The kitchen furniture market in Brazil

Il mercato dei mobili per cucina in Brasile

Cucina | Ottobre 2018

€960

RAPPORTO IN LINGUA INGLESE

Ottobre 2018,

I Ed. ,

39 pagine

Prezzo (licenza per singolo utente):

EUR 960 / USD 1027.2

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: S63

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

CSIL Market Research Report The kitchen furniture market in Brazil provides an analysis of the kitchen furniture production and consumption, imports and exports in Brazil, in values and in quantities, with data and figures on the activity trend and forecasts for the next two years.

Import and export data are shown by country and by geographical area of origin/destination.

An estimate of the breakdown of the kitchen furniture market in Brazil by cabinet door material and colour is included.

An overview on the kitchen furniture distribution system in Brazil is offered, including the following channels: furniture and kitchen furniture stores, furniture and appliance chains, monobrand and franchising stores, DIY and Contract segments.

The Report shows also an overview of the main market drivers (Population and other economic indicators, GDP, total investments, inflation and unemployment rate up to 2022).

Information on the competitive system include sales data and market shares of 50 among the top kitchen furniture manufacturers in Brazil, as well as short company profiles. Six different price segments are analyzed.

Website for a sample of 20 Brazilian manufacturers of kitchen furniture is also provided.

Aziende selezionate

Acorp, Albatroz, Aramoveis, Berlim, Bentec, Bertolini, Bontempo, Colormax, Cook, Cozimax,Cozinart,Dada, Daico, Dellanno, Ditalia, D’Silva, Durart, Estrela Moveis, Evviva, Favo, Florense,Henn, Imobal,Itatiaia, Kappersberg, Kitchens, Kit’s Paranà, Lacca, Leicht, Luciane, Mademoveis, Millennium, Mobler, Neuman, Nicioli, Notavel, Ornare, Pagani, Palmeira, Paludetto, Piramide, Poliform, Politorno, Requipe Cozinhas, Rudnick, SCA, SD, Segatto, Skema, Telasul, Todeschini, Unica, Varanda, Valcucine.

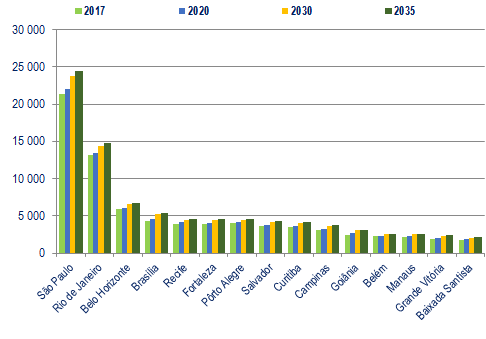

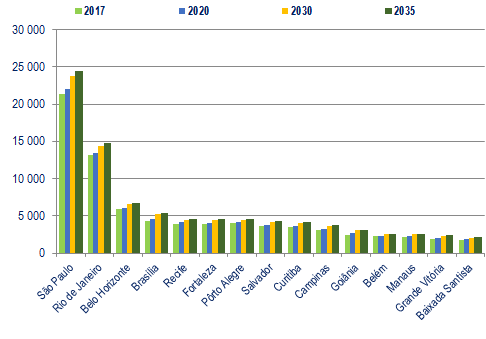

Population of the top 15 urban agglomerations in Brazil with 300,000 or more in 2018, 2017-2020-2030-2035. Thousands

In Brazil, the kitchen furniture production is mainly concentrated in the industrial furniture clusters of the Southern and the South-Eastern States, such as: Bento Gonçalves (RS), Interior of São Paulo (SP), Arapongas (PR), City of São Paulo and Metropolitan Area (SP), Ubá (MG), Curitiba (PR), São Bento do Sul (SC), Lagoa Vermelha (RS) and Rio de Janeiro and Metropolitan Area (RJ). The production of kitchen furniture in Brazil increased in 2017 and a further growth is expected during 2018 and 2019.

Among the major distributors in the large retail sector, we can mention Casas Bahia and Ponto Frio, Magazine Luiza, Lojas Cem, Ricardo Eletro, Marabraz and Lojas Colombo.

The kitchen furniture market in Brazil shows a mixed composition with large brands coexisting with small brands. Itatiaia, Todeschini, Evviva, Florense, Nicioli, Henn, Unica, Kappesberg, Politorno, Notável and Kit’s Paraná are among the main players. Top 50 manufacturers, according to CSIL estimates, hold around two thirds of the Brazilian market for kitchen furniture in value.

Abstract of Table of Contents

BASIC DATA AND ACTIVITY TREND

The kitchen furniture sector in Brazil at a glance. Main data and figures

The kitchen furniture sector in Brazil, basic data 2010-2017 in values and quantities

Furniture production in Brazil by product line (1,000 items), 2013-2017

INTERNATIONAL TRADE

Brazil. Export and import of kitchen furniture, by country and by geographical area of destination/origin, 2012-2017

DRIVING FORCES FOR DEMAND AND MAIN CLUSTERS

Population in Brazil and other economic indicators of the country

GDP, total investments, inflation and unemployment rate n Brazil, trend 2010-2017 end forecasts 2018-2022

Population of the top 50 urban agglomerations in Brazil with 300,000 or more in 2018, 2017-2030

Main manufacturing clusters: an analysis of supply at the territorial level

DISTRIBUTION

Mark-up

Furniture and kitchen furniture stores

Furniture and appliance chains

DIY segment

Purchasing process

Kitchen furniture market in Brazil. Estimated market shares by cabinet door material and colour

Built-in appliances

MARKET SHARES

The kitchen furniture market in Brazil: top 50 players. Sales data and market shares

Low and middle-low end segments ; Middle and middle-upper end segment ; Upper and luxury end segment: Main players, sales data and market shares for each price segment, short company profiles

CSIL Market Research Report The kitchen furniture market in Brazil provides an analysis of the kitchen furniture production and consumption, imports and exports in Brazil, in values and in quantities, with data and figures on the activity trend and forecasts for the next two years.

