The European market for Healthcare Lighting

Il mercato europeo dell'illuminazione medica

Illuminazione | Giugno 2021

€1600

RAPPORTO IN LINGUA INGLESE

Giugno 2021,

II Ed. ,

114 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1744

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: EU31

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

The Report takes into consideration lighting mainly for two healthcare macro segments and its main products: Hospitals (public and private) and Dental studies (usually private).

Specific segments analyzed include:

- Operating rooms, surgery

- Intensive care and examination rooms (including dental surgery lighting)

- Normal stay bedrooms

- Long-term care bedrooms. (Long-term care beds are hospital beds accommodating patients requiring long-term care due to chronic impairments and a reduced degree of independence in activities of daily living. They include beds in longterm care departments of general hospitals, beds for long-term care in specialty hospitals, and beds for palliative care).

- Common areas: Entrances and receptions, corridors, stairwells, lift lobbies

- Laboratories and pharmacies

- Emergency lighting (to provide light in the event of a main or local power supply failure)

- Outdoor lighting

- Lighting Controls (intelligent network-based lighting control solutions that incorporate communication between various system inputs and outputs related to lighting control with the use of one or more central computing devices. Lighting control systems serve to provide the right amount of light where and when it is needed).

The information provided in this report is based on desk analysis and field analysis. The desk analysis includes: statistical data collection from official sources (eg. Eurostat databases) and other sources (eg. associations, trade press); the review of other existing documentation (eg. press releases, web sources, studies relating to the lighting industry); the analysis of companies databases (eg. balance sheets).

The field analysis was carried on through 20 interviews with manufacturers and experts operating in the healthcare lighting industry.

Among the main drivers of the healthcare lighting market there are:

- Demographic changes (an Ageing population) together with growing demand for good health

- Healthcare facilities (from small clinics and doctor’s offices to urgent care centers and large hospitals)

- Dentists, dental practices.

An analysis of the competitive system by country or groups of countries is also provided for the main players of the sector, with sales data, market share and short company profiles (50 among the major players analised in the Report hold over 90% of the Healthcare lighting market in Europe).

Aziende selezionate

3F Filippi, Acem, Admeco, Alvo, Apollo Lighting, ASD Lighting, Astra Lighting, Benq Medical Technology, Berchtold, Biolume (Biodis), Brandon Medical, Buck, CSN Industrie, Cymo, DegreK, Derungs, Disano, Dr Mach, D-Tec, Dräger, Ema-Led, Euronda, Exled, Fagerhult, Famed Zywiec, Faromed Medizin-Technik, Glamox, Guido Ammirata, IBV Hungária Lighting, Ilo Electronic, Kavo, Kenex Electro-Medical, KLS Martin, Lena Lighting, Lucibel, LUG Light, Luxiona, Maquet, Mareli, Mavig, Merivaara, Midmark Europe, Modul Technik, NGC Medical, Normagroup (Normalux), OMS Lighting, Ordisi, Oricare, Osram Digital Lighting, Provita, Regent, Riester, Rimsa, Schmitz, Simeon Medical, Steris, Strycher, Surgiris, Signify, Thorpe FW, Trato TLV, Trilux, Trumpf Medical, Ultra Viol, Vosla, Waldmann, Zenium, Zumtobel

