October 2018,

I Ed. ,

39 pages

Price (single user license):

EUR 960 / USD 1027.2

For multiple/corporate license prices please contact us

Language: English

Report code: S63

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

CSIL Market Research Report The kitchen furniture market in Brazil provides an analysis of the kitchen furniture production and consumption, imports and exports in Brazil, in values and in quantities, with data and figures on the activity trend and forecasts for the next two years.

Import and export data are shown by country and by geographical area of origin/destination.

An estimate of the breakdown of the kitchen furniture market in Brazil by cabinet door material and colour is included.

An overview on the kitchen furniture distribution system in Brazil is offered, including the following channels: furniture and kitchen furniture stores, furniture and appliance chains, monobrand and franchising stores, DIY and Contract segments.

The Report shows also an overview of the main market drivers (Population and other economic indicators, GDP, total investments, inflation and unemployment rate up to 2022).

Information on the competitive system include sales data and market shares of 50 among the top kitchen furniture manufacturers in Brazil, as well as short company profiles. Six different price segments are analyzed.

Website for a sample of 20 Brazilian manufacturers of kitchen furniture is also provided.

Selected companies

Acorp, Albatroz, Aramoveis, Berlim, Bentec, Bertolini, Bontempo, Colormax, Cook, Cozimax,Cozinart,Dada, Daico, Dellanno, Ditalia, D’Silva, Durart, Estrela Moveis, Evviva, Favo, Florense,Henn, Imobal,Itatiaia, Kappersberg, Kitchens, Kit’s Paranà, Lacca, Leicht, Luciane, Mademoveis, Millennium, Mobler, Neuman, Nicioli, Notavel, Ornare, Pagani, Palmeira, Paludetto, Piramide, Poliform, Politorno, Requipe Cozinhas, Rudnick, SCA, SD, Segatto, Skema, Telasul, Todeschini, Unica, Varanda, Valcucine.

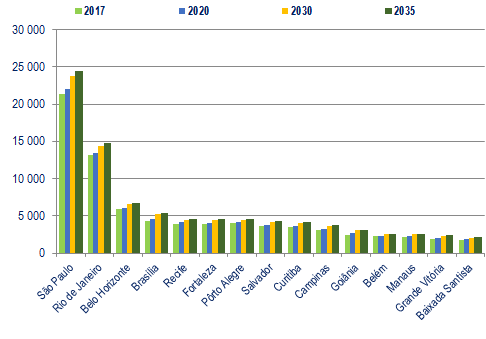

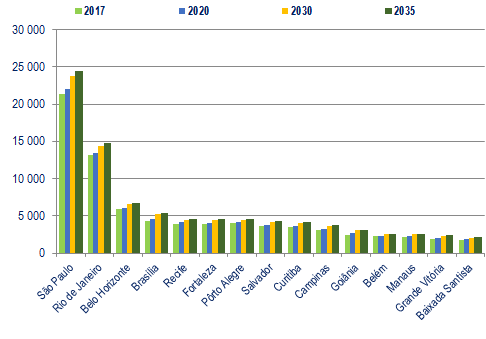

Population of the top 15 urban agglomerations in Brazil with 300,000 or more in 2018, 2017-2020-2030-2035. Thousands

In Brazil, the kitchen furniture production is mainly concentrated in the industrial furniture clusters of the Southern and the South-Eastern States, such as: Bento Gonçalves (RS), Interior of São Paulo (SP), Arapongas (PR), City of São Paulo and Metropolitan Area (SP), Ubá (MG), Curitiba (PR), São Bento do Sul (SC), Lagoa Vermelha (RS) and Rio de Janeiro and Metropolitan Area (RJ). The production of kitchen furniture in Brazil increased in 2017 and a further growth is expected during 2018 and 2019.

Among the major distributors in the large retail sector, we can mention Casas Bahia and Ponto Frio, Magazine Luiza, Lojas Cem, Ricardo Eletro, Marabraz and Lojas Colombo.

The kitchen furniture market in Brazil shows a mixed composition with large brands coexisting with small brands. Itatiaia, Todeschini, Evviva, Florense, Nicioli, Henn, Unica, Kappesberg, Politorno, Notável and Kit’s Paraná are among the main players. Top 50 manufacturers, according to CSIL estimates, hold around two thirds of the Brazilian market for kitchen furniture in value.

Abstract of Table of Contents

BASIC DATA AND ACTIVITY TREND

The kitchen furniture sector in Brazil at a glance. Main data and figures

The kitchen furniture sector in Brazil, basic data 2010-2017 in values and quantities

Furniture production in Brazil by product line (1,000 items), 2013-2017

INTERNATIONAL TRADE

Brazil. Export and import of kitchen furniture, by country and by geographical area of destination/origin, 2012-2017

DRIVING FORCES FOR DEMAND AND MAIN CLUSTERS

Population in Brazil and other economic indicators of the country

GDP, total investments, inflation and unemployment rate n Brazil, trend 2010-2017 end forecasts 2018-2022

Population of the top 50 urban agglomerations in Brazil with 300,000 or more in 2018, 2017-2030

Main manufacturing clusters: an analysis of supply at the territorial level

DISTRIBUTION

Mark-up

Furniture and kitchen furniture stores

Furniture and appliance chains

DIY segment

Purchasing process

Kitchen furniture market in Brazil. Estimated market shares by cabinet door material and colour

Built-in appliances

MARKET SHARES

The kitchen furniture market in Brazil: top 50 players. Sales data and market shares

Low and middle-low end segments ; Middle and middle-upper end segment ; Upper and luxury end segment: Main players, sales data and market shares for each price segment, short company profiles

CSIL Market Research Report The kitchen furniture market in Brazil provides an analysis of the kitchen furniture production and consumption, imports and exports in Brazil, in values and in quantities, with data and figures on the activity trend and forecasts for the next two years.

