March 2024,

VII Ed. ,

111 pages

Price (single user license):

EUR 2900 / USD 3103

For multiple/corporate license prices please contact us

Language: English

Report code: EU13

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The CSIL report The European market for outdoor furniture offers the latest data and sector trends, with an in-depth look at outdoor furniture products, competitive landscapes, and a focus on 15 countries selected for their representativeness in the sector within Europe: Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

This report analyses the following topics:

- Trends in market size and production of outdoor furniture in Europe 2018-2023

- Market development and forecasts up to 2025

- International trade and major trading partners

- Destination segments: contract projects and retail residential use

- Trends in products and materials: upholstered and non-upholstered lounge seating, tables and chairs, other outdoor furniture, emerging categories, finishings/materials

- Business performance by country: macroeconomic indicators, demand divers, and outdoor furniture sector figures

- Competitive system: Leading manufacturing companies of outdoor furniture and market share

- Distribution: distribution channels, and e-commerce

STRUCTURE OF THE REPORT

MARKET OVERVIEW

The first part of the study shows the main sector figures of the European Outdoor furniture industry, the market evolution, challenges, and figures by country, with basic data for production, consumption, imports, and exports for the time series 2018-2023.

Outdoor furniture market forecasts in Europe and by the considered countries are provided for 2024 and 2025.

The outdoor furniture consumption is broken down by destination segment (contract and retail), by kind of product (upholstered sofas, benches, sun loungers, chairs, tables, other) and by material (steel/iron, aluminum, wood/rattan/bamboo, plastic, rope, other).

The international trade of outdoor furniture and market openness are analysed through data for exports of outdoor furniture, with incidence on production, data for imports of outdoor furniture, with incidence on consumption, and trading partners for the considered countries.

COUNTRY ANALYSIS

For Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, United Kingdom the study provides basic outdoor furniture data, socio-economic indicators, and population by dwelling type.

THE COMPETITIVE SYSTEM

The report also analyses the leading manufacturers of outdoor furniture in Europe and includes short profiles for selected players. Total revenues are provided for a sample of 100 leading European outdoor furniture companies. For selected firms, estimated revenues in the contract and the retail segment.

Market share for a sample of companies by country is provided for Benelux, Germany, France, Italy, Spain, and the UK.

The report considers a total of over 150 outdoor furniture companies operating in Europe.

DISTRIBUTION

Outdoor furniture market by distribution channel (Furniture retailers, Furniture chains, DIY / Hypermarkets / Dept. Stores, Garden Centers, E-commerce, Direct sales) is provided for Europe and France, Germany, Italy, and the UK.

PRODUCTS CONSIDERED: upholstered and non-upholstered lounge seating, tables and chairs, and other outdoor furniture.

GEOGRAPHICAL COVERAGE: Europe as a whole, with a focus on Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, United Kingdom.

Selected companies

Among the companies considered in the report: Cane-Line, Dedon, EMU, Fermob, Fischer Mobel, Fuera Dentro, Grand Soleil – Igap, Grosfillex, Hartman, Keter UK, Kettal, Kettler, Lafuma Mobilier, Maze Rattan, Nardi, Paola Lenti, Progarden-IPAE, Royal Botania, ScanCom International, Sieger, Sp Berner, Stern, Talenti, Tribu, Vitra, Vondom.

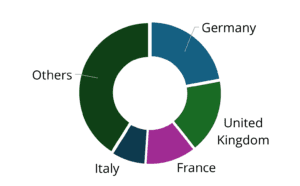

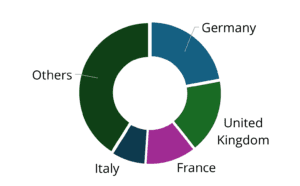

Leading Outdoor Furniture Importers in Europe, 2023. Percentages

Outdoor furniture is one of the best-performing segments within the European furniture industry, with a current overall market value that increased by about 30% cumulative compared to 2018. The largest consuming countries are Germany, the UK, Italy, and France, with a combined share of over 60%.

Although most sales in this sector continue to be in the retail segment, the share of sales of contract projects has increased in the past two years. Most outdoor furniture manufacturers interviewed by CSIL underlined a challenging market condition in the current year, while a recovery is expected for 2025.

