February 2014,

I Ed. ,

63 pages

Price (single user license):

EUR 1600 / USD 1696

For multiple/corporate license prices please contact us

Language: English

Report code: S75

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

The first edition of the report Furniture Distribution in India offers an accurate comprehensive picture of the Indian furniture market, providing 2008-2013 trends, short (2014-2015) and medium term forecasts (2020).

Statistics of furniture production, imports and exports are also provided.

The furniture market is broken down by product segment 2013.

Distribution channels and Reference Prices of the Indian furniture market are further considered both for domestically produced furniture and imported items.

The analysis of the Indian furniture market includes: demand drivers (macroeconomic indicators, population distribution and construction market) and purchasing process among Indian consumers.

The analysis of furniture distribution channels includes: Large scale furniture retailers, independent furniture specialists, architects and interior designers, E-commerce, local craftsmen and artisans (unorganized sector).

Among the considered products: Living and dining furniture, Upholstery, Bedrooms, Home tables and chairs, Kitchen furniture, consumer lighting fixtures, Bathroom furniture, Office furniture, Contract and Hotel furniture.

A specific analysis on main players in the distribution is given for the six states and eight megacities that are considered strategic for the future of the furniture business.

Leading furniture importers are listed by city, as well as leading architects and interior designers.

Considered states include Delhi-Haryana, Maharashastra Maharashtra, Karnataka, Kerala, West Bengal.

In the focused megacities a growth of household expenditure is given by around 50% from 2013 up to 2020, as an average.

Around 40 short profiles of the main distributors and manufacturers, both for domestic and imported furniture operating on the Indian furniture market are also available.

Addresses of around 400 Indian furniture manufacturers and retailers are also included and other 50 key contacts among fairs, magazines, architects and logistic companies. Addresses include web site and short presentation of kind of activity.

Selected companies

BP Ergo, Big Bazaar, Bo Concept Classic Furniture Continental, Damro, Décor Home, Divine Chairs, Ethan Allen, Evok, FabFurnish Featherlite, Fedisa Group, Godrej & Boyce, HomeTown, HouseFull IFJ, Ikea Interio Home, Kukresa Associates, Matharoo Associates, Megamode Millennium, Moroso Nilkamal, Opolis Architects, Pantaloon, Poliform. Reliance, Renaissance, Royal Interiors, Sauder, Sobha Developer, Style Supreme, Tangent, The Furniture Shop Triveri, Urban Living, Urban Ladder Usha Lexus, Vishal Retail, Vivek, Yantra, Wudcraft, Zara, Home, Zuari Furniture

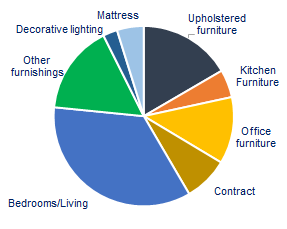

India. Furniture consumption by segment, 2013. Percentage shares

Furniture consumption in India recorded 10% average yearly growth over the last decade, reaching about US$ 15 billion in 2013 at retail prices. A further 4%-5% yearly increase is forecasted for the coming two years. The Report focuses on suggested eight megacities and 6 Indian states where the outlook of growth of household expenditure is given by around 50% up to the year 2020.

Branded furniture today has a market share of approximately 30% in India. With the ever increasing imports of low cost furniture, it has also challenged India’s highly skilled carpentry industry. With the talks of IKEA investing Rs.10,500 crore (Euro 1.2 billion) after the recent policies to allow 100% foreign direct investment (FDI) in single-brand retail, competition is going to be intense in the near future for furniture companies in India. China, Italy and Malaysia are the main exporters of furniture to India.

Abstract of Table of Contents

Methodology

1. Market overview

1.1 The furniture sector in India

- India. Furniture. Basic data: Production, Exports, Imports and Consumption

- India. The openness of the market

- India. Furniture consumption by segment

- India. Furniture consumption. Forecasts

1.2 International trade

- Furniture imports and furniture exports by country and by geographical area of origin/destination

- Furniture imports by product segment

2. The furniture distribution

2.1 Furniture consumption by State

2.1 Analysis of furniture distribution channels

2.2 Reference prices

2.3 The consumer

2.4 The purchasing process

2.5 Market approach for foreign companies

2.6 The retail segment

2.7 The hospitality segment

3. Top furniture companies and geographical distribution

3.1 Leading distributors

3.2 Geographical distribution and forecast 2020

- Sample of leading companies by Region

- Forecast up to 2020 of furniture demand for selected Region

4. Associations, Sector fairs and magazines

5. Demand drivers

5.1 Economic indicators

5.2 Population and urbanization process

5.3 Building activity

Appendix

- Excel file including names, address and contacts for: furniture manufacturers, distributors, importers, architects and main logistic companies in India

The first edition of the report Furniture Distribution in India offers an accurate comprehensive picture of the Indian furniture market, providing 2008-2013 trends, short (2014-2015) and medium term forecasts (2020).

Statistics of furniture production, imports and exports are also provided.

The furniture market is broken down by product segment 2013.

Distribution channels and Reference Prices of the Indian furniture market are further considered both for domestically produced furniture and imported items.

