Built-in appliances distribution and brand image in Italy

Furnishings & related sectors | November 2014

€3000

November 2014,

XX Ed. ,

126 pages

Price (single user license):

EUR 3000 / USD 3240

For multiple/corporate license prices please contact us

Language: Italian

Report code: IT.15

Publisher: CSIL

Status: Available for online purchase and immediate download. English available upon request

Download

Table of contents

This report, yearly published, has reached its XX edition and analyzes the behaviour of the Italian buyers of built-in appliances taking into consideration:

- the sales performance for kitchens and built-in appliances

- purchasing criteria by major buyers of built-in appliances

- development of brand-name image and customer satisfaction of major built-in appliances purchasers

. The study is based on 117 telephone interviews with kitchen furniture manufacturers, built-in appliances wholesalers and specialized appliances chains.

Distribution flows and purchases of built-in appliances are analyzed by customer type (kitchen furniture manufacturers, built-in appliances wholesalers). The report provides a detailed analysis by product type: sinks sales broken down by material, hobs, ovens, dishwashers, refrigerators sales broken down by type, hoods sales broken down by material and type.

All the products mentioned above are analyzed also by geographical area and by purchase range of built-in appliances.

The analysis of brand name-image covers 6 years and provides a ranking of the main quoted brands by product (refrigerators, hobs, ovens, dishwashers, hood, sinks) and by type of customer (kitchen furniture manufacturers, built-in appliances wholesalers).

The report also studies the development of the criteria used to select the suppliers of built-in appliances.

The results confirm that the two most important criteria are: Punctuality in delivering, After-sales technical assistance. Other criteria considered are: Brand and Product reliability, Prices, Wide range of products and models, Aesthetic qualities of the product/design and, Front staff professionalism. The Report shows also statements about ‘best product in the market’ and ‘the product that still is not in the market’. Due to an overall weak market, the Report shows as the main buyers are becoming more and more ‘demanding’ from their suppliers of built-in appliances.

The opinions on the built-in appliances brands expressed by the interviewed companies are organized according to brand name, type of customer (kitchen furniture manufacturers, built-in appliances wholesalers), criteria used to select the suppliers of built-in appliances.

Covered brands: Aeg, Hotpoint-Ariston, Bosch, Candy, Electrolux-Rex, Franke, Foster, Indesit, Miele, Nardi, Samsung, Scholtès, Siemens, Smeg, Whirlpool.

Covered products: built-in appliances, kitchen furniture, refrigerators, cooking appliances (hobs, ovens), dishwashers, built-in microwaves, small built-in appliances, hoods and sinks.

On request, a list of 1000 Useful contacts (150 manufacturers of kitchen furniture, 150 wholesalers, 700 kitchen furniture retailers).

Selected companies

Alpex, Arredo 3, Boffi, Hotpoint-Ariston, Bergamin, Beko, Best, Blanco, Bosch, Candy, Cedi, Colombini, Delta Inox, EDI, EDIS, EL.GA, Elica, Faber, Falmec, Franke, Foster, Ikea, Indesit, Liebherr, Lube,Mainox, Miele, Mondo Convenienza, Nardi, Neff, Electrolux-Rex,Pacelli Trade, Poliform, Samsung, Scavolini, Scholtès, Semeraro, Siemens, Smeg, Snaidero, Valcucine, Whirlpool

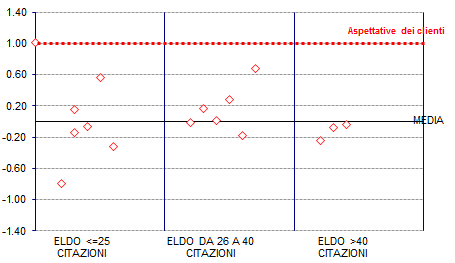

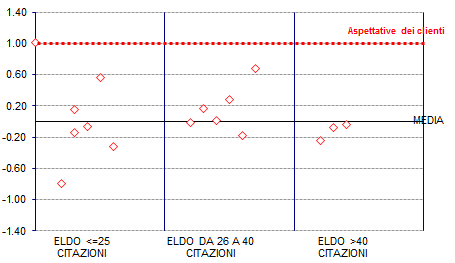

Fidelity to the distribution channel. Deviations from the average of the brands and mean expectations of customers, 2014. Total ratings

During 2014 sales of built-in appliances went down 3% in the canne of kitchen furniture manufacturers, 4% among the furniture chains, 6%-7% to built-in appliances wholesalers.

