July 2013,

II Ed. ,

200 pages

Price (single user license):

EUR 2000 / USD 2120

For multiple/corporate license prices please contact us

Language: English

Report code: W20

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

This Report provides an overview of the world hospitality furniture market, namely the world contract furniture market for hotels and resorts with a focus on the four and five star segments. After two years, it is the second CSIL Report on this Issue.

In detail, the report includes:

- Demand Drivers: Analysis of World Tourism Flows;

- Demand Analysis: Investigation of the number of new opened rooms in hotels and similar establishments and their renovation activities and identification of the top hotel chains in the world;

- Distribution system: Description of the purchasing process and of the main players involved;

- Supply Analysis: An overview of the Competitive System;

- Profile of the leading contractors;

- Profile of the top architects and interior design studios.

The Report is divided into four main geographical areas: Europe, Middle East, Asia and the Americas, with focus on some of the main countries for each Region.

For each area the medium-high segment has been analysed, paying attention mainly to four and five star hotels, considering the companies that can provide turnkey projects or can offer additional services, not merely the supply of single items.

Attention is given in highlighting the specific features of hundreds of key players of the hospitality sector, such as major architects and interior design studios, the major hotel chains and some of the major contractors.

This Report is the result of an in-deep methodology:

- Processing of macroeconomic data and home furniture sector statistics from CSIL’s databases;

- Around 100 interviews carried out specifically for this report.;

- Analysis of the available documentation referring to contract furnishings (regulations, tenders and ongoing projects);

- Study of the existing statistics on tourism flows from the United Nations World Tourism Organization (UNWTO) and the World Travel and Tourism Council (WTTC);

- Analysis of the national statistics on the number of hotels and similar establishments (Eurostat, ISTAT, ISEE, etc.);

- Sector magazines and company websites;

- Analysis of non-confidential documents already in the CSIL database (reports on the contract market in Europe and China, reports on complementary sectors in Saudi Arabia, UAE, Brazil, etc);

- CSIL processing of statistical data including all the available information sources in this field.

Value data are given for the following references:

- Furnishings of hotel rooms (excluding common parts). When possible the value include……(furniture, lighting, curtains and other furnishings);

- Furnishings of hotel rooms (including common parts). Same product mix as above;

- Turn-key hotel rooms (excluding common parts). It includes above mentioned furnishings plus fixed items (marble, glass, doors, etc.);

- Turn-key hotel rooms (including common parts). Same product mix as above.

It is worth mentioning that the term contract is used whenever the simple provision of furnishings, under the contracting formula (responsibility for all the work involved in a specific job order), is accompanied by a series of collateral services, such as support for designing spaces, and finding and coordinating sub-contractors for the completion of the furnishings. The overall market value for the hospitality furniture sector includes bedroom, mattresses, bathroom furniture, living room, marble, glass, windows, doors, textiles, lighting, mobile partition walls.

Selected companies

B&B, Bentley Design, Choice Hotels International, Consonni International, Depa International, Doimo Group, EE Smith, Foshan Richang, Frank Nicholson, Gainwell, Greenline Interiors, Havelock Europa, HBA/Hirsch Bedner Associates, Hilton Worldwide, Huabo Furniture, Intercontinental Hotel Group (IHG), Interna Contract spa, Marriott International, Maxsun, MobilProject, Molteni, Pierre-Yves Rochon , Poliform, Poltrona Frau Group, Richmond International, Rockwell Architecture, Santarossa, Saporiti, Selva AG SpA, Senyuan, Voeglauer, Wyndham Hotel Group

