September 2023,

V Ed. ,

102 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: M14

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

CSIL’s Report E-commerce in the mattress industry offers a detailed analysis of the online mattress market with a focus on three world areas (North America, Europe, and Asia Pacific), and the most up-to-date data and statistics of the sector.

The study analyses the largest retail mattress markets, estimating the current incidence of online mattress sales in key countries (the USA, Canada, China, India, South Korea, Germany, the UK, France, Italy, and Spain), the e-commerce mattress sales of the leading retailers (e-tailers, brick-and-mortar retailers, online mattress companies and mattress manufacturers) and providing company profiles highlighting their activity and performance in this sector.

Mattress sales and e-commerce mattress sales are provided for the time series 2020-2023* (*preliminary) by country/region.

E-COMMERCE BUSINESS MODELS. The report identifies the leading online retailers involved in mattress sales by business model:

- E-tailers (pure e-commerce companies)

- Brick and Click companies (dealers with physical stores and web-store)

- Non-furniture specialists’ chains (large multichannel dealers selling furniture, homewares, accessories, home improvement, lighting fixtures, and electronics).

- Online mattress companies (direct-to-consumer and start-ups selling online via their own web platform or through e-tailers)

- Mattress manufacturers selling online via own website

FEATURES OF THE ONLINE MATTRESS BUSINESS AND ORGANIZATION: The most important peculiarities of the e-commerce business in the mattress industry, including services (delivery and logistic issues, payment methods, return strategies), product features (bed-in-a-box, one-size-fits-all mattresses) and the role of industry suppliers.

ECOMMERCE IN THE MATTRESS INDUSTRY. THE LARGEST MARKETS: The report focuses on three world areas, North America (the United States and Canada), Europe (the United Kingdom, Germany, France, Italy, and Spain), and Asia Pacific (China, South Korea, and India).

For each considered geographical area and country the report provides:Retail and e-commerce sales (sector overview of economic and e-commerce indicators enriching the analysis) and E-commerce mattress sales (mattress sales and e-commerce mattress sales by country) up to 2023.

COMPETITION AND PROFILES OF THE LEADING COMPANIES IN THE ONLINE MATTRESS MARKET: online mattress sales by distribution channels and by leading retailers in Europe, the US, Canada, and the Asia Pacific.

The study also profiles the leading retailers and manufacturers operating in the online mattress market, highlighting their e-commerce activity and financial performance.

For online mattress companies, the report describes the most important supply features (number of trial nights, years of warranty, price of a twin mattress, in-home-delivery, and setup) and distribution strategy (presence of physical stores) and profiles of leading online mattress companies by country.

As regards mattress manufacturers selling online, leading players for each considered country are provided, together with information about their online activity.

SURVEY RESULTS: GLOBAL E-COMMERCE MATTRESS MARKET

The Report E-commerce in the mattress industry was also carried out through direct interviews with leading mattress manufacturers and retailers operating in the e-commerce mattress business and an online survey carried on by CSIL in August-September 2023, addressed to global retailers and manufacturers involved in the mattress industry.

Topics:

- E-commerce activity and Location

- Incidence of e-commerce sales on mattress sales

- Delivery and type of mattresses

- E-commerce mattress sales by sales channels

- The top promising markets for e-commerce mattress sales

- The most important services offered for e-commerce mattress sales

- Share of mattresses returned back

- Expected sales variation in 2023 over 2022 for online and total sales

Selected companies

Amazon, bett1, Casper, Emma, IKEA, JD.com, Kurlon, Mattress Firm, Mlily, Nectar Sleep-Resident, Otto, Pepperfry, Purple, Simba, Saatva, Serta Simmons, Simba Sleep, Suning, Taobao, Tempur Sealy, Tmall, Tuft&Needle, Wayfair, Zinus.

