December 2023,

XII Ed. ,

442 pages

Price (single user license):

EUR 2900 / USD 3103

For multiple/corporate license prices please contact us

Language: English

Report code: W22

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

CSIL market research report The world office furniture industry offers a comprehensive picture of the global office furniture sector, providing basic data for production, consumption imports and exports for the time series 2014-2023, international trade and major trading partners, world tables and economic indicators, market prospects up to 2025, summary tables for the 60 most important countries for office furniture production, consumption and trade, profiles of the leading office furniture manufacturers on a global level and a focus on the Top 20 office furniture countries.

An Executive summary introduces the report, providing an overview of the office furniture sector worldwide: the sector at a glance, the largest markets, international trade analysis, the competitive landscape, market prospects, product trends, sustainability, omnichannel retail and e-commerce, prices, and factors affecting the sector.

Part I reviews the world office furniture industry: the major producing and consuming countries, the status and prospects of world trade of office furniture, world trade matrix, current data, and CSIL forecasts for growth in office furniture demand in 2024-2025, by country and by regional groupings.

Part II provides office furniture economic indicators: An overview of the world office furniture industry (Production and exports, and Consumption and Imports); the opening of office furniture markets (growth of imports and exports, origin and destination of office furniture)

Part III analyses more in-depth the Top 20 countries for the office furniture industry: Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Malaysia, Netherlands, Poland, South Korea, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States, Vietnam

For each country:

- Office furniture production, apparent consumption, exports, imports for the years 2014-2023 and forecasts of yearly changes in office furniture consumption in 2024 and 2025.

- Information on breakdown of production by segment (office seating/office furniture excluding seating)

- Major trading partners (countries of origin of imports and destination of exports of office furniture).

- Socio-economic indicators, including population forecasts, resident population in main cities, projected growth, and the unemployment rate.

- Major office furniture manufacturers by turnover (over 400 companies in total) with short profiles of the main ones (Company name, Headquarters/Main Location, Phone number, Website, Activity, Product portfolio, Office furniture production % on total revenues, Total Turnover range, Employees range, Export share on total turnover).

Part IV includes profiles of 45 selected major office furniture manufacturers with Company information (headquarters, website and general email address, activity, product portfolio, and specialization); Controlled companies, subsidiaries, and other related companies; Manufacturing plants location; Products, sales breakdown, and distribution; Financial performance (total revenues and employees).

PART V provides summary office furniture market tables for the 60 countries covered by the report: Argentina, Australia, Austria, Bahrain, Belgium, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, India, Indonesia, Ireland, Italy, Japan, Kuwait, Latvia, Lithuania, Malaysia, Malta, Mexico, Morocco, Netherlands, Norway, Oman, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan (China), Thailand, Türkiye, Ukraine, United Arab Emirates, United Kingdom, United States, Vietnam.

Contents for each country table:

- The office furniture sector: a ten-year series of values data on production, imports, exports, consumption

- Opening of the office furniture sector to foreign trade: import penetration and export ratios for office furniture

- Economic indicators

- Real growth of office furniture consumption: 2024 and 2025 Forecasts

- Main office furniture trading partners

Selected companies

Among the considered companies: Ahrend, Fursys, Herman Miller, HNI, Itoki, Kinnarps, Knoll, Kokuyo, Okamura, Schiavello, Sedus, Senator, Steelcase, Sunon, Teknion, UE Furniture, Vitra.

