July 2022,

XI Ed. ,

246 pages

Price (single user license):

EUR 2000 / USD 2180

For multiple/corporate license prices please contact us

Language: English

Report code: S12

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The 11th of CSIL Report The European market for bathroom furniture, furnishings and wellness offers an accurate comprehensive picture of the bathroom furniture and furnishings industry in Europe (covering a total of 28 countries) , providing data and trends (both in value and in volume) on bathroom equipment consumption, at European level as a whole and for each country considered, for the total sector and by segment.

The study presents the main macroeconomic variables necessary to analyse the performance of the sector, the estimated stock of bathrooms in Europe, market trend 2016-2021 and forecast up to 2025, the analysis of the competitive system, a financial analysis on a sample of 100 selected European companies that have bathroom furniture as main business area, are also provided.

The analysis of the distribution system in the bathroom furniture and furnishing sector in Europe considers the main channels of sales: bathroom and kitchen specialist retailers, wholesalers of bathroom products, Plumbers and installers, furniture stores/chains and department stores, DIY, contract, e-commerce, offering estimates, at European level, of the value of each distribution channel by product type. Standard retail prices by product and by price range are also given for a sample of companies. The section also includes a listing of 50 architectural companies valuable for the Project market, and the 30 Local (city) markets to watch on a 2023 perspective.

This report takes into consideration 14 bathroom products grouped in five segments:

- Vanities: bathroom furniture; bathroom furnishings/Accessories (including soap dishes, towel racks, toilet brushes, tumbler supports, toilet tissue holders, robe hooks, shower curtains, etc.); bathroom mirrors; acrylic sinks

- Showers: shower screens (including shower screens/partitions, structures to install on the shower tray and bathtub panels); shower arms; shower trays; multifunctional shower booths (including equipped whirlpool columns that can be installed on the wall inside a simple cabin and Mini Spas)

- Faucets: bathroom faucets; kitchen faucets

- Ceramic hydro sanitary ware: all ceramic products (WC, sinks, bidets, urinals, bathtubs); WC seats

- Bathtubs: acrylic bathtubs; whirlpool bathtubs / Mini Spa.

The countries covered were divided into five areas according to their geographical proximity and similarity in market characteristics. These areas are:

- Northern Europe: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE)

- Western Europe: Belgium (BE) including Luxembourg, France (FR), Ireland (IE) and the United Kingdom (UK)

- Central Europe: Austria (AT), Germany (DE), the Netherlands (NL) and Switzerland (CH)

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

- Central-Eastern Europe (CEE): Bulgaria (BG), Croatia (HR), Czech Republic (CZ), Estonia (EE), Hungary (HU), Latvia (LV), Lithuania (LT), Poland (PL), Romania (RO), Slovakia (SK) and Slovenia (SL)

Via detailed tables are shown sales data and market shares of the top European bathroom furniture and furnishings companies for each bathroom products and in each European country considered, together with short company profiles.

An address list of around 280 European bathroom furniture and furnishings companies completes the study.

Selected companies

Allibert, Antonio Lupi, , Arbi, Arblu, Arbonia, Arcom, Ballingslöv, Baden Haus, Bathroom Brands, Bette, Boffi, Bristan, Burgbad, ompab, Coram, Cubico, Dansani-INR, Dornbracht, Duravit, Duscholux, Fackelmann, Fournier, Franke, Geberit, Gessi, Grohe, Guglielmi Rubinetterie, Hansgrohe, Haro, Hewi, Hoesch, Howden Joinery, Idea, Ideal Standard, Ikea, Inda + Samo, Jacuzzi, Kaldewei, Keuco, Klafs, Kludi, Kohler, Leda, Mattson Mora, Megius, Nuovvo, Nobili Rubinetterie, Norcros, Novellini, Oras, Paini Rubinetterie, Pelipal, Poalgi, Porcelanosa, Puris Bad ? Laguna, Roca, Roper Rhodes, Royo, Sanitas Troesch, Savini + Savini Due, Svedbergs, Victoria Plum, Villeroy & Boch, Vitra Vola, Wirquin, Wren

