March 2015,

I Ed. ,

81 pages

Price (single user license):

EUR 1600 / USD 1696

For multiple/corporate license prices please contact us

Language: English

Report code: EU32

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

According to CSIL research report The European market for office acoustic solutions, acoustic aspect is becoming more and more relevant in the office business lied not only to the noise absorption but also to the sound management.

The total acoustic panel surfaces currently consumed in the European office furniture business is estimated to account 2,250 thousands sqm, mainly used for producing continuous wall panels, free standing screens, high partitions, acoustic patches, cabinet doors, desk dividing screens and the so-called “cocoons”.

The weight of acoustic solutions on the office furniture industry is expected to increase significantly during the next years.

The European market for office acoustic solutions report analyses the acoustic trend in the office furniture market with a focus on acoustic panels by kind of applications and leading European players in this segment, with brand positioning by specialization and offered solution.

Countries covered: Germany, Austria and Switzerland; France, Belgium, the Netherlands; United Kingdom and Ireland; Italy; Spain and Portugal; Sweden and Scandinavia

Selected companies

Actiu, Ahrend, Bene, Glide, Estel, Senator, Caimi, Egger, Fantoni. Kvadrat, ZilenZio

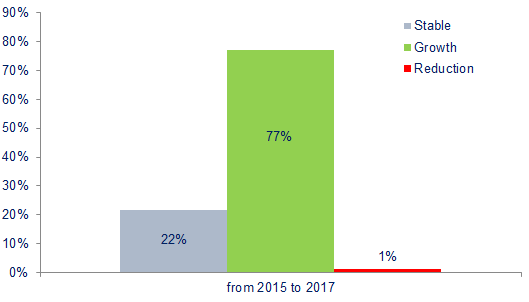

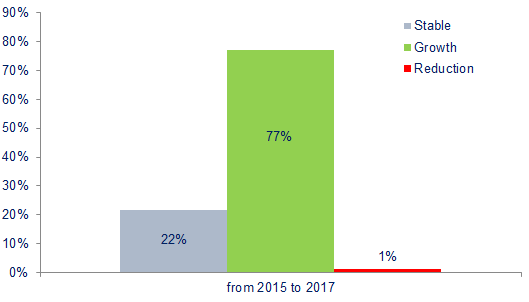

Trend in the use of acoustic applications in 2015-2017. % value on total number of interviews

The incidence of acoustic solutions in the office furniture business is expected to expand significantly during the next years. According to the majority of the interviewees (77%) sales in the acoustic segment will increase more rapidly than the office furniture sector in general.

In fact, besides a small group of companies, which pioneered in acoustics more than 20 years ago (ex. Abstracta with Softline in 1981), there is a relevant number of players which introduced acoustic solutions in the past five years (around 50% of the sample interviewed). Another 30% announced the presentation of new products in 2014 while a 20% expects to launch acoustic products in portfolio within 2015 for the first time.

Abstract of Table of Contents

1. Flat surfaces and acoustic panels

1.1 Total flat surfaces in the office furniture sector

1.2 Consumption of acoustic panels

1.3 Future developments

2. Acoustic in the office furniture sector

2.1 Acoustic panel applications

2.2 Relevant factors in selling acoustic solutions

2.3 Certifications

2.4 Office furniture manufacturers selling acoustic products

2.5 Specialist manufacturers of acoustic solution

3. The supply of acoustic panels

3.1 Mentioned suppliers

3.2 Supply chain and price levels

3.3 Expectations

Appendix.

A1. Sectors fairs

A2. Selected Press

A.3 Mentioned companies

According to CSIL research report The European market for office acoustic solutions, acoustic aspect is becoming more and more relevant in the office business lied not only to the noise absorption but also to the sound management.

The total acoustic panel surfaces currently consumed in the European office furniture business is estimated to account 2,250 thousands sqm, mainly used for producing continuous wall panels, free standing screens, high partitions, acoustic patches, cabinet doors, desk dividing screens and the so-called “cocoons”.

The weight of acoustic solutions on the office furniture industry is expected to increase significantly during the next years.

The European market for office acoustic solutions report analyses the acoustic trend in the office furniture market with a focus on acoustic panels by kind of applications and leading European players in this segment, with brand positioning by specialization and offered solution.

Countries covered: Germany, Austria and Switzerland; France, Belgium, the Netherlands; United Kingdom and Ireland; Italy; Spain and Portugal; Sweden and Scandinavia

Trend in the use of acoustic applications in 2015-2017. % value on total number of interviews

The incidence of acoustic solutions in the office furniture business is expected to expand significantly during the next years. According to the majority of the interviewees (77%) sales in the acoustic segment will increase more rapidly than the office furniture sector in general.

In fact, besides a small group of companies, which pioneered in acoustics more than 20 years ago (ex. Abstracta with Softline in 1981), there is a relevant number of players which introduced acoustic solutions in the past five years (around 50% of the sample interviewed). Another 30% announced the presentation of new products in 2014 while a 20% expects to launch acoustic products in portfolio within 2015 for the first time.

Abstract of Table of Contents

1. Flat surfaces and acoustic panels

1.1 Total flat surfaces in the office furniture sector

1.2 Consumption of acoustic panels

1.3 Future developments

2. Acoustic in the office furniture sector

2.1 Acoustic panel applications

2.2 Relevant factors in selling acoustic solutions

2.3 Certifications

2.4 Office furniture manufacturers selling acoustic products

2.5 Specialist manufacturers of acoustic solution

3. The supply of acoustic panels

3.1 Mentioned suppliers

3.2 Supply chain and price levels

3.3 Expectations

Appendix.

A1. Sectors fairs

A2. Selected Press

A.3 Mentioned companies

SEE ALSO

The world office furniture industry

December 2023, XII Ed. , 442 pages

A comprehensive picture of the global office furniture sector with production, consumption imports, and export data for the time series 2014-2023, international trade, market forecasts for the years 2024 and 2025, profiles of the leading office furniture manufacturers, and summary tables for 60 countries. Focus on the Top 20 office furniture countries.

The world market for Height Adjustable Tables

November 2023, I Ed. , 80 pages

A comprehensive analysis of the Height Adjustable Tables (HAT) market, delving into key players (manufacturers and suppliers), trends, and market forecasts by major world areas and relevant regions, focusing on product destinations.

The world market for office seating

November 2023, II Ed. , 162 pages

A comprehensive report analysing key statistics of the global office seating industry, including production, consumption, and international trade for the 2018-2023 time series, office seating market forecasts for 2024 and 2025, the leading companies, a range of products and their features, with a focus on three world regions (North America, Europe, and Asia-Pacific) and key countries.

The office furniture market in North America. The United States, Canada, and Mexico

July 2023, VII Ed. , 129 pages

Analysis of the office furniture industry in North America with a focus on the USA, Canada and Mexico. Value of office furniture market, market forecasts, figures by country, market share of leading companies, distribution channels

The European market for office furniture

June 2023, XXXV Ed. , 281 pages

An extensive analysis of the office furniture sector in Europe, with historical data on key indicators, and demand prospects, delving into the performance of the leading manufacturers, the product categories, and the distribution.