The kitchen furniture market in India

Il mercato dei mobili per cucina in India

Cucina | Aprile 2021

€1600

RAPPORTO IN LINGUA INGLESE

Aprile 2021,

II Ed. ,

85 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1696

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S76

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

The second edition of the Report The kitchen furniture market in India was produced using the following sources of information:

- field analysis and interviews

- desk research focusing on distributors/manufacturers working in the kitchen furniture industry and related activities;

- statistical and international sales data;

- general documentation relating to the kitchen furniture industry available both online and offline;

- official documents concerning macroeconomic trends and sector performances;

The report offers a comprehensive picture of the kitchen furniture industry in India, providing historical trends and forecasts in kitchen furniture production and consumption, imports and exports. Kitchen furniture sales by price ranges, product trends and supply structure, distribution system and main players are also considered as well as the value and weight of the built-in appliances on kitchen furniture supply.

The report provides a breakdown of kitchen furniture supply by cabinet door material (wood, veneer, laminated, slabs, thermoplastics, lacquered, plywood, melamine, steel, glass), by cabinet door colour (white, bright, neutral), by cabinet door lacquering (high gloss, opaque) and by worktop material (solid surface, stone, quartz, slabs, laminated, steel, wood, glass). Short profiles of the main local manufacturers of technical furniture fittings (Drawers, hinges, metalware) are also included.

A breakdown of Indian kitchen furniture exports and imports is provided by country and by geographical area of destination/origin.

The analysis of distribution system for kitchen furniture in India covers the following channels: direct sales/contract, kitchen specialists, furniture stores/chains, online sales. A list of leading furniture importers, architects and interior designers relevant for the kitchen furniture market is also provided by city, as well as the geographical breakdown of kitchen furniture sales in India for the main local companies.

The competitive system analyses the presence of the major kitchen furniture manufacturers in India, including short company profiles, sales data and market shares by price range, for a sample of 80 companies.

A focus on selected smart and fast Indian cities towards 2020 is also included.

Aziende selezionate

Aran World, Arancia Kuchen, Aster Cucine, Aura Kitchens, Ballerina Küchen, Borchi, Bulthaup, Cromatica, Cubo Design – Miton, Dada, Euromobil, Evok by Hindware, Fotile, Godrej Interio, Häcker Küchen, Hexa, Homelane, Ikea, Interwood, Kook Kitchen Koncepts, Kuche 7, Kutchina, Leicht Küchen, Meine Kuche, MGM Cucine, Modulinea, Nobilia, Nolte Küchen, Officine Gullo, Ommag, Oppein, Pepperfry, Poggenpohl, Poliform, Saviesa, Scavolini, Signature Kitchen, Siravi, Sleek International, Snaidero, Spacewood, Stosa, Team 7, Tiara Furniture, Valcucine, Veneta Cucine, Wurfel Kuche