Import and export data are shown by country and by geographical area of origin/destination.

An estimate of the breakdown of the kitchen furniture market in Brazil by cabinet door material and colour is included.

An overview on the kitchen furniture distribution system in Brazil is offered, including the following channels: furniture and kitchen furniture stores, furniture and appliance chains, monobrand and franchising stores, DIY and Contract segments.

The Report shows also an overview of the main market drivers (Population and other economic indicators, GDP, total investments, inflation and unemployment rate up to 2022).

Information on the competitive system include sales data and market shares of 50 among the top kitchen furniture manufacturers in Brazil, as well as short company profiles. Six different price segments are analyzed.

Website for a sample of 20 Brazilian manufacturers of kitchen furniture is also provided.

Population of the top 15 urban agglomerations in Brazil with 300,000 or more in 2018, 2017-2020-2030-2035. Thousands

In Brazil, the kitchen furniture production is mainly concentrated in the industrial furniture clusters of the Southern and the South-Eastern States, such as: Bento Gonçalves (RS), Interior of São Paulo (SP), Arapongas (PR), City of São Paulo and Metropolitan Area (SP), Ubá (MG), Curitiba (PR), São Bento do Sul (SC), Lagoa Vermelha (RS) and Rio de Janeiro and Metropolitan Area (RJ). The production of kitchen furniture in Brazil increased in 2017 and a further growth is expected during 2018 and 2019.

Among the major distributors in the large retail sector, we can mention Casas Bahia and Ponto Frio, Magazine Luiza, Lojas Cem, Ricardo Eletro, Marabraz and Lojas Colombo.

The kitchen furniture market in Brazil shows a mixed composition with large brands coexisting with small brands. Itatiaia, Todeschini, Evviva, Florense, Nicioli, Henn, Unica, Kappesberg, Politorno, Notável and Kit’s Paraná are among the main players. Top 50 manufacturers, according to CSIL estimates, hold around two thirds of the Brazilian market for kitchen furniture in value.

Abstract of Table of Contents

BASIC DATA AND ACTIVITY TREND

The kitchen furniture sector in Brazil at a glance. Main data and figures

The kitchen furniture sector in Brazil, basic data 2010-2017 in values and quantities

Furniture production in Brazil by product line (1,000 items), 2013-2017

INTERNATIONAL TRADE

Brazil. Export and import of kitchen furniture, by country and by geographical area of destination/origin, 2012-2017

DRIVING FORCES FOR DEMAND AND MAIN CLUSTERS

Population in Brazil and other economic indicators of the country

GDP, total investments, inflation and unemployment rate n Brazil, trend 2010-2017 end forecasts 2018-2022

Population of the top 50 urban agglomerations in Brazil with 300,000 or more in 2018, 2017-2030

Main manufacturing clusters: an analysis of supply at the territorial level

DISTRIBUTION

Mark-up

Furniture and kitchen furniture stores

Furniture and appliance chains

DIY segment

Purchasing process

Kitchen furniture market in Brazil. Estimated market shares by cabinet door material and colour

Built-in appliances

MARKET SHARES

The kitchen furniture market in Brazil: top 50 players. Sales data and market shares

Low and middle-low end segments ; Middle and middle-upper end segment ; Upper and luxury end segment: Main players, sales data and market shares for each price segment, short company profiles

SEE ALSO

Il mercato italiano dei mobili per cucina (Italian)

April 2024, XLII Ed. , 95 pages

This study offers a comprehensive analysis of the kitchen furniture industry in Italy through production and consumption data, trade interchange, market shares of the major players in the industry by price range, sales location, distribution channels, profitability, types of integrated appliances sold, types and materials of cabinet doors and countertops, market trends and prospects.

Kitchen furniture: World market outlook

December 2023, XVIII Ed. , 185 pages

CSIL analyses 60 kitchen furniture markets with a rich collection of key country data, production and consumption both in value and units. Company profiles for 35 among the main kitchen furniture manufacturers worldwide

The European market for kitchen furniture

May 2023, XXXIII Ed. , 305 pages

In 2022, the European production (30 EU countries) of kitchen furniture amounts to around 7 million units manufactured, including around one million units of upper end kitchens.

The kitchen furniture market in the United States

March 2023, VIII Ed. , 112 pages

In-deep analysis of the kitchen furniture sector in the US, with trends and forecasts of production, consumption, imports and exports, leading players by geographical areas and price ranges (clustered in six price groups), marketing policies and distribution channels

The kitchen furniture market in China

March 2022, IX Ed. , 160 pages

The Report, now at its IX edition, offers an in-depth investigation of the kitchen market in China, with size and trends of production, consumption, international trade, as well as analysis of demand determinants and competitive system