July 2015,

I Ed. ,

75 pages

Price (single user license):

EUR 2000 / USD 2120

For multiple/corporate license prices please contact us

Language: English

Report code: S80

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

This NEW report, The office furniture market in the Gulf countries provides market trends and updated data on the office furniture production, consumption, import and exports in 6 countries of the Gulf Region.

Office furniture sales are broken down by segment (office seating, operative desks, executive furniture, storage, communal areas) and by distribution channels (direct sales, furniture dealers, contractors and architects).

Office furniture imports and exports are broken down by country and geographical area of origin/destination.

Forecasts 2015 and 2016 of office furniture consumption are available.

The report gives figures on sales and estimates on market shares for approximately 100 sector companies operating in the region and also includes short profiles of leading manufacturers (local and international).

Market quantification is accompanied by a description of competition and a particular focus on distribution and how international players operate on the market.

An analysis of the furniture market includes: Demand Drivers (macroeconomic indicators, population GDP, and details on the potential market in the contract sector).

Countries considered: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates

Annex provides addresses of about 100 leading office companies and a list of selected trade press as well as a list of sector fair.

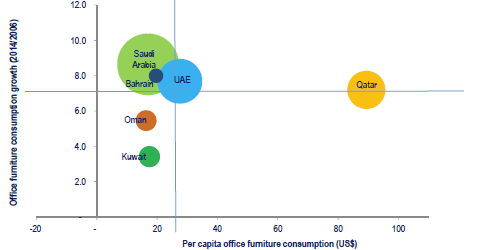

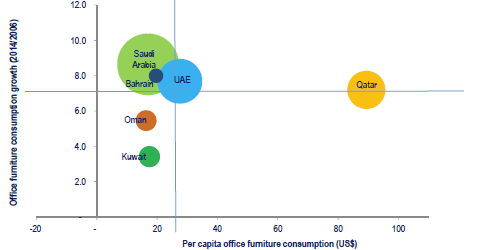

Gulf Countries. Office furniture market. Market positioning

The office furniture market in the Gulf Countries is worth about US$ 1,054 million. Manufacturing activities in the region are still limited (Saudi Arabia is an exception) and imported items claim the largest market share.

The largest markets in terms of office furniture consumption are Saudi Arabia, UAE and Qatar.

According to CSIL estimates, office furniture consumption across the whole region increased on average by 2.3% in 2014 and performances are expected to improve in 2015 and 2016.

Abstract of Table of Contents

0 METHODOLOGY

1. OFFICE FURNITURE MARKET: OUTLOOK

1.1 Market overview of the Gulf countries

Basic data: Furniture production, consumption, imports and exports, US$ million

Gulf Countries. Real growth in office furniture consumption. Forecasts 2015 and 2016. % change

Gulf Countries. Office furniture. Market positioning: largest markets in terms of office furniture consumption , highest per capita office consumption and fastest growing markets

Gulf Countries. Commercial supply in the largest marketplaces in 2014. Thousand square metres

Top 100 private projects in the Gulf Region. % shares of total project values

For each of the considered country: BAHRAIN, KUWAIT, OMAN, QATAR, SAUDI ARABIA, UNITED ARAB EMIRATES

2.1 Office furniture market: basic data

Furniture production, consumption, imports and exports, US$ million

Office furniture consumption. Forecasts 2015 and 2016. % change in real terms

2.2 International trade

2.3 Demand drivers and macroeconomic indicators

8. COMPETITIVE SYSTEM IN THE GULF COUNTRIES

8.1 Overview: leading local companies and foreign players

Total office furniture sales in a sample of leading companies. US$ million and percentages

9. PRODUCTS, DISTRIBUTION AND PRICES

9.1 Product segments

Office seating, Operative desking, Executive furniture, Storage filing and cabinets, Wall to wall units/Partitions, Furniture for communal areas

9.2 Projects and distribution channels

Leading contracting companies.

12. ANNEX

12.1 Trade fairs and main magazines

12.2 List of useful contacts

This NEW report, The office furniture market in the Gulf countries provides market trends and updated data on the office furniture production, consumption, import and exports in 6 countries of the Gulf Region.

