February 2015,

II Ed. ,

59 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: EU04UK

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The first edition of the report The kitchen furniture market in the United Kingdom offers an accurate comprehensive picture of the kitchen furniture industry, providing 2009-2014 trends in kitchen furniture production and consumption, imports and exports. Value and weight of built-in appliances on kitchen furniture supply is also considered.

A financial analysis provides the main profitability ratios, number of employees and turnover per employee of a sample of companies in the market.

The Supply structure breaks production down to lifestyle groups, cabinet door materials (solid wood, veneer, laminated, decorative papers, thermoplastic foils, lacquered, melamine/paper, aluminum, glass) and worktop materials (solid surface materials, engineered and natural stone, laminated, tiles, steel, wood, glass).

Distribution channels, from building, to kitchen specialist, furniture and home improvement (DIY) chains, down to single flagship stores, offers shares in volume and value, as well as discussing the major players within them.

Ultimately, the chapter on the competitive system analyses kitchen furniture sales of the top 50 kitchen manufacturers active in the UK market, both on the general level and segmenting the market (luxury, upper, upper-middle, middle, middle-low, low-end). Shares and numbers for each segment are included, as well as short profiles of approximately 30 main players in the kitchen furniture industry.

Addresses and full contacts of around 120 kitchen furniture manufacturers active in the UK are also included.

Among the considered products: kitchen furniture, solid wood kitchens, veneer kitchens, laminated kitchens, thermoplastic foils, lacquered kitchens, melamine kitchens, aluminum kitchens, classic kitchens, country kitchens, modern kitchens, design kitchens, luxury kitchens, upper range kitchens, middle-upper range kitchens, middle range kitchens, low range kitchens, cabinet doors, worktops, kitchens with built-in appliances, kitchens without built-in appliances, built-in appliances.

Selected companies

Alno Group, Avanti Kitchens, Ballerina Küchen, Ballingslöv International Group, Boffi, Bulthaup, Canburg, Commodore Kitchens, Crown Imperial, Eggersmann, Fournier, Häcker Küchen, Howdens Joinery, Ikea Europe, J&J Ormerod, John Lewis of Hungerford, Leicht Küchen, Manor Cabinet, Mereway, Moores Furniture Group, Nobia Group, Nobilia, Omega International, The Premiere Kitchen Company, Richmond Cabinet Company, Rixonway Kitchens, Sigma 3, Snaidero Group, Symphony Group, System six Kitchen

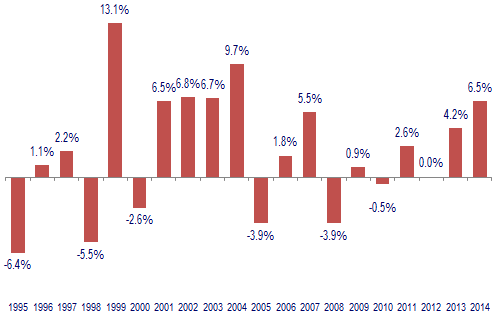

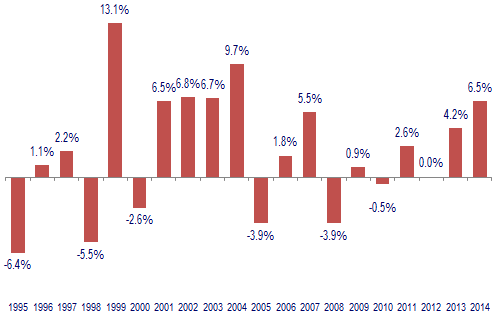

UK. 20 years of kitchen furniture consumption trends, 1995-2014, % change

In 2014, consumption in the UK kitchen market increased by 6.5% in GBP, while production rose by an even larger 7.9%. This rises were even stronger than the ones of 2013 (4.2% and 5%, respectively), suggesting that the UK market is entering an upward phase after several years of fluctuating performances.

On the contrary, both export and imports fell during the year, suggesting that British kitchen manufacturer are becoming more competitive relatively to their European competition than just a few years ago, especially in higher market segments.

Overall, kitchen consumption increased by a yearly average of 2.6% between 2010 and 2014, and is expected to strengthen further in the near future.

Top 3 market players account for almost 60% of the entire market, while, in terms of kitchen value, the middle segment accounts for a third of it, and approximately another third is given by higher-end ranges, which are consistently rising in recent years.

