RAPPORTO IN LINGUA INGLESE

Luglio 2015,

I Ed. ,

75 pagine

Prezzo (licenza per singolo utente):

EUR 2000 / USD 2140

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S80

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

This NEW report, The office furniture market in the Gulf countries provides market trends and updated data on the office furniture production, consumption, import and exports in 6 countries of the Gulf Region.

Office furniture sales are broken down by segment (office seating, operative desks, executive furniture, storage, communal areas) and by distribution channels (direct sales, furniture dealers, contractors and architects).

Office furniture imports and exports are broken down by country and geographical area of origin/destination.

Forecasts 2015 and 2016 of office furniture consumption are available.

The report gives figures on sales and estimates on market shares for approximately 100 sector companies operating in the region and also includes short profiles of leading manufacturers (local and international).

Market quantification is accompanied by a description of competition and a particular focus on distribution and how international players operate on the market.

An analysis of the furniture market includes: Demand Drivers (macroeconomic indicators, population GDP, and details on the potential market in the contract sector).

Countries considered: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates

Annex provides addresses of about 100 leading office companies and a list of selected trade press as well as a list of sector fair.

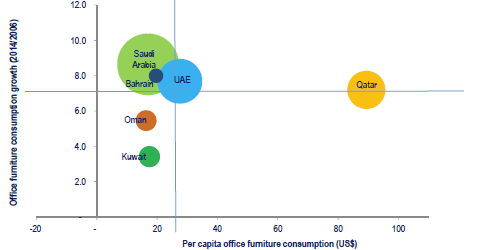

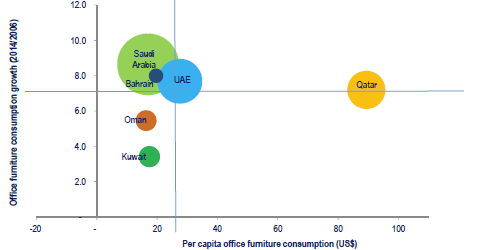

Gulf Countries. Office furniture market. Market positioning

The office furniture market in the Gulf Countries is worth about US$ 1,054 million. Manufacturing activities in the region are still limited (Saudi Arabia is an exception) and imported items claim the largest market share.

The largest markets in terms of office furniture consumption are Saudi Arabia, UAE and Qatar.

According to CSIL estimates, office furniture consumption across the whole region increased on average by 2.3% in 2014 and performances are expected to improve in 2015 and 2016.

Abstract of Table of Contents

0 METHODOLOGY

1. OFFICE FURNITURE MARKET: OUTLOOK

1.1 Market overview of the Gulf countries

Basic data: Furniture production, consumption, imports and exports, US$ million

Gulf Countries. Real growth in office furniture consumption. Forecasts 2015 and 2016. % change

Gulf Countries. Office furniture. Market positioning: largest markets in terms of office furniture consumption , highest per capita office consumption and fastest growing markets

Gulf Countries. Commercial supply in the largest marketplaces in 2014. Thousand square metres

Top 100 private projects in the Gulf Region. % shares of total project values

For each of the considered country: BAHRAIN, KUWAIT, OMAN, QATAR, SAUDI ARABIA, UNITED ARAB EMIRATES

2.1 Office furniture market: basic data

Furniture production, consumption, imports and exports, US$ million

Office furniture consumption. Forecasts 2015 and 2016. % change in real terms

2.2 International trade

2.3 Demand drivers and macroeconomic indicators

8. COMPETITIVE SYSTEM IN THE GULF COUNTRIES

8.1 Overview: leading local companies and foreign players

Total office furniture sales in a sample of leading companies. US$ million and percentages

9. PRODUCTS, DISTRIBUTION AND PRICES

9.1 Product segments

Office seating, Operative desking, Executive furniture, Storage filing and cabinets, Wall to wall units/Partitions, Furniture for communal areas

9.2 Projects and distribution channels

Leading contracting companies.

12. ANNEX

12.1 Trade fairs and main magazines

12.2 List of useful contacts

This NEW report, The office furniture market in the Gulf countries provides market trends and updated data on the office furniture production, consumption, import and exports in 6 countries of the Gulf Region.

Office furniture sales are broken down by segment (office seating, operative desks, executive furniture, storage, communal areas) and by distribution channels (direct sales, furniture dealers, contractors and architects).

Office furniture imports and exports are broken down by country and geographical area of origin/destination.

Forecasts 2015 and 2016 of office furniture consumption are available.

The report gives figures on sales and estimates on market shares for approximately 100 sector companies operating in the region and also includes short profiles of leading manufacturers (local and international).

