Office furniture features and workplace trends 2019-2020: a dealer point of view

Office | Retail & Ecommerce | January 2019

€1600

January 2019,

II Ed. ,

44 pages

Price (single user license):

EUR 1600 / USD 1696

For multiple/corporate license prices please contact us

Language: English

Report code: EU33b

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The office business in Europe is expected to grow moderately in the next two years, following a general downgrade of the macroeconomic projections by the principal international observers.

In such a context CSIL launched this survey for a better understanding of the workspace transformation describing its impact on product features. We gathered the view and the expectations of about one hundred distribution companies for the period 2019-2020.

The analysis involved around one hundred office furniture distributors (dealers, distributors, interior designers, specifiers)located in Western Europe and surveyed by CSIL in November 2018 – January 2019.

In particular, THE ANALYSIS CONCENTRATES ON:

- Office furniture market and forecasts 2019-2020

- Use of e-commerce and customer segments

- Workspace areas most in demand and relevant aspects considered by customers in 2019-2020

- Seating categories and coverings most in demand

- Kind of desks, desk combinations and materials most in demand

- Storage and materials most in demand

- Partitions, materials and acoustic solutions most in demand

- Most requested furniture for communal areas and meeting spaces

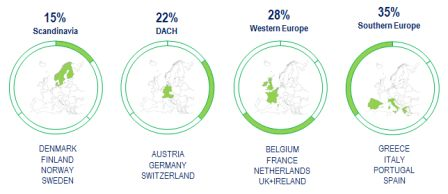

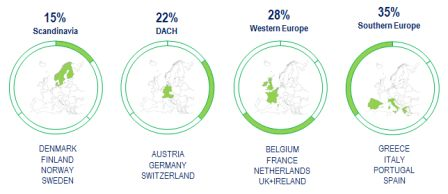

GEOGRAPHICAL COVERAGE

The countries were divided into four areas according to their geographical proximity and similar market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

The Sample. Location

One of the key challenges of the workspace conceiving today is the fact that a relevant portion of people no longer work at designated workstations. Informal meeting spaces are expected to be the office area most in demand in the next two years. Balancing open spaces with privacy areas will remain a focal issue when planning an office environment. Room-in-room and phone booths are becoming the norm especially in large projects, in Scandinavia, DACH and Western Europe, while this product is less used in the Southern region.Improve acoustic in the office environment will be a major task for customers in the next two years. As a consequence, acoustic products will continue flooding offices. Among the partitioning products, the “easy” and flexible solution will be the most demanded in the next two years.Customers will also pay more attention to ergonomic swivel chairs they will look to more advanced solutions in terms of mechanisms and materials. In line with this, the incidence of sit-stand desks on the total desks sold continues to expand among dealers. Huge transformation is expected for the storage segment with locker walls to be a preferred solution in future workplaces. Office storage in general is becoming more and more technological integrated.

Abstract of Table of Contents

EXECUTIVE SUMMARY. New workplace conceiving. Key products and customers tasks for the next two years

1. INTRODUCTION. Contents and methodology

2. THE EUROPEAN OFFICE FURNITURE MARKET. Current status and forecasts

2.1. Macroeconomic indicators

2.2. The office furniture market in Europe. Production, consumption, imports, exports data and consumption by country

2.3. Office furniture consumption. 2019-2020 Forecasts

3. DISTRIBUTORS. The Sample

3.1. Customer segments by region and by kind of distributor

3.2. E-commerce. Use and incidence on total sales

3.3. Turnover expectations. Expected sales variation for 2019

4. THE FUTURE OF WORKPLACE

4.1. Office areas. Most demanded furnished workspaces in 2019-2020

4.2. Customer choices when furnishing offices

5. OFFICE SEATING. Expectations for 2019-2020

5.1. Chairs. Most demanded products in the seating category

5.2. Coverings for swivel chairs and lounge chairs most in demand

6. OFFICE DESKING. Expectations for 2019-2020

6.1. Sit-stand desks. Incidence on total desks sales

6.2. Most demanded desks combinations by region

6.3. Most demanded worktop materials

7. FILING AND STORAGE. Expectations for 2019-2020

7.1. Evolution of storage products and storage products most in demand

7.2. Materials for storage products most in demand

8. PARTITIONS FOR OFFICES. Expectations for 2019-2020

8.1. Wall units and screens most in demand

8.2. Materials for office partitions most in demand

9. ACOUSTIC PRODUCTS. Expectations for 2019-2020

9.1. Sound management in offices. Acoustic solutions most in demand

10. COMMUNAL AREAS. Expectations for 2019-2020

10.1. The growth of shared spaces. Meeting and Communal areas most in demand

ANNEX 1. THE QUESTIONNAIRE. Single questions presented in the survey with average results

The office business in Europe is expected to grow moderately in the next two years, following a general downgrade of the macroeconomic projections by the principal international observers.

In such a context CSIL launched this survey for a better understanding of the workspace transformation describing its impact on product features. We gathered the view and the expectations of about one hundred distribution companies for the period 2019-2020.

