September 2023,

XVI Ed. ,

205 pages

Price (single user license):

EUR 1800 / USD 1908

For multiple/corporate license prices please contact us

Language: English

Report code: S.27

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, the consumption, the imports and the exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview of the distribution system and the main players operating in the market.

International Trade

Lighting fixtures exports and imports are considered, broken down by country and by geographical area of destination/origin (total lighting, only lighting fixtures, only lighting components). The time frame considered is 2017-2022.

Supply Structure

The lighting fixtures market is divided in four main segments:

- residential-consumer

- commercial-architectural

- industrial

- outdoor

Data on consumer/residential lighting are broken down by style (traditional, modern, design) and by product type (floor, table, wall and ceiling lamps, embedded lighting, downlight/sport light, chandeliers and suspensions), while data on commercial lighting are broken down by type of product (downlights, recessed luminaires, batten and modular systems, linear, LED strips, high bays, floor and table lamps, decorative and professional suspensions, projectors/spots/track, wall washers, and LED panels) and application (hospitality, office, retail, art and museums, entertainment, schools, airports and other big infrastructures). Industrial lighting consists of lighting for industrial sites, healthcare lighting, weather resistant and explosion-proof lighting, emergency lighting, marine lighting, and horticultural lighting. Outdoor lighting includes residential outdoor lighting, lighting for urban landscape, lighting for streets and major roads, area/campus lighting, lighting for tunnels and galleries, Christmas and special events lighting.

A focus on LED Lighting trend and forecast with an overview on main suppliers of LED chips and LED drivers, as well as an overview on smart/connected lighting and other new technologies available in the market are also included.

A financial analysis, on a sample of selected number of companies operating in the market, includes profitability ratios and financial structure indicators.

Distribution Channels

The analysis of the distribution system is organized by the following channels:

- Contract/Builders

- Lighting Specialists

- Wholesalers

- Lifestyle stores (Furniture stores/chains and department Stores)

- DIY stores

- E-commerce

A selection of leading e-commerce players, architectural offices and lighting designers operating in China is also included.

Competitive System

Finally, the report offers an analysis of the leading local and foreign players present on the Chinese market and in each segment considered; through sales data, market shares and short profiles.

An address list of more than 200 lighting fixtures manufacturer active in China is included.

Selected companies

Among the companies profiled and interviewed:

Anchises, Arup, Boysun, Brilliance, CH Lighting, Chint, Changelight, Chuang Yijia, DP Led, Eaglerise, FarEast, Fagerhult, FSL, Flos, Gloria, Jom, Haoyang, Minkave, Honglitronic, Honyar, Huayi, Huati, Ikea, Illusion Led, Imigy, Inesa Feilo, Inventronics, Jiawei, JD.com, Kennede, Leyard, Ledman, Leedarson, LiquiDesign, Loyal Lighting, Lumbency, Luxmate, MLS-Ledvance, Nationstar, NVC, Ocean’s King, Okeli, OML, Opple, PAK Lighting, Red100, Signify, Sosen, Tecnon, Torshare, Twinsel, Tospo, Unilumin, W2 Architects, Xindeco, Yankon, Yeelight, Youpon, Warom, WooJong, Xin Lichuang, Zhubo Design, Zumtobel

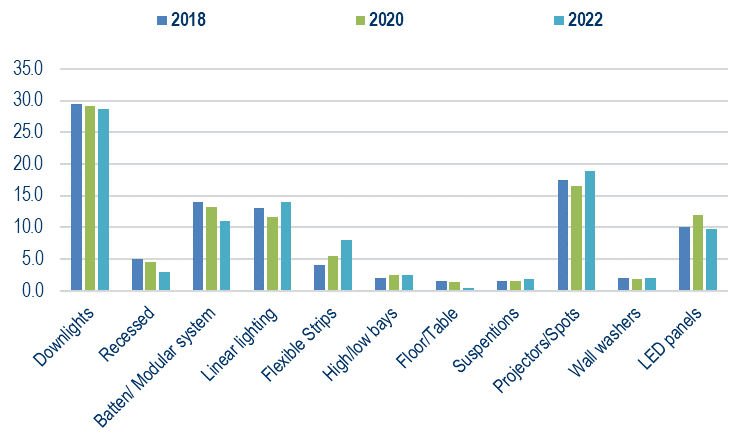

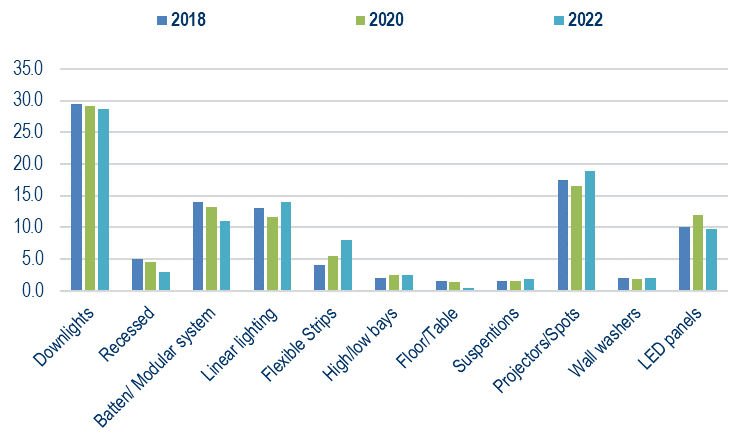

China. Breakdown of commercial lighting fixtures production by product type, 2018-2020-2022. Percentage values

According to CSIL estimate, Chinese lighting market is expected to return to growth in the medium-term; a significant market recovery is attended from 2024, after a reduction by 20% of employment and profitability during the last years.

