slovenia (Europe 13, formerly “Europe Part II”).

Selected companies

Agata Meble, Alvic, Aran, Armony, Arredo3, Arrital, Artego, Aster, Aviva Cuisines, Baldita, Ballingslov, Ballerina, Bauformat, Boffi, Brigitte, Bruynzeel, BRW, Bulthaup, Colombini, Dan, Decodom, Delta Cocinas, Dica, Discac, Doca, DSM Keukens, Eggo, Ekipa, Elkjop, Euromobil, FBD, Fournier, Freda, Gama Décor, Haecker, Hanak, Howdens Joinery, Ideal, Ikea, Kvik, Leicht, Lube, Mandemaakers, Menuiseries du Centre, Morel, Mob Cozinhas, Mondo Convenienza, Nikolidakis, Nobia, Nobilia, Nolte, Omega, Oppein, Pedini, Pronorm, Puustelli, Rempp, Rotpunkt, Rust Mebel, Rus Savitar, Sanitas Troesch, Santos, Sacksen Kuechen, SBA Furniture, Sbabo, Scavolini, Snaidero, Symphony, Schmidt, Siko, Sykora, Snaidero, Stosa, Strai, TCM, Tom Howley, Turi, Ultima Furniture, Valcucine, Valdesign, Vedum, Veneta Cucine, Villeroy & Boch, Vordingborg, We.Do.Holding, WFM Kitchen, Wren Kitchens

Europe. Kitchen furniture market at a glance.

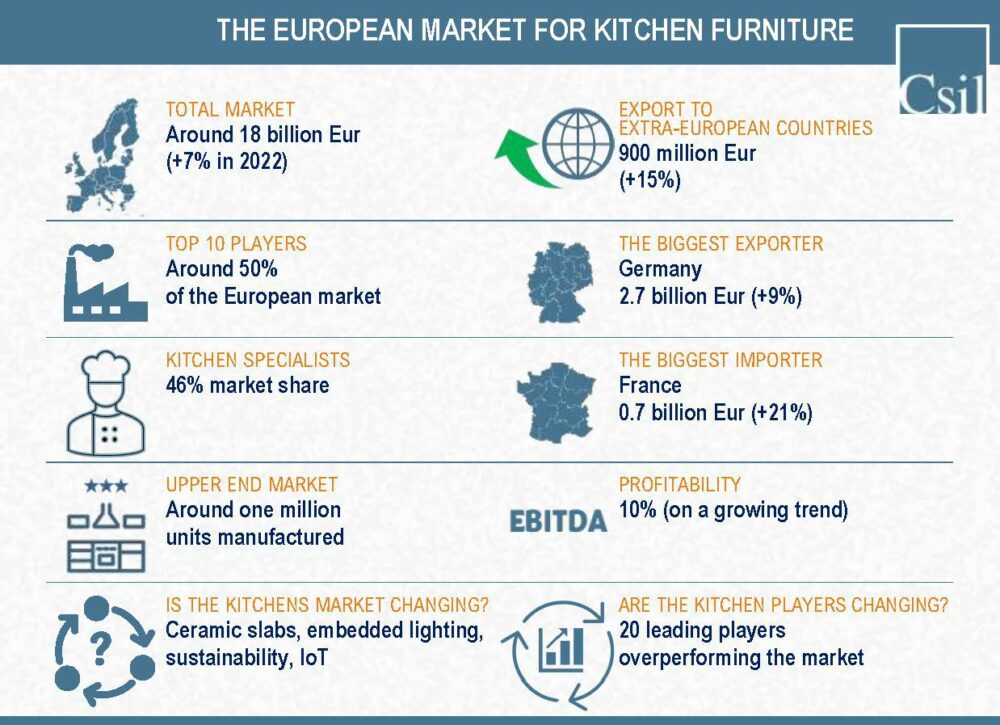

In 2022, the European production (30 EU countries) of kitchen furniture amounts to around 7 million units manufactured, including around one million units of upper end kitchens.

The kitchen furniture production is growing in 2022 (at least in nominal terms) in Germany, Italy, Denmark, Spain, Lithuania. Growth is driven by export in all these countries. Getting a glance on exports, growth rates are registered over 20% in Spain and Lithuania, among 9% in Germany and 15% in Italy.

Import growth (always in nominal terms) over 20% is registered in Central-Eastern countries as a whole and in France. A growth spike of +77% occurred in the United Kingdom.

Kitchen furniture prices increase is close to 10% on average. Significant differences country by country.

Among the leading players in Europe, we notice growth terms in nominal terms from 12% to 20% for around 20 among the European major kitchen furniture players.

