RAPPORTO IN LINGUA INGLESE

Marzo 2021,

II Ed. ,

137 pagine

Prezzo (licenza per singolo utente):

EUR 1200 / USD 1272

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: M04

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

Pushed by the pandemic, e-commerce became the fastest growing distribution channel in the furniture sector. What’s its incidence in the office furniture segment? This report analyses status and prospects of e-commerce for the office furniture industry and it is mainly divided in two parts.

PART I. ECOMMERCE FOR THE OFFICE FURNITURE INDUSTRY deals with the incidence of the online channel in the office furniture market with a focus on key geographical areas (Europe, North America, Asia) and analyses the different e-commerce business models and the performance of leading countries and players.

An overview of the world office furniture industry, with current furniture consumption data, and 2021 furniture market forecasts by region, introduces this part.

Office furniture e-commerce sales are provided by product category (Swivel chairs, Home office desks, Standard desks, Height-Adjustable desks, Other*), by region and by kind of distributor (E-tailers, Office and furniture distributors, Non-specialists/Lifestyle/DIY and Manufacturers with owned webshop).

Different e-commerce business models (Office furniture Manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains), their evolution and organization are discussed in light of companies’ experiences: the Omni-channel approach, Augmented reality, the incidence of mobile commerce, advertising strategies and the use of social media.

FOCUS ON: The furniture e-commerce business in Europe (details for Scandinavia, DACH, Benelux, France, Italy, Spain&Portugal, United Kingdom and Poland), North America (United States and Canada) and Asia (China, Japan, India): for each considered geographical area the report analyses the value and the incidence of e-commerce and the sales of the leading furniture and office furniture e-commerce players (websites selling office furniture, office manufacturers selling on-line).

Online sales of office furniture and related products are presented for around 170 leading players based in North America, Europe and Asia, with profiles highlighting their e-commerce policies. Profiles of the major companies are also provided.

PART II. E-COMMERCE FOR THE OFFICE FURNITURE INDUSTRY: SURVEY RESULTS

This part provides results of CSIL survey conducted on February-March, 2021 to leading office furniture manufacturers and distributors worldwide, aiming at understanding their approach to the web channel, their strategies, their future expectations, the most-demanded products and the average budgets by product category.

Aziende selezionate

Amazon, AJ Products, Ambientedirect, Buerostuhl24, Coupang, Cymax, Design Within Reach, Fully, Herman Miller, Home 24, Knoll, Ikea, JD, John Lewis, Office Depot, Overstock, Pepperfry, Restoration Hardware, Sediarreda, Steelcase, Suning, Tmall, Wayfair, Williams-Sonoma.

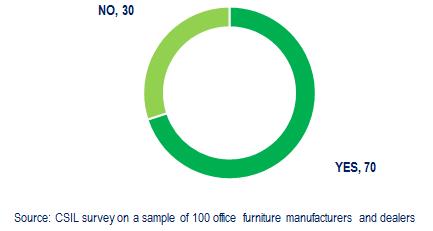

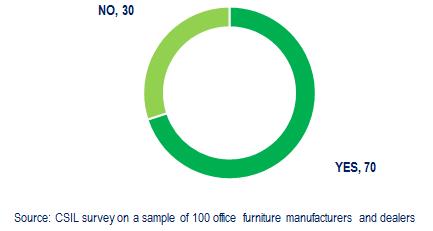

Does your company sell through E-COMMERCE in 2020?

(% breakdown of number of quotes)

The world furniture industry has been severely affected by the pandemic. According to CSIL, global office furniture consumption registered an unprecedented decrease in 2020.

At the same time, the restrictions of epidemic and the developing of working from home, has conducted e-commerce in the office furniture sector to develop very fast in recent months. The 2020 trend has been the opposite of the one registered by the office furniture sector. While the global office furniture consumption dropped in 2020, e-commerce consumption increased at a double digit rate in the same year.

Office furniture manufacturers are strongly investing in e-commerce and the majority of them already used this channel during 2020, despite it represented on average less than 5% of revenues. As it emerged from the CSIL survey, over 80% of companies currently not using e-commerce declared their intention to enter this channel within 2022.

