June 2021,

II Ed. ,

114 pages

Price (single user license):

EUR 1600 / USD 1728

For multiple/corporate license prices please contact us

Language: English

Report code: EU31

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The Report takes into consideration lighting mainly for two healthcare macro segments and its main products: Hospitals (public and private) and Dental studies (usually private).

Specific segments analyzed include:

- Operating rooms, surgery

- Intensive care and examination rooms (including dental surgery lighting)

- Normal stay bedrooms

- Long-term care bedrooms. (Long-term care beds are hospital beds accommodating patients requiring long-term care due to chronic impairments and a reduced degree of independence in activities of daily living. They include beds in longterm care departments of general hospitals, beds for long-term care in specialty hospitals, and beds for palliative care).

- Common areas: Entrances and receptions, corridors, stairwells, lift lobbies

- Laboratories and pharmacies

- Emergency lighting (to provide light in the event of a main or local power supply failure)

- Outdoor lighting

- Lighting Controls (intelligent network-based lighting control solutions that incorporate communication between various system inputs and outputs related to lighting control with the use of one or more central computing devices. Lighting control systems serve to provide the right amount of light where and when it is needed).

The information provided in this report is based on desk analysis and field analysis. The desk analysis includes: statistical data collection from official sources (eg. Eurostat databases) and other sources (eg. associations, trade press); the review of other existing documentation (eg. press releases, web sources, studies relating to the lighting industry); the analysis of companies databases (eg. balance sheets).

The field analysis was carried on through 20 interviews with manufacturers and experts operating in the healthcare lighting industry.

Among the main drivers of the healthcare lighting market there are:

- Demographic changes (an Ageing population) together with growing demand for good health

- Healthcare facilities (from small clinics and doctor’s offices to urgent care centers and large hospitals)

- Dentists, dental practices.

An analysis of the competitive system by country or groups of countries is also provided for the main players of the sector, with sales data, market share and short company profiles (50 among the major players analised in the Report hold over 90% of the Healthcare lighting market in Europe).

Selected companies

3F Filippi, Acem, Admeco, Alvo, Apollo Lighting, ASD Lighting, Astra Lighting, Benq Medical Technology, Berchtold, Biolume (Biodis), Brandon Medical, Buck, CSN Industrie, Cymo, DegreK, Derungs, Disano, Dr Mach, D-Tec, Dräger, Ema-Led, Euronda, Exled, Fagerhult, Famed Zywiec, Faromed Medizin-Technik, Glamox, Guido Ammirata, IBV Hungária Lighting, Ilo Electronic, Kavo, Kenex Electro-Medical, KLS Martin, Lena Lighting, Lucibel, LUG Light, Luxiona, Maquet, Mareli, Mavig, Merivaara, Midmark Europe, Modul Technik, NGC Medical, Normagroup (Normalux), OMS Lighting, Ordisi, Oricare, Osram Digital Lighting, Provita, Regent, Riester, Rimsa, Schmitz, Simeon Medical, Steris, Strycher, Surgiris, Signify, Thorpe FW, Trato TLV, Trilux, Trumpf Medical, Ultra Viol, Vosla, Waldmann, Zenium, Zumtobel

