RAPPORTO IN LINGUA INGLESE

Giugno 2011,

I Ed. ,

105 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1696

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S59

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

The first edition of the report Furniture Distribution in China offers an accurate comprehensive picture of the Chinese furniture and furnishings market, providing 2006-2010 trends (in value) of furniture production and consumption, imports and exports. Furniture consumption breakdown by segment and price ranges for the year 2010 (in value and in volume) is also included. Distribution channels, Mark up and Reference Prices of the Chinese furniture market are further considered.

The research includes also a Sector Analysis providing basic data on production, consumption, exports, imports and top companies of the following segment: Kitchen furniture, Bedroom furniture, Upholstered furniture, Office furniture and Hospitality furniture.

A deepening on the wealth distribution in China and a focus on Chinese luxury furniture market is also included.

The analysis of furniture distribution channels includes furniture specialist distributors, non specialist distributors and contract projects and covers: Owned stores, Franchising, Monobrand, Furniture chains, Furniture cities and Furniture streets, DIY and Electronics.

Short profiles of the main distributors operating on the Chinese furniture market are also available.

A description of the main distribution and consumption differences by Chinese province and sales distribution by province in a sample of companies are also provided. The provinces considered are: South, South-West, East, North, North-East, North-West, and Central.

An analysis of the Chinese furniture market includes: Demand Drivers (macroeconomic indicators, population distribution and construction market) and of the latest Product Trends among Chinese consumers.

Addresses of around 350 Chinese furniture manufacturers and retailers are also included and other 50 key contacts among fairs, magazines, architects and other sector consultants.

Among the considered products: Living and dining furniture, Upholstery, Bedrooms, Children bedrooms, Home tables and chairs, Mattresses, Kitchen furniture, Other occasional furniture, Bathroom furniture, Office furniture, Other non residential furniture, Residential lighting and Hotel furniture.

Aziende selezionate

Armani Casa, Armourcoat, Asig Design, Asis Design, Aureole, Beijing Furton, Bobocean, Bulthaup, Chengyue, Choisi, Chunzai Design, Como, Cowell, Dayazhai, Da Vinci, DC Design, Dickson, E&M, Fendi Casa, Flink, Formica, Forwaro, Fudebao, FuLong, GaoHua, Gwen Design, Home Classic, Honland, Huafeng, Huayi, Ji & C, Jiali, Joyce World, Kinetic, Kokai Studios, Kuka Technics, Lacquercraft, Landbond, Luxman, Maratti, Markor, MaxMarko, Maxxa, Muse, Poltrona Frau, Quanyou, Qumei, Rattan Masters, Royal Furniture, Royal Life, Savio Firmino, Saporiti, Shanghai Young Shape, Shing Mark, Siematic, Starcorp, Sunon, Tabu China, Tiancheng, Today, Trinity, Wanyou, Welldone, Welon, Xilinmen, Yayihua, Zhejiang Lihao Furniture

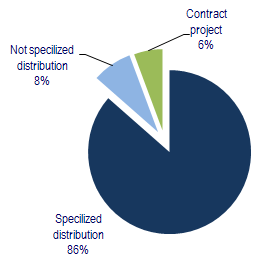

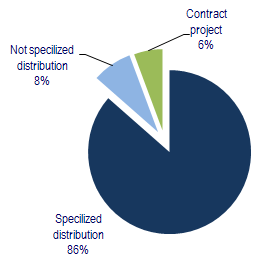

China. Furniture sales breakdown by distribution channel in a sample of companies, 2010. Percentage values

The Chinese furniture and furnishings market amounted to US$ 109 billion in 2010, corresponding in units to hundreds million units for the most common items (living and dining furniture, occasional furniture) and to millions of items for more added value products (kitchen and bathroom furniture, office furniture).

China’s furniture import value reached US$ 1.5 billion in 2010, recording a 38% year-on-year increase. Just 1% of the total consumption, but more than enough to allow 100 international companies to sell on average 15-20 million US$ (or 1.5-2.0 million for 1000 international exporters….).