Abstract of Table of Contents

1 Introduction

2 Basic Data and Activity Trend

- Kitchen furniture value, at factory and market prices, 2014

- Kitchen furniture production, export, import and consumption (values volumes and % changes), 2009-2014

- 20 years of kitchen furniture consumption in the UK, 1995-2014, GBP, % change

2 International Trade

- Kitchen furniture exports and imports

- Imports/exports of kitchen furniture by origin/destination (country and geographical area), 2008-2013

- Exports and imports of kitchen furniture by Top 10 countries of destination and origin, 2014

- Export and import indexes (2008-2013)

- Built-in appliances exports and imports (volumes and values), 2008-2013

- Total exports and imports of built-in appliances, 2014. Annual % changes

3 Financial Analysis

- Turnover, Average and median ROA, ROE and EBTIDA, 2009 – 2013 of 19 UK companies

- Employment trend in a sample of kitchen furniture manufacturers, 2009-13 and average turnover per employee

4 Supply Structure

- Breakdown of the kitchen furniture market by lifestyle groups, 2004 and 2014

- Breakdown of supply by cabinet door and worktop material

5 Distribution Channels

- Breakdown of kitchen furniture sales by distribution channel, 2014 (volumes and values)

6 The Competitive System

- Top 50 competitors in the UK kitchen market, revenues and market shares

- Top 10 kitchen manufacturers in 2004 and 2014: sales at factory prices and shares

- Value and volume of the kitchen furniture market by segments, 2014

- Top 10 kitchen manufacturers in the luxury segment, 2014. Sales at factory prices (current GBP million) and shares (%)

- Top 20 kitchen manufacturers in the upper/upper-middle/middle/middle-low/low segments, 2014. Sales at factory prices (current GBP million) and shares (%)

7 Demand Drivers

- Population change, UK countries and regions of England

- Residential population in main cities

- Country indicators, GDP per capita and disposable income per capita

- Annual household expenditure by UK Countries and regions

- Breakdown of annual household consumption in housing expenditure and home improvement

- Share of home improvements expenditure on total housing expenditure

- Distribution of population by dwelling type, 2009-13 % share

- Thousand SQM of usable floor area in building permits, variations 2009-13

Annex. Directory of Companies Active in the UK Market

- List of addresses and contacts

The first edition of the report The kitchen furniture market in the United Kingdom offers an accurate comprehensive picture of the kitchen furniture industry, providing 2009-2014 trends in kitchen furniture production and consumption, imports and exports. Value and weight of built-in appliances on kitchen furniture supply is also considered.

A financial analysis provides the main profitability ratios, number of employees and turnover per employee of a sample of companies in the market.

The Supply structure breaks production down to lifestyle groups, cabinet door materials (solid wood, veneer, laminated, decorative papers, thermoplastic foils, lacquered, melamine/paper, aluminum, glass) and worktop materials (solid surface materials, engineered and natural stone, laminated, tiles, steel, wood, glass).

Distribution channels, from building, to kitchen specialist, furniture and home improvement (DIY) chains, down to single flagship stores, offers shares in volume and value, as well as discussing the major players within them.

Ultimately, the chapter on the competitive system analyses kitchen furniture sales of the top 50 kitchen manufacturers active in the UK market, both on the general level and segmenting the market (luxury, upper, upper-middle, middle, middle-low, low-end). Shares and numbers for each segment are included, as well as short profiles of approximately 30 main players in the kitchen furniture industry.

Addresses and full contacts of around 120 kitchen furniture manufacturers active in the UK are also included.

Among the considered products: kitchen furniture, solid wood kitchens, veneer kitchens, laminated kitchens, thermoplastic foils, lacquered kitchens, melamine kitchens, aluminum kitchens, classic kitchens, country kitchens, modern kitchens, design kitchens, luxury kitchens, upper range kitchens, middle-upper range kitchens, middle range kitchens, low range kitchens, cabinet doors, worktops, kitchens with built-in appliances, kitchens without built-in appliances, built-in appliances.

UK. 20 years of kitchen furniture consumption trends, 1995-2014, % change

In 2014, consumption in the UK kitchen market increased by 6.5% in GBP, while production rose by an even larger 7.9%. This rises were even stronger than the ones of 2013 (4.2% and 5%, respectively), suggesting that the UK market is entering an upward phase after several years of fluctuating performances.

