Italian Kitchens are becoming increasingly international

The Italian kitchen furniture exports recorded a +15% growth last year, gaining additional market share in Europe, Asia, and the USA, with potential for further development in the upper-end market.

The European market for kitchen furniture held steady in size throughout 2022 (experiencing a significant price growth with a decrease in kitchen sales volume of approximately 2%, equivalent to 7 million units sold). Considering the strong growth in 2021, geopolitical tensions in Eastern Europe, inflation rates, and the consequent risk of economic slowdown, this is not a bad result overall (CSIL’s analysis are based on Eurostat data, preliminary figures for 2022).

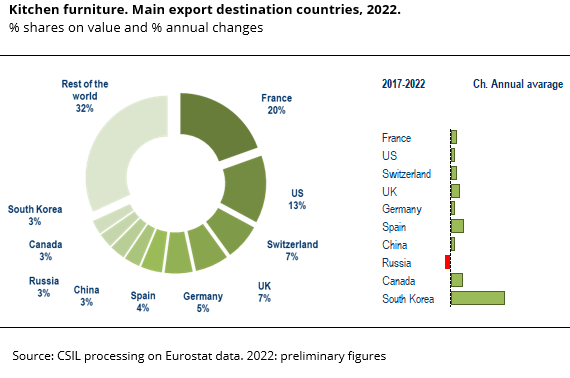

Italian kitchen furniture exports grew by about 15%, less than the +20% increase achieved by Spain, which, however, remains a relatively minor player in the global trading scene. Nevertheless, it exceeded the significant +9% growth in exports from Germany (the leading global exporter). Imports have increased by over 20% in France and in the United Kingdom.

Italian kitchen furniture exports are mainly focused on the medium and high-end segments. Luxury companies like Boffi and Poliform operate with substantial volumes and mid-range market leaders with high-end offerings like Veneta Cucine and Scavolini. In 2022, Italian kitchen furniture exports surpassed one billion Eur, with France being the primary market for Italian kitchens and the United States coming in second place with a strong increase in demand.

The Top 20 Exporters

CSIL cites the data of the top 20 Italian kitchen furniture exporters, with a turnover ranging from approximately 15 to 70 million Eur per company. Boffi, Veneta Cucine, Lube, Cubo Design, Cesar, Stosa, Arrital, are among the companies that have shown the highest growth rates abroad (ranging from 15% to 20% and up to 30% in some cases). For Armony, the main market is France, an important export destination for companies like Poliform, Cesar, and Zecchinon. A significant portion of Dada and Valcucine‘s turnover comes from various European markets. In the United States, Boffi and Scavolini have a strong presence.

Veneta Cucine has a presence abroad with 250 points of sales (around 60 in France, 40 in China), of which about 70 are mono-brand stores. Europe remains the most important area for Veneta Cucine (especially France), but the growth trend is also evident in Asia, with China being a primary foreign market. Snaidero has a presence abroad with over 200 sales outlets, including 12 flagship stores; Germany and the United States are two important markets. The contract channel represents approximately 25% of foreign turnover from a distribution perspective. Aran (with 400 stores abroad) is one of the companies with the most diversified international presence, and in this case, the contract channel is also significant.

Veneta Cucine has a presence abroad with 250 points of sales (around 60 in France, 40 in China), of which about 70 are mono-brand stores. Europe remains the most important area for Veneta Cucine (especially France), but the growth trend is also evident in Asia, with China being a primary foreign market. Snaidero has a presence abroad with over 200 sales outlets, including 12 flagship stores; Germany and the United States are two important markets. The contract channel represents approximately 25% of foreign turnover from a distribution perspective. Aran (with 400 stores abroad) is one of the companies with the most diversified international presence, and in this case, the contract channel is also significant.

Arredo 3‘s foreign network is primarily European (France, Germany, the UK), also among the top 20 national kitchen furniture exporters. For Lube, foreign market growth in 2022 is approximately 18%, with France, Spain, and China being among the main destinations. Among the kitchen exporters for whom the Asian market holds significant weight, we mention Boffi, Arclinea, Scic, and Euromobil.

Target: The United States

For the United States, Italy is the “only” sixth country of origin for kitchen furniture imports, but it is the top European and high-end importer, with a record growth in 2022 (+26%) and over 100 million USD more compared to Germany (respectively 155 and 50 million USD of kitchens imported from the US). However, it is worth noting that there are still opportunities in the States, considering that the major Italian luxury brands in the American market (Arclinea, Boffi, Scavolini, Snaidero) hold a limited market share of about 1%.

Italian companies typically start from New York, followed closely by Chicago and Los Angeles. Other significant US Italian kitchens centers include Boston, Houston, Washington, and Miami. In these locations, Italian brands generally have prestigious retail spaces (from Miami’s Miracle Mile to Chicago’s River North District) with relatively modest sizes (ranging from 200 to 300 square meters), including the notable 800-square-meter of Boffi Soho showroom. Among those showing interest in the US market, CSIL also mentions the Colombini Group, Veneta Cucine (both for their public statements), and Stosa, which participated in this year’s Kbis in Las Vegas (where German counterparts Nobilia and Bauformat were also present).

Find more details on the new edition of the CSIL report ‘The Italian market for kitchen furniture’