November 2022,

III Ed. ,

Excel DB and executive summary of 50 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: W29

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The report Financial Analysis of 100 Major Lighting Manufacturers Worldwide, now at its third edition, is the result of CSIL processing of a dataset made up of a large number of balance sheets (600 companies, for the period 2017-2021), including lighting fixtures, lighting components and lighting automotive manufacturers.

The purpose of this study is to assess the recent trends and structural characteristics of the lighting industry through the analysis of the balance sheets for the years 2017 to 2021 of a group of around 600 companies based worldwide and to identify, among them, the top 100 performing companies in the business. Top 100 players are reported separately as Big (over 50 million USD turnover) and Small players. In addition, a focus on the financial results of architectural and outdoor-oriented lighting companies is provided.

The total sample analysed, for which an homogeneous time series were available (approximately 500 companies), shows an average workforce of over 750 employees and an average turnover of over USD 158 million in 2021. In absolute terms, the industry exhibits a 2021 turnover of about USD 77 billion, an EBIT in excess of USD 5 billion, almost 365 employees.

The Report is made up by a short executive summary (around 50 pages) and an Excel database of company financial data and sector average.

The sample was selected according to the following criteria:

- availability of balance sheet data (consolidated and/or unconsolidated accounts);

- company turnover of over US$ 5 million in one of the years between 2017 and 2021;

- company’s core activity corresponding to one of the following NACE codes 2740: Manufacture of electric lighting equipment.

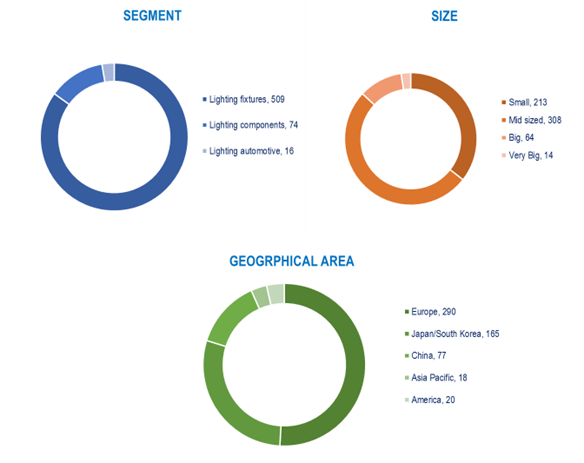

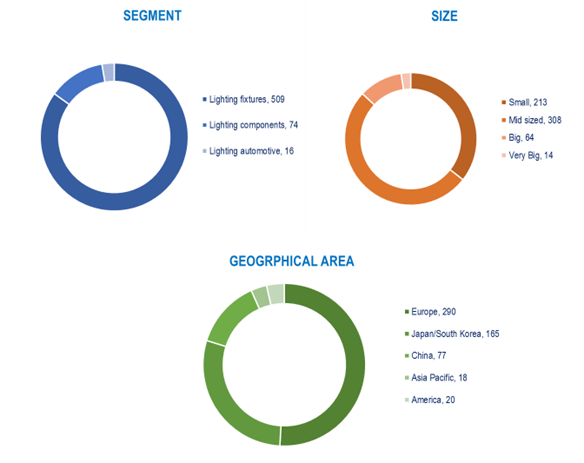

The sample of 600 companies analysed was broken down by geographical area, lighting segment, turnover range.

Sample by geographical area:

- 290 European companies

- 165 Japanese and South Korean companies

- 77 Chinese companies

- 18 Asian Pacific companies

- 20 American companies.

Sample by lighting segment:

- Lighting fixtures, 509 players

- Automotive Lighting, 16 players

- Lighting Components (semi-finished products, lighting sources), 74 manufacturers.

Sample by turnover range:

- 14 Very Big companies (Turnover 2021 over USD 1,000 million)

- 64 Big companies (Turnover 2021 over USD 100 million and under USD 1,000 million)

- 308 Mid-sized companies (Turnover 2021 over USD 10 million and under USD 100 million)

- 213 Small companies (Turnover 2021 below USD 10 million)

The analysis considers a selection of productivity/profitability indicators available from the balance sheets.

