India: greatness and complexity

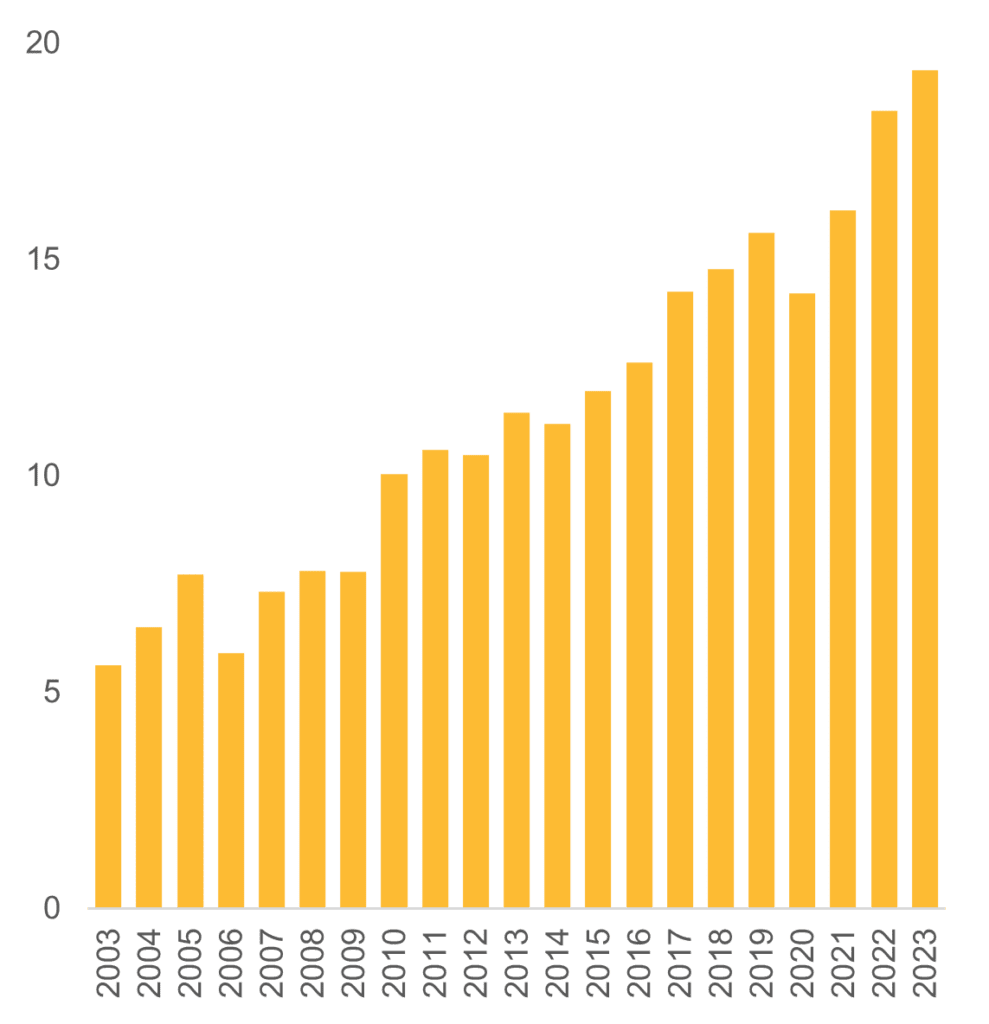

According to CSIL , India is the fourth largest furniture market in the world, climbing from 10th place ten years ago to reach a value of around US$ 19 billion in 2023.

Economic growth will be strong in 2023 and is expected to continue in 2024 (+6%, real GDP growth). 2023 will be remembered as the year when India overtook mainland China to become the world’s most populous country, with more than 1.4 billion people. The crown may have no intrinsic value, but it symbolises things that matter. According to UN projections, India’s population will almost certainly continue to grow for several decades, accounting for more than one-sixth of the increase in the world’s working-age population (15-64 year olds) between now and 2050. In contrast, China’s population has recently peaked and is set to decline sharply.

India is one of the world’s largest developing economies, but it often struggles to reconcile its considerable potential with its complex reality.

Despite impressive economic growth, per capita income remains low compared with China and other South-East Asian countries. Today, Chinese consumers are three times richer and South Korean and Japanese consumers six times richer than Indian consumers. This is also reflected in the furniture sector, where the Indian market is still characterised by low per capita furniture spending, both globally and compared to other Asia-Pacific countries. There is therefore significant growth potential in the coming years. India’s market has already been gradually catching up in recent years. The Indian furniture market has been driven by several structural social and economic factors, including population growth, urbanisation, economic growth and an emerging middle class with rising per capita income. These factors, as well as other structural drivers specific to the furniture sector, will continue to support the country’s market in the coming years.

The Indian furniture sector is still in the process of modernisation. At present, furniture retailing is still highly fragmented and characterised by the dominance of the unorganised sector, which accounts for the vast majority of the market (up to 80-90%). The recent boom in e-commerce in the furniture sector will contribute to the modernisation of the retail sector. During the pandemic, e-commerce development accelerated rapidly – between 2019 and 2022, furniture e-commerce sales in India are estimated to have doubled. Tens of millions of new internet shoppers entered the market during these years, driven by the special conditions created by the pandemic. And there is plenty of room for further growth: e-commerce penetration in India is significantly lower than in other major Asia-Pacific markets.

The outlook to 2024 remains positive for India’s furniture market, with the most promising performance in Asia Pacific. The market is expected to grow by a further 4% in real terms by 2025.

India. Furniture consumption, 2003-2023. USD Billion

The Indian furniture industry is fragmented and highly unorganised, with a shortage of skilled labour and relatively high raw material, transport and logistics costs (compared to China, for example). In recent years, a policy push by both state and central governments has encouraged the establishment of furniture parks and clusters across the country, with the aim of increasing the capacity and scale of furniture manufacturers, including by reducing logistics and supply chain costs. These policies have also encouraged foreign investment to set up manufacturing facilities in the country. In a scenario where companies are rethinking their supply strategies, India is potentially well placed to benefit from geopolitical and economic trends that are driving the diversification of Asia’s manufacturing supply chain. New entrants include two major upholstered furniture manufacturers, HTL, the leading Chinese upholstered furniture manufacturer, and Master Sofa from Malaysia.

The internationalisation of the Indian furniture sector is also being promoted by major furniture exhibitions, which not only cater to local manufacturers but also attract foreign ones. This is the case of IIFF, the India International Furniture Fairs, which took place in New Delhi from 14 to 17 December 2023 in the vast Pragati Maidan.

This year’s edition was the largest of the five editions, both in terms of exhibitors (around 150) and visitors (8,000 visitors, a growing number compared to the 2022 edition). The exhibition hosted furniture manufacturers exhibiting a wide range of products representing different foreign countries such as Turkey, Italy, Malaysia, France and Vietnam. For many companies, it was the first stepping stone to the Indian market and to establishing a long-term relationship with trade buyers. IIFF has established itself as a hub for trade buyers from various sectors of the furniture industry, including chain stores, independent retailers, HORECA (Hotel, Restaurant and Café), interior design, e-commerce, real estate development and institutional sales. Companies in particular from Vietnam and Malaysia found great opportunities of scouting to grabs prospects to differentiate their export destinations including also India since the poor performance of other markets of the region.

CSIL’s report ‘The Furniture Industry in India‘ will be issued in April 2024 and will contain all the main statistics and indicators useful to analyze the furniture sector in India. Furniture production, market size and international trade; factors affecting the competitiveness of producers; top manufacturers; market potentials; development insights; data by segment.