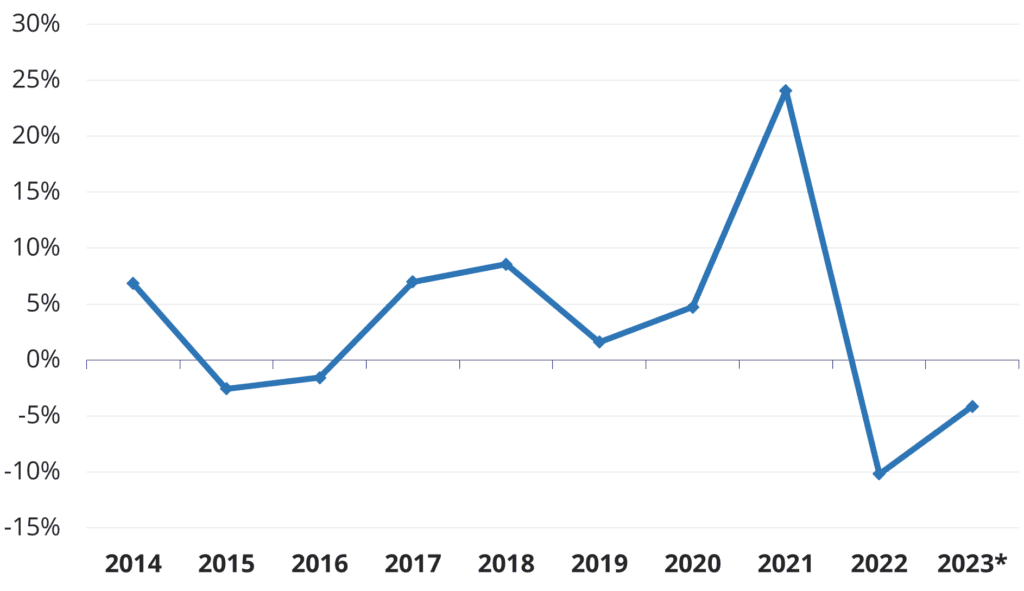

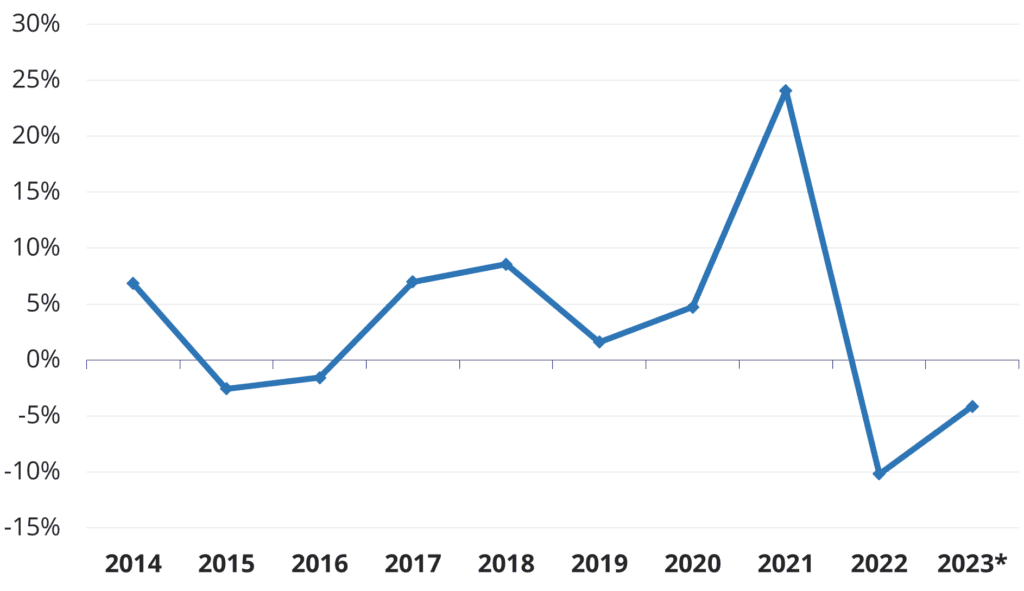

World office furniture trade, 2014-2023. Annual percentage changes

The world market for office furniture presently amounts to approximately US$ 49 billion. About 80% of this segment’s consumption takes place in ten major countries, the top ones are the United States, China, Japan, India, and Germany.

The office furniture sector is undergoing a huge transformation. On the production side, there is an increasing accent on sustainability in terms of long-life design, circular models, and rental. From the point of view of competition, the trend toward regional concentration and the identification of new product segments and target distribution channels continues.

Following the challenges of recent years, the world office furniture market is forecasted by CSIL for a slight recovery in 2024 and it is expected to strengthen in 2025 with different performance and pace across markets and regions worldwide.

Abstract of Table of Contents

INTRODUCTION

Aim of the study and structure

EXECUTIVE SUMMARY

Office furniture sector’s basic data, main features and trends of the sector

PART I – THE WORLD OFFICE FURNITURE INDUSTRY

1. The world maket for office furniture 2014-2023

Overview of world consumption of office furniture, the largest markets and office furniture imports

2. World production of office furniture

Overview of world production of office furniture, the major producing countries and office furniture exports

3. Office furniture: world market outlook

The world trade matrix for office furniture: imports/consumption and exports/production ratios for selected countries

Office furniture industry prospects: international trade and outlook of office furniture consumption in 60 countries

PART II – OFFICE FURNITURE INDICATORS

-World office furniture industry- Production and Exports / Consumption and Imports

-The opening of office furniture markets

-Destination of exports and origin of imports

-Office furniture consumption: 2024-2025 forecasts

PART III – TOP 20 COUNTRIES FOR THE OFFICE FURNITURE INDUSTRY WORLDWIDE

For each country (Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Malaysia, Netherlands, Poland, South Korea, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States, Vietnam)

-Office furniture production, apparent consumption, exports, imports 2014-2023, and consumption forecasts 2024 and 2025.

