April 2023,

X Ed. ,

114 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: W05VN

Publisher: CSIL

Download

Table of contents

CSIL’s Research Report The furniture industry in Vietnam offers an up-to-date and detailed analysis of the Vietnamese furniture sector and its prospects , through tables, graphs, illustrated maps, and further information processed from direct interviews with top furniture companies and sector experts.

The Furniture market outline part provides data for furniture production, consumption, imports, and exports for the time series 2012-2022 with furniture market forecasts for 2023 and 2024.

At a supply side, the Vietnam furniture productive system is analysed through selected productive factors (forest area and resources, the structure of land by land use, consumption of wood-based panels, imports of wood-based panels, employment) and a breakdown of furniture production by segment (upholstered furniture, kitchen furniture, office furniture, bedroom, dining and living room furniture, other furniture).

The competitive system includes a ranking of the top 50 manufacturers by furniture turnover, providing detailed profiles including the following information:

- Company name

- Address, website, email, year of establishment

- Ownership and type of company (FDI, Joint Venture, Vietnamese capital)

- Activity

- Product Portfolio

- Turnover and number of employees (last available year, typically 2022 or 2021)

- Export share and key export markets

- Manufacturing facilities (number and location)

The above information is available also in the detailed profiles of the top 128 Vietnamese and FDI furniture manufacturers.

Further 140 short profiles of Vietnamese furniture companies, are provided with turnover and number of employees range.

The report overall considers a total of around 270 furniture companies.

The analysis of the Vietnamese furniture market includes:

- Selected demand determinants (population, main cities, housing floors by region and by types of house, dwelling area per capita, international tourism, expenditure per capita, income per capita and expenditure per capita by type of expenditure);

- A breakdown of furniture consumption by segment (upholstered furniture, kitchen furniture, office furniture, bedroom, dining and living room furniture, and other furniture).

- Furniture market forecasts up to 2024.

The international trade of furniture is analysed from and to Vietnam: countries of destination/origin, furniture trade by segment (upholstered furniture, non-upholstered seats, bedroom furniture, kitchen furniture, office furniture, parts of furniture, parts of seats) and furniture trade by country/area.

The study is further enriched by:

- Prospects of the furniture industry in the country;

- CSIL’s assessment of market potential;

- A cross-country comparison.

CSIL’s Research Report ‘The furniture industry in Vietnam’ is part of the Country Furniture Outlook Series, that currently covers 100 markets.

Selected companies

Among the selected mentioned companies: An Cuong, Bassett Furniture, Henglin Chair, HHC Corpotarion, Motomotion Vietnam, ScanCom International, Timberland, Truong Thanh Furniture, UE Furniture, Wanek Ashley Furniture.

