RAPPORTO IN LINGUA INGLESE

Giugno 2015,

IV Ed. ,

67 pagine

Prezzo (licenza per singolo utente):

EUR 800 / USD 848

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: EU04DE

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

CSIL Market Report The kitchen furniture market in Germany is part of a wider study analysing the main kitchen furniture markets of Western European region (The European market for kitchen furniture, Part I).

The Report offers an accurate comprehensive picture of the kitchen furniture industry in Germany, and in two other German-speaking countries of Central Europe, Austria and Switzerland, providing 2009-2014 trends in kitchen furniture production and consumption, imports and exports, comparing them with selected macroeconomic data. The value and weight of built-in appliances on kitchen furniture supply are also considered.

Import and export data are analyzed by country and by geographical area of origin/destination.

The supply structure breaks down production by cabinet door material (solid wood, veneer, laminated, decorative papers, thermoplastic foils, lacquered, melamine, aluminum, glass), style (classic, modern), colour (white, bright colours, neutral colours), type (high gloss, opaque) and by worktop material (solid surface materials, stone and engineered stone, laminated, tiles, steel and aluminium, wood, glass).

The analysis of kitchen furniture distribution in Germany, Austria and Switzerland covers the following channels: kitchen specialists, furniture retailers, large furniture chains, DIY stores, contract/ building trade.

The chapter on the competitive system analyses the kitchen furniture production of the top 50 European kitchen furniture manufacturers, with a special focus on German players. Sales and market shares are broken down also by market segment (luxury, upper-end, upper-middle, middle, middle-low, low-end) and by country. Sales data and market shares of kitchen furniture in a sample of companies are also given for the Austrian and Swiss markets.

Short profiles of the main players in the kitchen furniture industry in these countries are also available.

In the end, a focus on European exports of kitchen furniture by area of destination (Central-Eastern Europe and Russia, Middle East, Asia and Pacific, North and Latin America).

Among the considered products: kitchen furniture, solid wood kitchens, veneer kitchens, laminated kitchens, thermoplastic foils, lacquered kitchens, melamine kitchens, aluminum kitchens, classic kitchens, modern kitchens, luxury kitchens, upper range kitchens, upper- middle range kitchens, middle range kitchens, middle-low range kitchens, low range kitchens, cabinet doors, worktops, kitchens with built-in appliances, kitchens without built-in appliances, built-in appliances.

Aziende selezionate

AFG Kitchens, Alno, Alpnach, Artego, Ballerina, Bauformat, Baumann, Beckermann, Boffi, Brigitte Küchen, Bulthaup, DAN Küchen, Eggersmann, Elbau, FR Nieburg, Häcker Küchen, Haka Küchen, Herzog, Ikea, La Cour Group, Leicht Küchen, Mandemakers, Nobia, Nobilia, Nolte, Oster Möbelwerkstätten, Pronorm, Rempp Küchen, Rotpunkt Rabe & Meyer, Sabag, Sachsen, SALM, Schröder Küchen, Schüller, SieMatic, Snaidero, Störmer Küchen, Team 7, Valcucine

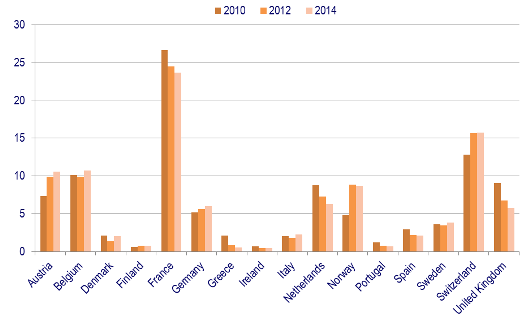

Europe. Imports of kitchen furniture by country of destination, 2010-2012-2014. % shares in value

The European kitchen furniture market (16 EU countries) amounts to almost 5.3 million units manufactured, for a market value (at factory prices) close to €12.8 billion (a 1.7% increase in comparison to 2013). Of these, almost 1 million kitchens (valued at €2.8 billion) were exported. Overall, consumption of kitchen furniture in EU16 (again, at factory prices), accounted for €11.7 billion, rising by 1.7% in comparison to 2013.

Germany is the main engine of the European kitchen sector: it accounts for more than a quarter of all the manufactured kitchens in EU16 countries in 2014, and even more in terms of value (34%). This productive capacity is strongly addressed to exports (50% of total European exports are of German origin), but the internal market is still very relevant, accounting on its own for one fifth of the European consumption in volume terms and one fourth in value.

Among other countries, it should be noted that Switzerland accounts for 16% of European imports, relying for more than 50% of its consumption (€500 million in 2014, +5%) on foreign producers, followed by Belgium and Austria, with €189 million and €187 million of imported kitchens each (22% of the European imports, summing the two countries).

