Trends in the European Office Market: the Dealer’s Point of View

Office | Retail & Ecommerce | December 2017

€1600

December 2017,

I Ed. ,

40 pages

Price (single user license):

EUR 1600 / USD 1696

For multiple/corporate license prices please contact us

Language: English

Report code: EU33a

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The European market for office furniture is currently showing signs of a general recovery. Following two years of consecutive growth the market is expected to further improve its performance in both 2018 and 2019.

In such a context, CSIL decided to launch a survey with the aim of understanding and describing the expectations of European office furniture distributors and the main sector trends over the next two years.

The study was launched to get a better understanding of the prospects for the office furniture sector in Europe by gathering the expectations of the distribution companies for the period 2018-2019. The analysis involved around 100 office furniture distributors (dealers, distributors, interior designers, specifiers) located in Western Europe and surveyed by CSIL in September-November 2017.

In particular the analysis concentrates on:

- The office furniture market and forecasts

- Quantification and performance of the main customer segments

- Factors influencing the purchasing decision

- Average customer budgets by product category, for both corporate tenders and individuals

- Trends for single office seating categories, use of sit-stand desks and evolution of office furniture areas

- Use of e-commerce and prospects

- Expansion of product portfolio and new product categories to be introduced

- Location of suppliers and delivery terms

The countries were divided into four areas according to their geographical proximity and similarity in market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

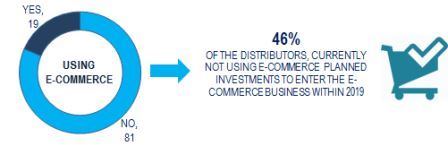

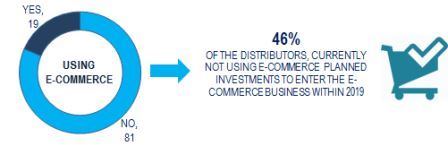

Sample. The use of e-commerce channel and perspectives. Percentages

The European market for office furniture is witnessing a general recovery. Following two years of consecutive growth, the market is expected to further improve its performance in both 2018 and 2019. In such a context this survey aimed at understanding and describing the expectations of European distributors regarding the main sector trends over the next two years.

As office distribution is progressively transforming from the simple supply of furniture items to a more global offer of service, consultancy and projects, the vast majority of survey respondents declared intentions to expand their offer and product portfolios.

Distributors are also paying attention to new instruments for approaching customers. The fact that customers (individuals and professionals in particular) look to Social Media for ideas, information and product reviews cannot be disregarded when developing a marketing and advertising campaign. In fact, a sizeable share of interviewees is considering investing in e-commerce by 2019.

The research findings are also shown by single geographic region and, when relevant, according to the size of the distributors (small or medium-large companies).

Abstract of Table of Contents

EXECUTIVE SUMMARY

1. INTRODUCTION

Contents

Methodology

Other CSIL reports on the office furniture industry and e-commerce

The sample

2. THE EUROPEAN OFFICE FURNITURE MARKET

Macroeconomics

The office furniture market

Forecasts

3. DISTRIBUTORS PRODUCT PORTFOLIO

Brand policy

Strategies

4. CUSTOMER ANALYSIS

Segments

The purchasing decision

Average customer budgets

5. PRODUCT TRENDS

Seating

Office spaces

Sit-stand desks

6. SUPPLIERS

Location of suppliers

Terms of delivery

7. E-COMMERCE EVOLUTION

E-commerce

ANNEX 1. THE QUESTIONNAIRE

The European market for office furniture is currently showing signs of a general recovery. Following two years of consecutive growth the market is expected to further improve its performance in both 2018 and 2019.

In such a context, CSIL decided to launch a survey with the aim of understanding and describing the expectations of European office furniture distributors and the main sector trends over the next two years.