European outdoor companies have structural connections with suppliers in China, Vietnam, and Indonesia. In recent years, however, some companies, especially those in the contract or luxury segment, have tried to reduce their dependence on Asian production by investing in manufacturing operations in Europe.

.

Abstract of Table of Contents

METHODOLOGY: Notes, Companies analyzed, Geographical definition, Considered Products, Materials and Distribution channels

EXECUTIVE SUMMARY: Outdoor furniture figures at a glance

1. MARKET OVERVIEW: The outdoor furniture market in Europe

1.1 Market evolution and figures by country

– Production, consumption and international trade of Outdoor furniture in Europe and by country

1.2 Contract and retail segments

– Outdoor furniture Market by destination

1.3 Products and materials

– Outdoor furniture consumption by product segment and by material

1.4 Market forecasts

– Outdoor furniture consumption in Europe and by country. Forecasts, 2024-2025

2. BUSINESS PERFORMANCE BY COUNTRY: Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, United Kingdom

– Production, consumption and international trade of outdoor furniture

– Socio-economic indicators, Hospitality industry, Population by dwelling type

3. INTERNATIONAL TRADE

3.1 Exports of outdoor furniture from Europe

– Outdoor furniture exports and incidence on production

3.2 Imports of outdoor furniture to Europe

– Outdoor furniture imports and incidence on consumption

3.3 International trade by country

– Exports of outdoor furniture, incidence on production and countries of destination

– Imports of outdoor furniture and incidence on consumption and countries of origin

4. COMPETITION: Leading manufacturers of outdoor furniture in Europe

4.1 Leading groups and market shares

– Brands operating in the market according to business specialization

4.2 Total sales of outdoor furniture

– Sector concentration

– Total revenues in a sample of 100 leading outdoor furniture companies

– Estimated revenues in the contract and in the retail segment

– Outdoor furniture supply by kind of product in a sample of companies

– Outdoor furniture supply by material used in a sample of companies

4.3 Outdoor furniture companies: Market shares by country

– Estimated revenues and market share for a sample of companies for Germany, France, Italy, Spain, UK

4.4 Company profiles

5. DISTRIBUTION OF OUTDOOR FURNITURE

– Outdoor furniture market by distribution channel

APPENDIX: List of Mentioned Companies

The CSIL report The European market for outdoor furniture offers the latest data and sector trends, with an in-depth look at outdoor furniture products, competitive landscapes, and a focus on 15 countries selected for their representativeness in the sector within Europe: Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

This report analyses the following topics:

- Trends in market size and production of outdoor furniture in Europe 2018-2023

- Market development and forecasts up to 2025

- International trade and major trading partners

- Destination segments: contract projects and retail residential use

- Trends in products and materials: upholstered and non-upholstered lounge seating, tables and chairs, other outdoor furniture, emerging categories, finishings/materials

- Business performance by country: macroeconomic indicators, demand divers, and outdoor furniture sector figures

- Competitive system: Leading manufacturing companies of outdoor furniture and market share

- Distribution: distribution channels, and e-commerce

STRUCTURE OF THE REPORT

MARKET OVERVIEW

The first part of the study shows the main sector figures of the European Outdoor furniture industry, the market evolution, challenges, and figures by country, with basic data for production, consumption, imports, and exports for the time series 2018-2023.

Outdoor furniture market forecasts in Europe and by the considered countries are provided for 2024 and 2025.

The outdoor furniture consumption is broken down by destination segment (contract and retail), by kind of product (upholstered sofas, benches, sun loungers, chairs, tables, other) and by material (steel/iron, aluminum, wood/rattan/bamboo, plastic, rope, other).

The international trade of outdoor furniture and market openness are analysed through data for exports of outdoor furniture, with incidence on production, data for imports of outdoor furniture, with incidence on consumption, and trading partners for the considered countries.

COUNTRY ANALYSIS

For Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, United Kingdom the study provides basic outdoor furniture data, socio-economic indicators, and population by dwelling type.