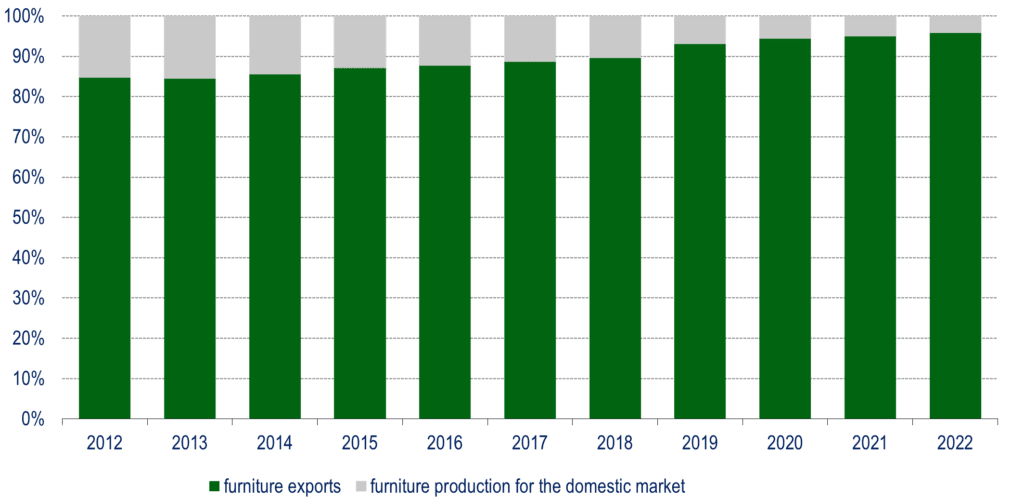

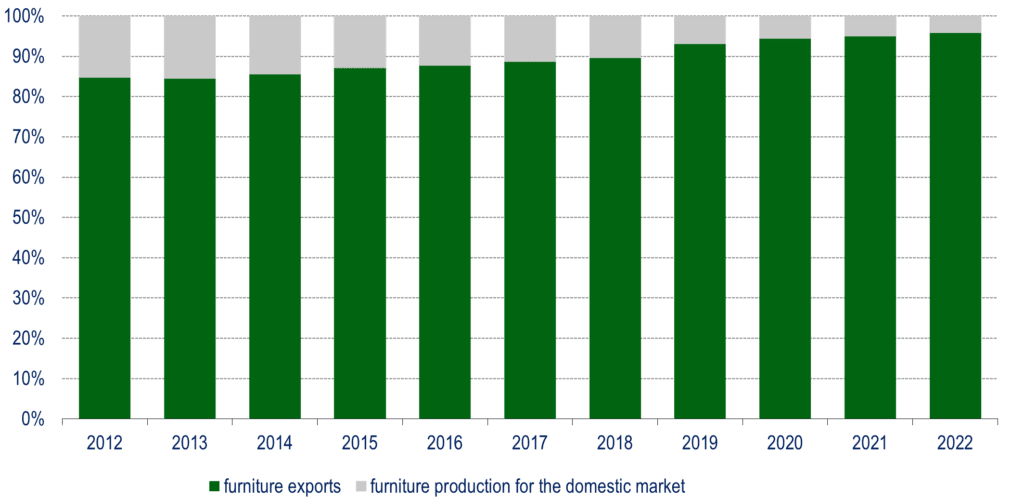

Vietnam. Furniture export/production ratio, 2012-2022, %

In recent years, Vietnam has become the 6th largest furniture producer and the 2nd largest furniture exporter worldwide. Exports have been the country’s furniture industry’s major driver, increasing from USD 5 billion to nearly USD 20 billion during the last decade.

Vietnam has emerged not only as a hub for domestic production sourcing but also as an attractive option for offshore manufacturing for overseas companies. The number of direct foreign investment companies (FDI) is growing year after year and typically with a larger average size in terms of turnover and workforce.

Abstract of Table of Contents

1. Summary: Key facts about the furniture sector in Vietnam

2. Vietnam furniture market potential

Furniture market outline, 2012-2022

Economic environment and furniture market forecasts, 2023-2024

3. Business climate indicators

4. Demand Determinants

5. Furniture Consumption in Vietnam

Trends in the Vietnamese furniture market and consumption by segment

6. Vietnam furniture Imports

Furniture imports growth, furniture consumption and imports/consumption ratio by segment

Origin of furniture imports and imports by segment

Imports and exports of furniture parts

7. Vietnam productive factors

8. Vietnam. Furniture Production

Furniture production, 2012-2022 and production by segment

9. Vietnam Furniture Exports

Furniture exports growth furniture production and exports/production ratio by segment

Destination of furniture exports and exports by segment

10. Furniture competitive system in Vietnam

Top 50 furniture manufacturers (FDI and Vietnamese owned companies) by total turnover.

Major foreign furniture companies with business activity in Vietnam

11. Vietnam. Major furniture manufacturers

12. Vietnam. Leading FDI and foreign companies

13. Vietnam. Other furniture companies

Annexes: Country Rankings, Furniture Data, Furniture Exports and Imports

CSIL’s Research Report The furniture industry in Vietnam offers an up-to-date and detailed analysis of the Vietnamese furniture sector and its prospects , through tables, graphs, illustrated maps, and further information processed from direct interviews with top furniture companies and sector experts.

The Furniture market outline part provides data for furniture production, consumption, imports, and exports for the time series 2012-2022 with furniture market forecasts for 2023 and 2024.

At a supply side, the Vietnam furniture productive system is analysed through selected productive factors (forest area and resources, the structure of land by land use, consumption of wood-based panels, imports of wood-based panels, employment) and a breakdown of furniture production by segment (upholstered furniture, kitchen furniture, office furniture, bedroom, dining and living room furniture, other furniture).

The competitive system includes a ranking of the top 50 manufacturers by furniture turnover, providing detailed profiles including the following information:

- Company name

- Address, website, email, year of establishment

- Ownership and type of company (FDI, Joint Venture, Vietnamese capital)

- Activity

- Product Portfolio

- Turnover and number of employees (last available year, typically 2022 or 2021)

- Export share and key export markets

- Manufacturing facilities (number and location)

The above information is available also in the detailed profiles of the top 128 Vietnamese and FDI furniture manufacturers.