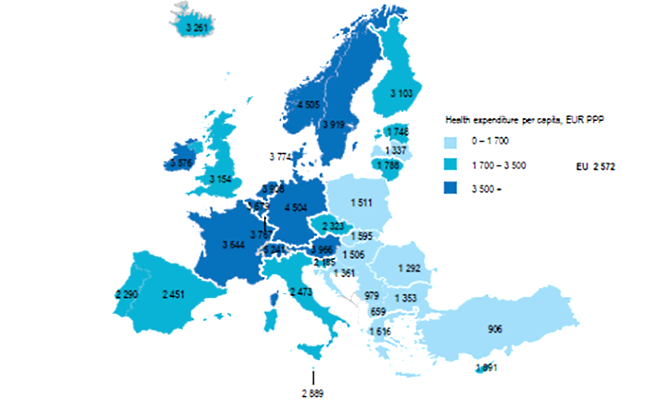

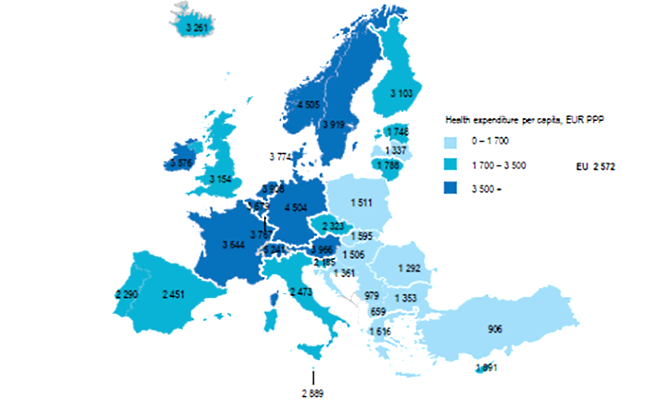

Europe. Health expenditure per capita. EUR PPP (Purchasing Power Parity)

In the coming years, many resources will be dedicated to the requalification of lighting systems in all places of public and private health services: from hospitals to clinics, from patient rooms to analysis laboratories.

Even if the number of hospital beds in Europe has been reduced in recent years, expenses for Healthcare show overall an increasing path, and a mid-term forecast of yearly 6% is given.

The European market of healthcare lighting is made by around 100 manufacturers, including approximately two clusters: 40 manufacturers of overall lighting fixtures, 70 specialists in healthcare/hospital equipment for which lighting is usually just a small share of their turnover.

Major 50 lighting players hold over 90% of the Healthcare lighting market in Europe. Main market is Germany (almost 30%), followed by France and the United Kingdom (together around 25%), Italy (8%), Spain and Switzerland (5% each).

Today (2020-2021) LED weights around 75% on the new installation in Healthcare premises and around 40% in terms of installed stock of luminaires (around 50% in Germany, 30% in East Europe.

INTRODUCTION

Research tools, Research fields, Overview: the lighting requalification in hospital environments

BASIC DATA, ACTIVITY TREND AND FORECAST

Healthcare lighting in Europe. Estimated market breakdown by country. 2020 Data

Healthcare lighting in Europe. Estimated market activity trend 2009-2014-2020 and forecast 2025

MARKET DRIVERS

Demographic changes: Population, 2000-2020 and Projections 2025-2100; Healthcare expenditure: Health expenditure as % of GDP by country; Hospitals: Number of hospitals and number of hospitals beds by country, Hospital beds by country by function of healthcare; Nursing and residential care facilities: Nursing and elderly home beds by country; Dental practices: Practising dentists by country.

MARKET VALUE BY SPECIFIC APPLICATION

Healthcare lighting in Europe. Estimated market breakdown by destination; Product range in a wide sample of manufacturers of healthcare lighting; Basic parameters and quality characteristics of lighting; Requirements for lighting; Reference prices of healthcare lighting products and stock of existing lighting.

Operating rooms, surgery.

Examination rooms, intensive care units

Beds (normal stay and long standing)

Common areas; entrances and receptions, corridors and circulation areas, stairwells and lift lobbies

Laboratories and pharmacies

Emergency lighting

Outdoor lighting

Lighting controls

COMPETITION

Major players in the healthcare lighting sector in Europe as a whole and by groups of countries. Sales data, market shares and short company profiles

PUBLIC AND PRIVATE DEMAND (DISTRIBUTION), SECTOR FAIRS ANDONLINE DIRECTORIES

ANNEX: SOME AMONG THE MENTIONED COMPANIES

The Report takes into consideration lighting mainly for two healthcare macro segments and its main products: Hospitals (public and private) and Dental studies (usually private).

