RAPPORTO IN LINGUA INGLESE

Ottobre 2017,

I Ed. ,

29 pagine

Prezzo (licenza per singolo utente):

EUR 1000 / USD 1070

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: IT41

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

This report analyses the the parasol market in Italy, and its competitive system.

The estimated size of the parasol market and its development over the last five years are presented.

The share of imports out of total consumption and its evolution over time is also shown.

The report comprises an analysis of the distribution channels on the Italian parasol market, including an estimate of their market shares. Estimates of the size of the different market ranges (low, middle-low, middle, middle-upper and high-end) are also provided.

A complete picture of the competitive arena is provided, with estimated market shares for over 30 top market players, including Italian and foreign manufacturers specialising in parasols, outdoor furniture companies that also provide parasols and importers.

The contract market is discussed and an estimate of its weight on the total market is provided.

The report also shows key product trends.

Aziende selezionate

Armagi, Bizzotto, Cosma, Dedon, Emu, Ethimo, Extremis, FIM, Fischer Moebel, Gandia Blasco, Glatz, Greenline, Guidetti, Il Giardino di Legno, Maffei, Manutti, Moia, Nuovo Ombrellificio Romano, Ombrelificio Silvia, Ombrellificio Ciompi, Ombrellificio Crema, Ombrellificio Magnani, Ombrellificio Poggesi, Ombrellificio Toscano, Ombrellificio Veneto, Ramberti, Royal Botania, Scolaro, Spillantini, Symo, Tessitura Fabbri, Talenti, Tessitura Selva, Tuuci, Umbrosa, Unopiù, Zucchelli

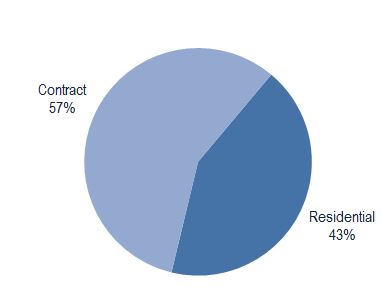

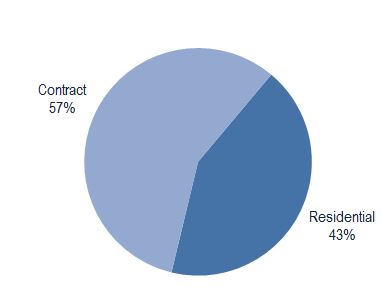

Breakdown of the Italian parasols market by market segment, in value, 2016. %

Overall the contract market accounts for 56% of the total value of the parasol market in Italy. The share of the residential market would be much higher if we considered the market in volume. About 40% of the parasol contract market is claimed by the beach establishments sub-segment.

As regards the dynamics of the contract and residential market, the contract market is currently the better performer, especially if we focus on the middle-to-high ranges. Within the contract segment the demand for parasols from beach establishments has declined over recent years, but the demand for parasols for hotels, bars and restaurants has increased and led to an overall increase in the contract segment.

Abstract of Table of Contents

Methodological notes

Executive summary

Market Size and development

Import flows

Product prices

Market breakdown

Selection of brands by main market range

Competitive system and top players

Market shares

Characteristics of different types of market players in Italy

Focus on selected market players

Sales by market: contract and residential

Size of the contract and residential segments

Contract segments characteristics

The residential segment

Sales by distribution channels

Product trends

This report analyses the the parasol market in Italy, and its competitive system.

The estimated size of the parasol market and its development over the last five years are presented.

The share of imports out of total consumption and its evolution over time is also shown.

The report comprises an analysis of the distribution channels on the Italian parasol market, including an estimate of their market shares. Estimates of the size of the different market ranges (low, middle-low, middle, middle-upper and high-end) are also provided.

A complete picture of the competitive arena is provided, with estimated market shares for over 30 top market players, including Italian and foreign manufacturers specialising in parasols, outdoor furniture companies that also provide parasols and importers.

The contract market is discussed and an estimate of its weight on the total market is provided.

The report also shows key product trends.

Breakdown of the Italian parasols market by market segment, in value, 2016. %

Overall the contract market accounts for 56% of the total value of the parasol market in Italy. The share of the residential market would be much higher if we considered the market in volume. About 40% of the parasol contract market is claimed by the beach establishments sub-segment.

As regards the dynamics of the contract and residential market, the contract market is currently the better performer, especially if we focus on the middle-to-high ranges. Within the contract segment the demand for parasols from beach establishments has declined over recent years, but the demand for parasols for hotels, bars and restaurants has increased and led to an overall increase in the contract segment.

Abstract of Table of Contents

Methodological notes

Executive summary

Market Size and development

Import flows

Product prices

Market breakdown

Selection of brands by main market range

Competitive system and top players

Market shares

Characteristics of different types of market players in Italy

Focus on selected market players

Sales by market: contract and residential

Size of the contract and residential segments

Contract segments characteristics

The residential segment

Sales by distribution channels

Product trends

RAPPORTI CORRELATI

The European Market for outdoor furniture (English)

Marzo 2024,

VII Ed. ,

111 pagine

Il mercato europeo dei mobili per esterni

Analisi dettagliata del settore del mobile per esterni in Europa, con un focus su 15 Paesi (Austria, Belgio, Danimarca, Finlandia, Francia, Germania, Italia, Paesi Bassi, Norvegia, Polonia, Portogallo, Spagna, Svezia, Svizzera, Regno Unito) che fornisce informazioni sulle dimensioni del mercato, sulle previsioni, sulla produzione, sul commercio internazionale, sui segmenti di destinazione, sulle tendenze di prodotto e sulla distribuzione, sul sistema competitivo, sui principali produttori.