April 2024,

XLII Ed. ,

95 pages

Price (single user license):

EUR 2000 / USD 2140

For multiple/corporate license prices please contact us

Language: Italian

Report code: IT05

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The CSIL Report “Il mercato italiano dei mobili per cucina” (in Italian language) now in its forty-second edition offers a comprehensive picture of the sector, providing trends and forecasts of production and consumption, imports and exports for the main countries of origin/destination, prices, distribution channels, policies for sustainability, sales data and market shares of the major players in the industry. The report also considers the impact of built-in appliances on the value of kitchen sales.

Kitchen production data are broken down by: cabinet door material (solid wood, veneer, laminate, ceramic, gres, thermoplastics, lacquer, melamine, aluminum, glass),cabinet door style (classic, rustic, basic, modern, design, hi-tech), cabinet door color (white, bright colors, neutral colors, wood-looking), lacquering of the cabinet door (glossy, matt), andtop material (synthetics, natural and engineered stone, quartz, laminate, ceramic slabs, steel, aluminum, wood, glass).

Also available are data on price trends factory prices of kitchen furniture, data on productive concentration and number of employees.

Key indicators of profitability, indicatorsrelated to capital and financial structure and indicatorsof productivity for a sample of enterprises are also presented.

The analysis of distribution of kitchens in Italy considers the following channels: direct/contract sales, specialized kitchen retailers, furniture stores, furniture chains, and department stores.

The Competitive system part analyses the presence of major Italian kitchen furniture manufacturing companies in the domestic market (as a whole and by geographic macro-areas) and in the foreign market.

Turnover and market share data, with brief company profiles, are provided for major Italian competitors for each price range (Low, Middle-low, Middle, Middle-upper, Upper-end, Luxury).

Also included is an address book of about 90 of Italy’s leading kitchen furniture manufacturers.

This research was prepared using the following tools:

-

- Direct interviews with a sample of more than 50 Italian manufacturers chosen on the basis of economic, geographic and size parameters, covering more than 80 percent of the total supply;

- Interviews with about 400 Italian kitchen furniture retailers;

- Company balance sheets of companies included in the sample but also of others not cooperating in the direct survey (about 100 companies in all);

- Official documentation regarding economic and industry data available for 2023 and 2024;

- Statistical data from ISTAT and Eurostat sources related to the trade interchange of kitchen furniture.

The object of the research is all furniture intended for kitchen furniture and all appliances sold in the market through this channel. The appliances considered are: sinks, hoods, built-in ovens, hobs, built-in refrigerators and dishwashers, and embedded lighting.

In the calculation of kitchens sold, in order not to alter statistical units and affect price reasoning, no account was taken of completions, nor of compositions of two to three modules and/or with measurements of less than one linear meter.

Selected companies

Aran, Arc Linea, Armony, Arredo 3, Arrital, Aster, Atma, Boffi, Cappellini, Cesar, Colombini, Copat Life, Cubo Design, Dada, Dibiesse Diesis, Doimo Cucine, Elmar, Effeti, Euromobil, Gentili, Gicinque, Ikea, Imab, L’Ottocento, Lago, Lineaquattro, Lube, Marinelli, Meson’s, Mittel, Modulnova, Mondo Convenienza, Nobilia, Pedini, Poliform, Sbabo, Scavolini, Snaidero, Stosa, Turi, Valcucine, Veneta Cucine, Zampieri, Zecchinon.

