Office & commercial furniture supply for small business and e-commerce in Europe. The dealer point of view

Ufficio | Distribuzione e eCommerce | Marzo 2020

€1600

RAPPORTO IN LINGUA INGLESE

Marzo 2020,

III Ed. ,

46 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1696

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: EU33c

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

Based on a CSIL survey launched on January 2020, that involved around one hundred office furniture distributors in Western Europe (dealers, distributors and e-tailers), this Report offers the analysis of the furniture supply activity for small accounts in Europe and the use of e-commerce for the purchase of furniture, as online sales are expected to increase rapidly in the next few years especially among individuals and small accounts.

The perspective of this research includes not only office spaces, but a wider panorama of activities like furniture for small hotels, B&B, bar/restaurants, co-working and home offices, a market which is heavily in the hand of distributors (both small and large) due to its high fragmentation and the reduced average dimensions of the supplies.

The analysis concentrated on:

- The supply for small accounts: customer segments, purchasing process, influencing factors.

- E-commerce for commercial furniture: channel evolution, organization, products and budgets, shipment and delivery.

- The office furniture market in Europe: recent sector’s data.

- CSIL estimates on E-commerce in the furniture sector.

Geographical coverage: Scandinavia (Denmark, Finland, Norway and Sweden); Central Europe (Germany, Austria and Switzerland); Western Europe (Belgium, France, Ireland, the Netherlands and the UK); Southern Europe (Greece, Italy, Portugal and Spain).

This is the first edition of the CSIL Report Office&commercial furniture supply for small business and e-commerce in Europe: the dealer point of view, the third release of the series The dealer’s point of view aiming to bring out the major insights and features of the office and commercial furniture sector and related products.

In the same series of reports:

Sample. Small business segments. Percentage shares of number of quotes

The number of SMEs, of which a major part are micro-SMEs, currently exceeds 25 million in the EU-28. The percentage of employed people in the EU that works from home, even sometimes, has increased steadily over the years. About 11 million sqm is the world surface occupied by coworking spaces and serviced offices. Furthermore, an increasing number of corporate companies that, while maintaining the HQ as the core of the brand identity, are looking for more flexible spaces that allows them to more easily and less costly follow the expansion-contraction of the market.

In such a context, this survey was launched aiming to understand which of the small business segments are expected to grow faster in the next years, how small businesses approach the purchase of furniture, which are factors that influence the purchase most, what is the incidence of e-commerce on sales, how distributors are managing web-tools, which are the best furniture products sold online, how much web customers spend on average and if customers are attracted more by price, services offered or communication tools.

Abstract of Table of Contents

INTRODUCTION. Contents of the study and Methodology

1. EXECUTIVE SUMMARY. Europe: Office and commercial furniture supply for small business and E-commerce

1.1. The Sample

1.2. Distributors expectations for 2020

2. SUPPLY TO THE SMALL BUSINESS SEGMENT

2.1. Large corporate or public office projects Vs Medium/small commitments by region and by kind of distributor (small or medium/large)

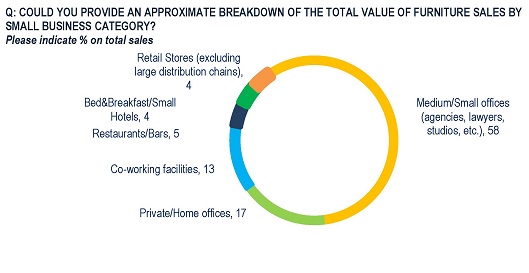

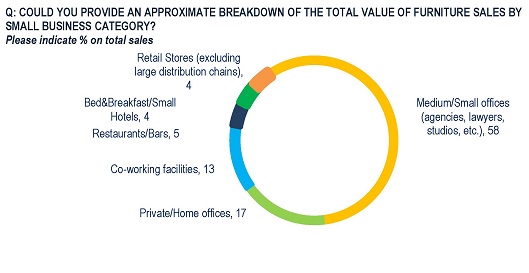

2.2. Small businesses Sales by segment (medium/small offices, private/home offices, co-working facilities, restaurants/bars, bed&breakfast/small hotels, retail stores), by region and prospects

2.3 The purchasing process. First approach, main factors that influence the purchase, promotion tools

3. THE E-COMMERCE

3.1 Strategies. The use of e-commerce

- Incidence of e-commerce on total sales and furniture portfolio available online

3.2 Web channels organizaton. E-commerce platforms and dedicated staff

3.3 E-commerce: most demanded products and average budgets

3.4 The online purchase. Main factors influencing the on-line purchase, shipment policy and delivery terms

4. OFFICE FURNITURE MARKET AND E-COMMERCE

4.1 Demand of office furniture in Europe and by country

4.2 International trade. Imports and Exports of office furniture by country and by segment (office furniture and office seating)

4.3 E-commerce for the furniture sector: a global picture

- World E-commerce sales of furniture

- World E-commerce sales of office furniture

THE QUESTIONNAIRE

Based on a CSIL survey launched on January 2020, that involved around one hundred office furniture distributors in Western Europe (dealers, distributors and e-tailers), this Report offers the analysis of the furniture supply activity for small accounts in Europe and the use of e-commerce for the purchase of furniture, as online sales are expected to increase rapidly in the next few years especially among individuals and small accounts.

The perspective of this research includes not only office spaces, but a wider panorama of activities like furniture for small hotels, B&B, bar/restaurants, co-working and home offices, a market which is heavily in the hand of distributors (both small and large) due to its high fragmentation and the reduced average dimensions of the supplies.