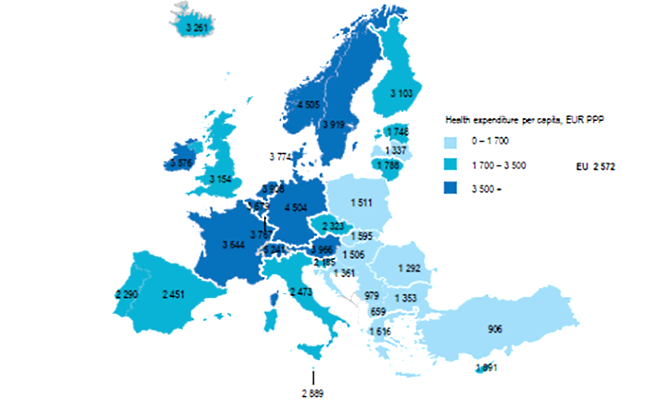

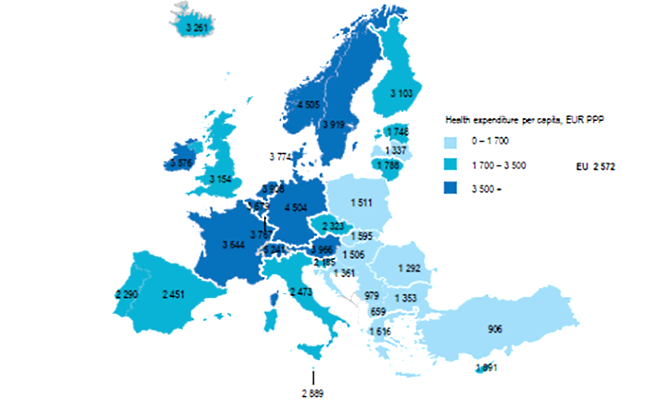

Europe. Health expenditure per capita. EUR PPP (Purchasing Power Parity)

In the coming years, many resources will be dedicated to the requalification of lighting systems in all places of public and private health services: from hospitals to clinics, from patient rooms to analysis laboratories.

Even if the number of hospital beds in Europe has been reduced in recent years, expenses for Healthcare show overall an increasing path, and a mid-term forecast of yearly 6% is given.

The European market of healthcare lighting is made by around 100 manufacturers, including approximately two clusters: 40 manufacturers of overall lighting fixtures, 70 specialists in healthcare/hospital equipment for which lighting is usually just a small share of their turnover.

Major 50 lighting players hold over 90% of the Healthcare lighting market in Europe. Main market is Germany (almost 30%), followed by France and the United Kingdom (together around 25%), Italy (8%), Spain and Switzerland (5% each).

Today (2020-2021) LED weights around 75% on the new installation in Healthcare premises and around 40% in terms of installed stock of luminaires (around 50% in Germany, 30% in East Europe.

INTRODUCTION

Research tools, Research fields, Overview: the lighting requalification in hospital environments

BASIC DATA, ACTIVITY TREND AND FORECAST

Healthcare lighting in Europe. Estimated market breakdown by country. 2020 Data

Healthcare lighting in Europe. Estimated market activity trend 2009-2014-2020 and forecast 2025

MARKET DRIVERS

Demographic changes: Population, 2000-2020 and Projections 2025-2100; Healthcare expenditure: Health expenditure as % of GDP by country; Hospitals: Number of hospitals and number of hospitals beds by country, Hospital beds by country by function of healthcare; Nursing and residential care facilities: Nursing and elderly home beds by country; Dental practices: Practising dentists by country.

MARKET VALUE BY SPECIFIC APPLICATION

Healthcare lighting in Europe. Estimated market breakdown by destination; Product range in a wide sample of manufacturers of healthcare lighting; Basic parameters and quality characteristics of lighting; Requirements for lighting; Reference prices of healthcare lighting products and stock of existing lighting.

Operating rooms, surgery.

Examination rooms, intensive care units

Beds (normal stay and long standing)

Common areas; entrances and receptions, corridors and circulation areas, stairwells and lift lobbies

Laboratories and pharmacies

Emergency lighting

Outdoor lighting

Lighting controls

COMPETITION

Major players in the healthcare lighting sector in Europe as a whole and by groups of countries. Sales data, market shares and short company profiles

PUBLIC AND PRIVATE DEMAND (DISTRIBUTION), SECTOR FAIRS ANDONLINE DIRECTORIES

ANNEX: SOME AMONG THE MENTIONED COMPANIES

The Report takes into consideration lighting mainly for two healthcare macro segments and its main products: Hospitals (public and private) and Dental studies (usually private).

Specific segments analyzed include:

- Operating rooms, surgery

- Intensive care and examination rooms (including dental surgery lighting)

- Normal stay bedrooms

- Long-term care bedrooms. (Long-term care beds are hospital beds accommodating patients requiring long-term care due to chronic impairments and a reduced degree of independence in activities of daily living. They include beds in longterm care departments of general hospitals, beds for long-term care in specialty hospitals, and beds for palliative care).