Introduction

Contents of the Report; Research tools and methodological notes; Terminology

Basic data

The European framework: Kitchen furniture production, international trade and consumption by country, in value and volume

Kitchen furniture production and consumption by market segment (six price ranges): in value and volume, at European level as a whole and for each European country considered

Activity trend and Forecasts

For the total Europe as a whole and for each European country considered: Production, consumption, international trade of kitchen furniture and comparison with selected country indicators, 2017-2022 and forecast 2023-2026

International trade

For the total Europe as a whole and for each European country considered: Kitchen furniture exports and imports 2017-2022, by country and by geographical area of destination/origin and international trade data for selected household appliances, 2018-2020-2022

Financial analysis

Key financial indicators (ROE, ROA, EBITDA and EBIT ratio) and Employment analysis (number of employees, turnover per employee, average cost of employee, cost of employees/turnover) for a sample of 120 European companies for which kitchen furniture production is the main business area

Supply structure

Analysis of the kitchen furniture production (Sector estimates and data for a sample of companies) broken down by:

-Cabinet door material

-Cabinet door style

-Cabinet door colour and lacquered type

-Kind of wood

-Worktop material

-Kind of lay-out

Hinges and drawers; Embedded lighting

Intellectual Property: Number of patent family issued in 2021-2022 owned by a sample of European kitchen companies

Distribution channels

Overview of the main distribution channels active on the European kitchen furniture market, at European level as a whole and for each country considered

-Kitchen specialists, Furniture shops, Furniture chains, Building trade, Contract, DIY, E-commerce, Direct sales

Selection of Kitchen furniture stores for the 2022 in the main European cities, by geographic area (Northern Europe, Western Europe, Central Europe, Southern Europe, Eastern Europe)

Estimates of the value and weight of the built-in appliances on the domestic sales of kitchen furniture by country

The competitive system

Leading players in Europe and market shares (consumption and production)

The European competitive system by market segment: luxury, upper-end, middle-upper, middle, middle-low, lower-end. Sales data, market shares and short company profiles

The European competitive system for each of the 30 European countries analyzed

Exports from Europe to Extra-European markets and Overseas: Americas, Asia and Pacific, Middle East end Africa

Annex

Directory of selected European kitchen furniture companies

This is the 33rd edition of “The European market for kitchen furniture” Report, issued by CSIL.

The Report is structured as follows:

Chapter 1. Basic data presents an overview of the European kitchen furniture sector based on CSIL’s processing of statistics and company data from official sources, both national and international, as well as sector information and field information collected through direct interviews with companies and sector experts. Through tables and graphs, data on kitchen furniture production, consumption and international trade are analysed, at European level as a whole and for each country considered, both in value and in volume, for the total sector and by price range.

Chapter 2. Activity trend and forecasts offers kitchen furniture statistics and the main macroeconomic indicators necessary to analyse the performance of the sector for the last 6 years (2017-2022), together with forecasts for the next four years, at European level as a whole and for each country considered.

Chapter 3. International trade provides detailed tables on the kitchen furniture exports and imports in the 30 European Countries considered, for the last 6 years, broken down by country and by geographical area of destination/origin.

Chapter 4. Financial Analysis builds, on a sample of 200 European kitchen furniture manufacturers, a study of their main profitability ratios (ROA, ROE and EBITDA) and measures their employee ratios.

Chapter 5. Supply structure offers an analysis of the types of products manufactured by the European kitchen furniture manufacturers, in addition to tables and information on the key players operating in each segment. Production is broken down by cabinet door material, by cabinet door style, by cabinet door colour, by lacquered cabinet door type and by worktop material.

Chapter 6. Distribution channels gives an overview of the main distribution channels active on the European kitchen furniture market, at European level as a whole and for country clusters considered.

Chapter 7. The competitive system: sales by price range and by country offers an insight into the leading local and foreign players present in each price range segment and in each European country considered. Through detailed tables are shown sales data and market shares of the top kitchen furniture companies; short profiles of the main players in the kitchen furniture industry are also available. In the end of this chapter, there is also a focus on European kitchen furniture exports and market shares outside EU30, by area of destination (Middle East and Africa, Asia and Pacific, North and Central-South America).

Annex. Directory of companies mentioned provides contact information for the main companies mentioned in this Report.

30 European countries are considered: Austria, Belgium-Luxembourg, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom (Europe 17, formerly “Europe Part I”), Bulgaria, Croatia, Cyprus, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Malta, Poland, Romania, Slovakia, Slovenia (Europe 13, formerly “Europe Part II”).