- Key financial data: Operating Revenue (Turnover), Added Value, P/L before Tax, Net Income, EBITDA, EBIT

- Turnover indicators: Total Assets, Shareholders Funds, Cash Flow

- Profitability ratios: Profit margin, ROE, ROA, EBITDA margin, EBIT margin

- Structure ratios: Current and Solvency ratio

- Employment data and per employee ratios: Number of Employees, Turnover per Employee, EBIT per employee, Average cost of employee, Costs of employees / Operating revenue.

Annexed Excel File containing:

- Financial tables on average lighting sector performance 2017-2021, based on the 600 companies’ sample;

- Companies’ ‘Best in Class’ selected data (top 100 performing players in 2021, ‘Big’ and ‘Small’);

- Website, Stock Exchange reference, Holding data for 600 companies (when available);

- Operating revenue (Turnover) 2021, number of employees and EBITDA available for around 600 companies.

The report is structured as follows:

- Lighting sector performance. Analysis of Key financial data of 600 balance-sheet, for the period 2017-2021. Overview of the total sample in terms of turnover growth and turnover indicators, profitability, financial structure, employment, and productivity.

- Analysis by geographical area. This chapter breaks down the sample of 600 companies by five geographical area, highlighting key financial data and ratios for each area.

- Analysis by lighting segment. Each company is classified according to its core activity. The following Lighting segments are identified: Lighting Fixtures, Lighting Components, Automotive Lighting.

- Analysis by company size. The sample of 600 companies was broken down by five turnover ranges, ranging from less than USD 10 million, to over USD 1,000 million during the last available year.

- Analysis of the ‘best in class’ companies. 100 companies were selected from the sample of 600 companies, grouped in ‘Best in Class’ big players and ‘Best in Class’ small players.

- Analysis of the Architectural and Outdoor companies. Performance analysis of a sample of 49 Architectural-oriented lighting companies and 35 Outdoor-oriented lighting companies.

Selected companies

Acuity Brands (USA), AEC (IT), Alto (KR), Arkoslight (ES), Artemide (IT), Bega (BE), Bisong Lighting (CN), Catellani & Smith (IT), Celsa (CO), Delta Light (BE), Dextra Group (UK), Eclatec (FR), Eglo (AT), Endo Lighting (JP), EXC-LED Technology (CN), Fagerhult (SE), Flos (IT), FSL (CN), Gewiss (IT), GMR Enlights (IT), Haoyang (CN), Hella (DE), Hubbell (USA), Intra Lighting (SI), Inventronics (CN), Iwasaki (JP), Koito Manufacturing (JP), Lamplast Finanziaria (IT), LEDs C4 (ES), Leedarson (CN), Lightnet (PL), Lighting and Urban Equipment (VN), Ligman (TH), Lival (FI), Lombardo (IT), Louis Poulsen (DK), LSI (USA), Luceco (UK), Maltani (KR), MK Illumination (SK), MLS (CN), Molto Luce (AT), Nemo (IT), Nowodworski (PL), Ocean’s King Lighting (CN), O Luce (IT), Opple (CN), Pars Shahab (IR), Performance In Lighting (IT), PUK Italia (IT), Ragni (FR), Rangdong (VN), Reggiani (IT), Roy Alpha (CO), Schreder (BE), SG Armaturen (NO), Signify (NL), Simes (IT), Sunway Opto-Electronic (CN), Thorpe (UK), Topmet (PL), Ushio (JP), Viabizzuno (IT), Vizulo (LT), Wever & Ducre (BE), Wooree(KR), Xal (AT), Zumtobel (AT).

Total Sample Survey: number of companies by lighting segment, company size, geographic area

After a steady decline started in 2019, as a result of trade frictions and geopolitical instabilities, and confirmed in 2020 due the Covid-19 crisis, 2021 shows a massive recover for the lighting sector.

The profitability indicators describe a sector with positive but decreasing return.

EBITDA margin was around 7.5% in 2021.

The average turnover per employee is approximately USD 211,000, slightly increased over the last five years.

All the size class recorded increases in turnover in 2021 except for small companies, whose average turnover contracted by 5%. Only the group classified as Big Companies reported a positive 2017-2021 trend as well as a double-digit 2021 result.

