RAPPORTO IN LINGUA INGLESE

Luglio 2017,

III Ed. ,

84 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1712

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S66

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

Please note: up-to-date data for The office furniture market in China and for the whole Asia Pacific area are available in the report The office furniture market in Asia Pacific and China (November 2021). Country analysis in the study is provided for Australia, China, India, Japan, Malaysia, South Korea, Taiwan (China), Thailand, Vietnam, with a special focus on China. For more information, please visit https://worldfurnitureonline.com/research-market/the-office-furniture-market-asia-pacific-0058538.htm and contact us

CSIL Market Research The office furniture market in China studies the size of the office furniture market, historical trends in office furniture production and consumption, imports and exports.

The report is enriched by an in-depth analysis of the competitive system in terms of company size, manufacturing locations and product breakdown.

Figures for sales and estimates of market shares for the leading office furniture manufacturers operating in China are also available (total office furniture production and segments: seating, operative desks, executive furniture, storage, wall-to-wall units).

Short profiles of the top office furniture manufacturers are also available.

Office furniture production is reported by segment (office seating, operative desks, executive furniture, office storage, wall-to-wall units). The analysis of supply includes product sub-segments (i.e. chairs by type, office desks by type) and materials used. The figures are given for a medium term time span (2010-2016) giving an indication of the market trend.

Office furniture imports and exports are broken down by country and geographical area of origin/destination.

A focus on the domestic market includes average prices declared by companies during the survey, sales by region and by main customers (public sector, foreign multinationals, medium and large private companies, small private companies, independent white collars, banking/insurance).

Data on the distribution system are also provided, with sales broken down by distribution channel and kind of customer.

An analysis of price levels is included, with a particular focus on office swivel chairs where brand positioning is given on the basis of the number of units manufactured by single company and the average price.

An analysis of the market potential focuses on the construction sector, the richest Chinese cities, luxury retail locations, trends in the hospitality sector and the commercial lighting fixtures segment.

Over 100 addresses of key operators are included. The study was carried out via direct interviews with more than 120 sector firms and distributors operating on the Chinese market.

Aziende selezionate

Aurora, Botai, C R Logic, Changjiang, Dious, Headway, Henglin Chair, Herman Miller, Hongye, Jongtay-Paiger, Kinwai, Kuo Ching, Lamex, Qianglong, Quama, Saosen, Sijin, Steelcase Asia Pacific, Sunon, UE Furniture, Victory Office Systems

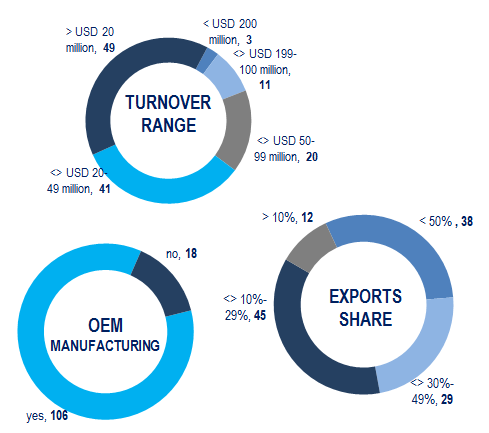

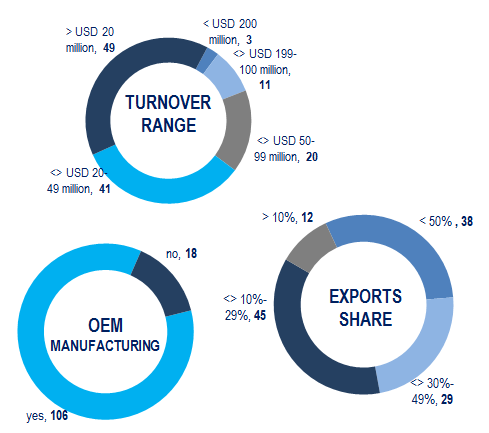

THE SAMPLE. Number of companies

With a total production value of US$ 14.8 billion in 2016, increasing by 12% on average over the last decade, China is the leading office furniture manufacturer at a world level. Furthermore, China, whose share of exports increased from 18% in 2007 to 38% in 2016 (US$ 3.7 billion) is also the major world exporter and the main supplier to the United States, Germany, France, the United Kingdom and Japan.