On the contrary, both export and imports fell during the year, suggesting that British kitchen manufacturer are becoming more competitive relatively to their European competition than just a few years ago, especially in higher market segments.

Overall, kitchen consumption increased by a yearly average of 2.6% between 2010 and 2014, and is expected to strengthen further in the near future.

Top 3 market players account for almost 60% of the entire market, while, in terms of kitchen value, the middle segment accounts for a third of it, and approximately another third is given by higher-end ranges, which are consistently rising in recent years.

Abstract of Table of Contents

1 Introduction

2 Basic Data and Activity Trend

- Kitchen furniture value, at factory and market prices, 2014

- Kitchen furniture production, export, import and consumption (values volumes and % changes), 2009-2014

- 20 years of kitchen furniture consumption in the UK, 1995-2014, GBP, % change

2 International Trade

- Kitchen furniture exports and imports

- Imports/exports of kitchen furniture by origin/destination (country and geographical area), 2008-2013

- Exports and imports of kitchen furniture by Top 10 countries of destination and origin, 2014

- Export and import indexes (2008-2013)

- Built-in appliances exports and imports (volumes and values), 2008-2013

- Total exports and imports of built-in appliances, 2014. Annual % changes

3 Financial Analysis

- Turnover, Average and median ROA, ROE and EBTIDA, 2009 – 2013 of 19 UK companies

- Employment trend in a sample of kitchen furniture manufacturers, 2009-13 and average turnover per employee

4 Supply Structure

- Breakdown of the kitchen furniture market by lifestyle groups, 2004 and 2014

- Breakdown of supply by cabinet door and worktop material

5 Distribution Channels

- Breakdown of kitchen furniture sales by distribution channel, 2014 (volumes and values)

6 The Competitive System

- Top 50 competitors in the UK kitchen market, revenues and market shares

- Top 10 kitchen manufacturers in 2004 and 2014: sales at factory prices and shares

- Value and volume of the kitchen furniture market by segments, 2014

- Top 10 kitchen manufacturers in the luxury segment, 2014. Sales at factory prices (current GBP million) and shares (%)

- Top 20 kitchen manufacturers in the upper/upper-middle/middle/middle-low/low segments, 2014. Sales at factory prices (current GBP million) and shares (%)

7 Demand Drivers

- Population change, UK countries and regions of England

- Residential population in main cities

- Country indicators, GDP per capita and disposable income per capita

- Annual household expenditure by UK Countries and regions

- Breakdown of annual household consumption in housing expenditure and home improvement

- Share of home improvements expenditure on total housing expenditure

- Distribution of population by dwelling type, 2009-13 % share

- Thousand SQM of usable floor area in building permits, variations 2009-13

Annex. Directory of Companies Active in the UK Market

- List of addresses and contacts

SEE ALSO

Il mercato italiano dei mobili per cucina (Italian)

April 2024, XLII Ed. , 95 pages

This study offers a comprehensive analysis of the kitchen furniture industry in Italy through production and consumption data, trade interchange, market shares of the major players in the industry by price range, sales location, distribution channels, profitability, types of integrated appliances sold, types and materials of cabinet doors and countertops, market trends and prospects.

Kitchen furniture: World market outlook

December 2023, XVIII Ed. , 185 pages

CSIL analyses 60 kitchen furniture markets with a rich collection of key country data, production and consumption both in value and units. Company profiles for 35 among the main kitchen furniture manufacturers worldwide

The European market for kitchen furniture

May 2023, XXXIII Ed. , 305 pages

In 2022, the European production (30 EU countries) of kitchen furniture amounts to around 7 million units manufactured, including around one million units of upper end kitchens.

The kitchen furniture market in the United States

March 2023, VIII Ed. , 112 pages

In-deep analysis of the kitchen furniture sector in the US, with trends and forecasts of production, consumption, imports and exports, leading players by geographical areas and price ranges (clustered in six price groups), marketing policies and distribution channels

The kitchen furniture market in China

March 2022, IX Ed. , 160 pages

The Report, now at its IX edition, offers an in-depth investigation of the kitchen market in China, with size and trends of production, consumption, international trade, as well as analysis of demand determinants and competitive system