- Common areas: Entrances and receptions, corridors, stairwells, lift lobbies

- Laboratories and pharmacies

- Emergency lighting (to provide light in the event of a main or local power supply failure)

- Outdoor lighting

- Lighting Controls (intelligent network-based lighting control solutions that incorporate communication between various system inputs and outputs related to lighting control with the use of one or more central computing devices. Lighting control systems serve to provide the right amount of light where and when it is needed).

The information provided in this report is based on desk analysis and field analysis. The desk analysis includes: statistical data collection from official sources (eg. Eurostat databases) and other sources (eg. associations, trade press); the review of other existing documentation (eg. press releases, web sources, studies relating to the lighting industry); the analysis of companies databases (eg. balance sheets).

The field analysis was carried on through 20 interviews with manufacturers and experts operating in the healthcare lighting industry.

Among the main drivers of the healthcare lighting market there are:

- Demographic changes (an Ageing population) together with growing demand for good health

- Healthcare facilities (from small clinics and doctor’s offices to urgent care centers and large hospitals)

- Dentists, dental practices.

An analysis of the competitive system by country or groups of countries is also provided for the main players of the sector, with sales data, market share and short company profiles (50 among the major players analised in the Report hold over 90% of the Healthcare lighting market in Europe).

Europe. Health expenditure per capita. EUR PPP (Purchasing Power Parity)

In the coming years, many resources will be dedicated to the requalification of lighting systems in all places of public and private health services: from hospitals to clinics, from patient rooms to analysis laboratories.

Even if the number of hospital beds in Europe has been reduced in recent years, expenses for Healthcare show overall an increasing path, and a mid-term forecast of yearly 6% is given.

The European market of healthcare lighting is made by around 100 manufacturers, including approximately two clusters: 40 manufacturers of overall lighting fixtures, 70 specialists in healthcare/hospital equipment for which lighting is usually just a small share of their turnover.

Major 50 lighting players hold over 90% of the Healthcare lighting market in Europe. Main market is Germany (almost 30%), followed by France and the United Kingdom (together around 25%), Italy (8%), Spain and Switzerland (5% each).

Today (2020-2021) LED weights around 75% on the new installation in Healthcare premises and around 40% in terms of installed stock of luminaires (around 50% in Germany, 30% in East Europe.

INTRODUCTION

Research tools, Research fields, Overview: the lighting requalification in hospital environments

BASIC DATA, ACTIVITY TREND AND FORECAST

Healthcare lighting in Europe. Estimated market breakdown by country. 2020 Data

Healthcare lighting in Europe. Estimated market activity trend 2009-2014-2020 and forecast 2025

MARKET DRIVERS

Demographic changes: Population, 2000-2020 and Projections 2025-2100; Healthcare expenditure: Health expenditure as % of GDP by country; Hospitals: Number of hospitals and number of hospitals beds by country, Hospital beds by country by function of healthcare; Nursing and residential care facilities: Nursing and elderly home beds by country; Dental practices: Practising dentists by country.

MARKET VALUE BY SPECIFIC APPLICATION

Healthcare lighting in Europe. Estimated market breakdown by destination; Product range in a wide sample of manufacturers of healthcare lighting; Basic parameters and quality characteristics of lighting; Requirements for lighting; Reference prices of healthcare lighting products and stock of existing lighting.

Operating rooms, surgery.

Examination rooms, intensive care units

Beds (normal stay and long standing)

Common areas; entrances and receptions, corridors and circulation areas, stairwells and lift lobbies

Laboratories and pharmacies

Emergency lighting

Outdoor lighting

Lighting controls

COMPETITION

Major players in the healthcare lighting sector in Europe as a whole and by groups of countries. Sales data, market shares and short company profiles

PUBLIC AND PRIVATE DEMAND (DISTRIBUTION), SECTOR FAIRS ANDONLINE DIRECTORIES

ANNEX: SOME AMONG THE MENTIONED COMPANIES

SEE ALSO

The worldwide market for connected lighting

February 2024, I Ed. , 88 pages

This report analyses the global lighting market focusing on LED and connected lighting trends. It provides market forecasts emphasizing the impact of green transition and digital transformation. The study also includes a section on industry competition, estimating sales, and market shares for leading manufacturers.

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in China

September 2023, XVI Ed. , 205 pages

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, consumption, imports and exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview on smart connected lighting trend, the distribution system and the main players operating in the market

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.