Office furniture features and workplace trends 2019-2020: a dealer point of view

Ufficio | Distribuzione e eCommerce | Gennaio 2019

€1600

RAPPORTO IN LINGUA INGLESE

Gennaio 2019,

II Ed. ,

44 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1696

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: EU33b

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

The office business in Europe is expected to grow moderately in the next two years, following a general downgrade of the macroeconomic projections by the principal international observers.

In such a context CSIL launched this survey for a better understanding of the workspace transformation describing its impact on product features. We gathered the view and the expectations of about one hundred distribution companies for the period 2019-2020.

The analysis involved around one hundred office furniture distributors (dealers, distributors, interior designers, specifiers)located in Western Europe and surveyed by CSIL in November 2018 – January 2019.

In particular, THE ANALYSIS CONCENTRATES ON:

- Office furniture market and forecasts 2019-2020

- Use of e-commerce and customer segments

- Workspace areas most in demand and relevant aspects considered by customers in 2019-2020

- Seating categories and coverings most in demand

- Kind of desks, desk combinations and materials most in demand

- Storage and materials most in demand

- Partitions, materials and acoustic solutions most in demand

- Most requested furniture for communal areas and meeting spaces

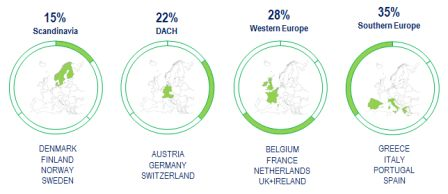

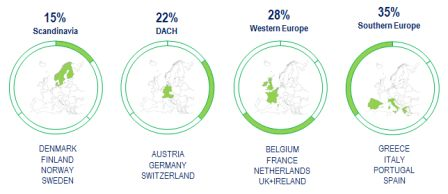

GEOGRAPHICAL COVERAGE

The countries were divided into four areas according to their geographical proximity and similar market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

The Sample. Location

One of the key challenges of the workspace conceiving today is the fact that a relevant portion of people no longer work at designated workstations. Informal meeting spaces are expected to be the office area most in demand in the next two years. Balancing open spaces with privacy areas will remain a focal issue when planning an office environment. Room-in-room and phone booths are becoming the norm especially in large projects, in Scandinavia, DACH and Western Europe, while this product is less used in the Southern region.Improve acoustic in the office environment will be a major task for customers in the next two years. As a consequence, acoustic products will continue flooding offices. Among the partitioning products, the “easy” and flexible solution will be the most demanded in the next two years.Customers will also pay more attention to ergonomic swivel chairs they will look to more advanced solutions in terms of mechanisms and materials. In line with this, the incidence of sit-stand desks on the total desks sold continues to expand among dealers. Huge transformation is expected for the storage segment with locker walls to be a preferred solution in future workplaces. Office storage in general is becoming more and more technological integrated.

Abstract of Table of Contents

EXECUTIVE SUMMARY. New workplace conceiving. Key products and customers tasks for the next two years

1. INTRODUCTION. Contents and methodology

2. THE EUROPEAN OFFICE FURNITURE MARKET. Current status and forecasts

2.1. Macroeconomic indicators

2.2. The office furniture market in Europe. Production, consumption, imports, exports data and consumption by country

2.3. Office furniture consumption. 2019-2020 Forecasts

3. DISTRIBUTORS. The Sample

3.1. Customer segments by region and by kind of distributor

3.2. E-commerce. Use and incidence on total sales

3.3. Turnover expectations. Expected sales variation for 2019

4. THE FUTURE OF WORKPLACE

4.1. Office areas. Most demanded furnished workspaces in 2019-2020

4.2. Customer choices when furnishing offices

5. OFFICE SEATING. Expectations for 2019-2020

5.1. Chairs. Most demanded products in the seating category

5.2. Coverings for swivel chairs and lounge chairs most in demand

6. OFFICE DESKING. Expectations for 2019-2020

6.1. Sit-stand desks. Incidence on total desks sales

6.2. Most demanded desks combinations by region

6.3. Most demanded worktop materials

7. FILING AND STORAGE. Expectations for 2019-2020

7.1. Evolution of storage products and storage products most in demand

7.2. Materials for storage products most in demand

8. PARTITIONS FOR OFFICES. Expectations for 2019-2020

8.1. Wall units and screens most in demand

8.2. Materials for office partitions most in demand

9. ACOUSTIC PRODUCTS. Expectations for 2019-2020

9.1. Sound management in offices. Acoustic solutions most in demand

10. COMMUNAL AREAS. Expectations for 2019-2020

10.1. The growth of shared spaces. Meeting and Communal areas most in demand

ANNEX 1. THE QUESTIONNAIRE. Single questions presented in the survey with average results

The office business in Europe is expected to grow moderately in the next two years, following a general downgrade of the macroeconomic projections by the principal international observers.

In such a context CSIL launched this survey for a better understanding of the workspace transformation describing its impact on product features. We gathered the view and the expectations of about one hundred distribution companies for the period 2019-2020.

The analysis involved around one hundred office furniture distributors (dealers, distributors, interior designers, specifiers)located in Western Europe and surveyed by CSIL in November 2018 – January 2019.