Specific segments analyzed include:

- Operating rooms, surgery

- Intensive care and examination rooms (including dental surgery lighting)

- Normal stay bedrooms

- Long-term care bedrooms. (Long-term care beds are hospital beds accommodating patients requiring long-term care due to chronic impairments and a reduced degree of independence in activities of daily living. They include beds in longterm care departments of general hospitals, beds for long-term care in specialty hospitals, and beds for palliative care).

- Common areas: Entrances and receptions, corridors, stairwells, lift lobbies

- Laboratories and pharmacies

- Emergency lighting (to provide light in the event of a main or local power supply failure)

- Outdoor lighting

- Lighting Controls (intelligent network-based lighting control solutions that incorporate communication between various system inputs and outputs related to lighting control with the use of one or more central computing devices. Lighting control systems serve to provide the right amount of light where and when it is needed).

The information provided in this report is based on desk analysis and field analysis. The desk analysis includes: statistical data collection from official sources (eg. Eurostat databases) and other sources (eg. associations, trade press); the review of other existing documentation (eg. press releases, web sources, studies relating to the lighting industry); the analysis of companies databases (eg. balance sheets).

The field analysis was carried on through 20 interviews with manufacturers and experts operating in the healthcare lighting industry.

Among the main drivers of the healthcare lighting market there are:

- Demographic changes (an Ageing population) together with growing demand for good health

- Healthcare facilities (from small clinics and doctor’s offices to urgent care centers and large hospitals)

- Dentists, dental practices.

An analysis of the competitive system by country or groups of countries is also provided for the main players of the sector, with sales data, market share and short company profiles (50 among the major players analised in the Report hold over 90% of the Healthcare lighting market in Europe).

Europe. Health expenditure per capita. EUR PPP (Purchasing Power Parity)

In the coming years, many resources will be dedicated to the requalification of lighting systems in all places of public and private health services: from hospitals to clinics, from patient rooms to analysis laboratories.

Even if the number of hospital beds in Europe has been reduced in recent years, expenses for Healthcare show overall an increasing path, and a mid-term forecast of yearly 6% is given.

The European market of healthcare lighting is made by around 100 manufacturers, including approximately two clusters: 40 manufacturers of overall lighting fixtures, 70 specialists in healthcare/hospital equipment for which lighting is usually just a small share of their turnover.

Major 50 lighting players hold over 90% of the Healthcare lighting market in Europe. Main market is Germany (almost 30%), followed by France and the United Kingdom (together around 25%), Italy (8%), Spain and Switzerland (5% each).

Today (2020-2021) LED weights around 75% on the new installation in Healthcare premises and around 40% in terms of installed stock of luminaires (around 50% in Germany, 30% in East Europe.

INTRODUCTION

Research tools, Research fields, Overview: the lighting requalification in hospital environments

BASIC DATA, ACTIVITY TREND AND FORECAST

Healthcare lighting in Europe. Estimated market breakdown by country. 2020 Data

Healthcare lighting in Europe. Estimated market activity trend 2009-2014-2020 and forecast 2025

MARKET DRIVERS

Demographic changes: Population, 2000-2020 and Projections 2025-2100; Healthcare expenditure: Health expenditure as % of GDP by country; Hospitals: Number of hospitals and number of hospitals beds by country, Hospital beds by country by function of healthcare; Nursing and residential care facilities: Nursing and elderly home beds by country; Dental practices: Practising dentists by country.

MARKET VALUE BY SPECIFIC APPLICATION

Healthcare lighting in Europe. Estimated market breakdown by destination; Product range in a wide sample of manufacturers of healthcare lighting; Basic parameters and quality characteristics of lighting; Requirements for lighting; Reference prices of healthcare lighting products and stock of existing lighting.

Operating rooms, surgery.

