February 2024,

I Ed. ,

88 pages

Price (single user license):

EUR 2000 / USD 2120

For multiple/corporate license prices please contact us

Language: English

Report code: S52

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

This is the first edition of CSIL Report ‘The worldwide market for connected lighting‘. The report presents an in-depth analysis of connected lighting segment as a relevant and emerging business in LED lighting market, studied in the previous reports.

The report is structured as follows:

BASIC DATA presents an overview of the world lighting market in 2023, including lighting fixtures and lamps and provides, through tables and graphs, estimates on the consumption of LED based lighting fixtures and LED lamps with specific details on connected luminaires and smart lamps, analysed by segment (indoor/outdoor, residential/professional), by geographic region and by connection technology (wired or wireless).

ACTIVITY TREND offers an analysis of LED lighting and Connected lighting market trend for the years 2019-2023, by geographic region and by lighting segment, as well as an estimate of the stock of LED luminaires and connected items for the same time frame. Finally, an estimate of LED lighting consumption is shown by price range and type of indoor/outdoor product, either in value and in quantity.

FORECASTS provides forecast 2024-2026 for the global lighting market, with projected estimates on the growth trend of LED penetration by geographic region and lighting segment. A focus on the demand drivers and on how green transition and digital transformation affect the lighting industry is also included.

CONNECTIVITY AND TECHNOLOGY depicts a qualitative analysis on the kind of lighting controls and protocols used by lighting manufacturers (DALI, Casambi, Zigbee-Matter, KNX, DMX, EnOcean, Lutron and others) and short profiles of a selection of providers of Smart Lighting Solution, power supplies and electronic components for the lighting industry (LED chips, LED drivers, LED modules, sensors, lighting control systems). An overview of the main types of sensors most commonly used by lighting manufacturers is also included.

Finally, a presentation of the main applications of smart lighting by segment (residential/professional, indoor/outdoor) is provided, with case studies of companies offering smart lighting systems.

WORLDWIDE COMPETITION offers estimates on the sales of connected lighting and market shares for a sample of global leading lighting manufacturers, together with short profiles for approximately 100 worldwide companies manufacturing lighting fixtures and lamps and companies supplying electronic components and smart technology to the lighting sector, with information on turnover range, main business segments, product portfolio, connected lighting solutions, lighting controls and protocols used.

ANNEX: Directory of companies mentioned provides contact information for the main companies mentioned in this Report.

Selected companies

Among the considered companies:

Acuity Brands, Artemide, Casambi, Cree Lighting, Disano Illuminazione, Eglo, EnOcean, Fagerhult, Flos, Glamox, Helvar, Inventronics, Kosnic Lighting, Ledvance, Lival, Lutron, Marset, Occhio, Opple Lighting, Prolicht, Regent, Schréder, Signify, Silvair, SLV, Trilux, Tuya, Ushio Lighting, Wipro Lighting, Zhaga, Zumtobel.

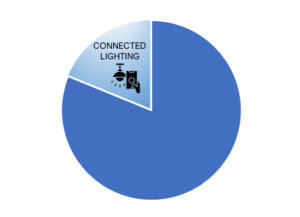

World incidence of connected lighting on LED lighting sales, 2023

The worldwide market for LED lighting fixtures and lamps worth around 85 billion US$ for the year 2023. About 14% of this value is estimated to be represented by “Connected Lighting”. The value of connected lighting products almost doubled over the last five years, posting an average annual growth of +17%.

Professional indoor lighting is currently the segment where connected lighting solutions show the highest penetration, followed by outdoor lighting. The incidence is by far below in residential indoor lighting and lamps. Geographically, the incidence of connected lighting on total LED lighting market is quite similar in Europe and North America, while the same ratio is lower in Asia-Pacific.

The evolution of the connected lighting is closely linked to energy-saving policies. The demand for these products will evolve significantly in the coming years, partly due to the supports provided by governments to achieve environmental targets.

Contents, research tools and methodological notes

Basic data

An overview of the world lighting market

Incidence of connected/smart solutions on total lighting sales

Sales of connected lighting by segment (Residential/Professional, Indoor/Outdoor)

Sales of connected lighting by geographic region

Sales of connected lighting by connection technology (Wired/Wireless)

Activity trend

LED lighting and connected lighting market: activity trend 2019-2023

- -by geographic region

- -by lighting segment

LED lighting and connected lighting market: estimated stock 2019-2023

Consumption of LED-based lighting fixtures and lamps by product and price range

Forecasts

LED Lighting and connected lighting market: forecasts 2024-2026

Demand drivers for the evolution of the connected lighting

Smart connected lighting and the green transition

Connectivity and technology

Lighting controls and protocols

Sensors and interoperability

Case studies for the connected lighting applications by segment

Worldwide competition

Leading companies and market shares in the connected lighting business

Company profiles for selected leading lighting manufacturers and suppliers

Appendix: List of the mentioned companies

This is the first edition of CSIL Report ‘The worldwide market for connected lighting‘. The report presents an in-depth analysis of connected lighting segment as a relevant and emerging business in LED lighting market, studied in the previous reports.