In particular, THE ANALYSIS CONCENTRATES ON:

- Office furniture market and forecasts 2019-2020

- Use of e-commerce and customer segments

- Workspace areas most in demand and relevant aspects considered by customers in 2019-2020

- Seating categories and coverings most in demand

- Kind of desks, desk combinations and materials most in demand

- Storage and materials most in demand

- Partitions, materials and acoustic solutions most in demand

- Most requested furniture for communal areas and meeting spaces

GEOGRAPHICAL COVERAGE

The countries were divided into four areas according to their geographical proximity and similar market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

The Sample. Location

One of the key challenges of the workspace conceiving today is the fact that a relevant portion of people no longer work at designated workstations. Informal meeting spaces are expected to be the office area most in demand in the next two years. Balancing open spaces with privacy areas will remain a focal issue when planning an office environment. Room-in-room and phone booths are becoming the norm especially in large projects, in Scandinavia, DACH and Western Europe, while this product is less used in the Southern region.Improve acoustic in the office environment will be a major task for customers in the next two years. As a consequence, acoustic products will continue flooding offices. Among the partitioning products, the “easy” and flexible solution will be the most demanded in the next two years.Customers will also pay more attention to ergonomic swivel chairs they will look to more advanced solutions in terms of mechanisms and materials. In line with this, the incidence of sit-stand desks on the total desks sold continues to expand among dealers. Huge transformation is expected for the storage segment with locker walls to be a preferred solution in future workplaces. Office storage in general is becoming more and more technological integrated.

Abstract of Table of Contents

EXECUTIVE SUMMARY. New workplace conceiving. Key products and customers tasks for the next two years

1. INTRODUCTION. Contents and methodology

2. THE EUROPEAN OFFICE FURNITURE MARKET. Current status and forecasts

2.1. Macroeconomic indicators

2.2. The office furniture market in Europe. Production, consumption, imports, exports data and consumption by country

2.3. Office furniture consumption. 2019-2020 Forecasts

3. DISTRIBUTORS. The Sample

3.1. Customer segments by region and by kind of distributor

3.2. E-commerce. Use and incidence on total sales

3.3. Turnover expectations. Expected sales variation for 2019

4. THE FUTURE OF WORKPLACE

4.1. Office areas. Most demanded furnished workspaces in 2019-2020

4.2. Customer choices when furnishing offices

5. OFFICE SEATING. Expectations for 2019-2020

5.1. Chairs. Most demanded products in the seating category

5.2. Coverings for swivel chairs and lounge chairs most in demand

6. OFFICE DESKING. Expectations for 2019-2020

6.1. Sit-stand desks. Incidence on total desks sales

6.2. Most demanded desks combinations by region

6.3. Most demanded worktop materials

7. FILING AND STORAGE. Expectations for 2019-2020

7.1. Evolution of storage products and storage products most in demand

7.2. Materials for storage products most in demand

8. PARTITIONS FOR OFFICES. Expectations for 2019-2020

8.1. Wall units and screens most in demand

8.2. Materials for office partitions most in demand

9. ACOUSTIC PRODUCTS. Expectations for 2019-2020

9.1. Sound management in offices. Acoustic solutions most in demand

10. COMMUNAL AREAS. Expectations for 2019-2020

10.1. The growth of shared spaces. Meeting and Communal areas most in demand

ANNEX 1. THE QUESTIONNAIRE. Single questions presented in the survey with average results

RAPPORTI CORRELATI

Furniture retailing in Europe (English)

Febbraio 2024,

XVII Ed. ,

296 pagine

La distribuzione del mobile in Europa

Analisi della distribuzione di mobili per la casa in 15 paesi europei. Il rapporto fornisce trend di consumo di mobili per la casa, previsioni di mercato, dati per paese, analisi per canale distributivo, formati di vendita e performance dei principali rivenditori di mobili per la casa in Europa

Top 100 mattress specialist retailers in Europe (English)

Novembre 2023,

I Ed. ,

14 pagine

Top 100 rivenditori specializzati di materassi in Europa

Il mercato europeo dei materassi: ranking dei 100 principali rivenditori specializzati in materassi in Europa.

E-commerce in the mattress industry (English)

Settembre 2023,

V Ed. ,

102 pagine

E-commerce nell'industria dei materassi

Ricerca dettagliata sul mercato mondiale dei materassi online con focus su tre aree: Nord America, Europa e Asia Pacifico. Questo studio fornisce dati di vendita, analisi dei principali mercati, l’incidenza delle vendite di materassi online nei principali paesi (Stati Uniti, Canada, Cina, India, Corea del Sud, Germania, Regno Unito, Francia, Italia e Spagna), le vendite di materassi online dei principali rivenditori e i profili delle maggiori aziende del settore.

La distribuzione del mobile in Italia. Analisi per provincia

Luglio 2023, XX Ed. , 174 pagine

Questo rapporto fornisce un quadro dettagliato della distribuzione del mobile e la sua evoluzione e dei consumi di mobili per comparti a livello nazionale e per provincia, quote di mercato e lo sviluppo dei canali di distribuzione, le vendite stimate di mobili per la casa per principali rivenditori, analisi approfondita sia delle grandi catene di distribuzione che dei rivenditori indipendenti, strategie e tendenze delle aziende

E-commerce for the furniture industry (English)

Novembre 2022,

IX Ed. ,

118 pagine

E-commerce nel settore del mobile

Questo rapporto analizza l’e-commerce nel settore del mobile, con focus sulle principali aree geografiche (Europa, Nord America e Asia Pacifico) e sui principali paesi, fornendo dimensioni del mercato e approfondendo i modelli di business, le performance dei principali operatori e i risultati di un sondaggio CSIL che evidenzia l’approccio dei produttori al canale web, le strategie, le aspettative e i prodotti più richiesti online.