The Architectural Lighting players are on average more profitable than the total sample, all the considered profitability indicators are almost twice the average ones. The Outdoor Lighting players are slightly more profitable than the average, as three out of five profitability indicators are above the sample average.

EXECUTIVE SUMMARY

1. SAMPLE SELECTION, METHODOLOGY AND DEFINITIONS

2. LIGHTING SECTOR PERFORMANCE

Total sample analysis: Key financial data, Profitability and Structure ratios, Employment and productivity, 2017-2021. Total and mean values

3. ANALYSIS BY GEOGRAPHICAL AREA

Total lighting sector. Key financial data and ratios, 2017-2021. Total and mean values by the following areas:

- Europe

- Japan and South Korea

- China

- Asia Pacific

- America

4. ANALYSIS BY LIGHTING SEGMENT

Key financial data and ratios, 2017-2021. Total and mean values by the following lighting segments:

- Lighting Fixtures

- Lighting Components

- Automotive Lighting

5. ANALYSIS BY COMPANY SIZE

Total lighting sector. Key financial data and ratios, 2017-2021. Total and mean values by company size:

- Very Big companies (turnover 2021 over 1000 USD million)

- Big companies (turnover 2021 over 100 million USD and under 1000 million USD)

- Mid-sized companies (turnover 2021 over 10 million USD and under 100 million USD)

- Small companies (turnover 2021 under 10 USD million)

6a. BEST IN CLASS COMPANIES: BIG PLAYERS

- Best in Class companies in the Lighting sector: Big players. Key financial data and ratios, 2017-2021. Total and mean values

- Best in Class companies in the Lighting sector: Big players. Selected key financial data and ratios, profitability and financial structure indicators, labour indicators by Company, 2021. Ranking by Operating revenue

6b. BEST IN CLASS COMPANIES: SMALL PLAYERS

- Best in Class companies in the Lighting sector: Small players. Key financial data and ratios, 2017-2021. Total and mean values

- Best in Class companies in the Lighting sector: Small players. Selected key financial data and ratios, profitability and financial structure indicators, labour indicators by Company, 2021. Ranking by Operating revenue

7. FOCUS ON ARCHITECTURAL AND OUTDOOR COMPANIES

- Top architectural and outdoor lighting players. Key financial data and ratios, 2017-2021. Total and mean values

- Selected key financial data and ratios, profitability and financial structure indicators, labour indicators by Company, 2021. Ranking by Operating revenue

ANNEX: LIST OF 600 COMPANIES: SELECTED FINANCIAL DATA, WEBSITE, STOCK EXCHANGE REFERENCE, HOLDING DATA

The report Financial Analysis of 100 Major Lighting Manufacturers Worldwide, now at its third edition, is the result of CSIL processing of a dataset made up of a large number of balance sheets (600 companies, for the period 2017-2021), including lighting fixtures, lighting components and lighting automotive manufacturers.

The purpose of this study is to assess the recent trends and structural characteristics of the lighting industry through the analysis of the balance sheets for the years 2017 to 2021 of a group of around 600 companies based worldwide and to identify, among them, the top 100 performing companies in the business. Top 100 players are reported separately as Big (over 50 million USD turnover) and Small players. In addition, a focus on the financial results of architectural and outdoor-oriented lighting companies is provided.

The total sample analysed, for which an homogeneous time series were available (approximately 500 companies), shows an average workforce of over 750 employees and an average turnover of over USD 158 million in 2021. In absolute terms, the industry exhibits a 2021 turnover of about USD 77 billion, an EBIT in excess of USD 5 billion, almost 365 employees.

The Report is made up by a short executive summary (around 50 pages) and an Excel database of company financial data and sector average.

The sample was selected according to the following criteria:

- availability of balance sheet data (consolidated and/or unconsolidated accounts);

- company turnover of over US$ 5 million in one of the years between 2017 and 2021;

- company’s core activity corresponding to one of the following NACE codes 2740: Manufacture of electric lighting equipment.

The sample of 600 companies analysed was broken down by geographical area, lighting segment, turnover range.