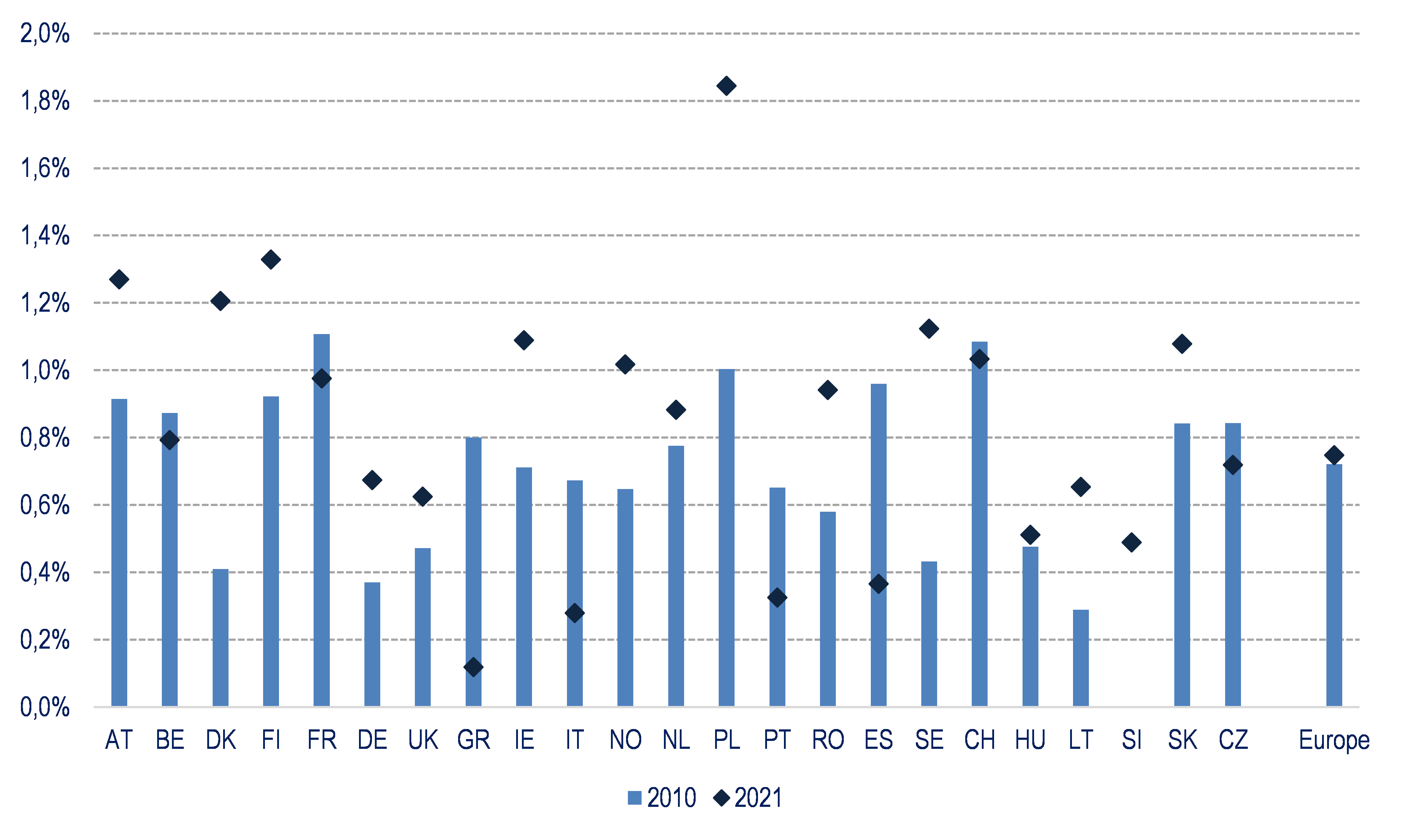

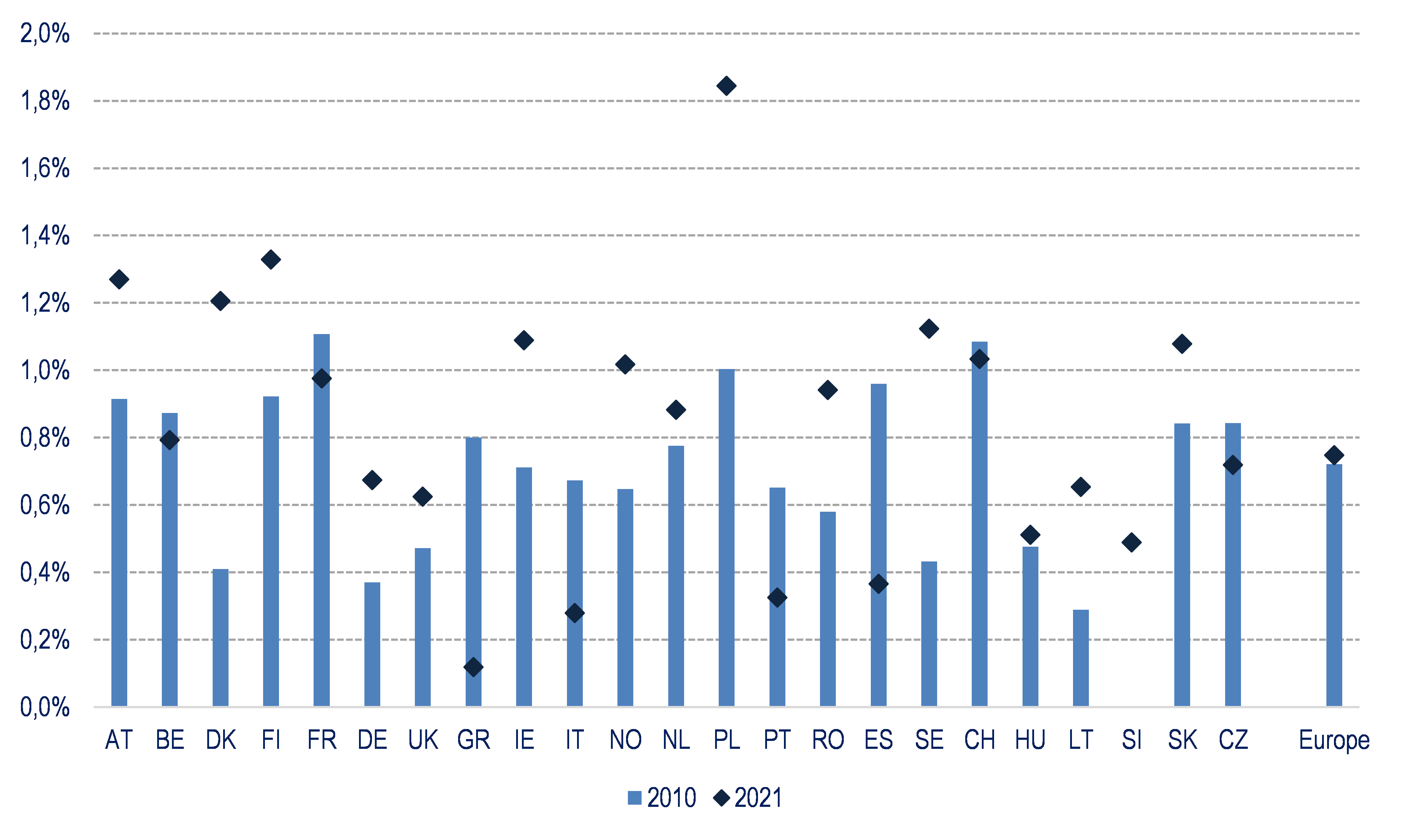

Europe. Housing construction for selected countries. Share of housing completed as a percentage of the total existing housing stock. 2010 and 2021

CSIL estimates that the European bathroom furniture, furnishing and wellness market increased by 12% in 2021 to a value of Eur 15.5 billion and by 2.9% on average per year since 2016. As a preliminary CSIL estimates a further growth by 2.7% in 2022. This positive trend has been confirmed by the preliminary results of many companies, who kept recording increasing orders in the first half of 2022 despite rising prices, economic and geopolitical instability.