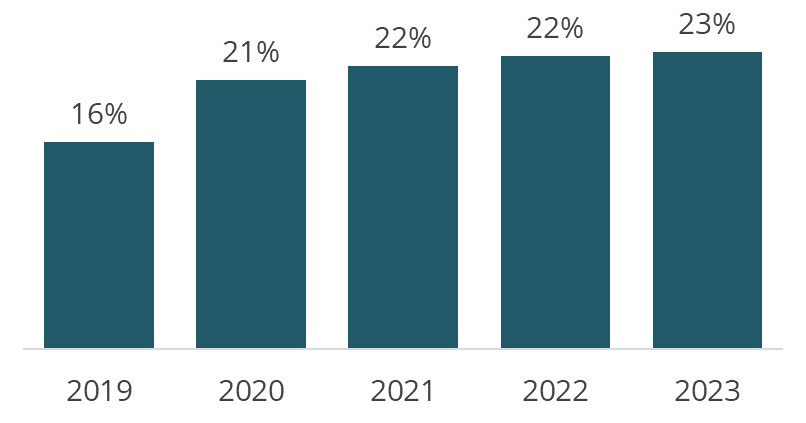

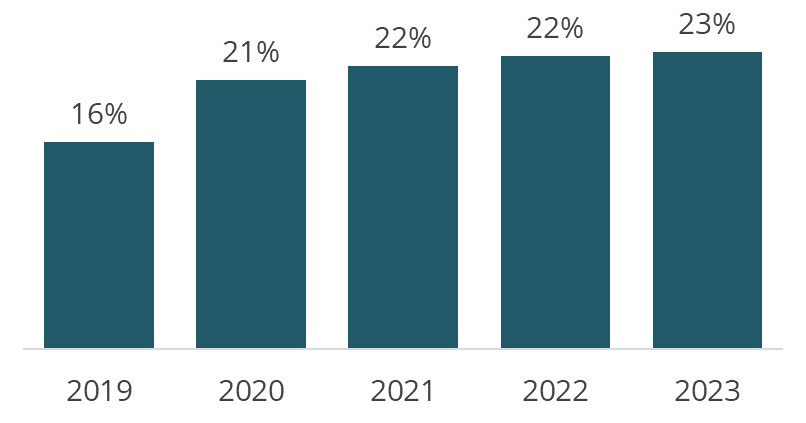

World. Share of e-commerce mattress sales. 2019-2023. Percentage

The online mattress market is expected to reach $15 billion in 2023. This marks a slight decrease in online mattress sales compared to the peak year in 2021, although the decline is less pronounced than what has been observed in the overall mattress retail market.

After hypergrowth in online sales and the propensity to buy online in 2020 and 2021, in most countries, a stabilisation of e-commerce incidences is expected to occur in 2023. North America remains the largest market for mattresses sold online, followed by Asia Pacific. In Asia, China dominates the market, while South Korea has one of the highest online penetration shares and India is one of the fastest growing markets for online mattresses. Europe ranks third, with the United Kingdom and Germany being the largest markets in the region.

Abstract of Table of Contents

INTRODUCTION: Data gathering, terminology, processing methodology and sample of companies

EXECUTIVE SUMMARY: E-commerce in the mattress industry performances and market peculiarities, companies insights for the first half of 2023

1. E-COMMERCE IN THE MATTRESS MARKET: An overview of the world mattress market

1.1. An overview of the world mattress market: mattress consumption and consumption by country. International trade of mattresses

1.2. E-commerce in the mattress market: Mattress sales and e-commerce mattress sales by country/region; Share of e-commerce mattress sales

1.3. Models of e-commerce business

- – E-tailers (pure e-commerce retailers)

- – Brick-and-Click companies (dealers with physical stores and webstore)

- – Non-furniture specialist chains

- – Online mattress companies (direct-to-consumer)

- – Mattress manufactures selling online via their own website

2. FEATURES OF THE ONLINE MATTRESS BUSINESS

2.1. The business evolution and organisation

- – Delivery options

- – Services and return strategies

- – Bed-in-a-box

- – The role of industry suppliers

- – One-size-fits-all mattresses and related bedding products

- – Payment methods

3. E-COMMERCE MATTRESS MARKET IN THE UNITED STATES AND CANADA

3.1. Retail and e-commerce sales: overview and demand drivers

- United States. E-commerce as a percentage of total retail sales

- United States and Canada: Macroeconomic and e-commerce indicators

3.2. E-commerce mattress sales in the USA and Canada

3.3. Competition: online mattress sales by distribution channel in a sample of companies and online mattress sales by leading retailers in the USA and Canada