-Information on breakdown of production by segment (office seating/office furniture excluding seating)

-Major trading partners (countries of origin of imports and destination of exports of office furniture)

-Socio-economic indicators

-Major office furniture manufacturers by turnover

PART IV: DETAILED PROFILES OF THE TOP OFFICE FURNITURE MANUFACTURERS

PART V: COUNTRY TABLES

For the 60 countries covered by the report (Argentina, Australia, Austria, Bahrain, Belgium, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, India, Indonesia, Ireland, Italy, Japan, Kuwait, Latvia, Lithuania, Malaysia, Malta, Mexico, Morocco, Netherlands, Norway, Oman, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan (China), Thailand, Türkiye, Ukraine, United Arab Emirates, United Kingdom, United States, Vietnam.)

-The office furniture sector in values

-Opening of the office furniture sector to foreign trade

-Economic indicators

-Real growth of office furniture consumption. Forecasts

-Exchange rates

-Main office furniture trading partners

APPENDIX

Notes, presentation conventions, classification of countries

CSIL market research report The world office furniture industry offers a comprehensive picture of the global office furniture sector, providing basic data for production, consumption imports and exports for the time series 2014-2023, international trade and major trading partners, world tables and economic indicators, market prospects up to 2025, summary tables for the 60 most important countries for office furniture production, consumption and trade, profiles of the leading office furniture manufacturers on a global level and a focus on the Top 20 office furniture countries.

An Executive summary introduces the report, providing an overview of the office furniture sector worldwide: the sector at a glance, the largest markets, international trade analysis, the competitive landscape, market prospects, product trends, sustainability, omnichannel retail and e-commerce, prices, and factors affecting the sector.

Part I reviews the world office furniture industry: the major producing and consuming countries, the status and prospects of world trade of office furniture, world trade matrix, current data, and CSIL forecasts for growth in office furniture demand in 2024-2025, by country and by regional groupings.

Part II provides office furniture economic indicators: An overview of the world office furniture industry (Production and exports, and Consumption and Imports); the opening of office furniture markets (growth of imports and exports, origin and destination of office furniture)

Part III analyses more in-depth the Top 20 countries for the office furniture industry: Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Malaysia, Netherlands, Poland, South Korea, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States, Vietnam

For each country:

- Office furniture production, apparent consumption, exports, imports for the years 2014-2023 and forecasts of yearly changes in office furniture consumption in 2024 and 2025.

- Information on breakdown of production by segment (office seating/office furniture excluding seating)

- Major trading partners (countries of origin of imports and destination of exports of office furniture).

- Socio-economic indicators, including population forecasts, resident population in main cities, projected growth, and the unemployment rate.

- Major office furniture manufacturers by turnover (over 400 companies in total) with short profiles of the main ones (Company name, Headquarters/Main Location, Phone number, Website, Activity, Product portfolio, Office furniture production % on total revenues, Total Turnover range, Employees range, Export share on total turnover).

Part IV includes profiles of 45 selected major office furniture manufacturers with Company information (headquarters, website and general email address, activity, product portfolio, and specialization); Controlled companies, subsidiaries, and other related companies; Manufacturing plants location; Products, sales breakdown, and distribution; Financial performance (total revenues and employees).

PART V provides summary office furniture market tables for the 60 countries covered by the report: Argentina, Australia, Austria, Bahrain, Belgium, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, India, Indonesia, Ireland, Italy, Japan, Kuwait, Latvia, Lithuania, Malaysia, Malta, Mexico, Morocco, Netherlands, Norway, Oman, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan (China), Thailand, Türkiye, Ukraine, United Arab Emirates, United Kingdom, United States, Vietnam.