In 2021, bathroom faucets, bathroom furniture, and sanitary ware are the biggest segments, accounting for approximately 19%, 18% and 17% respectively of the total market value. Germany confirms as the major European market for bathroom equipment, followed by Italy, the United Kingdom, and France.

The ten top players in CSIL sample have a cumulative market share of almost 45%. Most of them reported double digit result during 2021. The market leaders are Grohe, Geberit and Roca

Abstract of Table of Contents

Introduction

Methodology; Research tools; Terminology

Basic data

European market for bathroom furniture, furnishings and wellness. Estimated sales by product. Eur million, thousand units and average prices

- Vanities (bathroom furniture; bathroom furnishings/accessories; bathroom mirrors; acrylic sinks) Shower (shower screens; shower arms; shower trays; multifunctional shower booths); Faucets (bathroom and kitchen taps and faucets); Ceramic hydrosanitary ware (WC seats; ceramic sanitary ware); Bathtubs (acrylic bathtubs; whirlpool bathtubs)

European market for bathroom furniture, furnishings and wellness. Estimated sales by country. Eur million

- Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Netherlands, Norway, Spain, Portugal, Sweden, Switzerland, United Kingdom, Ireland, Bulgaria, Croatia, Czech Republic, Estonia, Hunagry, Latvia, Lithuania, Poland, Romania, Slovakia, Slovenia

Activity trend and forecasts

Market trend for the bathroom furniture, furnishings and wellness consumption by segment (2016-2021) and forecast of total consumption (2022-2025) for each country and for Europe as a whole

Trend of selected indicators (population, economic and construction indicators), 2016-2021, and forecast, 2022-2025, foer each country and Europe as a whole

Financial analysis

Selected financial indicators for a sample of 100 European manufacturing companies that produce bathroom furniture, furnishings and wellness in Europe. Profitability indicators (ROI, ROE, EBIT, EBITDA); Financial structure indicators (Assets, Shareholder funds, Cash flow, solvency ratio); Employment and Labour indicators.

Distribution

Europe. Estimated bathroom sales by distribution channel by product. Kitchen and Bathroom specialists; Wholesalers of bath products with showroom; Plumbers and installers; Furniture stores/chains and department stores; DIY; Contract; E-commerce

Europe. Bathroom furniture, furnishings and wellness. Estimated sales by distribution channel in a sample of companies

A selection of contacts for the Contract market: architectural offices

Prices

- Standard retail prices in Europe, for each bathroom product considered, for a sample of companies

- Bathroom furniture, furnishings and wellness. Estimated sales value in Europe by price range and by cluster of countries

Demand in a selected sample of cities and brands geocalization (Amsterdam, Athens, Barcelona, Berlin, Birmingham, Brussels, Bucharest, Cologne, Copenhagen, Dublin, Budapest, Frankfurt, Hamburg, Helsinki, Lisbon, London, Lyon, Madrid, Manchester, Milan, Munich, Oslo, Paris, Prague, Rome, Stockholm, Turin, Vienna, Warsaw, Zurich)

Company market shares by product

Bathroom furniture, furnishings and wellness. Estimated sales in Europe and market shares of a sample among the leading companies

Estimated bathroom sales in Europe and market shares by product for a sample among the leading companies: Bathroom furniture; Bathroom furnishings/Accessories and mirrors; Shower screens; Shower arms; Shower trays; Whirlpool bathtubs and Multifunctional shower booths; Bathroom and Kitchen taps and faucets; WC seats; Ceramic sanitary ware; Acrylic sinks and bathtubs

Company market shares by country

Estimated bathroom sales and market shares by European country considered for a sample among the leading companies: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Netherlands, Norway, Spain, Portugal, Sweden, Switzerland, United Kingdom, Ireland, Bulgaria, Croatia, Czech Republic, Hunagry, Poland, Romania, Slovakia, Slovenia

Annex

Address list of around 300 European bathroom furniture and furnishings companies

The 11th of CSIL Report The European market for bathroom furniture, furnishings and wellness offers an accurate comprehensive picture of the bathroom furniture and furnishings industry in Europe (covering a total of 28 countries) , providing data and trends (both in value and in volume) on bathroom equipment consumption, at European level as a whole and for each country considered, for the total sector and by segment.