The analysis concentrated on:

- The supply for small accounts: customer segments, purchasing process, influencing factors.

- E-commerce for commercial furniture: channel evolution, organization, products and budgets, shipment and delivery.

- The office furniture market in Europe: recent sector’s data.

- CSIL estimates on E-commerce in the furniture sector.

Geographical coverage: Scandinavia (Denmark, Finland, Norway and Sweden); Central Europe (Germany, Austria and Switzerland); Western Europe (Belgium, France, Ireland, the Netherlands and the UK); Southern Europe (Greece, Italy, Portugal and Spain).

This is the first edition of the CSIL Report Office&commercial furniture supply for small business and e-commerce in Europe: the dealer point of view, the third release of the series The dealer’s point of view aiming to bring out the major insights and features of the office and commercial furniture sector and related products.

In the same series of reports:

Sample. Small business segments. Percentage shares of number of quotes

The number of SMEs, of which a major part are micro-SMEs, currently exceeds 25 million in the EU-28. The percentage of employed people in the EU that works from home, even sometimes, has increased steadily over the years. About 11 million sqm is the world surface occupied by coworking spaces and serviced offices. Furthermore, an increasing number of corporate companies that, while maintaining the HQ as the core of the brand identity, are looking for more flexible spaces that allows them to more easily and less costly follow the expansion-contraction of the market.

In such a context, this survey was launched aiming to understand which of the small business segments are expected to grow faster in the next years, how small businesses approach the purchase of furniture, which are factors that influence the purchase most, what is the incidence of e-commerce on sales, how distributors are managing web-tools, which are the best furniture products sold online, how much web customers spend on average and if customers are attracted more by price, services offered or communication tools.

Abstract of Table of Contents

INTRODUCTION. Contents of the study and Methodology

1. EXECUTIVE SUMMARY. Europe: Office and commercial furniture supply for small business and E-commerce

1.1. The Sample

1.2. Distributors expectations for 2020

2. SUPPLY TO THE SMALL BUSINESS SEGMENT

2.1. Large corporate or public office projects Vs Medium/small commitments by region and by kind of distributor (small or medium/large)

2.2. Small businesses Sales by segment (medium/small offices, private/home offices, co-working facilities, restaurants/bars, bed&breakfast/small hotels, retail stores), by region and prospects

2.3 The purchasing process. First approach, main factors that influence the purchase, promotion tools

3. THE E-COMMERCE

3.1 Strategies. The use of e-commerce

- Incidence of e-commerce on total sales and furniture portfolio available online

3.2 Web channels organizaton. E-commerce platforms and dedicated staff

3.3 E-commerce: most demanded products and average budgets

3.4 The online purchase. Main factors influencing the on-line purchase, shipment policy and delivery terms

4. OFFICE FURNITURE MARKET AND E-COMMERCE

4.1 Demand of office furniture in Europe and by country

4.2 International trade. Imports and Exports of office furniture by country and by segment (office furniture and office seating)

4.3 E-commerce for the furniture sector: a global picture

- World E-commerce sales of furniture

- World E-commerce sales of office furniture

THE QUESTIONNAIRE

RAPPORTI CORRELATI

Furniture retailing in Europe (English)

Febbraio 2024,

XVII Ed. ,

296 pagine

La distribuzione del mobile in Europa

Analisi della distribuzione di mobili per la casa in 15 paesi europei. Il rapporto fornisce trend di consumo di mobili per la casa, previsioni di mercato, dati per paese, analisi per canale distributivo, formati di vendita e performance dei principali rivenditori di mobili per la casa in Europa

Top 100 mattress specialist retailers in Europe (English)

Novembre 2023,

I Ed. ,

14 pagine

Top 100 rivenditori specializzati di materassi in Europa

Il mercato europeo dei materassi: ranking dei 100 principali rivenditori specializzati in materassi in Europa.

E-commerce in the mattress industry (English)

Settembre 2023,

V Ed. ,

102 pagine

E-commerce nell'industria dei materassi

Ricerca dettagliata sul mercato mondiale dei materassi online con focus su tre aree: Nord America, Europa e Asia Pacifico. Questo studio fornisce dati di vendita, analisi dei principali mercati, l’incidenza delle vendite di materassi online nei principali paesi (Stati Uniti, Canada, Cina, India, Corea del Sud, Germania, Regno Unito, Francia, Italia e Spagna), le vendite di materassi online dei principali rivenditori e i profili delle maggiori aziende del settore.

La distribuzione del mobile in Italia. Analisi per provincia

Luglio 2023, XX Ed. , 174 pagine

Questo rapporto fornisce un quadro dettagliato della distribuzione del mobile e la sua evoluzione e dei consumi di mobili per comparti a livello nazionale e per provincia, quote di mercato e lo sviluppo dei canali di distribuzione, le vendite stimate di mobili per la casa per principali rivenditori, analisi approfondita sia delle grandi catene di distribuzione che dei rivenditori indipendenti, strategie e tendenze delle aziende

E-commerce for the furniture industry (English)

Novembre 2022,

IX Ed. ,

118 pagine

E-commerce nel settore del mobile

Questo rapporto analizza l’e-commerce nel settore del mobile, con focus sulle principali aree geografiche (Europa, Nord America e Asia Pacifico) e sui principali paesi, fornendo dimensioni del mercato e approfondendo i modelli di business, le performance dei principali operatori e i risultati di un sondaggio CSIL che evidenzia l’approccio dei produttori al canale web, le strategie, le aspettative e i prodotti più richiesti online.