China’s construction industry is expected to register an average annual growth of 2.4% between 2023 and 2025.

In 2022 production and consumption of luminaires in China are estimated to be worth approximately the same levels as five years ago, in real terms.

The best performing lighting market segments in China in 2022 were: outdoor, hospitality, horticultural and explosion-proof lighting, linear lighting.

Among the top performing players are: Signify, Yankon, Leedarson, CHINT, Haoyang, Youpon, Twinsel, Warom, Gloria Technology, Huadian, Chuang Yijia, Guanke Technologies, LEDMY, OKELI Lighting, CoreShine.

The top 60 players, in term of lighting sales in China, together accounts for over 40% of the market. Less concentrated the Chinese export of lighting fixtures, which is a highly fragmented business involving at least 5,000 players.

Contents of the Report; Research tools and methodological notes; Terminology

Basic Data, activity trend and forecasts

Total lighting market by technology: lighting fixtures and lamps (LED lamps and conventional lamps); Lighting fixtures production, consumption and international trade: total and by market segment (Indoor/Outdoor Lighting, Consumer/Professional Lighting). Data available in USD and RMB. The time frame considered is 2017-2022, forecasts 2023-2025

Mergers and acuisitions deals in the lighting sector, for a sample of companies, 2017-2023

International Trade

Exports and imports of lighting (lighting fixtures, lighting components, lamps) by country and geographical area of destination/origin. Data 2017-2022.

Financial analysis and Supply structure

Key financial data (turnover, EBITDA, EBIT, Net icnome) for a sample of companies; Profitability indicators (ROA, ROE, EBITDA, EBIT) in a sample of companies; Financial structure indicators (Assets, Shareholder funds, Cash flow, Current and Solvency ratio) in a sample of companies; Employment trend

Focus on LED lighting: 2015-2022 estimated data and 2023-2025 forecasts

Main Suppliers of LED chips and LED drivers; An overview on the Connected Lighting market in China

Breakdown of lighting fixtures production by four main segments (residential-consumer, commercial, industrial, outdoor lighting), by style, product type and application. Sector estimates and estimated breakdown for a sample of companies

Distribution

Analysis of the distribution system broken down by channel (Contract sales, Lighting specialist retailers, Lifestyle, Wholesalers, DIY/Home Improvement, E-commerce). Selection of 250 wholesalers of lighting fixtures and lighting equipment in China. Selection of leading architects, interior design studios and lighting designers operating in China.

Lighting fixtures reference prices in China, by product

Competitive system

Lighting sales data and market shares for a sample of leading Chinese and international companies: Total lighting, lighting fixtures and lamps.

Companies’ ranking by market segments (Indoor/Outdoor Lighting, Consumer/Professional Lighting) and applications. Short company profiles

Lighting fixtures export sales and market shares by Region of destination in selected Chinese companies (Asia and Pacific, Europe, Americas, Middle East and Africa)

Demand drivers

Macroeconomic Data (Country indicators). Population and urbanization process. Construction sector and real estate

Appendix: list of mentioned companies

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, the consumption, the imports and the exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview of the distribution system and the main players operating in the market.

International Trade

Lighting fixtures exports and imports are considered, broken down by country and by geographical area of destination/origin (total lighting, only lighting fixtures, only lighting components). The time frame considered is 2017-2022.

Supply Structure

The lighting fixtures market is divided in four main segments:

- residential-consumer

- commercial-architectural

- industrial

- outdoor

Data on consumer/residential lighting are broken down by style (traditional, modern, design) and by product type (floor, table, wall and ceiling lamps, embedded lighting, downlight/sport light, chandeliers and suspensions), while data on commercial lighting are broken down by type of product (downlights, recessed luminaires, batten and modular systems, linear, LED strips, high bays, floor and table lamps, decorative and professional suspensions, projectors/spots/track, wall washers, and LED panels) and application (hospitality, office, retail, art and museums, entertainment, schools, airports and other big infrastructures). Industrial lighting consists of lighting for industrial sites, healthcare lighting, weather resistant and explosion-proof lighting, emergency lighting, marine lighting, and horticultural lighting. Outdoor lighting includes residential outdoor lighting, lighting for urban landscape, lighting for streets and major roads, area/campus lighting, lighting for tunnels and galleries, Christmas and special events lighting.

