June 2011,

I Ed. ,

63 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: S.62

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The first edition of the report Furniture Distribution in Russia offers an accurate comprehensive picture of the Russian furniture market, providing 2000-2010 trends and forecasts 2011 and 2012 for furniture consumption. Statistics of furniture production, imports and exports are also provided. The furniture market is broken down by product segment and price ranges for the year 2010. Distribution channels, Mark up and Reference Prices of the Russian furniture market are further considered both for domestically produced furniture and imported items.

The research includes also a Sector Analysis providing basic data on production, consumption, exports, imports and top companies of the following segment: Kitchen furniture, Bedroom furniture, Upholstered furniture, Office furniture and Hospitality furniture.

The analysis of furniture distribution channels includes furniture specialist distributors, non specialist distributors and contract projects and covers: Owned stores, Franchising, Monobrand, Furniture chains, Furniture supermarkets and DIY.

Around 60 short profiles of the main distributors, both for domestic and imported furniture operating on the Russian furniture market are also available with contact details, product portfolio and brands.

The analysis of the Russian furniture market includes: Demand Drivers (macroeconomic indicators, population distribution and construction market) and of the latest Product Trends among Russian consumers.

Among the considered products: Living and dining furniture, Upholstery, Bedrooms, Home tables and chairs, Kitchen furniture, Other occasional furniture, Bathroom furniture, Office furniture, Other non residential furniture and Hotel furniture.

Selected companies

Kukhni Maria, 8 Marta, Stilnye Kukhni, Dyatkovo, Shatura Mebel, Tsvet Divanov, Stolplit, Atma Group, Red Italy, Mir Group, A.R. Impex, Galerie Neuhaus, Mir Nemetskoi Mebeli, Imperia Mebeli Ametist (Ima), French House

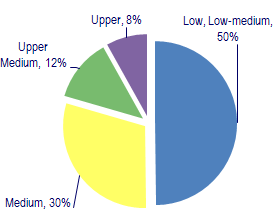

Furniture consumption by market range. 2010. % values

According to CSIL estimates, the upper market segment account isfor US$ 500 million at prodution prices and becomes three times higher at retail prices. The segment is mainly satisfied by imported items.

Abstract of Table of Contents

Introduction

- Furniture market outline, 2000-2010

1. The Russian Furniture Market

Recent developments (200-2010) and Future Trends (2011-2012)

2. Demand Determinants

Population

- Urban population by Federal District

- Population in major Russian cities, 2000-2025

Disposable income

- Inflation, 2000-2010. % values

- GDP and household final consumption growth, 2000-2009. % (constant prices)

Building activity

3. Furniture Imports

Imports of furniture by country and by geographical area, 2005-2010

Distribution channels for imported furniture

Imports logistic

Trade margins for imported furniture

4. Domestic Furniture Production

Furniture production trend

- Furniture production for the domestic and foreign markets. 2000-2010. US$ million

Distribution channels for domestically produced furniture

5. Furniture Consumption

Consumption by market range

Price trends

Consumption by product segment

Upholstered furniture

Kitchen furniture

Other household furniture

Office and contract furniture market

6. Selected Retailers Of Russian Furniture

7. Selected Importers, Retailers And Agencies Of Imported Furniture

8. Sector Fairs, Trade Press, Associations

The first edition of the report Furniture Distribution in Russia offers an accurate comprehensive picture of the Russian furniture market, providing 2000-2010 trends and forecasts 2011 and 2012 for furniture consumption. Statistics of furniture production, imports and exports are also provided. The furniture market is broken down by product segment and price ranges for the year 2010. Distribution channels, Mark up and Reference Prices of the Russian furniture market are further considered both for domestically produced furniture and imported items.

The research includes also a Sector Analysis providing basic data on production, consumption, exports, imports and top companies of the following segment: Kitchen furniture, Bedroom furniture, Upholstered furniture, Office furniture and Hospitality furniture.

The analysis of furniture distribution channels includes furniture specialist distributors, non specialist distributors and contract projects and covers: Owned stores, Franchising, Monobrand, Furniture chains, Furniture supermarkets and DIY.

Around 60 short profiles of the main distributors, both for domestic and imported furniture operating on the Russian furniture market are also available with contact details, product portfolio and brands.

The analysis of the Russian furniture market includes: Demand Drivers (macroeconomic indicators, population distribution and construction market) and of the latest Product Trends among Russian consumers.

Among the considered products: Living and dining furniture, Upholstery, Bedrooms, Home tables and chairs, Kitchen furniture, Other occasional furniture, Bathroom furniture, Office furniture, Other non residential furniture and Hotel furniture.

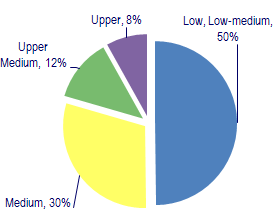

Furniture consumption by market range. 2010. % values

According to CSIL estimates, the upper market segment account isfor US$ 500 million at prodution prices and becomes three times higher at retail prices. The segment is mainly satisfied by imported items.

Abstract of Table of Contents

Introduction

- Furniture market outline, 2000-2010

1. The Russian Furniture Market

Recent developments (200-2010) and Future Trends (2011-2012)

2. Demand Determinants

Population

- Urban population by Federal District

- Population in major Russian cities, 2000-2025

Disposable income

- Inflation, 2000-2010. % values

- GDP and household final consumption growth, 2000-2009. % (constant prices)

Building activity

3. Furniture Imports

Imports of furniture by country and by geographical area, 2005-2010

Distribution channels for imported furniture

Imports logistic

Trade margins for imported furniture

4. Domestic Furniture Production

Furniture production trend

- Furniture production for the domestic and foreign markets. 2000-2010. US$ million

Distribution channels for domestically produced furniture

5. Furniture Consumption

Consumption by market range

Price trends

Consumption by product segment

Upholstered furniture

Kitchen furniture

Other household furniture

Office and contract furniture market

6. Selected Retailers Of Russian Furniture

7. Selected Importers, Retailers And Agencies Of Imported Furniture

8. Sector Fairs, Trade Press, Associations

SEE ALSO

Furniture retailing in Europe

February 2024, XVII Ed. , 296 pages

Comparative analysis of the home furniture retailing industry in 15 European countries, with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers in Europe

Top 100 mattress specialist retailers in Europe

November 2023, I Ed. , 14 pages

A bird’s eye view of players in the European mattress market with a ranking of the 100 leading mattress specialist retailers in Europe.

E-commerce in the mattress industry

September 2023, V Ed. , 102 pages

Detailed analysis of the global e-commerce mattress markets with a focus on North America, Europe, and the Asia Pacific. Features of the online mattress business, the current incidence of online mattress sales by geographical areas and in key countries, the major markets, e-commerce mattress sales of the leading retailers by area, and company profiles of top players operating in the online mattress sector.

La distribuzione del mobile in Italia. Analisi per provincia (Italian)

July 2023, XX Ed. , 174 pages

This report provides a detailed picture of the Italian furniture market and retailing, for the whole national market and by province, providing the size and development of the home furniture market and its segments, market shares and development of distribution channels, estimated home furniture sales for key retailers, in-depth analysis of both large retail chains and independent retailers, companies’ strategies and trends

Top 100 furniture retailers in Europe

November 2022, I Ed. , 15 pages

Analysis of the European Furniture retail competitive landscape: ranking of the 100 leading retailers, with company name, group, headquarter location, website, brands, estimated home furniture turnover, and number of stores.