The study presents the main macroeconomic variables necessary to analyse the performance of the sector, the estimated stock of bathrooms in Europe, market trend 2016-2021 and forecast up to 2025, the analysis of the competitive system, a financial analysis on a sample of 100 selected European companies that have bathroom furniture as main business area, are also provided.

The analysis of the distribution system in the bathroom furniture and furnishing sector in Europe considers the main channels of sales: bathroom and kitchen specialist retailers, wholesalers of bathroom products, Plumbers and installers, furniture stores/chains and department stores, DIY, contract, e-commerce, offering estimates, at European level, of the value of each distribution channel by product type. Standard retail prices by product and by price range are also given for a sample of companies. The section also includes a listing of 50 architectural companies valuable for the Project market, and the 30 Local (city) markets to watch on a 2023 perspective.

This report takes into consideration 14 bathroom products grouped in five segments:

- Vanities: bathroom furniture; bathroom furnishings/Accessories (including soap dishes, towel racks, toilet brushes, tumbler supports, toilet tissue holders, robe hooks, shower curtains, etc.); bathroom mirrors; acrylic sinks

- Showers: shower screens (including shower screens/partitions, structures to install on the shower tray and bathtub panels); shower arms; shower trays; multifunctional shower booths (including equipped whirlpool columns that can be installed on the wall inside a simple cabin and Mini Spas)

- Faucets: bathroom faucets; kitchen faucets

- Ceramic hydro sanitary ware: all ceramic products (WC, sinks, bidets, urinals, bathtubs); WC seats

- Bathtubs: acrylic bathtubs; whirlpool bathtubs / Mini Spa.

The countries covered were divided into five areas according to their geographical proximity and similarity in market characteristics. These areas are:

- Northern Europe: Denmark (DK), Finland (FI), Norway (NO) and Sweden (SE)

- Western Europe: Belgium (BE) including Luxembourg, France (FR), Ireland (IE) and the United Kingdom (UK)

- Central Europe: Austria (AT), Germany (DE), the Netherlands (NL) and Switzerland (CH)

- Southern Europe: Greece (GR), Italy (IT), Portugal (PT) and Spain (ES);

- Central-Eastern Europe (CEE): Bulgaria (BG), Croatia (HR), Czech Republic (CZ), Estonia (EE), Hungary (HU), Latvia (LV), Lithuania (LT), Poland (PL), Romania (RO), Slovakia (SK) and Slovenia (SL)

Via detailed tables are shown sales data and market shares of the top European bathroom furniture and furnishings companies for each bathroom products and in each European country considered, together with short company profiles.

An address list of around 280 European bathroom furniture and furnishings companies completes the study.

Europe. Housing construction for selected countries. Share of housing completed as a percentage of the total existing housing stock. 2010 and 2021

CSIL estimates that the European bathroom furniture, furnishing and wellness market increased by 12% in 2021 to a value of Eur 15.5 billion and by 2.9% on average per year since 2016. As a preliminary CSIL estimates a further growth by 2.7% in 2022. This positive trend has been confirmed by the preliminary results of many companies, who kept recording increasing orders in the first half of 2022 despite rising prices, economic and geopolitical instability.

In 2021, bathroom faucets, bathroom furniture, and sanitary ware are the biggest segments, accounting for approximately 19%, 18% and 17% respectively of the total market value. Germany confirms as the major European market for bathroom equipment, followed by Italy, the United Kingdom, and France.