Abstract of Table of Contents

INTRODUCTION. Research Tools, Methodology, Sample of companies

EXECUTIVE SUMMARY. E-commerce for the office furniture sector at a glance

1. E-COMMERCE FOR THE OFFICE FURNITURE INDUSTRY

1.1 An overview of the office furniture market

1.2. E-commerce for the furniture industry: basic data

- E-commerce incidence on office furniture consumption

- Office furniture consumption and e-commerce sales by geographic region

- E-commerce of office furniture by product

1.3. Models of e-commerce business: Office Furniture Manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains

2. ACTIVITY TREND

2.1. E-commerce growth trends

2.2. The business evolution and organisation: Omnichannel approach, Augmented reality, Mobile shopping tips, Social media and advertising strategies

3. EUROPE

3.1. Retail and e-commerce sales: overview and demand drivers

- Economic and E-commerce Indicators

- The United Kingdom, Germany, France and Spain: e-commerce indicators

3.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

3.3. Leading e-commerce players. Office supplies and stationery dealers

3.4. Office manufacturers selling on-line

4. NORTH AMERICA

4.1. Retail and e-commerce sales: overview and demand drivers

- United States and Canada. Economic and e-commerce Indicators

4.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

4.3. Leading e-commerce players

4.4. Office furniture manufacturers selling on-line

5. ASIA

5.1. Retail and e-commerce sales: overview and demand drivers

- Asia Pacific: China, India and Japan. Economic and E-commerce Indicators

5.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

5.3. Leading e-commerce players, in China, India, Japan, South Korea and Australia

6. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS

6.1. The sample

6.2. Revenue performance and expectations

6.3. The use of e-commerce

6.4. E-commerce channel and promotion

6.5. Products, customers, budgets

4.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

4.3. Leading e-commerce players

4.4. Office furniture manufacturers selling on-line

5. ASIA

5.1. Retail and e-commerce sales: overview and demand drivers

- Asia Pacific: China, India and Japan. Economic and E-commerce Indicators

5.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

5.3. Leading e-commerce players, in China, India, Japan, South Korea and Australia

6. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS

6.1. The sample

6.2. Revenue performance and expectations

6.3. The use of e-commerce

6.4. E-commerce channel and promotion

6.5. Products, customers, budgets

Pushed by the pandemic, e-commerce became the fastest growing distribution channel in the furniture sector. What’s its incidence in the office furniture segment? This report analyses status and prospects of e-commerce for the office furniture industry and it is mainly divided in two parts.

PART I. ECOMMERCE FOR THE OFFICE FURNITURE INDUSTRY deals with the incidence of the online channel in the office furniture market with a focus on key geographical areas (Europe, North America, Asia) and analyses the different e-commerce business models and the performance of leading countries and players.

An overview of the world office furniture industry, with current furniture consumption data, and 2021 furniture market forecasts by region, introduces this part.

Office furniture e-commerce sales are provided by product category (Swivel chairs, Home office desks, Standard desks, Height-Adjustable desks, Other*), by region and by kind of distributor (E-tailers, Office and furniture distributors, Non-specialists/Lifestyle/DIY and Manufacturers with owned webshop).

Different e-commerce business models (Office furniture Manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains), their evolution and organization are discussed in light of companies’ experiences: the Omni-channel approach, Augmented reality, the incidence of mobile commerce, advertising strategies and the use of social media.

FOCUS ON: The furniture e-commerce business in Europe (details for Scandinavia, DACH, Benelux, France, Italy, Spain&Portugal, United Kingdom and Poland), North America (United States and Canada) and Asia (China, Japan, India): for each considered geographical area the report analyses the value and the incidence of e-commerce and the sales of the leading furniture and office furniture e-commerce players (websites selling office furniture, office manufacturers selling on-line).

Online sales of office furniture and related products are presented for around 170 leading players based in North America, Europe and Asia, with profiles highlighting their e-commerce policies. Profiles of the major companies are also provided.

PART II. E-COMMERCE FOR THE OFFICE FURNITURE INDUSTRY: SURVEY RESULTS

This part provides results of CSIL survey conducted on February-March, 2021 to leading office furniture manufacturers and distributors worldwide, aiming at understanding their approach to the web channel, their strategies, their future expectations, the most-demanded products and the average budgets by product category.

Does your company sell through E-COMMERCE in 2020?

(% breakdown of number of quotes)

The world furniture industry has been severely affected by the pandemic. According to CSIL, global office furniture consumption registered an unprecedented decrease in 2020.

At the same time, the restrictions of epidemic and the developing of working from home, has conducted e-commerce in the office furniture sector to develop very fast in recent months. The 2020 trend has been the opposite of the one registered by the office furniture sector. While the global office furniture consumption dropped in 2020, e-commerce consumption increased at a double digit rate in the same year.

Office furniture manufacturers are strongly investing in e-commerce and the majority of them already used this channel during 2020, despite it represented on average less than 5% of revenues. As it emerged from the CSIL survey, over 80% of companies currently not using e-commerce declared their intention to enter this channel within 2022.