According to our sample of top buyers, among products missing in the market we can mention budget free-standing, oven with built-in microwave, more induction hobs, Vapor.

To be recommended: Indesit on Promotion, Electrolux on Service.

Purchasing criteria: delivery on time and speed for new assortment is first. The wide range will be obtained by the competition among more brands. Going up the criteria of Easy/Professional contact with the sales force, as well as reliability and innovation. Overall, Whirlpool and Miele are on the top of the ranking in the trade satisfaction analysis. For all the brands (in different measure), average scores were higher in the period 2008-2009 than during the last two years (2013-2014).

Abstract of Table of Contents

Scope of the research and methodology

Scope of the research

Methodology

Composition of the interviewed companies sample

Representativeness of the interviewed companies sample

Activity trend

Sales of built-in appliances

Sales of kitchen furniture

Distribution flows and purchases by product

To whom sells the built-in appliances wholesaler

Relationship with the suppliers

Purchases by product type (sinks, hobs/ovens, dishwashers, refrigerators, hoods)

Built-in appliances brands and product type

Number of brands dealt with

Number of quoted brands by product type (refrigerators, hobs/ovens, dishwashers/washing machines, hoods, sinks)

Purchasing criteria

Criteria for the selection of built-in appliances suppliers

Opinions on built-in appliances brands

Summary of opinions

Opinions on the main characteristics of brands: commercial, service, product and promotion area

Overview of the opinions by:

- brand name

- type of customer (kitchen manufacturers, built-in electrical appliances wholesalers)

- customer size (large scale customers, small and medium-sized customers)

- geographical area (North, Center, South and Islands)

- customer size (large scale customers, small and medium-sized customers)

Annex 1: Questionnaire used in the survey

Annex 2: 1000 useful contacts (on request)

This report, yearly published, has reached its XX edition and analyzes the behaviour of the Italian buyers of built-in appliances taking into consideration:

- the sales performance for kitchens and built-in appliances

- purchasing criteria by major buyers of built-in appliances

- development of brand-name image and customer satisfaction of major built-in appliances purchasers

. The study is based on 117 telephone interviews with kitchen furniture manufacturers, built-in appliances wholesalers and specialized appliances chains.

Distribution flows and purchases of built-in appliances are analyzed by customer type (kitchen furniture manufacturers, built-in appliances wholesalers). The report provides a detailed analysis by product type: sinks sales broken down by material, hobs, ovens, dishwashers, refrigerators sales broken down by type, hoods sales broken down by material and type.

All the products mentioned above are analyzed also by geographical area and by purchase range of built-in appliances.

The analysis of brand name-image covers 6 years and provides a ranking of the main quoted brands by product (refrigerators, hobs, ovens, dishwashers, hood, sinks) and by type of customer (kitchen furniture manufacturers, built-in appliances wholesalers).

The report also studies the development of the criteria used to select the suppliers of built-in appliances.

The results confirm that the two most important criteria are: Punctuality in delivering, After-sales technical assistance. Other criteria considered are: Brand and Product reliability, Prices, Wide range of products and models, Aesthetic qualities of the product/design and, Front staff professionalism. The Report shows also statements about ‘best product in the market’ and ‘the product that still is not in the market’. Due to an overall weak market, the Report shows as the main buyers are becoming more and more ‘demanding’ from their suppliers of built-in appliances.