Europe. Kitchen furniture market at a glance.

In 2022, the European production (30 EU countries) of kitchen furniture amounts to around 7 million units manufactured, including around one million units of upper end kitchens.

The kitchen furniture production is growing in 2022 (at least in nominal terms) in Germany, Italy, Denmark, Spain, Lithuania. Growth is driven by export in all these countries. Getting a glance on exports, growth rates are registered over 20% in Spain and Lithuania, among 9% in Germany and 15% in Italy.

Import growth (always in nominal terms) over 20% is registered in Central-Eastern countries as a whole and in France. A growth spike of +77% occurred in the United Kingdom.

Kitchen furniture prices increase is close to 10% on average. Significant differences country by country.

Among the leading players in Europe, we notice growth terms in nominal terms from 12% to 20% for around 20 among the European major kitchen furniture players.

Introduction

Contents of the Report; Research tools and methodological notes; Terminology

Basic data

The European framework: Kitchen furniture production, international trade and consumption by country, in value and volume

Kitchen furniture production and consumption by market segment (six price ranges): in value and volume, at European level as a whole and for each European country considered

Activity trend and Forecasts

For the total Europe as a whole and for each European country considered: Production, consumption, international trade of kitchen furniture and comparison with selected country indicators, 2017-2022 and forecast 2023-2026

International trade

For the total Europe as a whole and for each European country considered: Kitchen furniture exports and imports 2017-2022, by country and by geographical area of destination/origin and international trade data for selected household appliances, 2018-2020-2022

Financial analysis

Key financial indicators (ROE, ROA, EBITDA and EBIT ratio) and Employment analysis (number of employees, turnover per employee, average cost of employee, cost of employees/turnover) for a sample of 120 European companies for which kitchen furniture production is the main business area

Supply structure

Analysis of the kitchen furniture production (Sector estimates and data for a sample of companies) broken down by:

-Cabinet door material

-Cabinet door style

-Cabinet door colour and lacquered type

-Kind of wood

-Worktop material

-Kind of lay-out

Hinges and drawers; Embedded lighting

Intellectual Property: Number of patent family issued in 2021-2022 owned by a sample of European kitchen companies

Distribution channels

Overview of the main distribution channels active on the European kitchen furniture market, at European level as a whole and for each country considered

-Kitchen specialists, Furniture shops, Furniture chains, Building trade, Contract, DIY, E-commerce, Direct sales

Selection of Kitchen furniture stores for the 2022 in the main European cities, by geographic area (Northern Europe, Western Europe, Central Europe, Southern Europe, Eastern Europe)

Estimates of the value and weight of the built-in appliances on the domestic sales of kitchen furniture by country

The competitive system

Leading players in Europe and market shares (consumption and production)

The European competitive system by market segment: luxury, upper-end, middle-upper, middle, middle-low, lower-end. Sales data, market shares and short company profiles

The European competitive system for each of the 30 European countries analyzed

Exports from Europe to Extra-European markets and Overseas: Americas, Asia and Pacific, Middle East end Africa

Annex

Directory of selected European kitchen furniture companies

SEE ALSO

Il mercato italiano dei mobili per cucina (Italian)

April 2024, XLII Ed. , 95 pages

This study offers a comprehensive analysis of the kitchen furniture industry in Italy through production and consumption data, trade interchange, market shares of the major players in the industry by price range, sales location, distribution channels, profitability, types of integrated appliances sold, types and materials of cabinet doors and countertops, market trends and prospects.

Kitchen furniture: World market outlook

December 2023, XVIII Ed. , 185 pages

CSIL analyses 60 kitchen furniture markets with a rich collection of key country data, production and consumption both in value and units. Company profiles for 35 among the main kitchen furniture manufacturers worldwide

The kitchen furniture market in the United States

March 2023, VIII Ed. , 112 pages

In-deep analysis of the kitchen furniture sector in the US, with trends and forecasts of production, consumption, imports and exports, leading players by geographical areas and price ranges (clustered in six price groups), marketing policies and distribution channels

The kitchen furniture market in China

March 2022, IX Ed. , 160 pages

The Report, now at its IX edition, offers an in-depth investigation of the kitchen market in China, with size and trends of production, consumption, international trade, as well as analysis of demand determinants and competitive system

Smart cities and flagship stores: kitchen furniture

July 2021, I Ed. , 206 pages

Profiles of 85 cities worldwide (ranked according to their business attractiveness) with a selection of economic and demographic indicators, and estimates and forecasts of the potential market for kitchen furniture. Analysis of the geographical presence of a selected sample of 100 brands, with a focus on kitchen furniture outlets