Abstract of Table of Contents

1. MARKET SIZE and ACTIVITY TREND

Furniture production, consumption, exports and imports over the period 2007-2010

Furniture consumption in value and in volume 2010

Consumption breakdown by segment and price range 2010

2. SECTOR ANALYSIS

Production consumption, imports and leading operators of the following segment: Kitchen furniture, Bedroom furniture, Upholstered furniture, Office furniture and Hospitality furniture.

3. FURNITURE CONSUMPTION AND DISTRIBUTION

Wealth Distribution (Focus on the luxury segment),

Chinese distribution channels for domestic products

Chinese distribution channel for foreign products

Retail formats: Owned stores, franchising, monobrand, Furniture chains, Furniture streets and furniture towns, DIY and Electronics Mark-up and reference prices

Short profile of the leading furniture chains operating in China

Short profile of some important independent retailers and manufacturers’ owned stores

Short profile of the leading DIY and supermarkets

Short profile of the leading Electronics/appliances stores

Distribution by Province: South, South-West, East, North, North-East, North-West, Central and Target Cities

4. KEY CONTACTS

Fairs

Magazines

Leading architects and interior design studios

Software houses

Associations

5. DEMAND DRIVERS AND PRODUCT TRENDS

Population

Construction market

Product trends

APPENDIX I List of furniture manufacturers

APPENDIX II List of furniture retailers

APPENDIX III List of architectural studios

APPENDIX IV List of fairs, magazines, institutions and other sector consultants

The first edition of the report Furniture Distribution in China offers an accurate comprehensive picture of the Chinese furniture and furnishings market, providing 2006-2010 trends (in value) of furniture production and consumption, imports and exports. Furniture consumption breakdown by segment and price ranges for the year 2010 (in value and in volume) is also included. Distribution channels, Mark up and Reference Prices of the Chinese furniture market are further considered.

The research includes also a Sector Analysis providing basic data on production, consumption, exports, imports and top companies of the following segment: Kitchen furniture, Bedroom furniture, Upholstered furniture, Office furniture and Hospitality furniture.

A deepening on the wealth distribution in China and a focus on Chinese luxury furniture market is also included.

The analysis of furniture distribution channels includes furniture specialist distributors, non specialist distributors and contract projects and covers: Owned stores, Franchising, Monobrand, Furniture chains, Furniture cities and Furniture streets, DIY and Electronics.

Short profiles of the main distributors operating on the Chinese furniture market are also available.

A description of the main distribution and consumption differences by Chinese province and sales distribution by province in a sample of companies are also provided. The provinces considered are: South, South-West, East, North, North-East, North-West, and Central.

An analysis of the Chinese furniture market includes: Demand Drivers (macroeconomic indicators, population distribution and construction market) and of the latest Product Trends among Chinese consumers.

Addresses of around 350 Chinese furniture manufacturers and retailers are also included and other 50 key contacts among fairs, magazines, architects and other sector consultants.

Among the considered products: Living and dining furniture, Upholstery, Bedrooms, Children bedrooms, Home tables and chairs, Mattresses, Kitchen furniture, Other occasional furniture, Bathroom furniture, Office furniture, Other non residential furniture, Residential lighting and Hotel furniture.

China. Furniture sales breakdown by distribution channel in a sample of companies, 2010. Percentage values

The Chinese furniture and furnishings market amounted to US$ 109 billion in 2010, corresponding in units to hundreds million units for the most common items (living and dining furniture, occasional furniture) and to millions of items for more added value products (kitchen and bathroom furniture, office furniture).

China’s furniture import value reached US$ 1.5 billion in 2010, recording a 38% year-on-year increase. Just 1% of the total consumption, but more than enough to allow 100 international companies to sell on average 15-20 million US$ (or 1.5-2.0 million for 1000 international exporters….).

