Trends in the European Office Market: the Dealer’s Point of View

Ufficio | Distribuzione e eCommerce | Dicembre 2017

€1600

RAPPORTO IN LINGUA INGLESE

Dicembre 2017,

I Ed. ,

40 pagine

Prezzo (licenza per singolo utente):

EUR 1600 / USD 1728

Contattateci per licenze corporate e multiuser

Lingua: English

Codice report: EU33a

Editore: CSIL

Status: available for online purchase and immediate download

Download

Indici dei contenuti

The European market for office furniture is currently showing signs of a general recovery. Following two years of consecutive growth the market is expected to further improve its performance in both 2018 and 2019.

In such a context, CSIL decided to launch a survey with the aim of understanding and describing the expectations of European office furniture distributors and the main sector trends over the next two years.

The study was launched to get a better understanding of the prospects for the office furniture sector in Europe by gathering the expectations of the distribution companies for the period 2018-2019. The analysis involved around 100 office furniture distributors (dealers, distributors, interior designers, specifiers) located in Western Europe and surveyed by CSIL in September-November 2017.

In particular the analysis concentrates on:

- The office furniture market and forecasts

- Quantification and performance of the main customer segments

- Factors influencing the purchasing decision

- Average customer budgets by product category, for both corporate tenders and individuals

- Trends for single office seating categories, use of sit-stand desks and evolution of office furniture areas

- Use of e-commerce and prospects

- Expansion of product portfolio and new product categories to be introduced

- Location of suppliers and delivery terms

The countries were divided into four areas according to their geographical proximity and similarity in market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

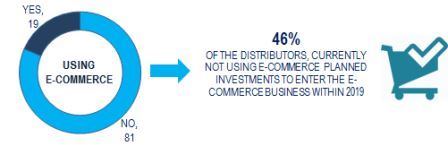

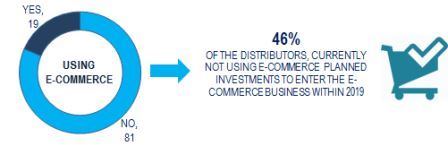

Sample. The use of e-commerce channel and perspectives. Percentages

The European market for office furniture is witnessing a general recovery. Following two years of consecutive growth, the market is expected to further improve its performance in both 2018 and 2019. In such a context this survey aimed at understanding and describing the expectations of European distributors regarding the main sector trends over the next two years.

As office distribution is progressively transforming from the simple supply of furniture items to a more global offer of service, consultancy and projects, the vast majority of survey respondents declared intentions to expand their offer and product portfolios.

Distributors are also paying attention to new instruments for approaching customers. The fact that customers (individuals and professionals in particular) look to Social Media for ideas, information and product reviews cannot be disregarded when developing a marketing and advertising campaign. In fact, a sizeable share of interviewees is considering investing in e-commerce by 2019.

The research findings are also shown by single geographic region and, when relevant, according to the size of the distributors (small or medium-large companies).

Abstract of Table of Contents

EXECUTIVE SUMMARY

1. INTRODUCTION

Contents

Methodology

Other CSIL reports on the office furniture industry and e-commerce

The sample

2. THE EUROPEAN OFFICE FURNITURE MARKET

Macroeconomics

The office furniture market

Forecasts

3. DISTRIBUTORS PRODUCT PORTFOLIO

Brand policy

Strategies

4. CUSTOMER ANALYSIS

Segments

The purchasing decision

Average customer budgets

5. PRODUCT TRENDS

Seating

Office spaces

Sit-stand desks

6. SUPPLIERS

Location of suppliers

Terms of delivery

7. E-COMMERCE EVOLUTION

E-commerce

ANNEX 1. THE QUESTIONNAIRE

The European market for office furniture is currently showing signs of a general recovery. Following two years of consecutive growth the market is expected to further improve its performance in both 2018 and 2019.

In such a context, CSIL decided to launch a survey with the aim of understanding and describing the expectations of European office furniture distributors and the main sector trends over the next two years.

The study was launched to get a better understanding of the prospects for the office furniture sector in Europe by gathering the expectations of the distribution companies for the period 2018-2019. The analysis involved around 100 office furniture distributors (dealers, distributors, interior designers, specifiers) located in Western Europe and surveyed by CSIL in September-November 2017.