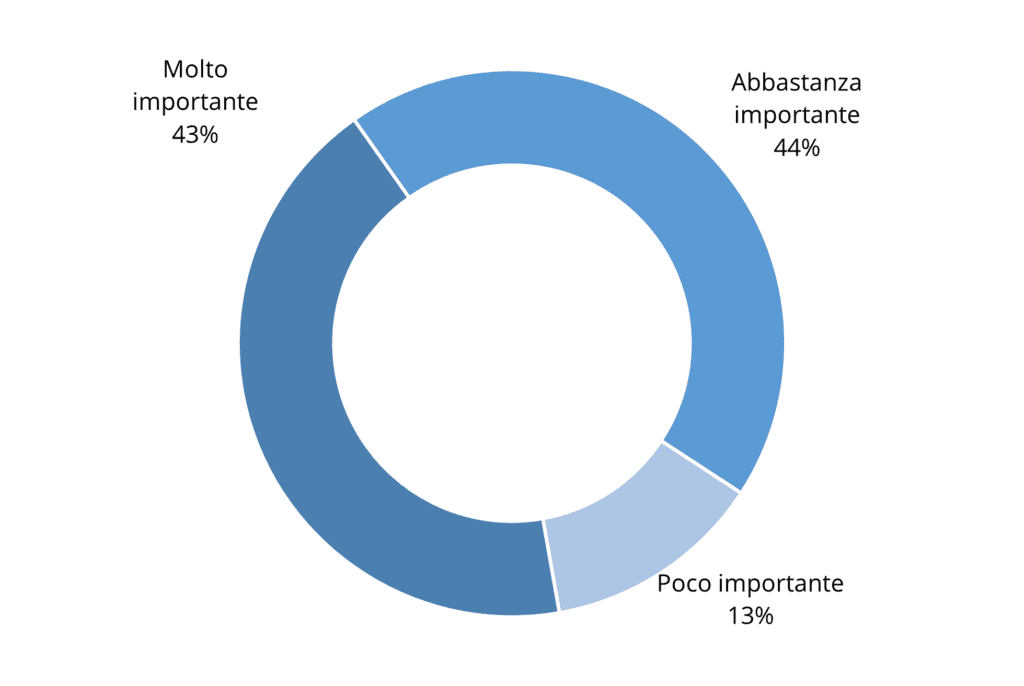

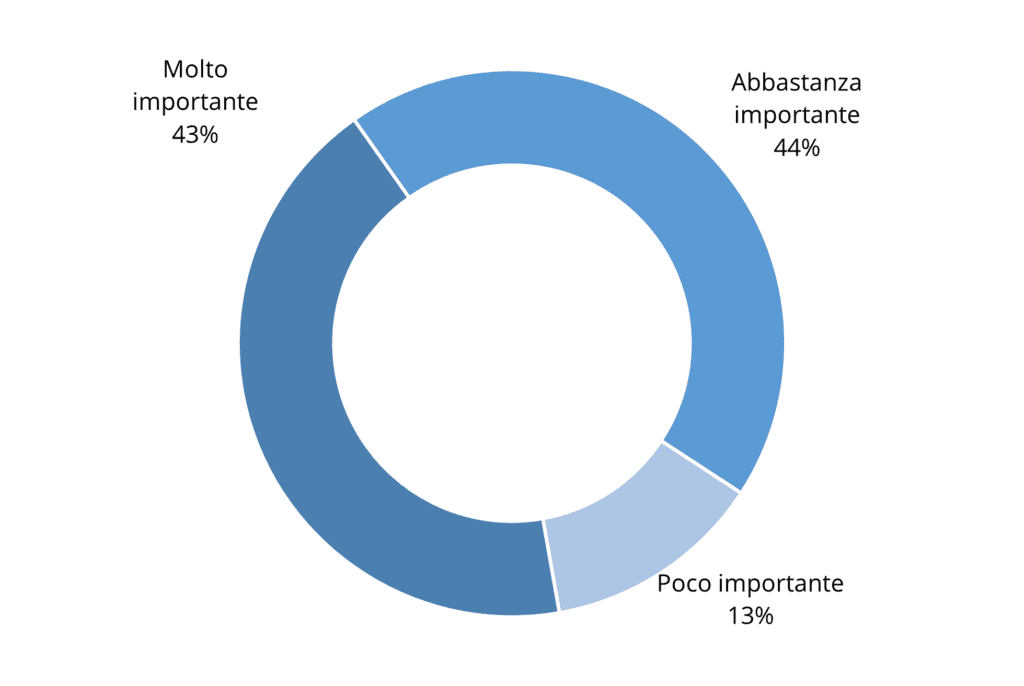

Importance of “sustainability” of kitchen furniture for a sample of distributors. Percentage values

According to CSIL data, about 930,000 kitchens are produced in Italy. After two years of significant growth, the sector is going through a delicate moment. Company production volumes tend to return to more restrained levels, and manufacturers have to deal with a cost structure that is much heavier than in the past.

The industry continues to maintain a high propensity for product innovation, consolidating some trends and emerging new ones including a growing emphasis on integrated technology, an expansion of outdoor-related offerings, and increased environmental awareness. According to CSIL’s survey involving a sample of kitchen furniture retailers, more than 40 percent of respondents consider sustainability issues to be of primary importance now more than ever.