THE COMPETITIVE SYSTEM

The report also analyses the leading manufacturers of outdoor furniture in Europe and includes short profiles for selected players. Total revenues are provided for a sample of 100 leading European outdoor furniture companies. For selected firms, estimated revenues in the contract and the retail segment.

Market share for a sample of companies by country is provided for Benelux, Germany, France, Italy, Spain, and the UK.

The report considers a total of over 150 outdoor furniture companies operating in Europe.

DISTRIBUTION

Outdoor furniture market by distribution channel (Furniture retailers, Furniture chains, DIY / Hypermarkets / Dept. Stores, Garden Centers, E-commerce, Direct sales) is provided for Europe and France, Germany, Italy, and the UK.

PRODUCTS CONSIDERED: upholstered and non-upholstered lounge seating, tables and chairs, and other outdoor furniture.

GEOGRAPHICAL COVERAGE: Europe as a whole, with a focus on Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, United Kingdom.

Leading Outdoor Furniture Importers in Europe, 2023. Percentages

Outdoor furniture is one of the best-performing segments within the European furniture industry, with a current overall market value that increased by about 30% cumulative compared to 2018. The largest consuming countries are Germany, the UK, Italy, and France, with a combined share of over 60%.

Although most sales in this sector continue to be in the retail segment, the share of sales of contract projects has increased in the past two years. Most outdoor furniture manufacturers interviewed by CSIL underlined a challenging market condition in the current year, while a recovery is expected for 2025.

European outdoor companies have structural connections with suppliers in China, Vietnam, and Indonesia. In recent years, however, some companies, especially those in the contract or luxury segment, have tried to reduce their dependence on Asian production by investing in manufacturing operations in Europe.

.

Abstract of Table of Contents

METHODOLOGY: Notes, Companies analyzed, Geographical definition, Considered Products, Materials and Distribution channels

EXECUTIVE SUMMARY: Outdoor furniture figures at a glance

1. MARKET OVERVIEW: The outdoor furniture market in Europe

1.1 Market evolution and figures by country

– Production, consumption and international trade of Outdoor furniture in Europe and by country

1.2 Contract and retail segments

– Outdoor furniture Market by destination

1.3 Products and materials

– Outdoor furniture consumption by product segment and by material

1.4 Market forecasts

– Outdoor furniture consumption in Europe and by country. Forecasts, 2024-2025

2. BUSINESS PERFORMANCE BY COUNTRY: Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland, United Kingdom

– Production, consumption and international trade of outdoor furniture

– Socio-economic indicators, Hospitality industry, Population by dwelling type

3. INTERNATIONAL TRADE

3.1 Exports of outdoor furniture from Europe

– Outdoor furniture exports and incidence on production

3.2 Imports of outdoor furniture to Europe

– Outdoor furniture imports and incidence on consumption

3.3 International trade by country

– Exports of outdoor furniture, incidence on production and countries of destination

– Imports of outdoor furniture and incidence on consumption and countries of origin

4. COMPETITION: Leading manufacturers of outdoor furniture in Europe

4.1 Leading groups and market shares

– Brands operating in the market according to business specialization

4.2 Total sales of outdoor furniture

– Sector concentration

– Total revenues in a sample of 100 leading outdoor furniture companies

– Estimated revenues in the contract and in the retail segment

– Outdoor furniture supply by kind of product in a sample of companies

– Outdoor furniture supply by material used in a sample of companies

4.3 Outdoor furniture companies: Market shares by country

– Estimated revenues and market share for a sample of companies for Germany, France, Italy, Spain, UK

4.4 Company profiles

5. DISTRIBUTION OF OUTDOOR FURNITURE

– Outdoor furniture market by distribution channel

APPENDIX: List of Mentioned Companies

SEE ALSO

The Parasol Market in Italy

October 2017, I Ed. , 29 pages

The contract market accounts for 56% of the total value of the parasol market in Italy. The demand for parasols for hotels, bars and restaurants has increased and led to an overall increase in the contract segment.

Il mercato italiano degli arredi per esterno (Italian)

March 2010, Ed. , 103 pages

This report offers a comprehensive picture of the outdoor furniture market in Italy, providing trends and basic data (production and consumption, imports and exports) of this sector.