3.4. E-commerce retailers (pure e-tailers, retailers selling online)

3.5. Online mattress companies (direct-to-consumer): Supply features comparison of the Leading online mattress companies and Price for a twin mattress in a sample of online mattress companies

3.6. Mattress manufacturers selling online

4. E-COMMERCE MATTRESS MARKET IN EUROPE: France, Germany, Italy, Spain and the UK

4.1. Retail and e-commerce sales: overview and demand drivers

- Europe. Economic and E-commerce Indicators

- France, Germany, Italy, Spain and the United Kingdom: e-commerce indicators

4.2. E-commerce mattress sales in Europe

- Mattress sales and e-commerce mattress sales in France, Germany, Italy, Spain and the United Kingdom

4.3. Competition: online mattress sales by distribution channel in a sample of companies and online mattress sales by leading retailers in Europe

4.4. E-commerce retailers (pure e-tailers, retailers selling online)

4.5. Online mattress companies (direct-to-consumer): Supply features comparison of the Leading online mattress companies and Price for a twin mattress in a sample of online mattress companies

4.6. Mattress manufacturers selling online

5. E-COMMERCE MATTRESS MARKET IN ASIA PACIFIC: China, India and South Korea

5.1. Retail and e-commerce sales: overview and demand drivers

- Asia Pacific: China, India and South Korea. Economic and E-commerce Indicators

5.2. E-commerce mattress sales in Asia Pacific

- Mattress sales and e-commerce mattress sales in China, India, South Korea

5.3. E-commerce retailers (pure e-tailers, retailers selling online)

- E-commerce retailers selling mattresses in Asia Pacific: China, India, South Korea

5.4. Online mattress companies (direct-to-consumer)

5.5. Mattress manufacturers selling online

6. ANNEX: Results of the CSIL survey on the Global e-commerce mattress market

6.1. Survey results: Global e-commerce mattress market

- E-commerce activity

- Location

- Incidence of e-commerce sales on mattress sales

- Shipments and types of mattresses

- E-commerce mattress sales by sales channels

- Top 5 promising markets for e-commerce mattress sales

- Services offered for e-commerce mattress sales

- Share of mattresses returned back

- Expected sales variation in 2023 over 2022 for online and total sales

7. MENTIONED COMPANIES

List of mentioned companies selling mattresses online: country, retailing format, activity, website

CSIL’s Report E-commerce in the mattress industry offers a detailed analysis of the online mattress market with a focus on three world areas (North America, Europe, and Asia Pacific), and the most up-to-date data and statistics of the sector.

The study analyses the largest retail mattress markets, estimating the current incidence of online mattress sales in key countries (the USA, Canada, China, India, South Korea, Germany, the UK, France, Italy, and Spain), the e-commerce mattress sales of the leading retailers (e-tailers, brick-and-mortar retailers, online mattress companies and mattress manufacturers) and providing company profiles highlighting their activity and performance in this sector.

Mattress sales and e-commerce mattress sales are provided for the time series 2020-2023* (*preliminary) by country/region.

E-COMMERCE BUSINESS MODELS. The report identifies the leading online retailers involved in mattress sales by business model:

- E-tailers (pure e-commerce companies)

- Brick and Click companies (dealers with physical stores and web-store)

- Non-furniture specialists’ chains (large multichannel dealers selling furniture, homewares, accessories, home improvement, lighting fixtures, and electronics).

- Online mattress companies (direct-to-consumer and start-ups selling online via their own web platform or through e-tailers)

- Mattress manufacturers selling online via own website

FEATURES OF THE ONLINE MATTRESS BUSINESS AND ORGANIZATION: The most important peculiarities of the e-commerce business in the mattress industry, including services (delivery and logistic issues, payment methods, return strategies), product features (bed-in-a-box, one-size-fits-all mattresses) and the role of industry suppliers.