Abstract of Table of Contents

INTRODUCTION. Research Tools, Methodology, Sample of companies

EXECUTIVE SUMMARY. E-commerce for the office furniture sector at a glance

1. E-COMMERCE FOR THE OFFICE FURNITURE INDUSTRY

1.1 An overview of the office furniture market

1.2. E-commerce for the furniture industry: basic data

- E-commerce incidence on office furniture consumption

- Office furniture consumption and e-commerce sales by geographic region

- E-commerce of office furniture by product

1.3. Models of e-commerce business: Office Furniture Manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains

2. ACTIVITY TREND

2.1. E-commerce growth trends

2.2. The business evolution and organisation: Omnichannel approach, Augmented reality, Mobile shopping tips, Social media and advertising strategies

3. EUROPE

3.1. Retail and e-commerce sales: overview and demand drivers

- Economic and E-commerce Indicators

- The United Kingdom, Germany, France and Spain: e-commerce indicators

3.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

3.3. Leading e-commerce players. Office supplies and stationery dealers

3.4. Office manufacturers selling on-line

4. NORTH AMERICA

4.1. Retail and e-commerce sales: overview and demand drivers

- United States and Canada. Economic and e-commerce Indicators

4.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

4.3. Leading e-commerce players

4.4. Office furniture manufacturers selling on-line

5. ASIA

5.1. Retail and e-commerce sales: overview and demand drivers

- Asia Pacific: China, India and Japan. Economic and E-commerce Indicators

5.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

5.3. Leading e-commerce players, in China, India, Japan, South Korea and Australia

6. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS

6.1. The sample

6.2. Revenue performance and expectations

6.3. The use of e-commerce

6.4. E-commerce channel and promotion

6.5. Products, customers, budgets

4.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

4.3. Leading e-commerce players

4.4. Office furniture manufacturers selling on-line

5. ASIA

5.1. Retail and e-commerce sales: overview and demand drivers

- Asia Pacific: China, India and Japan. Economic and E-commerce Indicators

5.2. Sector overview. Office furniture consumption, e-commerce sales and market shares by country

5.3. Leading e-commerce players, in China, India, Japan, South Korea and Australia

6. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS

6.1. The sample

6.2. Revenue performance and expectations

6.3. The use of e-commerce

6.4. E-commerce channel and promotion

6.5. Products, customers, budgets

RAPPORTI CORRELATI

Furniture retailing in Europe (English)

Febbraio 2024,

XVII Ed. ,

296 pagine

La distribuzione del mobile in Europa

Analisi della distribuzione di mobili per la casa in 15 paesi europei. Il rapporto fornisce trend di consumo di mobili per la casa, previsioni di mercato, dati per paese, analisi per canale distributivo, formati di vendita e performance dei principali rivenditori di mobili per la casa in Europa

Top 100 mattress specialist retailers in Europe (English)

Novembre 2023,

I Ed. ,

14 pagine

Top 100 rivenditori specializzati di materassi in Europa

Il mercato europeo dei materassi: ranking dei 100 principali rivenditori specializzati in materassi in Europa.

E-commerce in the mattress industry (English)

Settembre 2023,

V Ed. ,

102 pagine

E-commerce nell'industria dei materassi

Ricerca dettagliata sul mercato mondiale dei materassi online con focus su tre aree: Nord America, Europa e Asia Pacifico. Questo studio fornisce dati di vendita, analisi dei principali mercati, l’incidenza delle vendite di materassi online nei principali paesi (Stati Uniti, Canada, Cina, India, Corea del Sud, Germania, Regno Unito, Francia, Italia e Spagna), le vendite di materassi online dei principali rivenditori e i profili delle maggiori aziende del settore.

La distribuzione del mobile in Italia. Analisi per provincia

Luglio 2023, XX Ed. , 174 pagine

Questo rapporto fornisce un quadro dettagliato della distribuzione del mobile e la sua evoluzione e dei consumi di mobili per comparti a livello nazionale e per provincia, quote di mercato e lo sviluppo dei canali di distribuzione, le vendite stimate di mobili per la casa per principali rivenditori, analisi approfondita sia delle grandi catene di distribuzione che dei rivenditori indipendenti, strategie e tendenze delle aziende

Top 100 furniture retailers in Europe (English)

Novembre 2022,

I Ed. ,

15 pagine

Top 100 distributori di mobili in Europa

Analisi del sistema competitivo della distribuzione del mobile in Europa: ranking dei 100 principali rivenditori, con nome dell’azienda, gruppo, sede principale, sito web, brand, fatturato stimato di mobili per la casa e numero di negozi.