Examination rooms, intensive care units

Beds (normal stay and long standing)

Common areas; entrances and receptions, corridors and circulation areas, stairwells and lift lobbies

Laboratories and pharmacies

Emergency lighting

Outdoor lighting

Lighting controls

COMPETITION

Major players in the healthcare lighting sector in Europe as a whole and by groups of countries. Sales data, market shares and short company profiles

PUBLIC AND PRIVATE DEMAND (DISTRIBUTION), SECTOR FAIRS ANDONLINE DIRECTORIES

ANNEX: SOME AMONG THE MENTIONED COMPANIES

RAPPORTI CORRELATI

The worldwide market for connected lighting (english)

Febbraio 2024,

I Ed. ,

88 pagine

Il mercato mondiale dell'illuminazione connessa

Questo rapporto analizza il mercato globale dell’illuminazione concentrandosi sulle tendenze dei LED e dell’illuminazione connessa. Fornisce previsioni di mercato sottolineando l’impatto della transizione green e della trasformazione digitale. Lo studio include anche una sezione sulla concorrenza del settore, stimando le vendite e le quote di mercato dei principali produttori.

Lighting: World Market Outlook (English)

Novembre 2023,

XXVI Ed. ,

123 pagine

Il mercato mondiale dell'illuminazione

La ventiseiesima edizione della ricerca CSIL “Lighting: World market outlook” analizza, attraverso tabelle e grafici, i dati relativi alla produzione, al consumo e al commercio internazionale di apparecchi di illuminazione a livello mondiale nel suo complesso con un focus su 70 Paesi, per gli anni 2013-2022 e i preliminari del 2023. Sono inoltre fornite previsioni di mercato per i prossimi tre anni (2024-2026).

The lighting fixtures market in China (English)

Settembre 2023,

XVI Ed. ,

205 pagine

Il mercato degli apparecchi per illuminazione in Cina

La 16a edizione di The Lighting Fixtures market in China offre un’analisi accurata e approfondita del settore degli apparecchi di illuminazione in Cina, fornendo dati e tendenze per il periodo 2017-2022 e previsioni fino al 2025. Da un lato, il rapporto analizza le principali tendenze che hanno interessato il mercato negli ultimi cinque anni, considerando la produzione, il consumo, le importazioni e le esportazioni di apparecchi di illuminazione nel Paese. Dall’altro, offre un’analisi della struttura dell’offerta e del sistema competitivo, una panoramica sul trend dell’ illuminazione connessa/smart, il sistema di distribuzione e i principali attori che operano nel mercato.

The lighting fixtures market in the United States (English)

Giugno 2023,

XVII Ed. ,

256 pagine

Il mercato degli apparecchi per illuminazione negli Stati Uniti

Il mercato statunitense dell’illuminazione nel 2022 registra una crescita del 6,5% in termini nominali per quanto riguarda gli apparecchi di illuminazione (consumer, professionale, per esterni), fino a 23,2 miliardi di dollari. Il mercato delle lampade registra un calo (circa -2,9%). Il segmento residenziale è cresciuto ben oltre la media del mercato (+5,9% in media negli ultimi cinque anni). Nel 2022, il peso degli uffici e dell’intrattenimento sul mercato complessivo dell’illuminazione commerciale è diminuito, mentre sono cresciuti i locali pubblici e l’ospitalità. Nel 2022, il valore delle costruzioni completate è cresciuto di oltre il 10%, raggiungendo quasi 1,8 miliardi di dollari.

The European market for lighting fixtures (English)

Maggio 2023,

XXXII Ed. ,

392 pagine

Il mercato europeo degli apparecchi per illuminazione

Nel 2022, il consumo di apparecchi di illuminazione nei Paesi dell’UE30 ha registrato un aumento dell’8,3%, raggiungendo un valore di 19,9 miliardi di euro. Risultati migliori per l’illuminazione commerciale (rispetto a quella residenziale, industriale e per esterni), per i grandi operatori (con un Ebitda del 12%), per il design, per l’illuminazione di aree, per l’ospitalità, per il contract (rispetto alla vendita al dettaglio), per l’illuminazione lineare e per l’emergenza. Più brevetti IP e acquisizioni. I primi 10 operatori detengono una quota di mercato del 30%.