Further 140 short profiles of Vietnamese furniture companies, are provided with turnover and number of employees range.

The report overall considers a total of around 270 furniture companies.

The analysis of the Vietnamese furniture market includes:

- Selected demand determinants (population, main cities, housing floors by region and by types of house, dwelling area per capita, international tourism, expenditure per capita, income per capita and expenditure per capita by type of expenditure);

- A breakdown of furniture consumption by segment (upholstered furniture, kitchen furniture, office furniture, bedroom, dining and living room furniture, and other furniture).

- Furniture market forecasts up to 2024.

The international trade of furniture is analysed from and to Vietnam: countries of destination/origin, furniture trade by segment (upholstered furniture, non-upholstered seats, bedroom furniture, kitchen furniture, office furniture, parts of furniture, parts of seats) and furniture trade by country/area.

The study is further enriched by:

- Prospects of the furniture industry in the country;

- CSIL’s assessment of market potential;

- A cross-country comparison.

CSIL’s Research Report ‘The furniture industry in Vietnam’ is part of the Country Furniture Outlook Series, that currently covers 100 markets.

Vietnam. Furniture export/production ratio, 2012-2022, %

In recent years, Vietnam has become the 6th largest furniture producer and the 2nd largest furniture exporter worldwide. Exports have been the country’s furniture industry’s major driver, increasing from USD 5 billion to nearly USD 20 billion during the last decade.

Vietnam has emerged not only as a hub for domestic production sourcing but also as an attractive option for offshore manufacturing for overseas companies. The number of direct foreign investment companies (FDI) is growing year after year and typically with a larger average size in terms of turnover and workforce.

Abstract of Table of Contents

1. Summary: Key facts about the furniture sector in Vietnam

2. Vietnam furniture market potential

Furniture market outline, 2012-2022

Economic environment and furniture market forecasts, 2023-2024

3. Business climate indicators

4. Demand Determinants

5. Furniture Consumption in Vietnam

Trends in the Vietnamese furniture market and consumption by segment

6. Vietnam furniture Imports

Furniture imports growth, furniture consumption and imports/consumption ratio by segment

Origin of furniture imports and imports by segment

Imports and exports of furniture parts

7. Vietnam productive factors

8. Vietnam. Furniture Production

Furniture production, 2012-2022 and production by segment

9. Vietnam Furniture Exports

Furniture exports growth furniture production and exports/production ratio by segment

Destination of furniture exports and exports by segment

10. Furniture competitive system in Vietnam

Top 50 furniture manufacturers (FDI and Vietnamese owned companies) by total turnover.

Major foreign furniture companies with business activity in Vietnam

11. Vietnam. Major furniture manufacturers

12. Vietnam. Leading FDI and foreign companies

13. Vietnam. Other furniture companies

Annexes: Country Rankings, Furniture Data, Furniture Exports and Imports

SEE ALSO

The furniture industry in India

April 2024, IX Ed. , 81 pages

Comprehensive analysis of the furniture sector in India, delving into the country’s productive system, the furniture demand and trade (time series 2013-2023), the furniture market development (forecasts up to 2025) with CSIL’s assessment of market potential and competitive landscape covering the leading Indian manufacturers of furniture, their performance and profiles.

United Kingdom Furniture Outlook

January 2024, XXVIII Ed. , 23 pages

Analysis of the furniture market in the United Kingdom, with value and trends of furniture production and consumption, furniture imports, and exports. Top furniture companies in the UK. Demand determinants, market potential and future prospect for the Furniture market.

Poland Furniture Outlook

January 2024, XXII Ed. , 25 pages

Market research analyses the furniture industry in Poland: furniture market size and forecasts, trends in furniture production, consumption, imports and exports, list of top furniture companies. Demand determinants, market potential and future prospect for the Polish furniture market.

Germany Furniture Outlook

January 2024, XXVIII Ed. , 23 pages

This market research analyses the furniture market in Germany providing value and trends of furniture production and consumption, furniture imports and exports. Top furniture companies in Germany with short profiles. Demand determinants, market potential and future prospect for the Furniture market.

France Furniture Outlook

January 2024, XXVIII Ed. , 20 pages

This market research analyses the furniture market in France providing value and trends of furniture production and consumption, furniture imports and exports. Top furniture companies. Demand determinants, market potential and future prospect for the Furniture market.