Contents for each country table:

- The office furniture sector: a ten-year series of values data on production, imports, exports, consumption

- Opening of the office furniture sector to foreign trade: import penetration and export ratios for office furniture

- Economic indicators

- Real growth of office furniture consumption: 2024 and 2025 Forecasts

- Main office furniture trading partners

World office furniture trade, 2014-2023. Annual percentage changes

The world market for office furniture presently amounts to approximately US$ 49 billion. About 80% of this segment’s consumption takes place in ten major countries, the top ones are the United States, China, Japan, India, and Germany.

The office furniture sector is undergoing a huge transformation. On the production side, there is an increasing accent on sustainability in terms of long-life design, circular models, and rental. From the point of view of competition, the trend toward regional concentration and the identification of new product segments and target distribution channels continues.

Following the challenges of recent years, the world office furniture market is forecasted by CSIL for a slight recovery in 2024 and it is expected to strengthen in 2025 with different performance and pace across markets and regions worldwide.

Abstract of Table of Contents

INTRODUCTION

Aim of the study and structure

EXECUTIVE SUMMARY

Office furniture sector’s basic data, main features and trends of the sector

PART I – THE WORLD OFFICE FURNITURE INDUSTRY

1. The world maket for office furniture 2014-2023

Overview of world consumption of office furniture, the largest markets and office furniture imports

2. World production of office furniture

Overview of world production of office furniture, the major producing countries and office furniture exports

3. Office furniture: world market outlook

The world trade matrix for office furniture: imports/consumption and exports/production ratios for selected countries

Office furniture industry prospects: international trade and outlook of office furniture consumption in 60 countries

PART II – OFFICE FURNITURE INDICATORS

-World office furniture industry- Production and Exports / Consumption and Imports

-The opening of office furniture markets

-Destination of exports and origin of imports

-Office furniture consumption: 2024-2025 forecasts

PART III – TOP 20 COUNTRIES FOR THE OFFICE FURNITURE INDUSTRY WORLDWIDE

For each country (Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Malaysia, Netherlands, Poland, South Korea, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States, Vietnam)

-Office furniture production, apparent consumption, exports, imports 2014-2023, and consumption forecasts 2024 and 2025.

-Information on breakdown of production by segment (office seating/office furniture excluding seating)

-Major trading partners (countries of origin of imports and destination of exports of office furniture)

-Socio-economic indicators

-Major office furniture manufacturers by turnover

PART IV: DETAILED PROFILES OF THE TOP OFFICE FURNITURE MANUFACTURERS

PART V: COUNTRY TABLES

For the 60 countries covered by the report (Argentina, Australia, Austria, Bahrain, Belgium, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, India, Indonesia, Ireland, Italy, Japan, Kuwait, Latvia, Lithuania, Malaysia, Malta, Mexico, Morocco, Netherlands, Norway, Oman, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan (China), Thailand, Türkiye, Ukraine, United Arab Emirates, United Kingdom, United States, Vietnam.)

-The office furniture sector in values

-Opening of the office furniture sector to foreign trade

-Economic indicators

-Real growth of office furniture consumption. Forecasts

-Exchange rates

-Main office furniture trading partners

APPENDIX

Notes, presentation conventions, classification of countries

SEE ALSO

The world market for Height Adjustable Tables

November 2023, I Ed. , 80 pages

A comprehensive analysis of the Height Adjustable Tables (HAT) market, delving into key players (manufacturers and suppliers), trends, and market forecasts by major world areas and relevant regions, focusing on product destinations.

The world market for office seating

November 2023, II Ed. , 162 pages

A comprehensive report analysing key statistics of the global office seating industry, including production, consumption, and international trade for the 2018-2023 time series, office seating market forecasts for 2024 and 2025, the leading companies, a range of products and their features, with a focus on three world regions (North America, Europe, and Asia-Pacific) and key countries.

The office furniture market in North America. The United States, Canada, and Mexico

July 2023, VII Ed. , 129 pages

Analysis of the office furniture industry in North America with a focus on the USA, Canada and Mexico. Value of office furniture market, market forecasts, figures by country, market share of leading companies, distribution channels

The European market for office furniture

June 2023, XXXV Ed. , 281 pages

An extensive analysis of the office furniture sector in Europe, with historical data on key indicators, and demand prospects, delving into the performance of the leading manufacturers, the product categories, and the distribution.

Top 100 office furniture manufacturers in Europe

September 2022, I Ed. , 15 pages

Who are the top office furniture manufacturers in Europe? This study offers a bird’s-eye view of the European office furniture competitive system through the analysis of the leading 100 producers benchmarking their performance, their level of specialization, their relevance in the business, and the whole sector concentration.