Profiles of 50 major appliance manufacturers worldwide

Furnishings & related sectors | September 2021

€1600

September 2021,

VIII Ed. ,

260 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: AP.17

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

This report ranks 50 appliance manufacturers selected according to their volume of sales. From the point of view of the ownership, 38 of these companies are public listed while 12 are private owned. The analysis includes global players and “regional leaders”. Considering the country of the headquarters: 15 companies are Chinese (including Taiwan), 7 Japanese, 7 Americans, 5 Italians, 11 of other European countries (including Turkey), 3 from South Korea and 2 from India.

The Report provides information on the following research field (major ‘white’ appliances): refrigerators and freezers, washers and dryers, dishwashers, hoods, cooking appliances, microwave ovens, air conditioners, vacuum cleaners

The report is divided as follows:

PART I: SCENARIO

- Basic data on the major home appliances sector, including ranking by sales of major appliances and performance of the top major appliances manufacturers

- Appliances manufacturers estimated market shares by kind of product segment (washing, refrigeration, cooking, dishwashing, air conditioning) and by Region (EMEA, America, Asia Pacific)

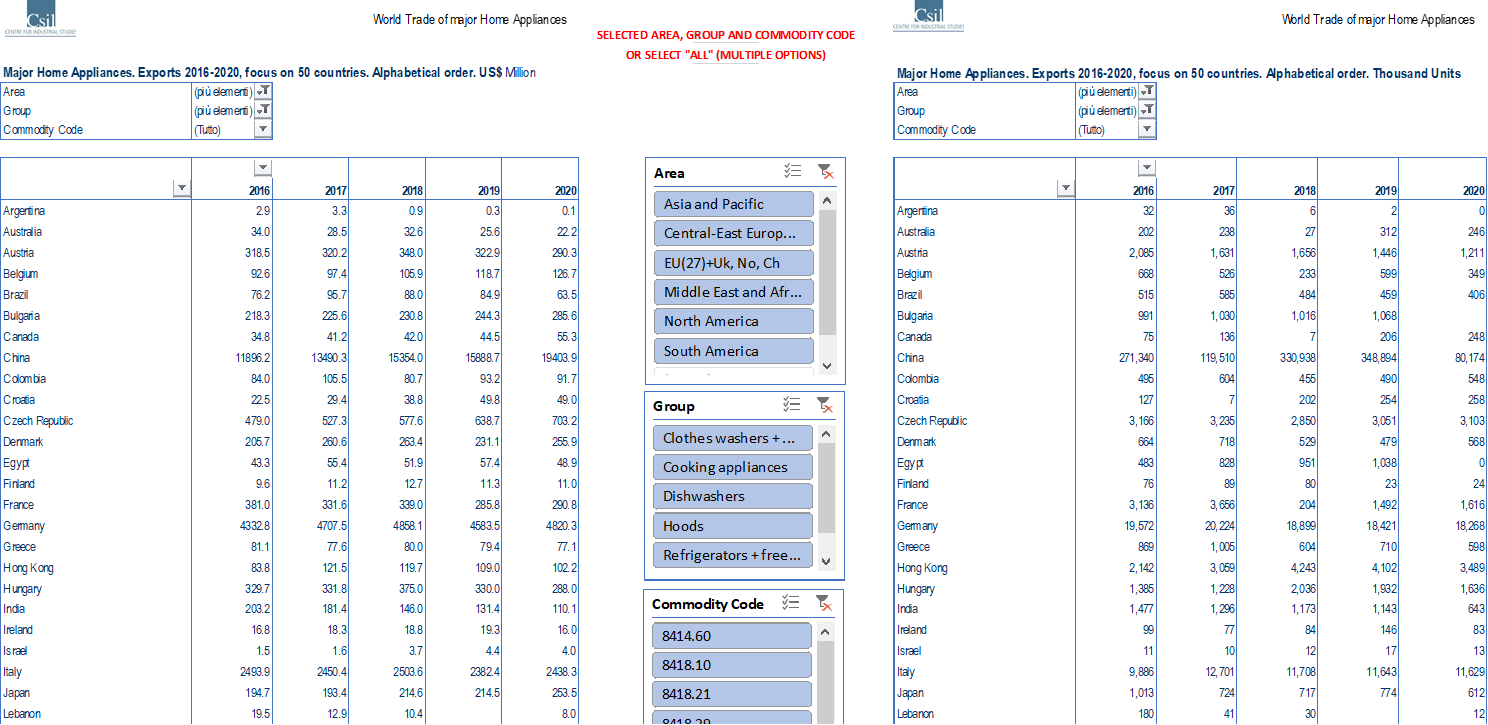

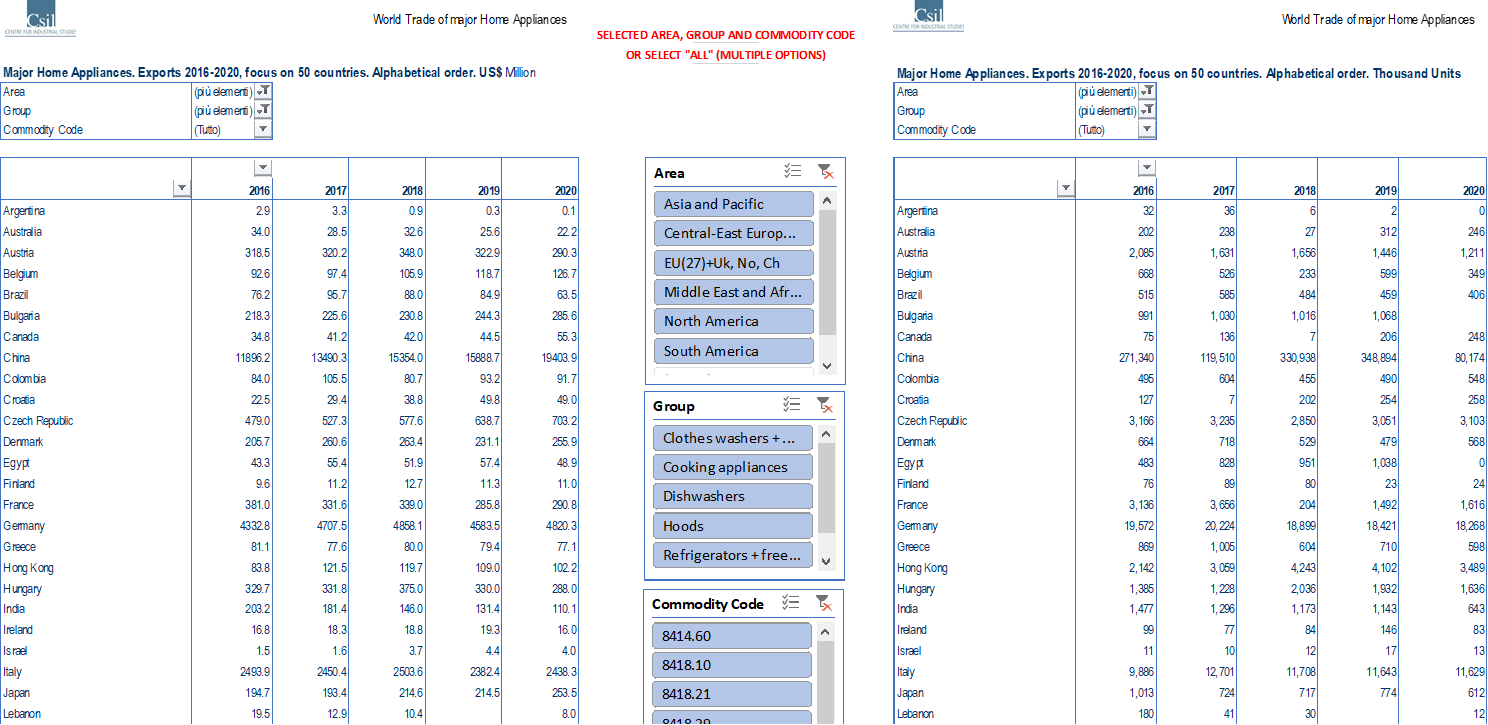

- Exports and imports of major home appliances by main countries and product segments

PART II: TOP 50 MAJOR APPLIANCES MANUFACTURERS

Profiles of 50 major appliances manufacturers worldwide with information on company background, historical and recent facts, basic data (including total turnover of the last five years, white appliances turnover and white appliances share on total production, number of employees and turnover per employee, as well as number of household appliances sold, when available), sales breakdown by business, by product and by geographical area, production sites and brands.