Abstract of Table of Contents

Introduction: Scope of the research and methodology

Kitchen furniture market: basic data

The European framework: Production, exports, imports and consumption by country, in volume and value

Europe. Production breakdown by market segment

Kitchen furniture market: activity trend, 2009-2014

Europe. Production, consumption, international trade of kitchen furniture and macroeconomic indicators

Austria. Production, consumption, international trade of kitchen furniture and macroeconomic indicators

Germany. Production, consumption, international trade of kitchen furniture and macroeconomic indicators

Switzerland. Production, consumption, international trade of kitchen furniture and macroeconomic indicators

International trade

Europe. Exports and imports of kitchen furniture by country and by geographical area, 2009-2014

Europe. Trade balance of kitchen furniture by country, 2009 and 2014

Austria. Exports and imports of kitchen furniture by country and by geographical area, 2009-2014

Germany. Exports and imports of kitchen furniture by country and by geographical area, 2009-2014

Switzerland. Exports and imports of kitchen furniture by country and by geographical area, 2009-2014

Employment

Germany. Employment trend in a sample of kitchen furniture manufacturers, 2012-2014

Supply structure

Breakdown of supply by cabinet door material

- Europe. Breakdown of supply by cabinet door material and by geographical area

- Europe. Breakdown of supply by cabinet door material, in a sample of companies

Breakdown of supply by door finishing style

- Germany. Breakdown of supply by cabinet door style

Breakdown of supply by colour and type

- Europe. Breakdown of supply by cabinet door colour

- Germany. Breakdown of supply by cabinet door colour in a sample of companies

Breakdown of supply by worktop material

- Germany. Breakdown of supply by worktop material in a sample of companies

Distribution channels

Distribution channels in Germany

- Europe. Breakdown of kitchen furniture sales by distribution channel by country

- Europe. Breakdown of kitchen furniture sales by distribution channel in a sample of companies

- Germany. Breakdown of kitchen furniture sales by distribution channel

- Kitchen specialists

- Furniture chains

- Contract market

- Germany. The Contract kitchen furniture segment by final destination

- Germany. Contract market value split in Kitchens & Worktops and Built-in appliances

- Germany. Incidence of the contract market on overall kitchen furniture market in different years

- Germany. Sample of companies operating on the kitchen contract market

- Reference Prices

- Built in Appliances

- Germany. Breakdown of built-in appliances by distribution channel

- Germany. Breakdown of built-in appliances according to purchase purpose

- Europe. Weight of built-in appliances on factory prices

- Europe. Share and sales of built-in appliances in a sample of companies

Distribution channels in Austria and Switzerland

- Austria. Breakdown of kitchen furniture sales by distribution channel

- Switzerland. Breakdown of kitchen furniture sales by distribution channel

The competitive system

Leading players in Europe: focus on German players

- Europe. Market share on total kitchen production for a sample of German companies. 2010-2014

- Europe. Total production of kitchen furniture of the top 50 companies at market prices

Germany: the competitive system

- Germany. Sales of kitchen furniture in a sample of companies

- Germany. Sales of kitchen furniture for a sample of major companies in the low range

- Germany. Sales of kitchen furniture for a sample of major companies in the middle-low range

- Germany. Sales of kitchen furniture for a sample of major companies in the middle range

- Germany. Sales of kitchen furniture for a sample of major companies in the middle-upper range

- Germany. Sales of kitchen furniture for a sample of major companies in the upper range

- Germany. Sales of kitchen furniture for a sample of major companies in the luxury range

Austria: the competitive system

- Austria. Sales of kitchen furniture in a sample of companies

Switzerland: the competitive system

- Switzerland. Sales of kitchen furniture in a sample of companies

Exports and market share outside EU16

- Europe. Kitchen furniture. Market share on total export in a sample of German companies, 2010-2014

- Exports to Central-Eastern Europe and Russia

- Exports to the Middle East

- Exports to Asia Pacific

- Exports to North America

- Exports to Latin America

CSIL Market Report The kitchen furniture market in Germany is part of a wider study analysing the main kitchen furniture markets of Western European region (The European market for kitchen furniture, Part I).

The Report offers an accurate comprehensive picture of the kitchen furniture industry in Germany, and in two other German-speaking countries of Central Europe, Austria and Switzerland, providing 2009-2014 trends in kitchen furniture production and consumption, imports and exports, comparing them with selected macroeconomic data. The value and weight of built-in appliances on kitchen furniture supply are also considered.

Import and export data are analyzed by country and by geographical area of origin/destination.