The industrial structure in China is highly fragmented as the majority of office furniture manufacturers are small and medium-sized companies. The largest 100 players in terms of turnover account for less than 40% of total production.

The increasing pressure due to higher operational costs is forcing some smaller players to close down. At the low-end of the market China is experiencing competition from other Asian countries and from North American brands.

Abstract of Table of Contents

EXECUTIVE SUMMARY

INTRODUCTION

Research field and methodology

The sample

THE OFFICE FURNITURE SECTOR

Production, consumption, exports and imports over the period 2011-2016 Values in USD and RMB

Sector peculiarities

- Total sales of office furniture for the top 10 manufacturers, 2016. Million USD and % market shares

- Office furniture consumption forecast

THE OFFICE FURNITURE SUPPLY

Manufacturing presence

- Anji Chair District

COMPETITION

Market shares

Sales by product

- Office seating, Operative desks, Executive furntiure, Filing cabinets and storage, Wall-to-wall units and Partitions

THE DOMESTIC MARKET

Sales by region and market shares

Customer segmentation and distribution channels

Prices

INTERNATIONAL TRADE

China top office furniture exporter worldwide

- China. Top ten markets for office furniture exports. Chinese export activity and penetration.

Exports

Imports

DEMAND DETERMINANTS

ANNEX 1. ADDITIONAL STATISTICS

ANNEX 2 TRADE FAIRS, AND ASSOCIATIONS

ANNEX 3. LIST OF MANUFACTURERS

Please note: up-to-date data for The office furniture market in China and for the whole Asia Pacific area are available in the report The office furniture market in Asia Pacific and China (November 2021). Country analysis in the study is provided for Australia, China, India, Japan, Malaysia, South Korea, Taiwan (China), Thailand, Vietnam, with a special focus on China. For more information, please visit https://worldfurnitureonline.com/research-market/the-office-furniture-market-asia-pacific-0058538.htm and contact us

CSIL Market Research The office furniture market in China studies the size of the office furniture market, historical trends in office furniture production and consumption, imports and exports.

The report is enriched by an in-depth analysis of the competitive system in terms of company size, manufacturing locations and product breakdown.

Figures for sales and estimates of market shares for the leading office furniture manufacturers operating in China are also available (total office furniture production and segments: seating, operative desks, executive furniture, storage, wall-to-wall units).

Short profiles of the top office furniture manufacturers are also available.

Office furniture production is reported by segment (office seating, operative desks, executive furniture, office storage, wall-to-wall units). The analysis of supply includes product sub-segments (i.e. chairs by type, office desks by type) and materials used. The figures are given for a medium term time span (2010-2016) giving an indication of the market trend.

Office furniture imports and exports are broken down by country and geographical area of origin/destination.

A focus on the domestic market includes average prices declared by companies during the survey, sales by region and by main customers (public sector, foreign multinationals, medium and large private companies, small private companies, independent white collars, banking/insurance).

Data on the distribution system are also provided, with sales broken down by distribution channel and kind of customer.

An analysis of price levels is included, with a particular focus on office swivel chairs where brand positioning is given on the basis of the number of units manufactured by single company and the average price.

An analysis of the market potential focuses on the construction sector, the richest Chinese cities, luxury retail locations, trends in the hospitality sector and the commercial lighting fixtures segment.

Over 100 addresses of key operators are included. The study was carried out via direct interviews with more than 120 sector firms and distributors operating on the Chinese market.