Abstract of Table of Contents

1. MARKET SIZE and ACTIVITY TREND

Furniture production, consumption, exports and imports over the period 2007-2010

Furniture consumption in value and in volume 2010

Consumption breakdown by segment and price range 2010

2. SECTOR ANALYSIS

Production consumption, imports and leading operators of the following segment: Kitchen furniture, Bedroom furniture, Upholstered furniture, Office furniture and Hospitality furniture.

3. FURNITURE CONSUMPTION AND DISTRIBUTION

Wealth Distribution (Focus on the luxury segment),

Chinese distribution channels for domestic products

Chinese distribution channel for foreign products

Retail formats: Owned stores, franchising, monobrand, Furniture chains, Furniture streets and furniture towns, DIY and Electronics Mark-up and reference prices

Short profile of the leading furniture chains operating in China

Short profile of some important independent retailers and manufacturers’ owned stores

Short profile of the leading DIY and supermarkets

Short profile of the leading Electronics/appliances stores

Distribution by Province: South, South-West, East, North, North-East, North-West, Central and Target Cities

4. KEY CONTACTS

Fairs

Magazines

Leading architects and interior design studios

Software houses

Associations

5. DEMAND DRIVERS AND PRODUCT TRENDS

Population

Construction market

Product trends

APPENDIX I List of furniture manufacturers

APPENDIX II List of furniture retailers

APPENDIX III List of architectural studios

APPENDIX IV List of fairs, magazines, institutions and other sector consultants

RAPPORTI CORRELATI

Furniture retailing in Europe (English)

Febbraio 2024,

XVII Ed. ,

296 pagine

La distribuzione del mobile in Europa

Analisi della distribuzione di mobili per la casa in 15 paesi europei. Il rapporto fornisce trend di consumo di mobili per la casa, previsioni di mercato, dati per paese, analisi per canale distributivo, formati di vendita e performance dei principali rivenditori di mobili per la casa in Europa

Top 100 mattress specialist retailers in Europe (English)

Novembre 2023,

I Ed. ,

14 pagine

Top 100 rivenditori specializzati di materassi in Europa

Il mercato europeo dei materassi: ranking dei 100 principali rivenditori specializzati in materassi in Europa.

E-commerce in the mattress industry (English)

Settembre 2023,

V Ed. ,

102 pagine

E-commerce nell'industria dei materassi

Ricerca dettagliata sul mercato mondiale dei materassi online con focus su tre aree: Nord America, Europa e Asia Pacifico. Questo studio fornisce dati di vendita, analisi dei principali mercati, l’incidenza delle vendite di materassi online nei principali paesi (Stati Uniti, Canada, Cina, India, Corea del Sud, Germania, Regno Unito, Francia, Italia e Spagna), le vendite di materassi online dei principali rivenditori e i profili delle maggiori aziende del settore.

La distribuzione del mobile in Italia. Analisi per provincia

Luglio 2023, XX Ed. , 174 pagine

Questo rapporto fornisce un quadro dettagliato della distribuzione del mobile e la sua evoluzione e dei consumi di mobili per comparti a livello nazionale e per provincia, quote di mercato e lo sviluppo dei canali di distribuzione, le vendite stimate di mobili per la casa per principali rivenditori, analisi approfondita sia delle grandi catene di distribuzione che dei rivenditori indipendenti, strategie e tendenze delle aziende

E-commerce for the furniture industry (English)

Novembre 2022,

IX Ed. ,

118 pagine

E-commerce nel settore del mobile

Questo rapporto analizza l’e-commerce nel settore del mobile, con focus sulle principali aree geografiche (Europa, Nord America e Asia Pacifico) e sui principali paesi, fornendo dimensioni del mercato e approfondendo i modelli di business, le performance dei principali operatori e i risultati di un sondaggio CSIL che evidenzia l’approccio dei produttori al canale web, le strategie, le aspettative e i prodotti più richiesti online.