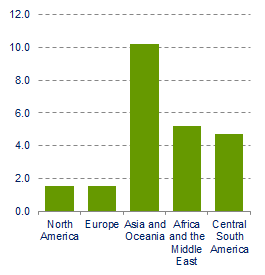

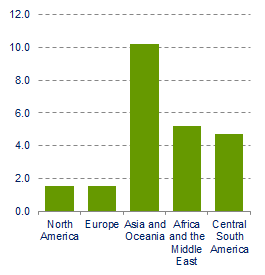

Hotel rooms worldwide. Growth by geographical area, 2012/2009. Percentages

Worldwide Hospitality market is estimated by CSIL at over USD 27.1 billion at end-user prices for the year 2012. The North American hospitality market is the biggest accounting for around 40% of the total, followed by Europe with 26% and Asia/Oceania accounting for 24%.In MENA countries the hospitality market is estimated to be worth approximately USD 2 billion, whereas the market in Central/South America, mainly driven by Brazil, accounts for around 3% of the world hospitality market.In 2012 roughly 353,000 new rooms have been furnished and 573,000 rooms have been renovated, for a total of about 926,000 rooms. Asian countries have currently the largest pipeline in the world, with 380,902 new rooms in construction.Average EBITDA among the European furniture manufacturers working in this field is around 8%. Market share for major players do not excess 2% when considering the worldwide market. It reaches 10%-15% when considering specific markets and specific products.

Abstract of Table of Contents

Introduction

Working tools

Market size and segmentation

1.1 Basic data

- Number of existing hotel rooms worldwide, 2000, 2009 and 2012

- World. Hospitality market: size and segmentation, 2012. Units and USD million

1.2 Activity trend - Tourist arrivals, number of rooms, company revenues, contract furniture consumption

- Consumption of contract furniture by main countries

1.3 The competitive system worldwide

1.4 Leading hotel groups

1.4 Tourist arrivals

Europe

Market overview

Reference prices

Purchasing process

For the following groups of countries: Germany, Austria, Switzerland and Scandinavian countries; Belgium, France, Netherlands, United Kingdom; Italy, Spain, Portugal and Turkey

Driving forces

Appendix 1 List of the top 150 hotel chains

Appendix 2: List of the leading Architecture and Design studios

Appendix 3: List of leading hotel contractors: both general contractors and furniture manufacturers acting as project leaders

This Report provides an overview of the world hospitality furniture market, namely the world contract furniture market for hotels and resorts with a focus on the four and five star segments. After two years, it is the second CSIL Report on this Issue.

In detail, the report includes:

- Demand Drivers: Analysis of World Tourism Flows;

- Demand Analysis: Investigation of the number of new opened rooms in hotels and similar establishments and their renovation activities and identification of the top hotel chains in the world;

- Distribution system: Description of the purchasing process and of the main players involved;

- Supply Analysis: An overview of the Competitive System;

- Profile of the leading contractors;

- Profile of the top architects and interior design studios.

The Report is divided into four main geographical areas: Europe, Middle East, Asia and the Americas, with focus on some of the main countries for each Region.

For each area the medium-high segment has been analysed, paying attention mainly to four and five star hotels, considering the companies that can provide turnkey projects or can offer additional services, not merely the supply of single items.

Attention is given in highlighting the specific features of hundreds of key players of the hospitality sector, such as major architects and interior design studios, the major hotel chains and some of the major contractors.

This Report is the result of an in-deep methodology:

- Processing of macroeconomic data and home furniture sector statistics from CSIL’s databases;

- Around 100 interviews carried out specifically for this report.;

- Analysis of the available documentation referring to contract furnishings (regulations, tenders and ongoing projects);

- Study of the existing statistics on tourism flows from the United Nations World Tourism Organization (UNWTO) and the World Travel and Tourism Council (WTTC);

- Analysis of the national statistics on the number of hotels and similar establishments (Eurostat, ISTAT, ISEE, etc.);

- Sector magazines and company websites;

- Analysis of non-confidential documents already in the CSIL database (reports on the contract market in Europe and China, reports on complementary sectors in Saudi Arabia, UAE, Brazil, etc);

- CSIL processing of statistical data including all the available information sources in this field.