ECOMMERCE IN THE MATTRESS INDUSTRY. THE LARGEST MARKETS: The report focuses on three world areas, North America (the United States and Canada), Europe (the United Kingdom, Germany, France, Italy, and Spain), and Asia Pacific (China, South Korea, and India).

For each considered geographical area and country the report provides:Retail and e-commerce sales (sector overview of economic and e-commerce indicators enriching the analysis) and E-commerce mattress sales (mattress sales and e-commerce mattress sales by country) up to 2023.

COMPETITION AND PROFILES OF THE LEADING COMPANIES IN THE ONLINE MATTRESS MARKET: online mattress sales by distribution channels and by leading retailers in Europe, the US, Canada, and the Asia Pacific.

The study also profiles the leading retailers and manufacturers operating in the online mattress market, highlighting their e-commerce activity and financial performance.

For online mattress companies, the report describes the most important supply features (number of trial nights, years of warranty, price of a twin mattress, in-home-delivery, and setup) and distribution strategy (presence of physical stores) and profiles of leading online mattress companies by country.

As regards mattress manufacturers selling online, leading players for each considered country are provided, together with information about their online activity.

SURVEY RESULTS: GLOBAL E-COMMERCE MATTRESS MARKET

The Report E-commerce in the mattress industry was also carried out through direct interviews with leading mattress manufacturers and retailers operating in the e-commerce mattress business and an online survey carried on by CSIL in August-September 2023, addressed to global retailers and manufacturers involved in the mattress industry.

Topics:

- E-commerce activity and Location

- Incidence of e-commerce sales on mattress sales

- Delivery and type of mattresses

- E-commerce mattress sales by sales channels

- The top promising markets for e-commerce mattress sales

- The most important services offered for e-commerce mattress sales

- Share of mattresses returned back

- Expected sales variation in 2023 over 2022 for online and total sales

World. Share of e-commerce mattress sales. 2019-2023. Percentage

The online mattress market is expected to reach $15 billion in 2023. This marks a slight decrease in online mattress sales compared to the peak year in 2021, although the decline is less pronounced than what has been observed in the overall mattress retail market.

After hypergrowth in online sales and the propensity to buy online in 2020 and 2021, in most countries, a stabilisation of e-commerce incidences is expected to occur in 2023. North America remains the largest market for mattresses sold online, followed by Asia Pacific. In Asia, China dominates the market, while South Korea has one of the highest online penetration shares and India is one of the fastest growing markets for online mattresses. Europe ranks third, with the United Kingdom and Germany being the largest markets in the region.

Abstract of Table of Contents

INTRODUCTION: Data gathering, terminology, processing methodology and sample of companies

EXECUTIVE SUMMARY: E-commerce in the mattress industry performances and market peculiarities, companies insights for the first half of 2023

1. E-COMMERCE IN THE MATTRESS MARKET: An overview of the world mattress market

1.1. An overview of the world mattress market: mattress consumption and consumption by country. International trade of mattresses

1.2. E-commerce in the mattress market: Mattress sales and e-commerce mattress sales by country/region; Share of e-commerce mattress sales

1.3. Models of e-commerce business

- – E-tailers (pure e-commerce retailers)

- – Brick-and-Click companies (dealers with physical stores and webstore)

- – Non-furniture specialist chains

- – Online mattress companies (direct-to-consumer)

- – Mattress manufactures selling online via their own website

2. FEATURES OF THE ONLINE MATTRESS BUSINESS

2.1. The business evolution and organisation

- – Delivery options

- – Services and return strategies

- – Bed-in-a-box

- – The role of industry suppliers

- – One-size-fits-all mattresses and related bedding products

- – Payment methods

3. E-COMMERCE MATTRESS MARKET IN THE UNITED STATES AND CANADA

3.1. Retail and e-commerce sales: overview and demand drivers

- United States. E-commerce as a percentage of total retail sales

- United States and Canada: Macroeconomic and e-commerce indicators

3.2. E-commerce mattress sales in the USA and Canada

3.3. Competition: online mattress sales by distribution channel in a sample of companies and online mattress sales by leading retailers in the USA and Canada

