June 2017,

III Ed. ,

82 pages

Price (single user license):

EUR 1600 / USD 1712

For multiple/corporate license prices please contact us

Language: English

Report code: S.41

Publisher: CSIL

Status: available for online purchase and immediate download

Download

Table of contents

JAPAN SECTION

This Market Research Report provides an analysis of the kitchen furniture market in Japan providing trends in kitchen furniture production and consumption, imports and exports, reference prices, marketing policies and distribution. Short profiles of major players are given as well as their market shares.

Data on kitchen furniture production and consumption, imports and exports are given for the years 2008-2016, in US$ million and YEN billion.

An analysis of Japanese kitchen furniture imports and exports is provided by country and by geographical area of destination/origin.

Kitchen furniture production in volume is split between system kitchens and sectional kitchens.

Kitchen furniture consumption in Japan is broken down according to the size and structure of the kitchen room, worktop material, cabinet door material and colour.

The distribution of kitchen furniture on the Japanese market is described, mentioning the different distribution channels: department stores, lifestyle concept stores, home centres, furniture chains, appliance retailers, e-commerce. Short profiles are included for the main distributors of furniture and household appliances present on the Japanese market.

Reference prices for kitchens and built-in appliances are listed.

The main magazines, associations and fairs in the kitchen furniture segment in Japan are mentioned

The competitive system analyses the major players present on the Japanese kitchen furniture market, providing short company profiles, their estimated turnover and market shares.

Addresses of the companies mentioned are also enclosed.

SOUTH KOREA SECTION

This Market Research Report offers an overview of the kitchen furniture industry in South Korea providing trends in kitchen furniture production and consumption, imports and exports, reference prices, marketing policies and distribution. Short profiles of major players are given as well as their market shares.

Data on kitchen furniture production and consumption, imports and exports are given for the period 2008-2016, in US$ million and KRW billion.

An analysis of Korean kitchen furniture imports and exports is provided by country and by geographical area of destination/origin.

The kitchen furniture supply in Korea is broken down according to cabinet door material, kitchen size and worktop material.

The competitive system analyses the main players present on the Korean kitchen furniture market, providing short company profiles, turnover data and market shares.

The demand determinants examined in the first chapter of the report are: economic indicators, population indicators and data on the construction sector.

Addresses of the companies mentioned are also enclosed.

Selected companies

Actus, Cleanup, Bals Corporation, Beltecno Corp, Best Denki, Edion, Enex, Hanssem, Hitachi, Ikea, Isetan, Joshin Denki, Joyful Honda, Lixil, LG Electronics, Hyundai Livart, NEFS Natural Elegance Furniture System, Leicht, Nolte Küchen, Mitsukoshi, Nafco, Nitori, Noritz Corp, Ozone, Otsuka Kagu, Panasonic, Pamouna, Poggenpohl, Sanwa, Shimachu, Seibu, Sunwave, Takara Standard, Takashimaya, Token, Toto, Toyo Kitchen, Valcucine, Veneta Cucine, Yamada Denki, Yamaha Livingtec Corp, Withus, Wood One

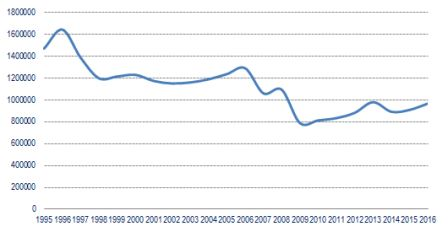

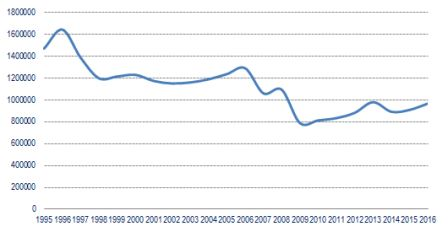

Japan. New Construction Starts of Dwellings (Number of Dwelling Units), 1995-2016

The market for system kitchens is gradually increasing in Japan: 1.1-1.2 million units ten years ago, 1.3 million in recent times (2013-2016).

Construction (increasing by 2.8% in the early months of 2017) is one of the drivers of the renewed growth.

In both Japan and South Korea, the top four kitchen furniture players control 60%-70% of the market.

During 2016 imports of kitchen furniture from Europe increased slightly in Japan and almost doubled in South Korea.

Abstract of Table of Contents

Basic data and activity trend

- Size and structure of the kitchen room; Kitchen worktop: product breakdown by material; Kitchen doors: product breakdown by material and colour

Qualitative description of home electrical appliances

Distribution

Distribution of kitchen furniture and reference prices

Main contractors and specifiers; Architectural practices; Department stores; Lifestyle concept stores; Home centres; Furniture chains; Appliances retailers; Mail order and e-commerce

Useful contacts (magazines, sector associations, trade fairs

The competitive system

Profiles of top kitchen furniture players

Other kitchen furniture players

- Kitchen furniture market. Estimated sales in Japan of the major companies and market shares

Appendix: list of the mentioned kitchen furniture players

PART II: THE KITCHEN FURNITURE MARKET IN SOUTH KOREA

Macroeconomic indicators

Population, Economy

Basic data and activity trend

Kitchen furniture production, export, import and consumption, 2008-2016. Million US$, Billion KRW and annual % changes

International trade

Kitchen Furniture exports and imports by country and by geographical area of destination/origin, 2011-2016

Supply structure

Breakdown of kitchen furniture supply by cabinet door material, by kitchen size, by worktop material

Numbers of built-in appliances per 100 kitchens sold

Distribution

Distribution channels and reference prices

Breakdown of kitchen furniture sales by geographical region

The competitive system

Profiles of the major kitchen furniture players

- Kitchen furniture market. Estimated sales in South Korea of the major companies and market shares

Appendix: list of the mentioned kitchen furniture players

JAPAN SECTION

This Market Research Report provides an analysis of the kitchen furniture market in Japan providing trends in kitchen furniture production and consumption, imports and exports, reference prices, marketing policies and distribution. Short profiles of major players are given as well as their market shares.