The ten top players in CSIL sample have a cumulative market share of almost 45%. Most of them reported double digit result during 2021. The market leaders are Grohe, Geberit and Roca

Abstract of Table of Contents

Introduction

Methodology; Research tools; Terminology

Basic data

European market for bathroom furniture, furnishings and wellness. Estimated sales by product. Eur million, thousand units and average prices

- Vanities (bathroom furniture; bathroom furnishings/accessories; bathroom mirrors; acrylic sinks) Shower (shower screens; shower arms; shower trays; multifunctional shower booths); Faucets (bathroom and kitchen taps and faucets); Ceramic hydrosanitary ware (WC seats; ceramic sanitary ware); Bathtubs (acrylic bathtubs; whirlpool bathtubs)

European market for bathroom furniture, furnishings and wellness. Estimated sales by country. Eur million

- Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Netherlands, Norway, Spain, Portugal, Sweden, Switzerland, United Kingdom, Ireland, Bulgaria, Croatia, Czech Republic, Estonia, Hunagry, Latvia, Lithuania, Poland, Romania, Slovakia, Slovenia

Activity trend and forecasts

Market trend for the bathroom furniture, furnishings and wellness consumption by segment (2016-2021) and forecast of total consumption (2022-2025) for each country and for Europe as a whole

Trend of selected indicators (population, economic and construction indicators), 2016-2021, and forecast, 2022-2025, foer each country and Europe as a whole

Financial analysis

Selected financial indicators for a sample of 100 European manufacturing companies that produce bathroom furniture, furnishings and wellness in Europe. Profitability indicators (ROI, ROE, EBIT, EBITDA); Financial structure indicators (Assets, Shareholder funds, Cash flow, solvency ratio); Employment and Labour indicators.

Distribution

Europe. Estimated bathroom sales by distribution channel by product. Kitchen and Bathroom specialists; Wholesalers of bath products with showroom; Plumbers and installers; Furniture stores/chains and department stores; DIY; Contract; E-commerce

Europe. Bathroom furniture, furnishings and wellness. Estimated sales by distribution channel in a sample of companies

A selection of contacts for the Contract market: architectural offices

Prices

- Standard retail prices in Europe, for each bathroom product considered, for a sample of companies

- Bathroom furniture, furnishings and wellness. Estimated sales value in Europe by price range and by cluster of countries

Demand in a selected sample of cities and brands geocalization (Amsterdam, Athens, Barcelona, Berlin, Birmingham, Brussels, Bucharest, Cologne, Copenhagen, Dublin, Budapest, Frankfurt, Hamburg, Helsinki, Lisbon, London, Lyon, Madrid, Manchester, Milan, Munich, Oslo, Paris, Prague, Rome, Stockholm, Turin, Vienna, Warsaw, Zurich)

Company market shares by product

Bathroom furniture, furnishings and wellness. Estimated sales in Europe and market shares of a sample among the leading companies

Estimated bathroom sales in Europe and market shares by product for a sample among the leading companies: Bathroom furniture; Bathroom furnishings/Accessories and mirrors; Shower screens; Shower arms; Shower trays; Whirlpool bathtubs and Multifunctional shower booths; Bathroom and Kitchen taps and faucets; WC seats; Ceramic sanitary ware; Acrylic sinks and bathtubs

Company market shares by country

Estimated bathroom sales and market shares by European country considered for a sample among the leading companies: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Netherlands, Norway, Spain, Portugal, Sweden, Switzerland, United Kingdom, Ireland, Bulgaria, Croatia, Czech Republic, Hunagry, Poland, Romania, Slovakia, Slovenia

Annex

Address list of around 300 European bathroom furniture and furnishings companies

SEE ALSO

The Italian market for bathroom furniture and accessories

May 2010, XXVIII Ed. , 98 pages

This report analyses the market of bathroom furniture and accessories in Italy, providing production, consumption and trade data for this industry. For the major companies, rankings, sales in the domestic and foreign market are also provided

The bathroom furniture market and wellness in China

October 2008, II Ed. , 72 pages

This report offers an overview of the bathroom furnishings and wellness sector in China, providing data on bathroom furniture, bathroom accessories, shower enclosures, multifunctional shower boxes and whirlpools production and consumption, international trade, supply structure, distribution and prices