July 2017,

III Ed. ,

84 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: S66

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

Please note: up-to-date data for The office furniture market in China and for the whole Asia Pacific area are available in the report The office furniture market in Asia Pacific and China (November 2021). Country analysis in the study is provided for Australia, China, India, Japan, Malaysia, South Korea, Taiwan (China), Thailand, Vietnam, with a special focus on China. For more information, please visit https://worldfurnitureonline.com/research-market/the-office-furniture-market-asia-pacific-0058538.htm and contact us

CSIL Market Research The office furniture market in China studies the size of the office furniture market, historical trends in office furniture production and consumption, imports and exports.

The report is enriched by an in-depth analysis of the competitive system in terms of company size, manufacturing locations and product breakdown.

Figures for sales and estimates of market shares for the leading office furniture manufacturers operating in China are also available (total office furniture production and segments: seating, operative desks, executive furniture, storage, wall-to-wall units).

Short profiles of the top office furniture manufacturers are also available.

Office furniture production is reported by segment (office seating, operative desks, executive furniture, office storage, wall-to-wall units). The analysis of supply includes product sub-segments (i.e. chairs by type, office desks by type) and materials used. The figures are given for a medium term time span (2010-2016) giving an indication of the market trend.

Office furniture imports and exports are broken down by country and geographical area of origin/destination.

A focus on the domestic market includes average prices declared by companies during the survey, sales by region and by main customers (public sector, foreign multinationals, medium and large private companies, small private companies, independent white collars, banking/insurance).

Data on the distribution system are also provided, with sales broken down by distribution channel and kind of customer.

An analysis of price levels is included, with a particular focus on office swivel chairs where brand positioning is given on the basis of the number of units manufactured by single company and the average price.

An analysis of the market potential focuses on the construction sector, the richest Chinese cities, luxury retail locations, trends in the hospitality sector and the commercial lighting fixtures segment.

Over 100 addresses of key operators are included. The study was carried out via direct interviews with more than 120 sector firms and distributors operating on the Chinese market.

Selected companies

Aurora, Botai, C R Logic, Changjiang, Dious, Headway, Henglin Chair, Herman Miller, Hongye, Jongtay-Paiger, Kinwai, Kuo Ching, Lamex, Qianglong, Quama, Saosen, Sijin, Steelcase Asia Pacific, Sunon, UE Furniture, Victory Office Systems

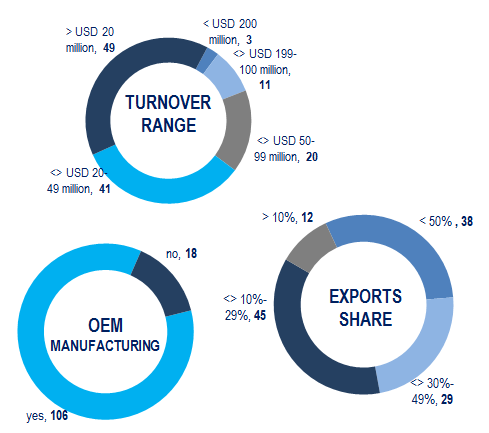

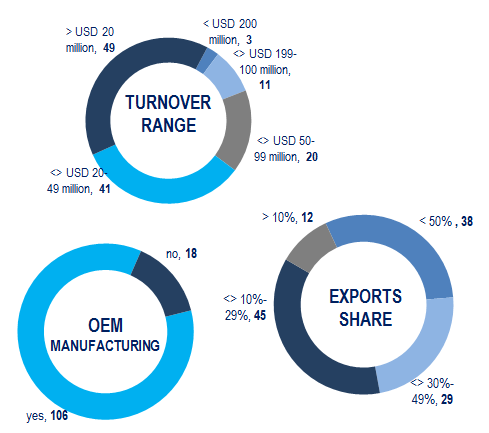

THE SAMPLE. Number of companies

With a total production value of US$ 14.8 billion in 2016, increasing by 12% on average over the last decade, China is the leading office furniture manufacturer at a world level. Furthermore, China, whose share of exports increased from 18% in 2007 to 38% in 2016 (US$ 3.7 billion) is also the major world exporter and the main supplier to the United States, Germany, France, the United Kingdom and Japan.

The industrial structure in China is highly fragmented as the majority of office furniture manufacturers are small and medium-sized companies. The largest 100 players in terms of turnover account for less than 40% of total production.

The increasing pressure due to higher operational costs is forcing some smaller players to close down. At the low-end of the market China is experiencing competition from other Asian countries and from North American brands.

Abstract of Table of Contents

EXECUTIVE SUMMARY

INTRODUCTION

Research field and methodology

The sample

THE OFFICE FURNITURE SECTOR

Production, consumption, exports and imports over the period 2011-2016 Values in USD and RMB

Sector peculiarities

- Total sales of office furniture for the top 10 manufacturers, 2016. Million USD and % market shares

- Office furniture consumption forecast

THE OFFICE FURNITURE SUPPLY

Manufacturing presence

- Anji Chair District

COMPETITION

Market shares

Sales by product

- Office seating, Operative desks, Executive furntiure, Filing cabinets and storage, Wall-to-wall units and Partitions

THE DOMESTIC MARKET

Sales by region and market shares

Customer segmentation and distribution channels

Prices

INTERNATIONAL TRADE

China top office furniture exporter worldwide

- China. Top ten markets for office furniture exports. Chinese export activity and penetration.