A focus on LED Lighting trend and forecast with an overview on main suppliers of LED chips and LED drivers, as well as an overview on smart/connected lighting and other new technologies available in the market are also included.

A financial analysis, on a sample of selected number of companies operating in the market, includes profitability ratios and financial structure indicators.

Distribution Channels

The analysis of the distribution system is organized by the following channels:

- Contract/Builders

- Lighting Specialists

- Wholesalers

- Lifestyle stores (Furniture stores/chains and department Stores)

- DIY stores

- E-commerce

A selection of leading e-commerce players, architectural offices and lighting designers operating in China is also included.

Competitive System

Finally, the report offers an analysis of the leading local and foreign players present on the Chinese market and in each segment considered; through sales data, market shares and short profiles.

An address list of more than 200 lighting fixtures manufacturer active in China is included.

China. Breakdown of commercial lighting fixtures production by product type, 2018-2020-2022. Percentage values

According to CSIL estimate, Chinese lighting market is expected to return to growth in the medium-term; a significant market recovery is attended from 2024, after a reduction by 20% of employment and profitability during the last years.

China’s construction industry is expected to register an average annual growth of 2.4% between 2023 and 2025.

In 2022 production and consumption of luminaires in China are estimated to be worth approximately the same levels as five years ago, in real terms.

The best performing lighting market segments in China in 2022 were: outdoor, hospitality, horticultural and explosion-proof lighting, linear lighting.

Among the top performing players are: Signify, Yankon, Leedarson, CHINT, Haoyang, Youpon, Twinsel, Warom, Gloria Technology, Huadian, Chuang Yijia, Guanke Technologies, LEDMY, OKELI Lighting, CoreShine.

The top 60 players, in term of lighting sales in China, together accounts for over 40% of the market. Less concentrated the Chinese export of lighting fixtures, which is a highly fragmented business involving at least 5,000 players.

Contents of the Report; Research tools and methodological notes; Terminology

Basic Data, activity trend and forecasts

Total lighting market by technology: lighting fixtures and lamps (LED lamps and conventional lamps); Lighting fixtures production, consumption and international trade: total and by market segment (Indoor/Outdoor Lighting, Consumer/Professional Lighting). Data available in USD and RMB. The time frame considered is 2017-2022, forecasts 2023-2025

Mergers and acuisitions deals in the lighting sector, for a sample of companies, 2017-2023

International Trade

Exports and imports of lighting (lighting fixtures, lighting components, lamps) by country and geographical area of destination/origin. Data 2017-2022.

Financial analysis and Supply structure

Key financial data (turnover, EBITDA, EBIT, Net icnome) for a sample of companies; Profitability indicators (ROA, ROE, EBITDA, EBIT) in a sample of companies; Financial structure indicators (Assets, Shareholder funds, Cash flow, Current and Solvency ratio) in a sample of companies; Employment trend

Focus on LED lighting: 2015-2022 estimated data and 2023-2025 forecasts

Main Suppliers of LED chips and LED drivers; An overview on the Connected Lighting market in China

Breakdown of lighting fixtures production by four main segments (residential-consumer, commercial, industrial, outdoor lighting), by style, product type and application. Sector estimates and estimated breakdown for a sample of companies

Distribution

Analysis of the distribution system broken down by channel (Contract sales, Lighting specialist retailers, Lifestyle, Wholesalers, DIY/Home Improvement, E-commerce). Selection of 250 wholesalers of lighting fixtures and lighting equipment in China. Selection of leading architects, interior design studios and lighting designers operating in China.

Lighting fixtures reference prices in China, by product

Competitive system

Lighting sales data and market shares for a sample of leading Chinese and international companies: Total lighting, lighting fixtures and lamps.

Companies’ ranking by market segments (Indoor/Outdoor Lighting, Consumer/Professional Lighting) and applications. Short company profiles

Lighting fixtures export sales and market shares by Region of destination in selected Chinese companies (Asia and Pacific, Europe, Americas, Middle East and Africa)

Demand drivers

Macroeconomic Data (Country indicators). Population and urbanization process. Construction sector and real estate

Appendix: list of mentioned companies

SEE ALSO

The worldwide market for connected lighting

February 2024, I Ed. , 88 pages

This report analyses the global lighting market focusing on LED and connected lighting trends. It provides market forecasts emphasizing the impact of green transition and digital transformation. The study also includes a section on industry competition, estimating sales, and market shares for leading manufacturers.

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.

The lighting fixtures market in Middle East and North Africa

February 2023, VIII Ed. , 231 pages

The report offers an accurate analysis of the lighting fixtures market in 12 MENA countries: Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia, United Arab Emirates, Egypt, Algeria, Morocco, Tunisia, hereafter referred to as MENA region. The first section of the Report shows the aggregate figures and the outlook of the area, including the activity trend by segment, product, application, the distribution and competition analysis. The second part of the Report contains the analysis by single country considered (data and trend on lighting fixtures market, production and international trade; a description of the distribution system; an overview of the competitive system and major macroeconomic indicators)