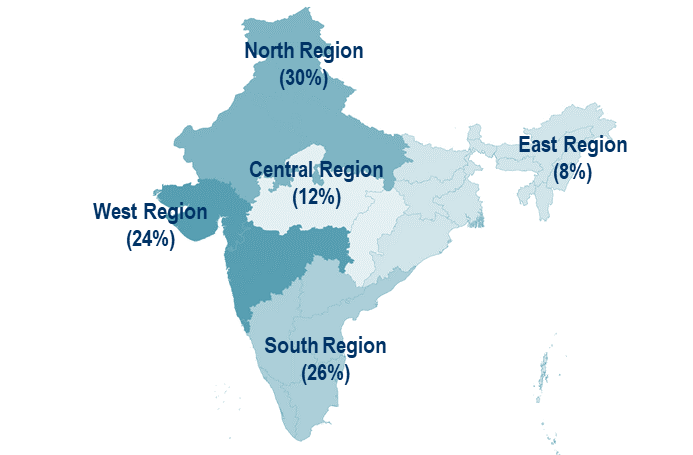

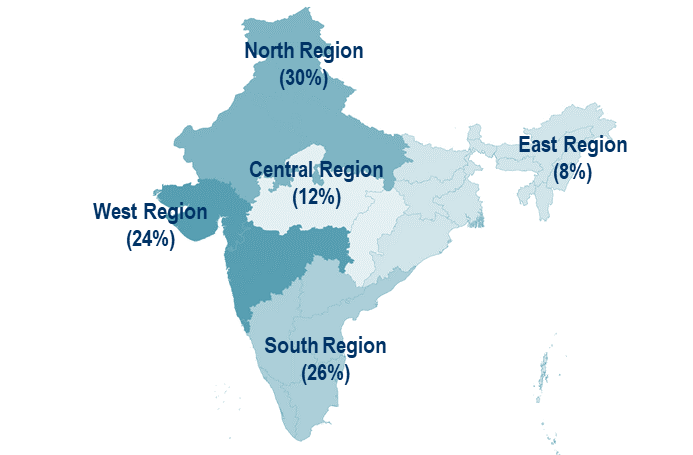

Kitchen furniture sales by region 2020

The kitchen furniture market in India for the year 2020 is estimated by CSIL equal to 300 thousand units and 540 million USD in value (factory prices).

During the 2008-2013 period, the kitchen furniture market in India increased from around 145,000 to 210,000 units (average 8% per year).

From 2013 to 2019, the market increased from 200-220 thousand units, to over 300 thousand units.

Decrease during 2020 affected mainly the lower end of the market and imported units.

A jump to a market of 380 thousand kitchens can be expected within the next three years, and a target of around one million kitchens per year within ten years.

Considering the overall size of the Indian market, and its potential, it can be said that the kitchen furniture industry in India is just at its early steps.

As an average, a kitchen manufacturer produces approximately 60% of kitchen furniture and (as an average, ranging usually from 20% to 60%) 40% living furniture (less frequently bathroom, doors or other furniture).

Abstract of Table of Contents

Research tools and methodology

Activity trend and forecasts

The kitchen furniture sector in India, activity trend 2014-2020 and forecasts 2021-2023

The kitchen furniture market in India by price range, 2020. % share, values, volumes and average price

International trade

Exports and Imports of kitchen furniture by the main countries of destination/origin, 2015-2020

Product trends and structure of the offer

Breakdown of kitchen furniture sales by kind of doors and by kind of look

Kitchen furniture breakdown by kind of worktop

Drawers, hinges, metalware: Consumption of technical fittings breakdown by product type

Competition

Top 60 Indian players and their presence on the Country

Kitchen furniture sales in India, 2020. Market shares for the top 80 players

Top players in the upper end segment; Top players in the mid end segment; Top players in the mass market

Distribution

Breakdown of kitchen furniture sales by distribution channel

Number of outlets and sales per outlet for a sample of Indian kitchen furniture players

List of builders relevant for the kitchen furniture market

Breakdown of kitchen furniture sales by Geographic Area

Number of appliances and worktops per 100 kitchens sold in a sample of companies

Leading furniture importers, architects and interior designers by city

Macroeconomic and growth drivers

Focus on selected smart and fast Indian cities towards 2020

The second edition of the Report The kitchen furniture market in India was produced using the following sources of information:

- field analysis and interviews

- desk research focusing on distributors/manufacturers working in the kitchen furniture industry and related activities;

- statistical and international sales data;

- general documentation relating to the kitchen furniture industry available both online and offline;

- official documents concerning macroeconomic trends and sector performances;

The report offers a comprehensive picture of the kitchen furniture industry in India, providing historical trends and forecasts in kitchen furniture production and consumption, imports and exports. Kitchen furniture sales by price ranges, product trends and supply structure, distribution system and main players are also considered as well as the value and weight of the built-in appliances on kitchen furniture supply.

The report provides a breakdown of kitchen furniture supply by cabinet door material (wood, veneer, laminated, slabs, thermoplastics, lacquered, plywood, melamine, steel, glass), by cabinet door colour (white, bright, neutral), by cabinet door lacquering (high gloss, opaque) and by worktop material (solid surface, stone, quartz, slabs, laminated, steel, wood, glass). Short profiles of the main local manufacturers of technical furniture fittings (Drawers, hinges, metalware) are also included.

A breakdown of Indian kitchen furniture exports and imports is provided by country and by geographical area of destination/origin.

The analysis of distribution system for kitchen furniture in India covers the following channels: direct sales/contract, kitchen specialists, furniture stores/chains, online sales. A list of leading furniture importers, architects and interior designers relevant for the kitchen furniture market is also provided by city, as well as the geographical breakdown of kitchen furniture sales in India for the main local companies.

The competitive system analyses the presence of the major kitchen furniture manufacturers in India, including short company profiles, sales data and market shares by price range, for a sample of 80 companies.