Import and export data are shown by country and by geographical area of origin/destination.

An estimate of the breakdown of the kitchen furniture market in Brazil by cabinet door material and colour is included.

An overview on the kitchen furniture distribution system in Brazil is offered, including the following channels: furniture and kitchen furniture stores, furniture and appliance chains, monobrand and franchising stores, DIY and Contract segments.

The Report shows also an overview of the main market drivers (Population and other economic indicators, GDP, total investments, inflation and unemployment rate up to 2022).

Information on the competitive system include sales data and market shares of 50 among the top kitchen furniture manufacturers in Brazil, as well as short company profiles. Six different price segments are analyzed.

Website for a sample of 20 Brazilian manufacturers of kitchen furniture is also provided.

Population of the top 15 urban agglomerations in Brazil with 300,000 or more in 2018, 2017-2020-2030-2035. Thousands

In Brazil, the kitchen furniture production is mainly concentrated in the industrial furniture clusters of the Southern and the South-Eastern States, such as: Bento Gonçalves (RS), Interior of São Paulo (SP), Arapongas (PR), City of São Paulo and Metropolitan Area (SP), Ubá (MG), Curitiba (PR), São Bento do Sul (SC), Lagoa Vermelha (RS) and Rio de Janeiro and Metropolitan Area (RJ). The production of kitchen furniture in Brazil increased in 2017 and a further growth is expected during 2018 and 2019.

Among the major distributors in the large retail sector, we can mention Casas Bahia and Ponto Frio, Magazine Luiza, Lojas Cem, Ricardo Eletro, Marabraz and Lojas Colombo.

The kitchen furniture market in Brazil shows a mixed composition with large brands coexisting with small brands. Itatiaia, Todeschini, Evviva, Florense, Nicioli, Henn, Unica, Kappesberg, Politorno, Notável and Kit’s Paraná are among the main players. Top 50 manufacturers, according to CSIL estimates, hold around two thirds of the Brazilian market for kitchen furniture in value.

Abstract of Table of Contents

BASIC DATA AND ACTIVITY TREND

The kitchen furniture sector in Brazil at a glance. Main data and figures

The kitchen furniture sector in Brazil, basic data 2010-2017 in values and quantities

Furniture production in Brazil by product line (1,000 items), 2013-2017

INTERNATIONAL TRADE

Brazil. Export and import of kitchen furniture, by country and by geographical area of destination/origin, 2012-2017

DRIVING FORCES FOR DEMAND AND MAIN CLUSTERS

Population in Brazil and other economic indicators of the country

GDP, total investments, inflation and unemployment rate n Brazil, trend 2010-2017 end forecasts 2018-2022

Population of the top 50 urban agglomerations in Brazil with 300,000 or more in 2018, 2017-2030

Main manufacturing clusters: an analysis of supply at the territorial level

DISTRIBUTION

Mark-up

Furniture and kitchen furniture stores

Furniture and appliance chains

DIY segment

Purchasing process

Kitchen furniture market in Brazil. Estimated market shares by cabinet door material and colour

Built-in appliances

MARKET SHARES

The kitchen furniture market in Brazil: top 50 players. Sales data and market shares

Low and middle-low end segments ; Middle and middle-upper end segment ; Upper and luxury end segment: Main players, sales data and market shares for each price segment, short company profiles

RAPPORTI CORRELATI

Il mercato italiano dei mobili per cucina

Aprile 2024, XLII Ed. , 95 pagine

Questo studio offre un’analisi completa del settore dei mobili per cucina in Italia attraverso dati di produzione e consumo, interscambio commerciale, quote di mercato dei principali operatori del settore per fascia di prezzo, localizzazione delle vendite, canali distributivi, redditività, tipologie di elettrodomestici integrati venduti, tipologie e materiali di antine e piani, andamento del mercato e prospettive.

Kitchen furniture: World market outlook (English)

Dicembre 2023,

XVIII Ed. ,

185 pagine

Mobili per cucina: outlook mondiale

CSIL analizza 60 mercati di mobili per cucina con una ricca raccolta di dati sui paesi, produzione e consumo sia in valore che in unità. Profili aziendali di 35 tra i principali produttori di mobili per cucina a livello mondiale.

The European market for kitchen furniture (English)

Maggio 2023,

XXXIII Ed. ,

305 pagine

Il mercato europeo dei mobili per cucina

Nel 2022, la produzione europea (30 Paesi) di mobili per cucina ammonta a circa 7 milioni di unità prodotte, di cui circa un milione nel segmento di fascia alta.

The kitchen furniture market in the United States (English)

Marzo 2023,

VIII Ed. ,

112 pagine

Il mercato dei mobili per cucina negli Stati Uniti

Analisi approfondita del settore dei mobili per cucina negli Stati Uniti (USA), con andamento e previsioni per produzione, consumi, importazioni ed esportazioni, principali player per aree geografiche e fasce di prezzo (raggruppati in sei fasce di prezzo), politiche di marketing e canali distributivi

La distribuzione dei mobili per cucina in Italia

Giugno 2020, VIII Ed. , 105 pagine

Indagine CSIL, giunta alla sua 8a edizione, volta a rilevare l’opinione dei rivenditori di mobili per cucina in Italia sui principali marchi di cucina presenti nel nostro Paese. Valutazioni qualitative e di trade satisfaction in termini di servizio, prodotto, prezzi, promozione (articolati lungo 17 item) e individuazione dei punti di forza e di debolezza per ciascuno dei 16 marchi analizzati