Sample by geographical area:

- 290 European companies

- 165 Japanese and South Korean companies

- 77 Chinese companies

- 18 Asian Pacific companies

- 20 American companies.

Sample by lighting segment:

- Lighting fixtures, 509 players

- Automotive Lighting, 16 players

- Lighting Components (semi-finished products, lighting sources), 74 manufacturers.

Sample by turnover range:

- 14 Very Big companies (Turnover 2021 over USD 1,000 million)

- 64 Big companies (Turnover 2021 over USD 100 million and under USD 1,000 million)

- 308 Mid-sized companies (Turnover 2021 over USD 10 million and under USD 100 million)

- 213 Small companies (Turnover 2021 below USD 10 million)

The analysis considers a selection of productivity/profitability indicators available from the balance sheets.

- Key financial data: Operating Revenue (Turnover), Added Value, P/L before Tax, Net Income, EBITDA, EBIT

- Turnover indicators: Total Assets, Shareholders Funds, Cash Flow

- Profitability ratios: Profit margin, ROE, ROA, EBITDA margin, EBIT margin

- Structure ratios: Current and Solvency ratio

- Employment data and per employee ratios: Number of Employees, Turnover per Employee, EBIT per employee, Average cost of employee, Costs of employees / Operating revenue.

Annexed Excel File containing:

- Financial tables on average lighting sector performance 2017-2021, based on the 600 companies’ sample;

- Companies’ ‘Best in Class’ selected data (top 100 performing players in 2021, ‘Big’ and ‘Small’);

- Website, Stock Exchange reference, Holding data for 600 companies (when available);

- Operating revenue (Turnover) 2021, number of employees and EBITDA available for around 600 companies.

The report is structured as follows:

- Lighting sector performance. Analysis of Key financial data of 600 balance-sheet, for the period 2017-2021. Overview of the total sample in terms of turnover growth and turnover indicators, profitability, financial structure, employment, and productivity.

- Analysis by geographical area. This chapter breaks down the sample of 600 companies by five geographical area, highlighting key financial data and ratios for each area.

- Analysis by lighting segment. Each company is classified according to its core activity. The following Lighting segments are identified: Lighting Fixtures, Lighting Components, Automotive Lighting.

- Analysis by company size. The sample of 600 companies was broken down by five turnover ranges, ranging from less than USD 10 million, to over USD 1,000 million during the last available year.

- Analysis of the ‘best in class’ companies. 100 companies were selected from the sample of 600 companies, grouped in ‘Best in Class’ big players and ‘Best in Class’ small players.

- Analysis of the Architectural and Outdoor companies. Performance analysis of a sample of 49 Architectural-oriented lighting companies and 35 Outdoor-oriented lighting companies.

Total Sample Survey: number of companies by lighting segment, company size, geographic area

After a steady decline started in 2019, as a result of trade frictions and geopolitical instabilities, and confirmed in 2020 due the Covid-19 crisis, 2021 shows a massive recover for the lighting sector.

The profitability indicators describe a sector with positive but decreasing return.

EBITDA margin was around 7.5% in 2021.

The average turnover per employee is approximately USD 211,000, slightly increased over the last five years.

All the size class recorded increases in turnover in 2021 except for small companies, whose average turnover contracted by 5%. Only the group classified as Big Companies reported a positive 2017-2021 trend as well as a double-digit 2021 result.

The Architectural Lighting players are on average more profitable than the total sample, all the considered profitability indicators are almost twice the average ones. The Outdoor Lighting players are slightly more profitable than the average, as three out of five profitability indicators are above the sample average.