A focus on selected smart and fast Indian cities towards 2020 is also included.

Kitchen furniture sales by region 2020

The kitchen furniture market in India for the year 2020 is estimated by CSIL equal to 300 thousand units and 540 million USD in value (factory prices).

During the 2008-2013 period, the kitchen furniture market in India increased from around 145,000 to 210,000 units (average 8% per year).

From 2013 to 2019, the market increased from 200-220 thousand units, to over 300 thousand units.

Decrease during 2020 affected mainly the lower end of the market and imported units.

A jump to a market of 380 thousand kitchens can be expected within the next three years, and a target of around one million kitchens per year within ten years.

Considering the overall size of the Indian market, and its potential, it can be said that the kitchen furniture industry in India is just at its early steps.

As an average, a kitchen manufacturer produces approximately 60% of kitchen furniture and (as an average, ranging usually from 20% to 60%) 40% living furniture (less frequently bathroom, doors or other furniture).

Abstract of Table of Contents

Research tools and methodology

Activity trend and forecasts

The kitchen furniture sector in India, activity trend 2014-2020 and forecasts 2021-2023

The kitchen furniture market in India by price range, 2020. % share, values, volumes and average price

International trade

Exports and Imports of kitchen furniture by the main countries of destination/origin, 2015-2020

Product trends and structure of the offer

Breakdown of kitchen furniture sales by kind of doors and by kind of look

Kitchen furniture breakdown by kind of worktop

Drawers, hinges, metalware: Consumption of technical fittings breakdown by product type

Competition

Top 60 Indian players and their presence on the Country

Kitchen furniture sales in India, 2020. Market shares for the top 80 players

Top players in the upper end segment; Top players in the mid end segment; Top players in the mass market

Distribution

Breakdown of kitchen furniture sales by distribution channel

Number of outlets and sales per outlet for a sample of Indian kitchen furniture players

List of builders relevant for the kitchen furniture market

Breakdown of kitchen furniture sales by Geographic Area

Number of appliances and worktops per 100 kitchens sold in a sample of companies

Leading furniture importers, architects and interior designers by city

Macroeconomic and growth drivers

Focus on selected smart and fast Indian cities towards 2020

RAPPORTI CORRELATI

Il mercato italiano dei mobili per cucina

Aprile 2024, XLII Ed. , 95 pagine

Questo studio offre un’analisi completa del settore dei mobili per cucina in Italia attraverso dati di produzione e consumo, interscambio commerciale, quote di mercato dei principali operatori del settore per fascia di prezzo, localizzazione delle vendite, canali distributivi, redditività, tipologie di elettrodomestici integrati venduti, tipologie e materiali di antine e piani, andamento del mercato e prospettive.

Kitchen furniture: World market outlook (English)

Dicembre 2023,

XVIII Ed. ,

185 pagine

Mobili per cucina: outlook mondiale

CSIL analizza 60 mercati di mobili per cucina con una ricca raccolta di dati sui paesi, produzione e consumo sia in valore che in unità. Profili aziendali di 35 tra i principali produttori di mobili per cucina a livello mondiale.

The European market for kitchen furniture (English)

Maggio 2023,

XXXIII Ed. ,

305 pagine

Il mercato europeo dei mobili per cucina

Nel 2022, la produzione europea (30 Paesi) di mobili per cucina ammonta a circa 7 milioni di unità prodotte, di cui circa un milione nel segmento di fascia alta.

The kitchen furniture market in the United States (English)

Marzo 2023,

VIII Ed. ,

112 pagine

Il mercato dei mobili per cucina negli Stati Uniti

Analisi approfondita del settore dei mobili per cucina negli Stati Uniti (USA), con andamento e previsioni per produzione, consumi, importazioni ed esportazioni, principali player per aree geografiche e fasce di prezzo (raggruppati in sei fasce di prezzo), politiche di marketing e canali distributivi

La distribuzione dei mobili per cucina in Italia

Giugno 2020, VIII Ed. , 105 pagine

Indagine CSIL, giunta alla sua 8a edizione, volta a rilevare l’opinione dei rivenditori di mobili per cucina in Italia sui principali marchi di cucina presenti nel nostro Paese. Valutazioni qualitative e di trade satisfaction in termini di servizio, prodotto, prezzi, promozione (articolati lungo 17 item) e individuazione dei punti di forza e di debolezza per ciascuno dei 16 marchi analizzati