Abstract of Table of Contents

Methodology

Executive summary

The kitchen furniture sector in Italy: basic data

Production and consumption, exports and imports of kitchen furniture

Location of Italian kitchen furniture supply

Breakdown of supply and demand by price range, values and quantities

Activity trends and forecasts

Trend in production and consumption of kitchen furniture in Italy, 2013-2023

How much kitchen prices in Italy will increase on average by 2023

The Italian economy: indicators of potential demand, 2018-2023

Economic indicators and forecasts of kitchen consumption in Italy, 2024-2025

Furniture and household appliance bonuses

Trade

Trends in Italian kitchen exports and imports and degree of market openness, 2013-2023

Main destination countries of Italian kitchen exports and main source countries of imports, 2018-2023

Financial analysis

Profitability indicators for a sample of companies

Capital and financial structure and productivity indicators for a sample of companies

Employment trends and unit labour costs for a sample of companies

Breakdown of supply by type of materials and styles

Type of door: breakdown of kitchen sales by material, colour and door finish: industry estimates and data for a sample of companies

Type of kitchen top: breakdown of kitchen sales by material of top: industry estimates and data from a sample of companies

Kitchen style: kitchen sales breakdown by kitchen style: industry estimates and data from a sample of companies

Kitchen layout: indicative kitchen sales shape and location

The topic of sustainability: How important is ‘Sustainability’ of the kitchen for the retailer

Distribution channels

Kitchen consumption in Italian regions and provinces

Kitchen consumption by distribution channel: sector estimates and data from a sample of companies

Sales outlets: average surface area, brands handled, kitchens sold, kitchen prices and associated costs

Main distribution chains

Kitchen furniture and built-in appliances

Incidence of built-in appliances on the value of kitchen sales, 2018-2023

Best-selling and trending appliances

The competitive system

The top 50 companies by production: market shares and company profiles

Kitchen sales in Italy and Italian kitchen sales abroad in a sample of 50 Italian companies

Production by price range (luxury, high, medium-high, medium-economical, economical) of the main companies in the sector

Appendix: Addresses of the main Italian companies mentioned in the report

The CSIL Report “Il mercato italiano dei mobili per cucina” (in Italian language) now in its forty-second edition offers a comprehensive picture of the sector, providing trends and forecasts of production and consumption, imports and exports for the main countries of origin/destination, prices, distribution channels, policies for sustainability, sales data and market shares of the major players in the industry. The report also considers the impact of built-in appliances on the value of kitchen sales.

Kitchen production data are broken down by: cabinet door material (solid wood, veneer, laminate, ceramic, gres, thermoplastics, lacquer, melamine, aluminum, glass),cabinet door style (classic, rustic, basic, modern, design, hi-tech), cabinet door color (white, bright colors, neutral colors, wood-looking), lacquering of the cabinet door (glossy, matt), andtop material (synthetics, natural and engineered stone, quartz, laminate, ceramic slabs, steel, aluminum, wood, glass).

Also available are data on price trends factory prices of kitchen furniture, data on productive concentration and number of employees.

Key indicators of profitability, indicatorsrelated to capital and financial structure and indicatorsof productivity for a sample of enterprises are also presented.

The analysis of distribution of kitchens in Italy considers the following channels: direct/contract sales, specialized kitchen retailers, furniture stores, furniture chains, and department stores.

The Competitive system part analyses the presence of major Italian kitchen furniture manufacturing companies in the domestic market (as a whole and by geographic macro-areas) and in the foreign market.

Turnover and market share data, with brief company profiles, are provided for major Italian competitors for each price range (Low, Middle-low, Middle, Middle-upper, Upper-end, Luxury).

Also included is an address book of about 90 of Italy’s leading kitchen furniture manufacturers.

This research was prepared using the following tools:

-

- Direct interviews with a sample of more than 50 Italian manufacturers chosen on the basis of economic, geographic and size parameters, covering more than 80 percent of the total supply;

- Interviews with about 400 Italian kitchen furniture retailers;

- Company balance sheets of companies included in the sample but also of others not cooperating in the direct survey (about 100 companies in all);

- Official documentation regarding economic and industry data available for 2023 and 2024;

- Statistical data from ISTAT and Eurostat sources related to the trade interchange of kitchen furniture.

The object of the research is all furniture intended for kitchen furniture and all appliances sold in the market through this channel. The appliances considered are: sinks, hoods, built-in ovens, hobs, built-in refrigerators and dishwashers, and embedded lighting.