Market quantification is accompanied by a description of competition and a particular focus on distribution and how international players operate on the market.

An analysis of the furniture market includes: Demand Drivers (macroeconomic indicators, population GDP, and details on the potential market in the contract sector).

Countries considered: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, United Arab Emirates

Annex provides addresses of about 100 leading office companies and a list of selected trade press as well as a list of sector fair.

Gulf Countries. Office furniture market. Market positioning

The office furniture market in the Gulf Countries is worth about US$ 1,054 million. Manufacturing activities in the region are still limited (Saudi Arabia is an exception) and imported items claim the largest market share.

The largest markets in terms of office furniture consumption are Saudi Arabia, UAE and Qatar.

According to CSIL estimates, office furniture consumption across the whole region increased on average by 2.3% in 2014 and performances are expected to improve in 2015 and 2016.

Abstract of Table of Contents

0 METHODOLOGY

1. OFFICE FURNITURE MARKET: OUTLOOK

1.1 Market overview of the Gulf countries

Basic data: Furniture production, consumption, imports and exports, US$ million

Gulf Countries. Real growth in office furniture consumption. Forecasts 2015 and 2016. % change

Gulf Countries. Office furniture. Market positioning: largest markets in terms of office furniture consumption , highest per capita office consumption and fastest growing markets

Gulf Countries. Commercial supply in the largest marketplaces in 2014. Thousand square metres

Top 100 private projects in the Gulf Region. % shares of total project values

For each of the considered country: BAHRAIN, KUWAIT, OMAN, QATAR, SAUDI ARABIA, UNITED ARAB EMIRATES

2.1 Office furniture market: basic data

Furniture production, consumption, imports and exports, US$ million

Office furniture consumption. Forecasts 2015 and 2016. % change in real terms

2.2 International trade

2.3 Demand drivers and macroeconomic indicators

8. COMPETITIVE SYSTEM IN THE GULF COUNTRIES

8.1 Overview: leading local companies and foreign players

Total office furniture sales in a sample of leading companies. US$ million and percentages

9. PRODUCTS, DISTRIBUTION AND PRICES

9.1 Product segments

Office seating, Operative desking, Executive furniture, Storage filing and cabinets, Wall to wall units/Partitions, Furniture for communal areas

9.2 Projects and distribution channels

Leading contracting companies.

12. ANNEX

12.1 Trade fairs and main magazines

12.2 List of useful contacts

RAPPORTI CORRELATI

The world office furniture industry (English)

Dicembre 2023,

XII Ed. ,

442 pagine

L'industria mondiale dei mobili per ufficio

Panoramica del settore mondiale dell’arredo ufficio con dati di produzione, consumo, importazioni ed esportazioni 2014-2023, commercio internazionale, previsioni di mercato 2024 e 2025, profili dei principali produttori e le tabelle di sintesi per 60 Paesi. Focus sui 20 principali paesi produttori di mobili per ufficio.

The World Market for Height Adjustable Tables (English)

Novembre 2023,

I Ed. ,

80 pagine

Il mercato mondiale delle scrivanie regolabili in altezza

Rapporto dettagliato sul settore mondiale delle scrivanie regolabili in altezza (HAT), che analizza le tendenze e le previsioni di mercato per le principali aree geografiche e regioni nel mondo, i maggiori player (produttori e fornitori), la destinazione di prodotto.

The world market for office seating (English)

Novembre 2023,

II Ed. ,

162 pagine

Il mercato mondiale delle sedute per ufficio

Rapporto dettagliato che analizza il settore mondiale delle sedute per ufficio, con dati di produzione, consumo e commercio internazionale per la serie storica 2018-2023, previsioni del mercato 2024 e 2025, il sistema competitivo, le diverse tipologie di prodotto e le loro caratteristiche, con un focus su tre aree (Nord America, Europa e Asia-Pacifico) e paesi chiave.

The office furniture market in North America: the United States, Canada and Mexico (English)

Luglio 2023,

VII Ed. ,

129 pagine

Il mercato dei mobili per ufficio in Nord America: Stati Uniti, Canada e Messico

Analisi dell’industria dei mobili per ufficio in Nord America, con focus su Stati Uniti, Canada e Messico. Valore del mercato e previsioni, dati per paese, quote di mercato delle aziende leader, canali distributivi.

The European market for office furniture (English)

Giugno 2023,

XXXV Ed. ,

281 pagine

Il mercato europeo dei mobili per ufficio

Analisi dettagliata del settore dei mobili per ufficio in Europa: dati storici, principali indicatori e dati di base, prospettive della domanda, sistema competitivo e performance dei principali produttori, categorie di prodotto e distribuzione.