Value data are given for the following references:

- Furnishings of hotel rooms (excluding common parts). When possible the value include……(furniture, lighting, curtains and other furnishings);

- Furnishings of hotel rooms (including common parts). Same product mix as above;

- Turn-key hotel rooms (excluding common parts). It includes above mentioned furnishings plus fixed items (marble, glass, doors, etc.);

- Turn-key hotel rooms (including common parts). Same product mix as above.

It is worth mentioning that the term contract is used whenever the simple provision of furnishings, under the contracting formula (responsibility for all the work involved in a specific job order), is accompanied by a series of collateral services, such as support for designing spaces, and finding and coordinating sub-contractors for the completion of the furnishings. The overall market value for the hospitality furniture sector includes bedroom, mattresses, bathroom furniture, living room, marble, glass, windows, doors, textiles, lighting, mobile partition walls.

Hotel rooms worldwide. Growth by geographical area, 2012/2009. Percentages

Worldwide Hospitality market is estimated by CSIL at over USD 27.1 billion at end-user prices for the year 2012. The North American hospitality market is the biggest accounting for around 40% of the total, followed by Europe with 26% and Asia/Oceania accounting for 24%.In MENA countries the hospitality market is estimated to be worth approximately USD 2 billion, whereas the market in Central/South America, mainly driven by Brazil, accounts for around 3% of the world hospitality market.In 2012 roughly 353,000 new rooms have been furnished and 573,000 rooms have been renovated, for a total of about 926,000 rooms. Asian countries have currently the largest pipeline in the world, with 380,902 new rooms in construction.Average EBITDA among the European furniture manufacturers working in this field is around 8%. Market share for major players do not excess 2% when considering the worldwide market. It reaches 10%-15% when considering specific markets and specific products.

Abstract of Table of Contents

Introduction

Working tools

Market size and segmentation

1.1 Basic data

- Number of existing hotel rooms worldwide, 2000, 2009 and 2012

- World. Hospitality market: size and segmentation, 2012. Units and USD million

1.2 Activity trend - Tourist arrivals, number of rooms, company revenues, contract furniture consumption

- Consumption of contract furniture by main countries

1.3 The competitive system worldwide

1.4 Leading hotel groups

1.4 Tourist arrivals

Europe

Market overview

Reference prices

Purchasing process

For the following groups of countries: Germany, Austria, Switzerland and Scandinavian countries; Belgium, France, Netherlands, United Kingdom; Italy, Spain, Portugal and Turkey

Driving forces

Appendix 1 List of the top 150 hotel chains

Appendix 2: List of the leading Architecture and Design studios

Appendix 3: List of leading hotel contractors: both general contractors and furniture manufacturers acting as project leaders

SEE ALSO

The contract furniture and furnishings market in Europe

March 2023, IX Ed. , 208 pages

A detailed analysis of the European contract furniture business providing market size, production, market development, consumption forecasts, demand drivers, projects, sales, and market shares of the leading players, sales by destination segment –with a special focus on furniture for Education– and by product category.

The world high-end furniture market

June 2022, IV Ed. , 194 pages

A comprehensive picture of the world market for high-end furniture, providing market size, forecasts, distribution channels and retailers, market features, barriers, purchasing trends and short profiles of the leading world high-end furniture brands.

Windows and doors: world market outlook

October 2013, I Ed. , 133 pages

This new market research contains current and historical data (production, consumption, imports, exports) and analysis of Window and Door industry for a total of 70 countries

The Italian market for windows and glass surfaces

March 2013, II Ed. , 74 pages

This study provides data on the production and consumption of windows, French windows and glass covered surfaces on the Italian market. It is the result of roughly 100 direct interviews with representative firms

The Chinese contract market

January 2013, I Ed. , 85 pages

The Report is the result of 200 interviews with key players (Contract Furniture Manufacturers, Design Studios and Builders, Hotel Chains and other relevant Clients) and two years of CSIL research in China, on contract-related topics. Figures and analysis are described from two different point of views: end user sectors and main products.