The report is structured as follows:

BASIC DATA presents an overview of the world lighting market in 2023, including lighting fixtures and lamps and provides, through tables and graphs, estimates on the consumption of LED based lighting fixtures and LED lamps with specific details on connected luminaires and smart lamps, analysed by segment (indoor/outdoor, residential/professional), by geographic region and by connection technology (wired or wireless).

ACTIVITY TREND offers an analysis of LED lighting and Connected lighting market trend for the years 2019-2023, by geographic region and by lighting segment, as well as an estimate of the stock of LED luminaires and connected items for the same time frame. Finally, an estimate of LED lighting consumption is shown by price range and type of indoor/outdoor product, either in value and in quantity.

FORECASTS provides forecast 2024-2026 for the global lighting market, with projected estimates on the growth trend of LED penetration by geographic region and lighting segment. A focus on the demand drivers and on how green transition and digital transformation affect the lighting industry is also included.

CONNECTIVITY AND TECHNOLOGY depicts a qualitative analysis on the kind of lighting controls and protocols used by lighting manufacturers (DALI, Casambi, Zigbee-Matter, KNX, DMX, EnOcean, Lutron and others) and short profiles of a selection of providers of Smart Lighting Solution, power supplies and electronic components for the lighting industry (LED chips, LED drivers, LED modules, sensors, lighting control systems). An overview of the main types of sensors most commonly used by lighting manufacturers is also included.

Finally, a presentation of the main applications of smart lighting by segment (residential/professional, indoor/outdoor) is provided, with case studies of companies offering smart lighting systems.

WORLDWIDE COMPETITION offers estimates on the sales of connected lighting and market shares for a sample of global leading lighting manufacturers, together with short profiles for approximately 100 worldwide companies manufacturing lighting fixtures and lamps and companies supplying electronic components and smart technology to the lighting sector, with information on turnover range, main business segments, product portfolio, connected lighting solutions, lighting controls and protocols used.

ANNEX: Directory of companies mentioned provides contact information for the main companies mentioned in this Report.

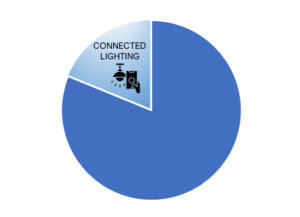

World incidence of connected lighting on LED lighting sales, 2023

The worldwide market for LED lighting fixtures and lamps worth around 85 billion US$ for the year 2023. About 14% of this value is estimated to be represented by “Connected Lighting”. The value of connected lighting products almost doubled over the last five years, posting an average annual growth of +17%.

Professional indoor lighting is currently the segment where connected lighting solutions show the highest penetration, followed by outdoor lighting. The incidence is by far below in residential indoor lighting and lamps. Geographically, the incidence of connected lighting on total LED lighting market is quite similar in Europe and North America, while the same ratio is lower in Asia-Pacific.

The evolution of the connected lighting is closely linked to energy-saving policies. The demand for these products will evolve significantly in the coming years, partly due to the supports provided by governments to achieve environmental targets.

Contents, research tools and methodological notes

Basic data

An overview of the world lighting market

Incidence of connected/smart solutions on total lighting sales

Sales of connected lighting by segment (Residential/Professional, Indoor/Outdoor)

Sales of connected lighting by geographic region

Sales of connected lighting by connection technology (Wired/Wireless)

Activity trend

LED lighting and connected lighting market: activity trend 2019-2023

- -by geographic region

- -by lighting segment

LED lighting and connected lighting market: estimated stock 2019-2023

Consumption of LED-based lighting fixtures and lamps by product and price range

Forecasts

LED Lighting and connected lighting market: forecasts 2024-2026

Demand drivers for the evolution of the connected lighting

Smart connected lighting and the green transition

Connectivity and technology

Lighting controls and protocols

Sensors and interoperability

Case studies for the connected lighting applications by segment

Worldwide competition

Leading companies and market shares in the connected lighting business

Company profiles for selected leading lighting manufacturers and suppliers

Appendix: List of the mentioned companies

SEE ALSO

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in China

September 2023, XVI Ed. , 205 pages

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, consumption, imports and exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview on smart connected lighting trend, the distribution system and the main players operating in the market

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.

The lighting fixtures market in Middle East and North Africa

February 2023, VIII Ed. , 231 pages

The report offers an accurate analysis of the lighting fixtures market in 12 MENA countries: Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia, United Arab Emirates, Egypt, Algeria, Morocco, Tunisia, hereafter referred to as MENA region. The first section of the Report shows the aggregate figures and the outlook of the area, including the activity trend by segment, product, application, the distribution and competition analysis. The second part of the Report contains the analysis by single country considered (data and trend on lighting fixtures market, production and international trade; a description of the distribution system; an overview of the competitive system and major macroeconomic indicators)