The supply structure breaks down production by cabinet door material (solid wood, veneer, laminated, decorative papers, thermoplastic foils, lacquered, melamine, aluminum, glass), style (classic, modern), colour (white, bright colours, neutral colours), type (high gloss, opaque) and by worktop material (solid surface materials, stone and engineered stone, laminated, tiles, steel and aluminium, wood, glass).

The analysis of kitchen furniture distribution in Germany, Austria and Switzerland covers the following channels: kitchen specialists, furniture retailers, large furniture chains, DIY stores, contract/ building trade.

The chapter on the competitive system analyses the kitchen furniture production of the top 50 European kitchen furniture manufacturers, with a special focus on German players. Sales and market shares are broken down also by market segment (luxury, upper-end, upper-middle, middle, middle-low, low-end) and by country. Sales data and market shares of kitchen furniture in a sample of companies are also given for the Austrian and Swiss markets.

Short profiles of the main players in the kitchen furniture industry in these countries are also available.

In the end, a focus on European exports of kitchen furniture by area of destination (Central-Eastern Europe and Russia, Middle East, Asia and Pacific, North and Latin America).

Among the considered products: kitchen furniture, solid wood kitchens, veneer kitchens, laminated kitchens, thermoplastic foils, lacquered kitchens, melamine kitchens, aluminum kitchens, classic kitchens, modern kitchens, luxury kitchens, upper range kitchens, upper- middle range kitchens, middle range kitchens, middle-low range kitchens, low range kitchens, cabinet doors, worktops, kitchens with built-in appliances, kitchens without built-in appliances, built-in appliances.

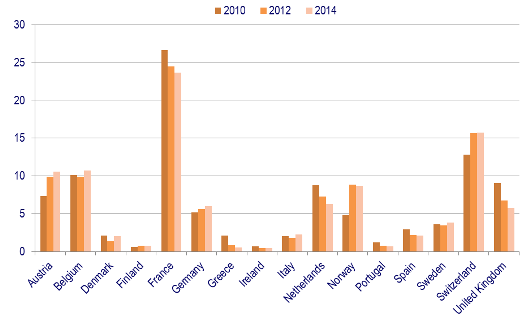

Europe. Imports of kitchen furniture by country of destination, 2010-2012-2014. % shares in value

The European kitchen furniture market (16 EU countries) amounts to almost 5.3 million units manufactured, for a market value (at factory prices) close to €12.8 billion (a 1.7% increase in comparison to 2013). Of these, almost 1 million kitchens (valued at €2.8 billion) were exported. Overall, consumption of kitchen furniture in EU16 (again, at factory prices), accounted for €11.7 billion, rising by 1.7% in comparison to 2013.

Germany is the main engine of the European kitchen sector: it accounts for more than a quarter of all the manufactured kitchens in EU16 countries in 2014, and even more in terms of value (34%). This productive capacity is strongly addressed to exports (50% of total European exports are of German origin), but the internal market is still very relevant, accounting on its own for one fifth of the European consumption in volume terms and one fourth in value.

Among other countries, it should be noted that Switzerland accounts for 16% of European imports, relying for more than 50% of its consumption (€500 million in 2014, +5%) on foreign producers, followed by Belgium and Austria, with €189 million and €187 million of imported kitchens each (22% of the European imports, summing the two countries).

Abstract of Table of Contents

Introduction: Scope of the research and methodology

Kitchen furniture market: basic data

The European framework: Production, exports, imports and consumption by country, in volume and value

Europe. Production breakdown by market segment

Kitchen furniture market: activity trend, 2009-2014

Europe. Production, consumption, international trade of kitchen furniture and macroeconomic indicators

Austria. Production, consumption, international trade of kitchen furniture and macroeconomic indicators

Germany. Production, consumption, international trade of kitchen furniture and macroeconomic indicators

Switzerland. Production, consumption, international trade of kitchen furniture and macroeconomic indicators

International trade

Europe. Exports and imports of kitchen furniture by country and by geographical area, 2009-2014

Europe. Trade balance of kitchen furniture by country, 2009 and 2014

Austria. Exports and imports of kitchen furniture by country and by geographical area, 2009-2014

Germany. Exports and imports of kitchen furniture by country and by geographical area, 2009-2014

Switzerland. Exports and imports of kitchen furniture by country and by geographical area, 2009-2014

Employment

Germany. Employment trend in a sample of kitchen furniture manufacturers, 2012-2014

Supply structure

Breakdown of supply by cabinet door material

- Europe. Breakdown of supply by cabinet door material and by geographical area

- Europe. Breakdown of supply by cabinet door material, in a sample of companies

Breakdown of supply by door finishing style

- Germany. Breakdown of supply by cabinet door style

Breakdown of supply by colour and type

- Europe. Breakdown of supply by cabinet door colour

- Germany. Breakdown of supply by cabinet door colour in a sample of companies

Breakdown of supply by worktop material

- Germany. Breakdown of supply by worktop material in a sample of companies

Distribution channels

Distribution channels in Germany

- Europe. Breakdown of kitchen furniture sales by distribution channel by country