In the ranking we can find:

- specialized companies, with an incidence of major appliances on the total turnover in excess of 80% (Whirlpool, Electrolux, BSH, Arçelik)

- companies with two or more relevant business units, where major appliances represent 30%-60% (Hisense, LG, Nortek, Franke, Paloma, Rinnai)

- holding companies where major appliances represent just a minor portion of the total turnover (e.g.Toshiba, Samsung, Hitachi, Liebherr, etc.)

PART III: ANNEX EXCEL DATABASE

A detailed and customizable Excel database with all the market figures and international trade by single product code is delivered together with this report. Data are reported both in values (US$) and in quantities (Units).

Selected companies

Amica, Arçelik, BSH, CNA Group, Dacor, Daikin, De’ Longhi, Electrolux, Elica, Falmec, Franke-Artemis, Galanz, Gree, Haier-Candy, Hisense-Gorenje, Johnson Controls, Lennox International, LG Electronics, Liebherr, Middleby Corporation, Midea, Miele, Panasonic, Rinnai, Robam, Samsung, Smeg, Teka, Vestel White Goods, Whirlpool

World. Trade of major home appliances

The world market of major consumer appliances amounted to US$ 258 billion in 2020 and it is projected versus a double-digit growth during the current year.

About 52% of the mentioned value originate in Asia-Pacific, followed by EMEA and America. In EMEA Countries the trend has been particularly vigorous conducting the market to a growth of +2.6% on a twelve-month basis. In America the yearly performance was negative with a -2.0% if compared to 2019. Asia-Pacific increased by 0.6% with different performance according to markets, weak in India and Japan, more dynamic in China and South Korea.

According to CSIL preliminary estimates the year 2021 is showing a strong double digit rebound. Interim reports published by manufacturers are announcing very positive financial performance in the first half of the year which is expected to continue in the coming months.

Abstract of Table of Contents

Introduction

Contents of the Report; Research field and working tools

PART I: SCENARIO

Basic data

World. Home appliances market, basic data 2018-2020 by each considered segment: Refrigerators, Cooking (including Hoods), Dishwashing, Washing (Laundry), Air-Conditioning

World. Home appliances market: trend 2016-2020 and forecasts 2021-2024

World. Home appliances market by geographical area, 2016-2020 estimates and 2021 forecasts

Recent mergers and acquisitions and relevant business factors emerged over the last year for the leading manufacturers

Top manufacturers market shares, 2016, 2018 and 2020 ; Leading companies. Total sales of home appliances in 2018 and 2020

Manufacturing locations and employment for a sample of leading companies: Production facilities location and number of employess in the home appliance business, 2016-2018-2020

Leading companies: estimated sales and market shares by product segment (Refrigeration, Washing, Dishwashing, Air-Conditioning, Cooking) and geographical area (EMEA, Americas, Asia and Pacific)

Home appliances estimated market breakdown by geographical area, 2018

Home appliances manufacturers: selected financial indicators (ROA, ROE, EBITDA ratios) and Cost of employees and R&D expenses on revenues, 2016-2020

World trade of major appliances

World trade of major appliances by country/geographical area

World exports and imports trade of major appliances by segment and main products, 2016-2018-2020

Five major exporting and importing countries of major appliances. Exports and imports, 2016-2020

Trade balance of major home appliances, 2016-2020: focus on 50 countries

World trade of major appliances by segment, 2016-2020, for the 50 considered countries. Data in value (US$ Million) and volume (Thousand items)

PART II: PROFILES OF 50 MAJOR APPLIANCES MANUFACTURERS WORLDWIDE

Activity description; Appliances product portfolio; History, Mergers and acquisitions; Financial figures available (Turnover, Employees, Operating Margin, Number of units sold); Sales breakdown by geographical area and by product segment; Production overview; Manufacturing locations; Brands