The analysis involved around one hundred office furniture distributors (dealers, distributors, interior designers, specifiers)located in Western Europe and surveyed by CSIL in November 2018 – January 2019.

In particular, THE ANALYSIS CONCENTRATES ON:

- Office furniture market and forecasts 2019-2020

- Use of e-commerce and customer segments

- Workspace areas most in demand and relevant aspects considered by customers in 2019-2020

- Seating categories and coverings most in demand

- Kind of desks, desk combinations and materials most in demand

- Storage and materials most in demand

- Partitions, materials and acoustic solutions most in demand

- Most requested furniture for communal areas and meeting spaces

GEOGRAPHICAL COVERAGE

The countries were divided into four areas according to their geographical proximity and similar market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

The Sample. Location

One of the key challenges of the workspace conceiving today is the fact that a relevant portion of people no longer work at designated workstations. Informal meeting spaces are expected to be the office area most in demand in the next two years. Balancing open spaces with privacy areas will remain a focal issue when planning an office environment. Room-in-room and phone booths are becoming the norm especially in large projects, in Scandinavia, DACH and Western Europe, while this product is less used in the Southern region.Improve acoustic in the office environment will be a major task for customers in the next two years. As a consequence, acoustic products will continue flooding offices. Among the partitioning products, the “easy” and flexible solution will be the most demanded in the next two years.Customers will also pay more attention to ergonomic swivel chairs they will look to more advanced solutions in terms of mechanisms and materials. In line with this, the incidence of sit-stand desks on the total desks sold continues to expand among dealers. Huge transformation is expected for the storage segment with locker walls to be a preferred solution in future workplaces. Office storage in general is becoming more and more technological integrated.

Abstract of Table of Contents

EXECUTIVE SUMMARY. New workplace conceiving. Key products and customers tasks for the next two years

1. INTRODUCTION. Contents and methodology

2. THE EUROPEAN OFFICE FURNITURE MARKET. Current status and forecasts

2.1. Macroeconomic indicators

2.2. The office furniture market in Europe. Production, consumption, imports, exports data and consumption by country

2.3. Office furniture consumption. 2019-2020 Forecasts

3. DISTRIBUTORS. The Sample

3.1. Customer segments by region and by kind of distributor

3.2. E-commerce. Use and incidence on total sales

3.3. Turnover expectations. Expected sales variation for 2019

4. THE FUTURE OF WORKPLACE

4.1. Office areas. Most demanded furnished workspaces in 2019-2020

4.2. Customer choices when furnishing offices

5. OFFICE SEATING. Expectations for 2019-2020

5.1. Chairs. Most demanded products in the seating category

5.2. Coverings for swivel chairs and lounge chairs most in demand

6. OFFICE DESKING. Expectations for 2019-2020

6.1. Sit-stand desks. Incidence on total desks sales

6.2. Most demanded desks combinations by region

6.3. Most demanded worktop materials

7. FILING AND STORAGE. Expectations for 2019-2020

7.1. Evolution of storage products and storage products most in demand

7.2. Materials for storage products most in demand

8. PARTITIONS FOR OFFICES. Expectations for 2019-2020

8.1. Wall units and screens most in demand

8.2. Materials for office partitions most in demand

9. ACOUSTIC PRODUCTS. Expectations for 2019-2020

9.1. Sound management in offices. Acoustic solutions most in demand

10. COMMUNAL AREAS. Expectations for 2019-2020

10.1. The growth of shared spaces. Meeting and Communal areas most in demand

ANNEX 1. THE QUESTIONNAIRE. Single questions presented in the survey with average results

SEE ALSO

Furniture retailing in Europe

February 2024, XVII Ed. , 296 pages

Comparative analysis of the home furniture retailing industry in 15 European countries, with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers in Europe

Top 100 mattress specialist retailers in Europe

November 2023, I Ed. , 14 pages

A bird’s eye view of players in the European mattress market with a ranking of the 100 leading mattress specialist retailers in Europe.

E-commerce in the mattress industry

September 2023, V Ed. , 102 pages

Detailed analysis of the global e-commerce mattress markets with a focus on North America, Europe, and the Asia Pacific. Features of the online mattress business, the current incidence of online mattress sales by geographical areas and in key countries, the major markets, e-commerce mattress sales of the leading retailers by area, and company profiles of top players operating in the online mattress sector.

La distribuzione del mobile in Italia. Analisi per provincia (Italian)

July 2023, XX Ed. , 174 pages

This report provides a detailed picture of the Italian furniture market and retailing, for the whole national market and by province, providing the size and development of the home furniture market and its segments, market shares and development of distribution channels, estimated home furniture sales for key retailers, in-depth analysis of both large retail chains and independent retailers, companies’ strategies and trends

E-commerce for the furniture industry

November 2022, IX Ed. , 118 pages

This report analyses e-commerce in the furniture market, with a focus on key geographical areas (Europe, North America, and Asia Pacific) and key countries, providing current market size, e-commerce business models, the performance of the leading players, and the results of a CSIL survey to furniture manufacturers that highlights their approach to the web channel, their strategies, future expectations, and the most-demanded furniture products online.