The study was launched to get a better understanding of the prospects for the office furniture sector in Europe by gathering the expectations of the distribution companies for the period 2018-2019. The analysis involved around 100 office furniture distributors (dealers, distributors, interior designers, specifiers) located in Western Europe and surveyed by CSIL in September-November 2017.

In particular the analysis concentrates on:

- The office furniture market and forecasts

- Quantification and performance of the main customer segments

- Factors influencing the purchasing decision

- Average customer budgets by product category, for both corporate tenders and individuals

- Trends for single office seating categories, use of sit-stand desks and evolution of office furniture areas

- Use of e-commerce and prospects

- Expansion of product portfolio and new product categories to be introduced

- Location of suppliers and delivery terms

The countries were divided into four areas according to their geographical proximity and similarity in market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

Sample. The use of e-commerce channel and perspectives. Percentages

The European market for office furniture is witnessing a general recovery. Following two years of consecutive growth, the market is expected to further improve its performance in both 2018 and 2019. In such a context this survey aimed at understanding and describing the expectations of European distributors regarding the main sector trends over the next two years.

As office distribution is progressively transforming from the simple supply of furniture items to a more global offer of service, consultancy and projects, the vast majority of survey respondents declared intentions to expand their offer and product portfolios.

Distributors are also paying attention to new instruments for approaching customers. The fact that customers (individuals and professionals in particular) look to Social Media for ideas, information and product reviews cannot be disregarded when developing a marketing and advertising campaign. In fact, a sizeable share of interviewees is considering investing in e-commerce by 2019.

The research findings are also shown by single geographic region and, when relevant, according to the size of the distributors (small or medium-large companies).

Abstract of Table of Contents

EXECUTIVE SUMMARY

1. INTRODUCTION

Contents

Methodology

Other CSIL reports on the office furniture industry and e-commerce

The sample

2. THE EUROPEAN OFFICE FURNITURE MARKET

Macroeconomics

The office furniture market

Forecasts

3. DISTRIBUTORS PRODUCT PORTFOLIO

Brand policy

Strategies

4. CUSTOMER ANALYSIS

Segments

The purchasing decision

Average customer budgets

5. PRODUCT TRENDS

Seating

Office spaces

Sit-stand desks

6. SUPPLIERS

Location of suppliers

Terms of delivery

7. E-COMMERCE EVOLUTION

E-commerce

ANNEX 1. THE QUESTIONNAIRE

SEE ALSO

Furniture retailing in Europe

February 2024, XVII Ed. , 296 pages

Comparative analysis of the home furniture retailing industry in 15 European countries, with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers in Europe

Top 100 mattress specialist retailers in Europe

November 2023, I Ed. , 14 pages

A bird’s eye view of players in the European mattress market with a ranking of the 100 leading mattress specialist retailers in Europe.

E-commerce in the mattress industry

September 2023, V Ed. , 102 pages

Detailed analysis of the global e-commerce mattress markets with a focus on North America, Europe, and the Asia Pacific. Features of the online mattress business, the current incidence of online mattress sales by geographical areas and in key countries, the major markets, e-commerce mattress sales of the leading retailers by area, and company profiles of top players operating in the online mattress sector.

La distribuzione del mobile in Italia. Analisi per provincia (Italian)

July 2023, XX Ed. , 174 pages

This report provides a detailed picture of the Italian furniture market and retailing, for the whole national market and by province, providing the size and development of the home furniture market and its segments, market shares and development of distribution channels, estimated home furniture sales for key retailers, in-depth analysis of both large retail chains and independent retailers, companies’ strategies and trends

E-commerce for the furniture industry

November 2022, IX Ed. , 118 pages

This report analyses e-commerce in the furniture market, with a focus on key geographical areas (Europe, North America, and Asia Pacific) and key countries, providing current market size, e-commerce business models, the performance of the leading players, and the results of a CSIL survey to furniture manufacturers that highlights their approach to the web channel, their strategies, future expectations, and the most-demanded furniture products online.