– Amica Group (Poland), Arçelik A.Ş (Turkey), Aucma Company Ltd (China), Bertazzoni (Italy), BSH (Germany), Chunlan (China), CNA Group (Spain), DACOR (United States), Dayou Winia Co Ltd (South Korea), Daikin (Japan), De’ Longhi (Italy), Electrolux (Sweden), Elica (Italy), Falmec (Italy), Fotile (China), Franke Home Solutions- Artemis Group (Switzerland), Galanz (China), Godrej Appliances (India), Gree (China), Haier (China), Hisense (China), Hitachi (Japan), Homa Appliances (China), Johnson Controls (Ireland), Lennox International (United States), LG Electronics Inc (South Korea), Liebherr (Switzerland), Konka (China), Mabe (Mexico), Meiling (China), Midea Group (China), The Middleby Corporation (United States), Miele (Germany), Mitsubishi Electric Corporation (Japan), Nortek – Melrose Plc (United States-United Kingdom), Onida (India), Paloma (Japan), Panasonic (Japan), Rinnai Corporation (Japan), Hangzhou Robam Appliances (China), Sakura (Taiwan), Samsung Electronics (South Korea), Sharp Corporation (Japan), Smeg (Italy), Sub-Zero Group (United States), Supor (China), Teka (Spain), Vatti Corporation (China), Vestel White Goods (Turkey), Whirlpool (United States)

PART III: ANNEX EXCEL DATABASE

APPENDIX: list of mentioned companies

This report ranks 50 appliance manufacturers selected according to their volume of sales. From the point of view of the ownership, 38 of these companies are public listed while 12 are private owned. The analysis includes global players and “regional leaders”. Considering the country of the headquarters: 15 companies are Chinese (including Taiwan), 7 Japanese, 7 Americans, 5 Italians, 11 of other European countries (including Turkey), 3 from South Korea and 2 from India.

The Report provides information on the following research field (major ‘white’ appliances): refrigerators and freezers, washers and dryers, dishwashers, hoods, cooking appliances, microwave ovens, air conditioners, vacuum cleaners

The report is divided as follows:

PART I: SCENARIO

- Basic data on the major home appliances sector, including ranking by sales of major appliances and performance of the top major appliances manufacturers

- Appliances manufacturers estimated market shares by kind of product segment (washing, refrigeration, cooking, dishwashing, air conditioning) and by Region (EMEA, America, Asia Pacific)

- Exports and imports of major home appliances by main countries and product segments

PART II: TOP 50 MAJOR APPLIANCES MANUFACTURERS

Profiles of 50 major appliances manufacturers worldwide with information on company background, historical and recent facts, basic data (including total turnover of the last five years, white appliances turnover and white appliances share on total production, number of employees and turnover per employee, as well as number of household appliances sold, when available), sales breakdown by business, by product and by geographical area, production sites and brands.

In the ranking we can find:

- specialized companies, with an incidence of major appliances on the total turnover in excess of 80% (Whirlpool, Electrolux, BSH, Arçelik)

- companies with two or more relevant business units, where major appliances represent 30%-60% (Hisense, LG, Nortek, Franke, Paloma, Rinnai)

- holding companies where major appliances represent just a minor portion of the total turnover (e.g.Toshiba, Samsung, Hitachi, Liebherr, etc.)

PART III: ANNEX EXCEL DATABASE

A detailed and customizable Excel database with all the market figures and international trade by single product code is delivered together with this report. Data are reported both in values (US$) and in quantities (Units).

World. Trade of major home appliances

The world market of major consumer appliances amounted to US$ 258 billion in 2020 and it is projected versus a double-digit growth during the current year.

About 52% of the mentioned value originate in Asia-Pacific, followed by EMEA and America. In EMEA Countries the trend has been particularly vigorous conducting the market to a growth of +2.6% on a twelve-month basis. In America the yearly performance was negative with a -2.0% if compared to 2019. Asia-Pacific increased by 0.6% with different performance according to markets, weak in India and Japan, more dynamic in China and South Korea.

According to CSIL preliminary estimates the year 2021 is showing a strong double digit rebound. Interim reports published by manufacturers are announcing very positive financial performance in the first half of the year which is expected to continue in the coming months.