Exports

Imports

DEMAND DETERMINANTS

ANNEX 1. ADDITIONAL STATISTICS

ANNEX 2 TRADE FAIRS, AND ASSOCIATIONS

ANNEX 3. LIST OF MANUFACTURERS

Please note: up-to-date data for The office furniture market in China and for the whole Asia Pacific area are available in the report The office furniture market in Asia Pacific and China (November 2021). Country analysis in the study is provided for Australia, China, India, Japan, Malaysia, South Korea, Taiwan (China), Thailand, Vietnam, with a special focus on China. For more information, please visit https://worldfurnitureonline.com/research-market/the-office-furniture-market-asia-pacific-0058538.htm and contact us

CSIL Market Research The office furniture market in China studies the size of the office furniture market, historical trends in office furniture production and consumption, imports and exports.

The report is enriched by an in-depth analysis of the competitive system in terms of company size, manufacturing locations and product breakdown.

Figures for sales and estimates of market shares for the leading office furniture manufacturers operating in China are also available (total office furniture production and segments: seating, operative desks, executive furniture, storage, wall-to-wall units).

Short profiles of the top office furniture manufacturers are also available.

Office furniture production is reported by segment (office seating, operative desks, executive furniture, office storage, wall-to-wall units). The analysis of supply includes product sub-segments (i.e. chairs by type, office desks by type) and materials used. The figures are given for a medium term time span (2010-2016) giving an indication of the market trend.

Office furniture imports and exports are broken down by country and geographical area of origin/destination.

A focus on the domestic market includes average prices declared by companies during the survey, sales by region and by main customers (public sector, foreign multinationals, medium and large private companies, small private companies, independent white collars, banking/insurance).

Data on the distribution system are also provided, with sales broken down by distribution channel and kind of customer.

An analysis of price levels is included, with a particular focus on office swivel chairs where brand positioning is given on the basis of the number of units manufactured by single company and the average price.

An analysis of the market potential focuses on the construction sector, the richest Chinese cities, luxury retail locations, trends in the hospitality sector and the commercial lighting fixtures segment.

Over 100 addresses of key operators are included. The study was carried out via direct interviews with more than 120 sector firms and distributors operating on the Chinese market.

THE SAMPLE. Number of companies

With a total production value of US$ 14.8 billion in 2016, increasing by 12% on average over the last decade, China is the leading office furniture manufacturer at a world level. Furthermore, China, whose share of exports increased from 18% in 2007 to 38% in 2016 (US$ 3.7 billion) is also the major world exporter and the main supplier to the United States, Germany, France, the United Kingdom and Japan.

The industrial structure in China is highly fragmented as the majority of office furniture manufacturers are small and medium-sized companies. The largest 100 players in terms of turnover account for less than 40% of total production.

The increasing pressure due to higher operational costs is forcing some smaller players to close down. At the low-end of the market China is experiencing competition from other Asian countries and from North American brands.

Abstract of Table of Contents

EXECUTIVE SUMMARY

INTRODUCTION

Research field and methodology

The sample

THE OFFICE FURNITURE SECTOR

Production, consumption, exports and imports over the period 2011-2016 Values in USD and RMB

Sector peculiarities

- Total sales of office furniture for the top 10 manufacturers, 2016. Million USD and % market shares

- Office furniture consumption forecast

THE OFFICE FURNITURE SUPPLY

Manufacturing presence

- Anji Chair District

COMPETITION

Market shares

Sales by product

- Office seating, Operative desks, Executive furntiure, Filing cabinets and storage, Wall-to-wall units and Partitions

THE DOMESTIC MARKET

Sales by region and market shares

Customer segmentation and distribution channels

Prices

INTERNATIONAL TRADE

China top office furniture exporter worldwide

- China. Top ten markets for office furniture exports. Chinese export activity and penetration.

Exports

Imports

DEMAND DETERMINANTS

ANNEX 1. ADDITIONAL STATISTICS

ANNEX 2 TRADE FAIRS, AND ASSOCIATIONS

ANNEX 3. LIST OF MANUFACTURERS

SEE ALSO

The world office furniture industry

December 2023, XII Ed. , 442 pages

A comprehensive picture of the global office furniture sector with production, consumption imports, and export data for the time series 2014-2023, international trade, market forecasts for the years 2024 and 2025, profiles of the leading office furniture manufacturers, and summary tables for 60 countries. Focus on the Top 20 office furniture countries.

The world market for Height Adjustable Tables

November 2023, I Ed. , 80 pages

A comprehensive analysis of the Height Adjustable Tables (HAT) market, delving into key players (manufacturers and suppliers), trends, and market forecasts by major world areas and relevant regions, focusing on product destinations.

The world market for office seating

November 2023, II Ed. , 162 pages

A comprehensive report analysing key statistics of the global office seating industry, including production, consumption, and international trade for the 2018-2023 time series, office seating market forecasts for 2024 and 2025, the leading companies, a range of products and their features, with a focus on three world regions (North America, Europe, and Asia-Pacific) and key countries.

The office furniture market in North America. The United States, Canada, and Mexico

July 2023, VII Ed. , 129 pages

Analysis of the office furniture industry in North America with a focus on the USA, Canada and Mexico. Value of office furniture market, market forecasts, figures by country, market share of leading companies, distribution channels

The European market for office furniture

June 2023, XXXV Ed. , 281 pages

An extensive analysis of the office furniture sector in Europe, with historical data on key indicators, and demand prospects, delving into the performance of the leading manufacturers, the product categories, and the distribution.