- Europe. Breakdown of kitchen furniture sales by distribution channel in a sample of companies

- Germany. Breakdown of kitchen furniture sales by distribution channel

- Kitchen specialists

- Furniture chains

- Contract market

- Germany. The Contract kitchen furniture segment by final destination

- Germany. Contract market value split in Kitchens & Worktops and Built-in appliances

- Germany. Incidence of the contract market on overall kitchen furniture market in different years

- Germany. Sample of companies operating on the kitchen contract market

- Reference Prices

- Built in Appliances

- Germany. Breakdown of built-in appliances by distribution channel

- Germany. Breakdown of built-in appliances according to purchase purpose

- Europe. Weight of built-in appliances on factory prices

- Europe. Share and sales of built-in appliances in a sample of companies

Distribution channels in Austria and Switzerland

- Austria. Breakdown of kitchen furniture sales by distribution channel

- Switzerland. Breakdown of kitchen furniture sales by distribution channel

The competitive system

Leading players in Europe: focus on German players

- Europe. Market share on total kitchen production for a sample of German companies. 2010-2014

- Europe. Total production of kitchen furniture of the top 50 companies at market prices

Germany: the competitive system

- Germany. Sales of kitchen furniture in a sample of companies

- Germany. Sales of kitchen furniture for a sample of major companies in the low range

- Germany. Sales of kitchen furniture for a sample of major companies in the middle-low range

- Germany. Sales of kitchen furniture for a sample of major companies in the middle range

- Germany. Sales of kitchen furniture for a sample of major companies in the middle-upper range

- Germany. Sales of kitchen furniture for a sample of major companies in the upper range

- Germany. Sales of kitchen furniture for a sample of major companies in the luxury range

Austria: the competitive system

- Austria. Sales of kitchen furniture in a sample of companies

Switzerland: the competitive system

- Switzerland. Sales of kitchen furniture in a sample of companies

Exports and market share outside EU16

- Europe. Kitchen furniture. Market share on total export in a sample of German companies, 2010-2014

- Exports to Central-Eastern Europe and Russia

- Exports to the Middle East

- Exports to Asia Pacific

- Exports to North America

- Exports to Latin America

RAPPORTI CORRELATI

Il mercato italiano dei mobili per cucina

Aprile 2024, XLII Ed. , 95 pagine

Questo studio offre un’analisi completa del settore dei mobili per cucina in Italia attraverso dati di produzione e consumo, interscambio commerciale, quote di mercato dei principali operatori del settore per fascia di prezzo, localizzazione delle vendite, canali distributivi, redditività, tipologie di elettrodomestici integrati venduti, tipologie e materiali di antine e piani, andamento del mercato e prospettive.

Kitchen furniture: World market outlook (English)

Dicembre 2023,

XVIII Ed. ,

185 pagine

Mobili per cucina: outlook mondiale

CSIL analizza 60 mercati di mobili per cucina con una ricca raccolta di dati sui paesi, produzione e consumo sia in valore che in unità. Profili aziendali di 35 tra i principali produttori di mobili per cucina a livello mondiale.

The European market for kitchen furniture (English)

Maggio 2023,

XXXIII Ed. ,

305 pagine

Il mercato europeo dei mobili per cucina

Nel 2022, la produzione europea (30 Paesi) di mobili per cucina ammonta a circa 7 milioni di unità prodotte, di cui circa un milione nel segmento di fascia alta.

The kitchen furniture market in the United States (English)

Marzo 2023,

VIII Ed. ,

112 pagine

Il mercato dei mobili per cucina negli Stati Uniti

Analisi approfondita del settore dei mobili per cucina negli Stati Uniti (USA), con andamento e previsioni per produzione, consumi, importazioni ed esportazioni, principali player per aree geografiche e fasce di prezzo (raggruppati in sei fasce di prezzo), politiche di marketing e canali distributivi

La distribuzione dei mobili per cucina in Italia

Giugno 2020, VIII Ed. , 105 pagine

Indagine CSIL, giunta alla sua 8a edizione, volta a rilevare l’opinione dei rivenditori di mobili per cucina in Italia sui principali marchi di cucina presenti nel nostro Paese. Valutazioni qualitative e di trade satisfaction in termini di servizio, prodotto, prezzi, promozione (articolati lungo 17 item) e individuazione dei punti di forza e di debolezza per ciascuno dei 16 marchi analizzati