In the calculation of kitchens sold, in order not to alter statistical units and affect price reasoning, no account was taken of completions, nor of compositions of two to three modules and/or with measurements of less than one linear meter.

Importance of “sustainability” of kitchen furniture for a sample of distributors. Percentage values

According to CSIL data, about 930,000 kitchens are produced in Italy. After two years of significant growth, the sector is going through a delicate moment. Company production volumes tend to return to more restrained levels, and manufacturers have to deal with a cost structure that is much heavier than in the past.

The industry continues to maintain a high propensity for product innovation, consolidating some trends and emerging new ones including a growing emphasis on integrated technology, an expansion of outdoor-related offerings, and increased environmental awareness. According to CSIL’s survey involving a sample of kitchen furniture retailers, more than 40 percent of respondents consider sustainability issues to be of primary importance now more than ever.

Abstract of Table of Contents

Methodology

Executive summary

The kitchen furniture sector in Italy: basic data

Production and consumption, exports and imports of kitchen furniture

Location of Italian kitchen furniture supply

Breakdown of supply and demand by price range, values and quantities

Activity trends and forecasts

Trend in production and consumption of kitchen furniture in Italy, 2013-2023

How much kitchen prices in Italy will increase on average by 2023

The Italian economy: indicators of potential demand, 2018-2023

Economic indicators and forecasts of kitchen consumption in Italy, 2024-2025

Furniture and household appliance bonuses

Trade

Trends in Italian kitchen exports and imports and degree of market openness, 2013-2023

Main destination countries of Italian kitchen exports and main source countries of imports, 2018-2023

Financial analysis

Profitability indicators for a sample of companies

Capital and financial structure and productivity indicators for a sample of companies

Employment trends and unit labour costs for a sample of companies

Breakdown of supply by type of materials and styles

Type of door: breakdown of kitchen sales by material, colour and door finish: industry estimates and data for a sample of companies

Type of kitchen top: breakdown of kitchen sales by material of top: industry estimates and data from a sample of companies

Kitchen style: kitchen sales breakdown by kitchen style: industry estimates and data from a sample of companies

Kitchen layout: indicative kitchen sales shape and location

The topic of sustainability: How important is ‘Sustainability’ of the kitchen for the retailer

Distribution channels

Kitchen consumption in Italian regions and provinces

Kitchen consumption by distribution channel: sector estimates and data from a sample of companies

Sales outlets: average surface area, brands handled, kitchens sold, kitchen prices and associated costs

Main distribution chains

Kitchen furniture and built-in appliances

Incidence of built-in appliances on the value of kitchen sales, 2018-2023

Best-selling and trending appliances

The competitive system

The top 50 companies by production: market shares and company profiles

Kitchen sales in Italy and Italian kitchen sales abroad in a sample of 50 Italian companies

Production by price range (luxury, high, medium-high, medium-economical, economical) of the main companies in the sector

Appendix: Addresses of the main Italian companies mentioned in the report

SEE ALSO

Kitchen furniture: World market outlook

December 2023, XVIII Ed. , 185 pages

CSIL analyses 60 kitchen furniture markets with a rich collection of key country data, production and consumption both in value and units. Company profiles for 35 among the main kitchen furniture manufacturers worldwide

The European market for kitchen furniture

May 2023, XXXIII Ed. , 305 pages

In 2022, the European production (30 EU countries) of kitchen furniture amounts to around 7 million units manufactured, including around one million units of upper end kitchens.

The kitchen furniture market in the United States

March 2023, VIII Ed. , 112 pages

In-deep analysis of the kitchen furniture sector in the US, with trends and forecasts of production, consumption, imports and exports, leading players by geographical areas and price ranges (clustered in six price groups), marketing policies and distribution channels

The kitchen furniture market in China

March 2022, IX Ed. , 160 pages

The Report, now at its IX edition, offers an in-depth investigation of the kitchen market in China, with size and trends of production, consumption, international trade, as well as analysis of demand determinants and competitive system

Smart cities and flagship stores: kitchen furniture

July 2021, I Ed. , 206 pages

Profiles of 85 cities worldwide (ranked according to their business attractiveness) with a selection of economic and demographic indicators, and estimates and forecasts of the potential market for kitchen furniture. Analysis of the geographical presence of a selected sample of 100 brands, with a focus on kitchen furniture outlets