The analysis of the Indian furniture market includes: demand drivers (macroeconomic indicators, population distribution and construction market) and purchasing process among Indian consumers.

The analysis of furniture distribution channels includes: Large scale furniture retailers, independent furniture specialists, architects and interior designers, E-commerce, local craftsmen and artisans (unorganized sector).

Among the considered products: Living and dining furniture, Upholstery, Bedrooms, Home tables and chairs, Kitchen furniture, consumer lighting fixtures, Bathroom furniture, Office furniture, Contract and Hotel furniture.

A specific analysis on main players in the distribution is given for the six states and eight megacities that are considered strategic for the future of the furniture business.

Leading furniture importers are listed by city, as well as leading architects and interior designers.

Considered states include Delhi-Haryana, Maharashastra Maharashtra, Karnataka, Kerala, West Bengal.

In the focused megacities a growth of household expenditure is given by around 50% from 2013 up to 2020, as an average.

Around 40 short profiles of the main distributors and manufacturers, both for domestic and imported furniture operating on the Indian furniture market are also available.

Addresses of around 400 Indian furniture manufacturers and retailers are also included and other 50 key contacts among fairs, magazines, architects and logistic companies. Addresses include web site and short presentation of kind of activity.

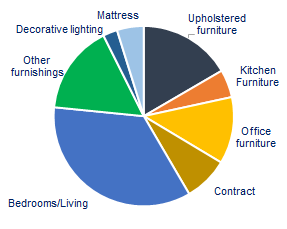

India. Furniture consumption by segment, 2013. Percentage shares

Furniture consumption in India recorded 10% average yearly growth over the last decade, reaching about US$ 15 billion in 2013 at retail prices. A further 4%-5% yearly increase is forecasted for the coming two years. The Report focuses on suggested eight megacities and 6 Indian states where the outlook of growth of household expenditure is given by around 50% up to the year 2020.

Branded furniture today has a market share of approximately 30% in India. With the ever increasing imports of low cost furniture, it has also challenged India’s highly skilled carpentry industry. With the talks of IKEA investing Rs.10,500 crore (Euro 1.2 billion) after the recent policies to allow 100% foreign direct investment (FDI) in single-brand retail, competition is going to be intense in the near future for furniture companies in India. China, Italy and Malaysia are the main exporters of furniture to India.

Abstract of Table of Contents

Methodology

1. Market overview

1.1 The furniture sector in India

- India. Furniture. Basic data: Production, Exports, Imports and Consumption

- India. The openness of the market

- India. Furniture consumption by segment

- India. Furniture consumption. Forecasts

1.2 International trade

- Furniture imports and furniture exports by country and by geographical area of origin/destination

- Furniture imports by product segment

2. The furniture distribution

2.1 Furniture consumption by State

2.1 Analysis of furniture distribution channels

2.2 Reference prices

2.3 The consumer

2.4 The purchasing process

2.5 Market approach for foreign companies

2.6 The retail segment

2.7 The hospitality segment

3. Top furniture companies and geographical distribution

3.1 Leading distributors

3.2 Geographical distribution and forecast 2020

- Sample of leading companies by Region

- Forecast up to 2020 of furniture demand for selected Region

4. Associations, Sector fairs and magazines

5. Demand drivers

5.1 Economic indicators

5.2 Population and urbanization process

5.3 Building activity

Appendix

- Excel file including names, address and contacts for: furniture manufacturers, distributors, importers, architects and main logistic companies in India

SEE ALSO

Furniture retailing in Europe

February 2024, XVII Ed. , 296 pages

Comparative analysis of the home furniture retailing industry in 15 European countries, with trends in home furniture consumption, market forecasts, data by country, analysis by distribution channel, retail formats and sales performances of leading home furniture retailers in Europe

Top 100 mattress specialist retailers in Europe

November 2023, I Ed. , 14 pages

A bird’s eye view of players in the European mattress market with a ranking of the 100 leading mattress specialist retailers in Europe.

E-commerce in the mattress industry

September 2023, V Ed. , 102 pages

Detailed analysis of the global e-commerce mattress markets with a focus on North America, Europe, and the Asia Pacific. Features of the online mattress business, the current incidence of online mattress sales by geographical areas and in key countries, the major markets, e-commerce mattress sales of the leading retailers by area, and company profiles of top players operating in the online mattress sector.

La distribuzione del mobile in Italia. Analisi per provincia (Italian)

July 2023, XX Ed. , 174 pages

This report provides a detailed picture of the Italian furniture market and retailing, for the whole national market and by province, providing the size and development of the home furniture market and its segments, market shares and development of distribution channels, estimated home furniture sales for key retailers, in-depth analysis of both large retail chains and independent retailers, companies’ strategies and trends

E-commerce for the furniture industry

November 2022, IX Ed. , 118 pages

This report analyses e-commerce in the furniture market, with a focus on key geographical areas (Europe, North America, and Asia Pacific) and key countries, providing current market size, e-commerce business models, the performance of the leading players, and the results of a CSIL survey to furniture manufacturers that highlights their approach to the web channel, their strategies, future expectations, and the most-demanded furniture products online.