Abstract of Table of Contents

Introduction

Contents of the Report; Research field and working tools

PART I: SCENARIO

Basic data

World. Home appliances market, basic data 2018-2020 by each considered segment: Refrigerators, Cooking (including Hoods), Dishwashing, Washing (Laundry), Air-Conditioning

World. Home appliances market: trend 2016-2020 and forecasts 2021-2024

World. Home appliances market by geographical area, 2016-2020 estimates and 2021 forecasts

Recent mergers and acquisitions and relevant business factors emerged over the last year for the leading manufacturers

Top manufacturers market shares, 2016, 2018 and 2020 ; Leading companies. Total sales of home appliances in 2018 and 2020

Manufacturing locations and employment for a sample of leading companies: Production facilities location and number of employess in the home appliance business, 2016-2018-2020

Leading companies: estimated sales and market shares by product segment (Refrigeration, Washing, Dishwashing, Air-Conditioning, Cooking) and geographical area (EMEA, Americas, Asia and Pacific)

Home appliances estimated market breakdown by geographical area, 2018

Home appliances manufacturers: selected financial indicators (ROA, ROE, EBITDA ratios) and Cost of employees and R&D expenses on revenues, 2016-2020

World trade of major appliances

World trade of major appliances by country/geographical area

World exports and imports trade of major appliances by segment and main products, 2016-2018-2020

Five major exporting and importing countries of major appliances. Exports and imports, 2016-2020

Trade balance of major home appliances, 2016-2020: focus on 50 countries

World trade of major appliances by segment, 2016-2020, for the 50 considered countries. Data in value (US$ Million) and volume (Thousand items)

PART II: PROFILES OF 50 MAJOR APPLIANCES MANUFACTURERS WORLDWIDE

Activity description; Appliances product portfolio; History, Mergers and acquisitions; Financial figures available (Turnover, Employees, Operating Margin, Number of units sold); Sales breakdown by geographical area and by product segment; Production overview; Manufacturing locations; Brands

– Amica Group (Poland), Arçelik A.Ş (Turkey), Aucma Company Ltd (China), Bertazzoni (Italy), BSH (Germany), Chunlan (China), CNA Group (Spain), DACOR (United States), Dayou Winia Co Ltd (South Korea), Daikin (Japan), De’ Longhi (Italy), Electrolux (Sweden), Elica (Italy), Falmec (Italy), Fotile (China), Franke Home Solutions- Artemis Group (Switzerland), Galanz (China), Godrej Appliances (India), Gree (China), Haier (China), Hisense (China), Hitachi (Japan), Homa Appliances (China), Johnson Controls (Ireland), Lennox International (United States), LG Electronics Inc (South Korea), Liebherr (Switzerland), Konka (China), Mabe (Mexico), Meiling (China), Midea Group (China), The Middleby Corporation (United States), Miele (Germany), Mitsubishi Electric Corporation (Japan), Nortek – Melrose Plc (United States-United Kingdom), Onida (India), Paloma (Japan), Panasonic (Japan), Rinnai Corporation (Japan), Hangzhou Robam Appliances (China), Sakura (Taiwan), Samsung Electronics (South Korea), Sharp Corporation (Japan), Smeg (Italy), Sub-Zero Group (United States), Supor (China), Teka (Spain), Vatti Corporation (China), Vestel White Goods (Turkey), Whirlpool (United States)

PART III: ANNEX EXCEL DATABASE

APPENDIX: list of mentioned companies

SEE ALSO

World market for professional appliances

November 2020, II Ed. , 190 pages

This Report provides information on the world market for professional appliances including: Foodservice equipment: including refrigeration, dishwashing, cooking appliances; Washing machines (Laundry); Air conditioning; Automatic vending machines

The Parasol Market in Italy

October 2017, I Ed. , 29 pages

The contract market accounts for 56% of the total value of the parasol market in Italy. The demand for parasols for hotels, bars and restaurants has increased and led to an overall increase in the contract segment.

Built-in appliances distribution and brand image in Italy

November 2014, XX Ed. , 126 pages

This report, yearly published, has reached its xx edition and analyzes the behaviour of the Italian purchasers of built-in appliances taking into consideration: the sales performance for kitchens and built-in appliances, purchasing criteria by major purchasers of built-in appliances, development of brand-name image and customer satisfaction of major built-in appliances purchasers. The study is based on 117 interviews with kitchen furniture manufacturers, built-in appliances wholesalers and specialised appliances chains

Windows and doors: world market outlook

October 2013, I Ed. , 133 pages

This new market research contains current and historical data (production, consumption, imports, exports) and analysis of Window and Door industry for a total of 70 countries