3.4. E-commerce retailers (pure e-tailers, retailers selling online)

3.5. Online mattress companies (direct-to-consumer): Supply features comparison of the Leading online mattress companies and Price for a twin mattress in a sample of online mattress companies

3.6. Mattress manufacturers selling online

4. E-COMMERCE MATTRESS MARKET IN EUROPE: France, Germany, Italy, Spain and the UK

4.1. Retail and e-commerce sales: overview and demand drivers

- Europe. Economic and E-commerce Indicators

- France, Germany, Italy, Spain and the United Kingdom: e-commerce indicators

4.2. E-commerce mattress sales in Europe

- Mattress sales and e-commerce mattress sales in France, Germany, Italy, Spain and the United Kingdom

4.3. Competition: online mattress sales by distribution channel in a sample of companies and online mattress sales by leading retailers in Europe

4.4. E-commerce retailers (pure e-tailers, retailers selling online)

4.5. Online mattress companies (direct-to-consumer): Supply features comparison of the Leading online mattress companies and Price for a twin mattress in a sample of online mattress companies

4.6. Mattress manufacturers selling online

5. E-COMMERCE MATTRESS MARKET IN ASIA PACIFIC: China, India and South Korea

5.1. Retail and e-commerce sales: overview and demand drivers

- Asia Pacific: China, India and South Korea. Economic and E-commerce Indicators

5.2. E-commerce mattress sales in Asia Pacific

- Mattress sales and e-commerce mattress sales in China, India, South Korea

5.3. E-commerce retailers (pure e-tailers, retailers selling online)

- E-commerce retailers selling mattresses in Asia Pacific: China, India, South Korea

5.4. Online mattress companies (direct-to-consumer)

5.5. Mattress manufacturers selling online

6. ANNEX: Results of the CSIL survey on the Global e-commerce mattress market

6.1. Survey results: Global e-commerce mattress market

- E-commerce activity

- Location

- Incidence of e-commerce sales on mattress sales

- Shipments and types of mattresses

- E-commerce mattress sales by sales channels

- Top 5 promising markets for e-commerce mattress sales

- Services offered for e-commerce mattress sales

- Share of mattresses returned back

- Expected sales variation in 2023 over 2022 for online and total sales

7. MENTIONED COMPANIES

List of mentioned companies selling mattresses online: country, retailing format, activity, website

SEE ALSO

The world mattress industry

July 2023, XX Ed. , 472 pages

A comprehensive picture of the global mattress sector, through historical series of basic data (production, consumption, imports and exports for the time series 2013-2022), mattress market development up to 2024, international trade flows, country analysis, detailed profiles of the leading manufacturers and their strategies. Find out the latest trends and data in the mattress industry across 50 countries.

Top 100 mattress manufacturers in the World

September 2023, II Ed. , 15 pages

Who are the top mattress manufacturers in the world? This study gives a picture of the global mattress competitive system through the analysis of the leading 100 producers benchmarking their performance and the whole sector concentration.

The contract furniture and furnishings market in Europe

March 2023, IX Ed. , 208 pages

A detailed analysis of the European contract furniture business providing market size, production, market development, consumption forecasts, demand drivers, projects, sales, and market shares of the leading players, sales by destination segment –with a special focus on furniture for Education– and by product category.

Furniture retailing in Europe

February 2024, XVII Ed. , 296 pages

Comparative analysis of the home furniture retailing industry in 15 European countries, with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers in Europe

The mattress market in China

November 2019, VI Ed. , 116 pages

In-depth overview of the mattress sector in China providing historical trends and current status of the Chinese mattress production, consumption, imports and exports. Market size and forecasts, supply structure and distribution system analysis, competitive system analysis, with profiles of largest manufacturers operating in the Chinese mattress market, around 250 considered companies among which producers, suppliers and retailers.

E-commerce for the furniture industry

November 2022, IX Ed. , 118 pages

This report analyses e-commerce in the furniture market, with a focus on key geographical areas (Europe, North America, and Asia Pacific) and key countries, providing current market size, e-commerce business models, the performance of the leading players, and the results of a CSIL survey to furniture manufacturers that highlights their approach to the web channel, their strategies, future expectations, and the most-demanded furniture products online.