In particular the analysis concentrates on:

- The office furniture market and forecasts

- Quantification and performance of the main customer segments

- Factors influencing the purchasing decision

- Average customer budgets by product category, for both corporate tenders and individuals

- Trends for single office seating categories, use of sit-stand desks and evolution of office furniture areas

- Use of e-commerce and prospects

- Expansion of product portfolio and new product categories to be introduced

- Location of suppliers and delivery terms

The countries were divided into four areas according to their geographical proximity and similarity in market characteristics. These areas are:

- Scandinavia: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE);

- Central Europe (DACH): Germany (DE), Austria (AT) and Switzerland (CH);

- Western Europe: Belgium (BE), France (FR), Ireland (IE), Netherlands (NL) and the United Kingdom (UK).

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

Sample. The use of e-commerce channel and perspectives. Percentages

The European market for office furniture is witnessing a general recovery. Following two years of consecutive growth, the market is expected to further improve its performance in both 2018 and 2019. In such a context this survey aimed at understanding and describing the expectations of European distributors regarding the main sector trends over the next two years.

As office distribution is progressively transforming from the simple supply of furniture items to a more global offer of service, consultancy and projects, the vast majority of survey respondents declared intentions to expand their offer and product portfolios.

Distributors are also paying attention to new instruments for approaching customers. The fact that customers (individuals and professionals in particular) look to Social Media for ideas, information and product reviews cannot be disregarded when developing a marketing and advertising campaign. In fact, a sizeable share of interviewees is considering investing in e-commerce by 2019.

The research findings are also shown by single geographic region and, when relevant, according to the size of the distributors (small or medium-large companies).

Abstract of Table of Contents

EXECUTIVE SUMMARY

1. INTRODUCTION

Contents

Methodology

Other CSIL reports on the office furniture industry and e-commerce

The sample

2. THE EUROPEAN OFFICE FURNITURE MARKET

Macroeconomics

The office furniture market

Forecasts

3. DISTRIBUTORS PRODUCT PORTFOLIO

Brand policy

Strategies

4. CUSTOMER ANALYSIS

Segments

The purchasing decision

Average customer budgets

5. PRODUCT TRENDS

Seating

Office spaces

Sit-stand desks

6. SUPPLIERS

Location of suppliers

Terms of delivery

7. E-COMMERCE EVOLUTION

E-commerce

ANNEX 1. THE QUESTIONNAIRE

RAPPORTI CORRELATI

Furniture retailing in Europe (English)

Febbraio 2024,

XVII Ed. ,

296 pagine

La distribuzione del mobile in Europa

Analisi della distribuzione di mobili per la casa in 15 paesi europei. Il rapporto fornisce trend di consumo di mobili per la casa, previsioni di mercato, dati per paese, analisi per canale distributivo, formati di vendita e performance dei principali rivenditori di mobili per la casa in Europa

Furniture retailing in Poland (English)

Febbraio 2024,

I Ed. ,

29 pagine

La distribuzione del mobile in Polonia

Analisi di mercato sulla distribuzione del mobile in Polonia. Consumi per segmento, importazioni, canali distributivi, principali rivenditori

Furniture retailing in Czech Republic (English)

Febbraio 2024,

I Ed. ,

29 pagine

La distribuzione del mobile in Repubblica Ceca

Analisi di mercato sulla distribuzione del mobile in Repubblica Ceca. Consumi per segmento, importazioni, canali distributivi, principali rivenditori

Furniture retailing in the United Kingdom (English)

Febbraio 2024,

XVII Ed. ,

29 pagine

La distribuzione del mobile nel Regno Unito

Analisi di mercato sulla distribuzione del mobile nel Regno Unito. Consumi per segmento, importazioni, canali distributivi, principali rivenditori

Furniture retailing in Austria (English)

Febbraio 2024,

XVII Ed. ,

22 pagine

La distribuzione del mobile in Austria

Analisi di mercato sulla distribuzione del mobile in Austria. Consumi per segmento, importazioni, canali distributivi, principali rivenditori