Office furniture sales are broken down by segment (office seating, operative desks, executive furniture, storage, communal areas) and by distribution channels (direct sales, furniture dealers, contractors and architects).

Office furniture imports and exports are broken down by country and geographical area of origin/destination.

Forecasts 2015 and 2016 of office furniture consumption are available.

The report gives figures on sales and estimates on market shares for approximately 100 sector companies operating in the region and also includes short profiles of leading manufacturers (local and international).

Market quantification is accompanied by a description of competition and a particular focus on distribution and how international players operate on the market.

An analysis of the furniture market includes: Demand Drivers (macroeconomic indicators, population GDP, and details on the potential market in the contract sector).

Countries considered: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates

Annex provides addresses of about 100 leading office companies and a list of selected trade press as well as a list of sector fair.

Gulf Countries. Office furniture market. Market positioning

The office furniture market in the Gulf Countries is worth about US$ 1,054 million. Manufacturing activities in the region are still limited (Saudi Arabia is an exception) and imported items claim the largest market share.

The largest markets in terms of office furniture consumption are Saudi Arabia, UAE and Qatar.

According to CSIL estimates, office furniture consumption across the whole region increased on average by 2.3% in 2014 and performances are expected to improve in 2015 and 2016.

Abstract of Table of Contents

0 METHODOLOGY

1. OFFICE FURNITURE MARKET: OUTLOOK

1.1 Market overview of the Gulf countries

Basic data: Furniture production, consumption, imports and exports, US$ million

Gulf Countries. Real growth in office furniture consumption. Forecasts 2015 and 2016. % change

Gulf Countries. Office furniture. Market positioning: largest markets in terms of office furniture consumption , highest per capita office consumption and fastest growing markets

Gulf Countries. Commercial supply in the largest marketplaces in 2014. Thousand square metres

Top 100 private projects in the Gulf Region. % shares of total project values

For each of the considered country: BAHRAIN, KUWAIT, OMAN, QATAR, SAUDI ARABIA, UNITED ARAB EMIRATES

2.1 Office furniture market: basic data

Furniture production, consumption, imports and exports, US$ million

Office furniture consumption. Forecasts 2015 and 2016. % change in real terms

2.2 International trade

2.3 Demand drivers and macroeconomic indicators

8. COMPETITIVE SYSTEM IN THE GULF COUNTRIES

8.1 Overview: leading local companies and foreign players

Total office furniture sales in a sample of leading companies. US$ million and percentages

9. PRODUCTS, DISTRIBUTION AND PRICES

9.1 Product segments

Office seating, Operative desking, Executive furniture, Storage filing and cabinets, Wall to wall units/Partitions, Furniture for communal areas

9.2 Projects and distribution channels

Leading contracting companies.

12. ANNEX

12.1 Trade fairs and main magazines

12.2 List of useful contacts

SEE ALSO

The world office furniture industry

December 2023, XII Ed. , 442 pages

A comprehensive picture of the global office furniture sector with production, consumption imports, and export data for the time series 2014-2023, international trade, market forecasts for the years 2024 and 2025, profiles of the leading office furniture manufacturers, and summary tables for 60 countries. Focus on the Top 20 office furniture countries.

The world market for Height Adjustable Tables

November 2023, I Ed. , 80 pages

A comprehensive analysis of the Height Adjustable Tables (HAT) market, delving into key players (manufacturers and suppliers), trends, and market forecasts by major world areas and relevant regions, focusing on product destinations.

The world market for office seating

November 2023, II Ed. , 162 pages

A comprehensive report analysing key statistics of the global office seating industry, including production, consumption, and international trade for the 2018-2023 time series, office seating market forecasts for 2024 and 2025, the leading companies, a range of products and their features, with a focus on three world regions (North America, Europe, and Asia-Pacific) and key countries.

The office furniture market in North America. The United States, Canada, and Mexico

July 2023, VII Ed. , 129 pages

Analysis of the office furniture industry in North America with a focus on the USA, Canada and Mexico. Value of office furniture market, market forecasts, figures by country, market share of leading companies, distribution channels

The European market for office furniture

June 2023, XXXV Ed. , 281 pages

An extensive analysis of the office furniture sector in Europe, with historical data on key indicators, and demand prospects, delving into the performance of the leading manufacturers, the product categories, and the distribution.