THE SAMPLE. Number of companies

With a total production value of US$ 14.8 billion in 2016, increasing by 12% on average over the last decade, China is the leading office furniture manufacturer at a world level. Furthermore, China, whose share of exports increased from 18% in 2007 to 38% in 2016 (US$ 3.7 billion) is also the major world exporter and the main supplier to the United States, Germany, France, the United Kingdom and Japan.

The industrial structure in China is highly fragmented as the majority of office furniture manufacturers are small and medium-sized companies. The largest 100 players in terms of turnover account for less than 40% of total production.

The increasing pressure due to higher operational costs is forcing some smaller players to close down. At the low-end of the market China is experiencing competition from other Asian countries and from North American brands.

Abstract of Table of Contents

EXECUTIVE SUMMARY

INTRODUCTION

Research field and methodology

The sample

THE OFFICE FURNITURE SECTOR

Production, consumption, exports and imports over the period 2011-2016 Values in USD and RMB

Sector peculiarities

- Total sales of office furniture for the top 10 manufacturers, 2016. Million USD and % market shares

- Office furniture consumption forecast

THE OFFICE FURNITURE SUPPLY

Manufacturing presence

- Anji Chair District

COMPETITION

Market shares

Sales by product

- Office seating, Operative desks, Executive furntiure, Filing cabinets and storage, Wall-to-wall units and Partitions

THE DOMESTIC MARKET

Sales by region and market shares

Customer segmentation and distribution channels

Prices

INTERNATIONAL TRADE

China top office furniture exporter worldwide

- China. Top ten markets for office furniture exports. Chinese export activity and penetration.

Exports

Imports

DEMAND DETERMINANTS

ANNEX 1. ADDITIONAL STATISTICS

ANNEX 2 TRADE FAIRS, AND ASSOCIATIONS

ANNEX 3. LIST OF MANUFACTURERS

RAPPORTI CORRELATI

The world office furniture industry (English)

Dicembre 2023,

XII Ed. ,

442 pagine

L'industria mondiale dei mobili per ufficio

Panoramica del settore mondiale dell’arredo ufficio con dati di produzione, consumo, importazioni ed esportazioni 2014-2023, commercio internazionale, previsioni di mercato 2024 e 2025, profili dei principali produttori e le tabelle di sintesi per 60 Paesi. Focus sui 20 principali paesi produttori di mobili per ufficio.

The World Market for Height Adjustable Tables (English)

Novembre 2023,

I Ed. ,

80 pagine

Il mercato mondiale delle scrivanie regolabili in altezza

Rapporto dettagliato sul settore mondiale delle scrivanie regolabili in altezza (HAT), che analizza le tendenze e le previsioni di mercato per le principali aree geografiche e regioni nel mondo, i maggiori player (produttori e fornitori), la destinazione di prodotto.

The world market for office seating (English)

Novembre 2023,

II Ed. ,

162 pagine

Il mercato mondiale delle sedute per ufficio

Rapporto dettagliato che analizza il settore mondiale delle sedute per ufficio, con dati di produzione, consumo e commercio internazionale per la serie storica 2018-2023, previsioni del mercato 2024 e 2025, il sistema competitivo, le diverse tipologie di prodotto e le loro caratteristiche, con un focus su tre aree (Nord America, Europa e Asia-Pacifico) e paesi chiave.

The office furniture market in North America: the United States, Canada and Mexico (English)

Luglio 2023,

VII Ed. ,

129 pagine

Il mercato dei mobili per ufficio in Nord America: Stati Uniti, Canada e Messico

Analisi dell’industria dei mobili per ufficio in Nord America, con focus su Stati Uniti, Canada e Messico. Valore del mercato e previsioni, dati per paese, quote di mercato delle aziende leader, canali distributivi.

The European market for office furniture (English)

Giugno 2023,

XXXV Ed. ,

281 pagine

Il mercato europeo dei mobili per ufficio

Analisi dettagliata del settore dei mobili per ufficio in Europa: dati storici, principali indicatori e dati di base, prospettive della domanda, sistema competitivo e performance dei principali produttori, categorie di prodotto e distribuzione.