The opinions on the built-in appliances brands expressed by the interviewed companies are organized according to brand name, type of customer (kitchen furniture manufacturers, built-in appliances wholesalers), criteria used to select the suppliers of built-in appliances.

Covered brands: Aeg, Hotpoint-Ariston, Bosch, Candy, Electrolux-Rex, Franke, Foster, Indesit, Miele, Nardi, Samsung, Scholtès, Siemens, Smeg, Whirlpool.

Covered products: built-in appliances, kitchen furniture, refrigerators, cooking appliances (hobs, ovens), dishwashers, built-in microwaves, small built-in appliances, hoods and sinks.

On request, a list of 1000 Useful contacts (150 manufacturers of kitchen furniture, 150 wholesalers, 700 kitchen furniture retailers).

Fidelity to the distribution channel. Deviations from the average of the brands and mean expectations of customers, 2014. Total ratings

During 2014 sales of built-in appliances went down 3% in the canne of kitchen furniture manufacturers, 4% among the furniture chains, 6%-7% to built-in appliances wholesalers.

According to our sample of top buyers, among products missing in the market we can mention budget free-standing, oven with built-in microwave, more induction hobs, Vapor.

To be recommended: Indesit on Promotion, Electrolux on Service.

Purchasing criteria: delivery on time and speed for new assortment is first. The wide range will be obtained by the competition among more brands. Going up the criteria of Easy/Professional contact with the sales force, as well as reliability and innovation. Overall, Whirlpool and Miele are on the top of the ranking in the trade satisfaction analysis. For all the brands (in different measure), average scores were higher in the period 2008-2009 than during the last two years (2013-2014).

Abstract of Table of Contents

Scope of the research and methodology

Scope of the research

Methodology

Composition of the interviewed companies sample

Representativeness of the interviewed companies sample

Activity trend

Sales of built-in appliances

Sales of kitchen furniture

Distribution flows and purchases by product

To whom sells the built-in appliances wholesaler

Relationship with the suppliers

Purchases by product type (sinks, hobs/ovens, dishwashers, refrigerators, hoods)

Built-in appliances brands and product type

Number of brands dealt with

Number of quoted brands by product type (refrigerators, hobs/ovens, dishwashers/washing machines, hoods, sinks)

Purchasing criteria

Criteria for the selection of built-in appliances suppliers

Opinions on built-in appliances brands

Summary of opinions

Opinions on the main characteristics of brands: commercial, service, product and promotion area

Overview of the opinions by:

- brand name

- type of customer (kitchen manufacturers, built-in electrical appliances wholesalers)

- customer size (large scale customers, small and medium-sized customers)

- geographical area (North, Center, South and Islands)

- customer size (large scale customers, small and medium-sized customers)

Annex 1: Questionnaire used in the survey

Annex 2: 1000 useful contacts (on request)

SEE ALSO

Profiles of 50 major appliance manufacturers worldwide

September 2021, VIII Ed. , 260 pages

The world market of major consumer appliances amounted to US$ 258 billion in 2020 and it is projected versus a double-digit growth during the current year. Company profiles with information on company background, historical and recent facts, basic data (including total turnover of the last five years, white appliances turnover and white appliances share on total production, number of employees …)

World market for professional appliances

November 2020, II Ed. , 190 pages

This Report provides information on the world market for professional appliances including: Foodservice equipment: including refrigeration, dishwashing, cooking appliances; Washing machines (Laundry); Air conditioning; Automatic vending machines

The Parasol Market in Italy

October 2017, I Ed. , 29 pages

The contract market accounts for 56% of the total value of the parasol market in Italy. The demand for parasols for hotels, bars and restaurants has increased and led to an overall increase in the contract segment.

Windows and doors: world market outlook

October 2013, I Ed. , 133 pages

This new market research contains current and historical data (production, consumption, imports, exports) and analysis of Window and Door industry for a total of 70 countries