Data on kitchen furniture production and consumption, imports and exports are given for the years 2008-2016, in US$ million and YEN billion.

An analysis of Japanese kitchen furniture imports and exports is provided by country and by geographical area of destination/origin.

Kitchen furniture production in volume is split between system kitchens and sectional kitchens.

Kitchen furniture consumption in Japan is broken down according to the size and structure of the kitchen room, worktop material, cabinet door material and colour.

The distribution of kitchen furniture on the Japanese market is described, mentioning the different distribution channels: department stores, lifestyle concept stores, home centres, furniture chains, appliance retailers, e-commerce. Short profiles are included for the main distributors of furniture and household appliances present on the Japanese market.

Reference prices for kitchens and built-in appliances are listed.

The main magazines, associations and fairs in the kitchen furniture segment in Japan are mentioned

The competitive system analyses the major players present on the Japanese kitchen furniture market, providing short company profiles, their estimated turnover and market shares.

Addresses of the companies mentioned are also enclosed.

SOUTH KOREA SECTION

This Market Research Report offers an overview of the kitchen furniture industry in South Korea providing trends in kitchen furniture production and consumption, imports and exports, reference prices, marketing policies and distribution. Short profiles of major players are given as well as their market shares.

Data on kitchen furniture production and consumption, imports and exports are given for the period 2008-2016, in US$ million and KRW billion.

An analysis of Korean kitchen furniture imports and exports is provided by country and by geographical area of destination/origin.

The kitchen furniture supply in Korea is broken down according to cabinet door material, kitchen size and worktop material.

The competitive system analyses the main players present on the Korean kitchen furniture market, providing short company profiles, turnover data and market shares.

The demand determinants examined in the first chapter of the report are: economic indicators, population indicators and data on the construction sector.

Addresses of the companies mentioned are also enclosed.

Japan. New Construction Starts of Dwellings (Number of Dwelling Units), 1995-2016

The market for system kitchens is gradually increasing in Japan: 1.1-1.2 million units ten years ago, 1.3 million in recent times (2013-2016).

Construction (increasing by 2.8% in the early months of 2017) is one of the drivers of the renewed growth.

In both Japan and South Korea, the top four kitchen furniture players control 60%-70% of the market.

During 2016 imports of kitchen furniture from Europe increased slightly in Japan and almost doubled in South Korea.

Abstract of Table of Contents

Basic data and activity trend

- Size and structure of the kitchen room; Kitchen worktop: product breakdown by material; Kitchen doors: product breakdown by material and colour

Qualitative description of home electrical appliances

Distribution

Distribution of kitchen furniture and reference prices

Main contractors and specifiers; Architectural practices; Department stores; Lifestyle concept stores; Home centres; Furniture chains; Appliances retailers; Mail order and e-commerce

Useful contacts (magazines, sector associations, trade fairs

The competitive system

Profiles of top kitchen furniture players

Other kitchen furniture players

- Kitchen furniture market. Estimated sales in Japan of the major companies and market shares

Appendix: list of the mentioned kitchen furniture players

PART II: THE KITCHEN FURNITURE MARKET IN SOUTH KOREA

Macroeconomic indicators

Population, Economy

Basic data and activity trend

Kitchen furniture production, export, import and consumption, 2008-2016. Million US$, Billion KRW and annual % changes

International trade

Kitchen Furniture exports and imports by country and by geographical area of destination/origin, 2011-2016

Supply structure

Breakdown of kitchen furniture supply by cabinet door material, by kitchen size, by worktop material

Numbers of built-in appliances per 100 kitchens sold

Distribution

Distribution channels and reference prices

Breakdown of kitchen furniture sales by geographical region

The competitive system

Profiles of the major kitchen furniture players

- Kitchen furniture market. Estimated sales in South Korea of the major companies and market shares

Appendix: list of the mentioned kitchen furniture players

SEE ALSO

Il mercato italiano dei mobili per cucina (Italian)

April 2024, XLII Ed. , 95 pages

This study offers a comprehensive analysis of the kitchen furniture industry in Italy through production and consumption data, trade interchange, market shares of the major players in the industry by price range, sales location, distribution channels, profitability, types of integrated appliances sold, types and materials of cabinet doors and countertops, market trends and prospects.

Kitchen furniture: World market outlook

December 2023, XVIII Ed. , 185 pages

CSIL analyses 60 kitchen furniture markets with a rich collection of key country data, production and consumption both in value and units. Company profiles for 35 among the main kitchen furniture manufacturers worldwide

The European market for kitchen furniture

May 2023, XXXIII Ed. , 305 pages

In 2022, the European production (30 EU countries) of kitchen furniture amounts to around 7 million units manufactured, including around one million units of upper end kitchens.

The kitchen furniture market in the United States

March 2023, VIII Ed. , 112 pages

In-deep analysis of the kitchen furniture sector in the US, with trends and forecasts of production, consumption, imports and exports, leading players by geographical areas and price ranges (clustered in six price groups), marketing policies and distribution channels

The kitchen furniture market in China

March 2022, IX Ed. , 160 pages

The Report, now at its IX edition, offers an in-depth investigation of the kitchen market in China, with size and trends of production, consumption, international trade, as well as analysis of demand determinants and competitive system