EXECUTIVE SUMMARY

1. SAMPLE SELECTION, METHODOLOGY AND DEFINITIONS

2. LIGHTING SECTOR PERFORMANCE

Total sample analysis: Key financial data, Profitability and Structure ratios, Employment and productivity, 2017-2021. Total and mean values

3. ANALYSIS BY GEOGRAPHICAL AREA

Total lighting sector. Key financial data and ratios, 2017-2021. Total and mean values by the following areas:

- Europe

- Japan and South Korea

- China

- Asia Pacific

- America

4. ANALYSIS BY LIGHTING SEGMENT

Key financial data and ratios, 2017-2021. Total and mean values by the following lighting segments:

- Lighting Fixtures

- Lighting Components

- Automotive Lighting

5. ANALYSIS BY COMPANY SIZE

Total lighting sector. Key financial data and ratios, 2017-2021. Total and mean values by company size:

- Very Big companies (turnover 2021 over 1000 USD million)

- Big companies (turnover 2021 over 100 million USD and under 1000 million USD)

- Mid-sized companies (turnover 2021 over 10 million USD and under 100 million USD)

- Small companies (turnover 2021 under 10 USD million)

6a. BEST IN CLASS COMPANIES: BIG PLAYERS

- Best in Class companies in the Lighting sector: Big players. Key financial data and ratios, 2017-2021. Total and mean values

- Best in Class companies in the Lighting sector: Big players. Selected key financial data and ratios, profitability and financial structure indicators, labour indicators by Company, 2021. Ranking by Operating revenue

6b. BEST IN CLASS COMPANIES: SMALL PLAYERS

- Best in Class companies in the Lighting sector: Small players. Key financial data and ratios, 2017-2021. Total and mean values

- Best in Class companies in the Lighting sector: Small players. Selected key financial data and ratios, profitability and financial structure indicators, labour indicators by Company, 2021. Ranking by Operating revenue

7. FOCUS ON ARCHITECTURAL AND OUTDOOR COMPANIES

- Top architectural and outdoor lighting players. Key financial data and ratios, 2017-2021. Total and mean values

- Selected key financial data and ratios, profitability and financial structure indicators, labour indicators by Company, 2021. Ranking by Operating revenue

ANNEX: LIST OF 600 COMPANIES: SELECTED FINANCIAL DATA, WEBSITE, STOCK EXCHANGE REFERENCE, HOLDING DATA

SEE ALSO

The worldwide market for connected lighting

February 2024, I Ed. , 88 pages

This report analyses the global lighting market focusing on LED and connected lighting trends. It provides market forecasts emphasizing the impact of green transition and digital transformation. The study also includes a section on industry competition, estimating sales, and market shares for leading manufacturers.

Lighting: World Market Outlook

November 2023, XXVI Ed. , 123 pages

The world market for lighting fixtures reached a value of USD 97 billion in 2023. After some fluctuating performance in the post-pandemic period, it is expected to remain stable in 2024, followed by moderate growth in 2025 and 2026. The major consuming countries are the US, China, Japan, India and Germany. The twenty-six edition of CSIL research “Lighting: World market outlook” analyzes, through tables and graphs, data on lighting fixtures production, consumption and international trade at worldwide level as a whole and for 70 considered countries, for the years 2013-2022 and 2023 preliminary. lighting fixtures market forecasts for the next three years (2024-2026) are also provided

The lighting fixtures market in China

September 2023, XVI Ed. , 205 pages

The 16th edition of The Lighting Fixtures market in China offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, consumption, imports and exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview on smart connected lighting trend, the distribution system and the main players operating in the market

The lighting fixtures market in the United States

June 2023, XVII Ed. , 256 pages

The total US lighting market is estimated to be worth around USD 26 billion in 2022. This value includes lighting fixtures and lamps. The US lighting market during 2022 registers a 6.5% growth in nominal terms as for lighting fixtures (consumer, professional, outdoor), up to 23.2 billion USD. The lamps market registers a decrease (about -2.9%). The residential segment has grown well above the market average (+5.9% on average over the last five years). In 2022, the weight of Office and Entertainment on the overall commercial lighting market has declined, while Hospitality and Public premises grew. In 2022, the value of completed construction grew by more than 10 percent to nearly USD 1.8 billion

The European market for lighting fixtures

May 2023, XXXII Ed. , 392 pages

In 2022, consumption of lighting fixtures in the EU30 countries registered a 8.3% increase, reaching a value of EUR 19.9 billion. Better results for commercial lighting (versus residential, industrial and outdoor), big players (with a 12% Ebitda), design oriented, area lighting, hospitality, contract (versus retail), linear lighting, emergency. More IP patents and acquisitions. Top 10 players hold a 30% market share.